Table of Contents

Introduction

Payment Processing Solutions Statistics: Payment processing solutions are pivotal in today’s financial systems. Acting as the foundation for safe and efficient money transfers among individuals, enterprises, and financial institutions.

They facilitate the convenience of cashless transactions, simplify global trade, and prioritize safeguarding data in our increasingly digital world.

The evolution of payment processing progressed from primitive barter systems to contemporary innovations like mobile payments and cryptocurrencies.

It has reached significant milestones while consistently adjusting to meet the evolving needs of both consumers and businesses.

In the current digital era, payment processing solutions are continually progressing, incorporating state-of-the-art. Technologies to guarantee the smooth and secure movement of funds. Effectively reshaping our approach to managing financial transactions.

Editor’s Choice

- In 2020, the point of sale (POS) software market generated approximately USD 15.57 billion in revenue. This upward trajectory continued into 2021 when it reached USD 17.66 billion.

- The global online payment gateway market is poised for significant expansion. Projected to surge from USD 26.79 billion in 2022 to USD 198.9 billion by 2032. Maintaining a consistent annual growth rate of 22.2% throughout the forecast period.

- The payment processing solutions market is experiencing robust growth. Evidenced by its steady CAGR of 12.00%.

- In 2022, the payment processing solutions market generated a substantial revenue of USD 65.6 billion.

- The global non-cash transaction volume increased from 471.2 billion in 2018 to 539.6 billion in 2019, emphasizing the growing shift towards digital transactions.

- By 2028, business-to-business (B2B) payments will reach $200 trillion. This indicates a significant transformation in how businesses handle transactions.

- The United States faced payment fraud losses totaling $8.14 billion in 2020. Highlighting the importance of security in payment processing.

- China led the way with mobile payments, reaching a staggering $178 trillion in 2020. Showcasing the shift towards cashless transactions.

- Nearly 70% of consumers in the United States used mobile banking in 2020. Reflecting the trend toward digital financial services.

- Digital wallets are predicted to make up 52% of global e-commerce transactions by 2023. Indicating a growing preference for this payment method.

Types of Payment Processing Solutions Statistics

Payment Processing Solutions Statistics By Point of Sale (POS) Systems

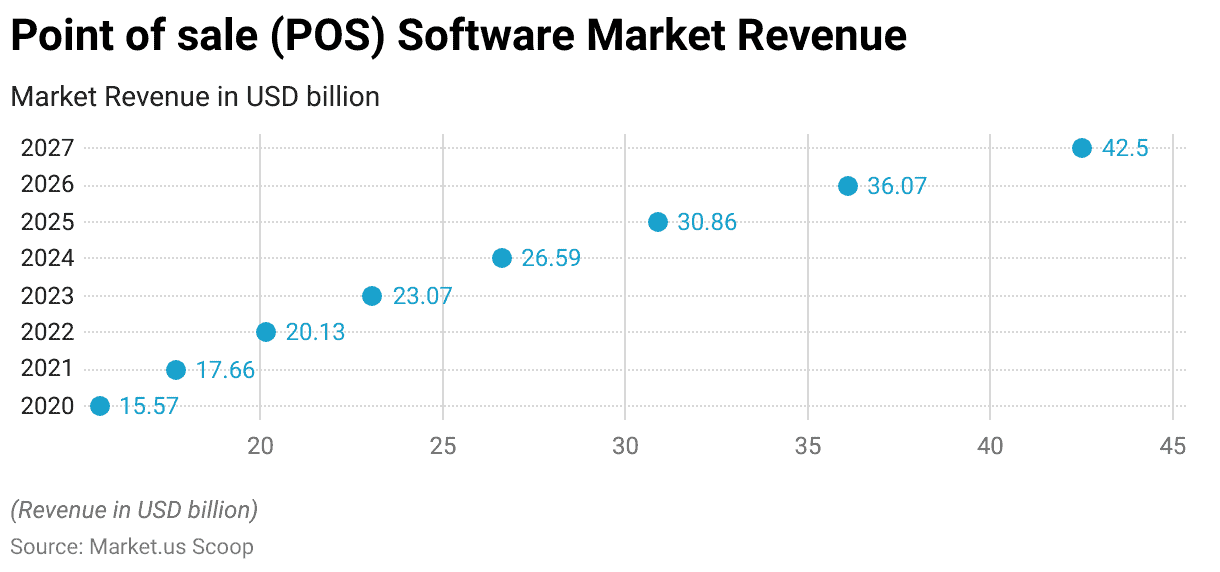

- The point of sale (POS) software market has shown remarkable growth in recent years, as reflected in its revenue figures.

- In 2020, the market generated approximately USD 15.57 billion in revenue, and this upward trajectory continued into 2021 when it reached USD 17.66 billion.

- The year 2022 saw further expansion, with revenue climbing to USD 20.13 billion.

- Projections for the following years indicate a continued upward trend. The market is expected to generate USD 23.07 billion in 2023, USD 26.59 billion in 2024, and USD 30.86 billion in 2025.

- As we look ahead, the POS software market is anticipated to experience substantial growth. With revenue forecasts reaching USD 36.07 billion in 2026 and USD 42.50 billion in 2027.

- These numbers underscore the increasing significance of POS software in the retail and business sectors. Driven by evolving consumer preferences and technological advancements.

- In 2020, North American retailers had distinct priorities regarding their point of sale (POS) systems.

- The top focus areas included integrating omnichannel capabilities. This was the foremost concern for 59% of retailers. Followed closely by 52% of retailers looking to improve their existing POS systems.

- Additionally, 44% of retailers focused on achieving a unified e-commerce platform and implementing mobile POS solutions.

- About 41% considered upgrading or replacing their POS systems, while 30% contemplated hardware upgrades.

- Conversely, compliance and considering a unified payment platform were less important, with only 7% of retailers prioritizing these aspects in 2020.

(Source: Statista, Retail Consulting Partners-2020)

Online Payment Gateways

- The global online payment gateway market is poised for significant expansion. Projected to surge from USD 26.79 billion in 2022 to USD 198.9 billion by 2032. Maintaining a consistent annual growth rate of 22.2% throughout the forecast period.

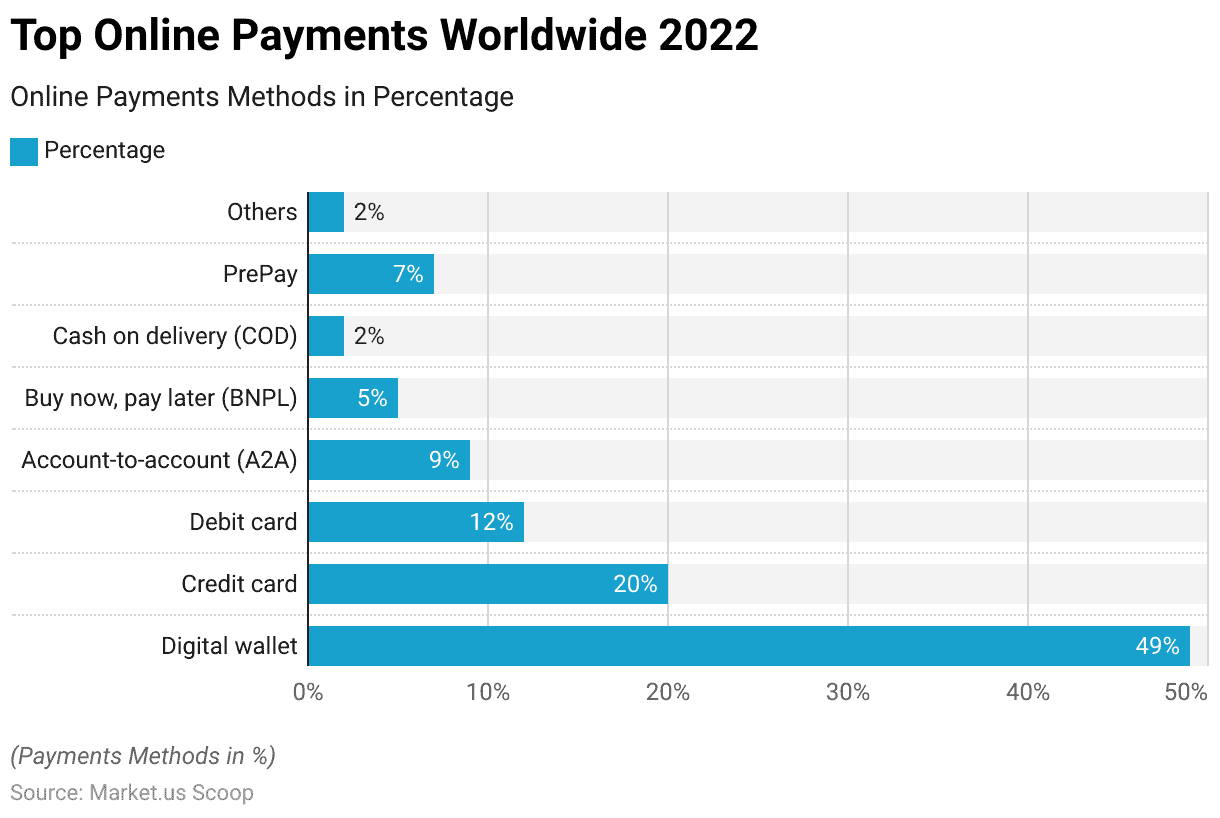

- In the realm of global online payments for the year 2022. Digital wallets emerged as the dominant player, commanding a significant share of 49%.

- Credit cards followed at 20%, while debit cards accounted for 12% of online transactions.

- Account-to-account (A2A) payments claimed a 9% share. Reflecting their growing popularity.

- The “Buy now, pay later” (BNPL) model contributed 5%. Offering consumers flexible payment options.

- Cash on delivery (COD) and PrePay comprised 2% and 7% of the online payment landscape.

- The remaining 2% was attributed to various other payment methods.

- These statistics provide insight into the diverse preferences of consumers and the evolving landscape of global online payments in 2022.

(Source: Market.us, Oberlo)

Mobile Payment Solutions

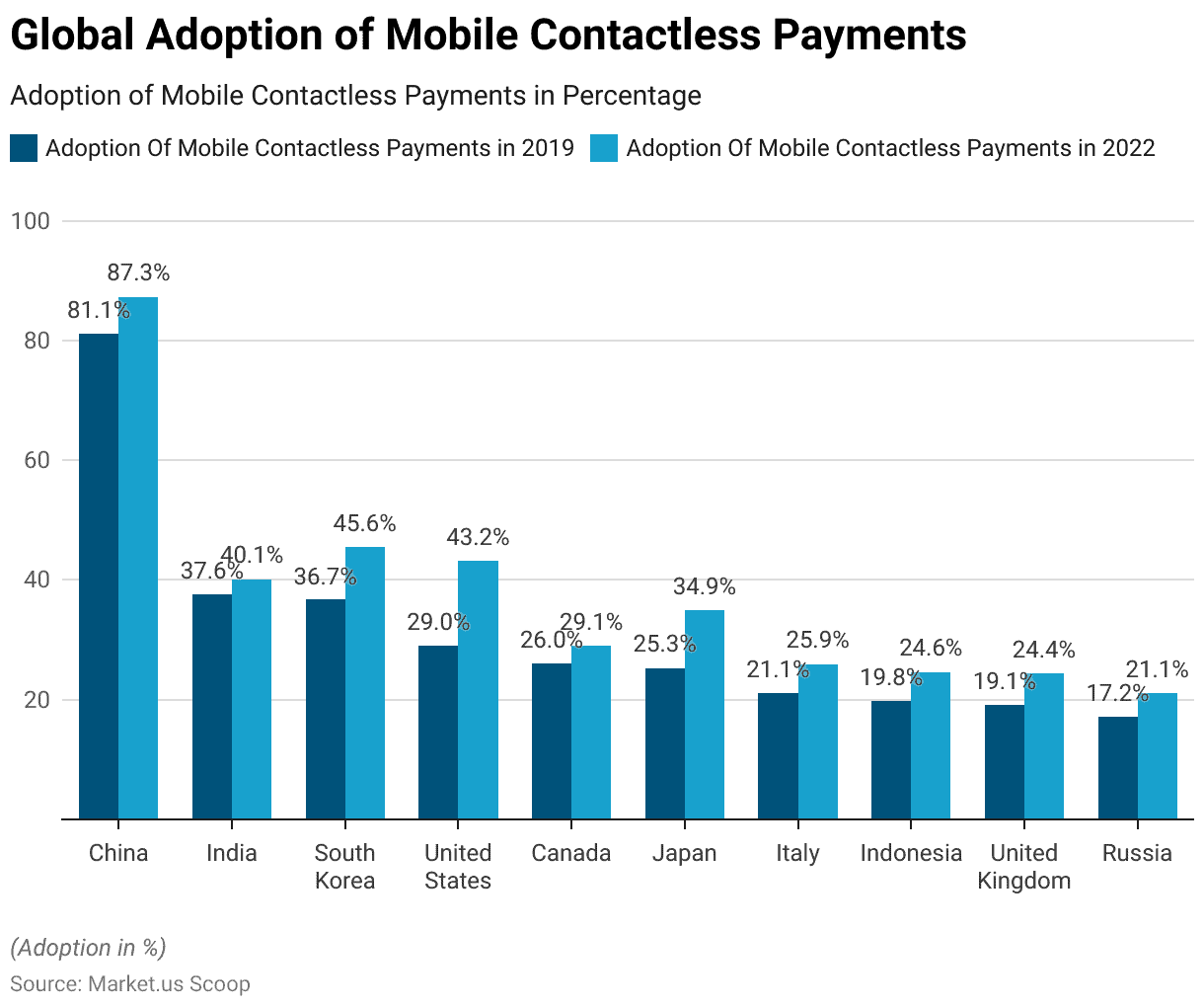

- In mobile contactless payments, the adoption rates in various countries witnessed notable changes between 2019 and 2022.

- China led the pack with a significant increase, soaring from 81.1% in 2019 to 87.3% in 2022.

- India, too, experienced more modest growth, with adoption rising from 37.6% to 40.1%.

- South Korea saw a noteworthy increase from 36.7% to 45.6%. Demonstrating a growing affinity for mobile contactless payments.

- The United States and Canada showcased substantial jumps from 29% to 43.2% and 26% to 29.1%, respectively.

- Japan and Italy followed suit, with adoption rates climbing from 25.3% to 34.9% and 21.1% to 25.9%, respectively.

- Meanwhile, Indonesia, the United Kingdom, and Russia also increased, with adoption rates ranging from 19.8% to 24.6%, 19.1% to 24.4%, and 17.2% to 21.1%, respectively.

- These shifts reflect the evolving preferences and growing acceptance of mobile contactless payments in these nations during this period.

Contactless Payments

- According to RBR Global’s forecast, over 80% of consumer credit cards will incorporate contactless payment technology by 2026.

- However, this represents a growth rate of approximately 119% from the current usage level, notably lower than the projected 221% increase in overall contactless payments during the same period.

- Payments-enabled wearable devices are anticipated to drive significant growth in contactless adoption.

- Furthermore, a projected increase in payments-enabled smartphones will be 99% by 2027.

- This shift towards NFC payments will likely result in more retailers accepting mobile wallet payments, but it also entails adjustments in chargeback procedures.

- In addition to filing chargeback complaints with credit card providers, consumers now have the option to file fraud complaints with mobile wallets, which may pose greater challenges for retailers in winning such disputes.

- In a survey conducted by ClearSale, it was found that only 5% of retailers reported success in disputing chargebacks with Google Wallet or Apple Pay, in contrast to a 48% success rate in refuting chargeback disputes with major card brands.

- According to a 2022 report, the per-user contactless spend is projected to reach $7,827 by 2026, which is double the spending seen in 2022 ($4,177) and more than triple the figure from 2019 ($2,101).

- Therefore, businesses not offering contactless options may miss significant revenue opportunities.

(Source: Fit Small Business, RBR, ClearSale)

Payment Processing Solutions Market Size Statistics

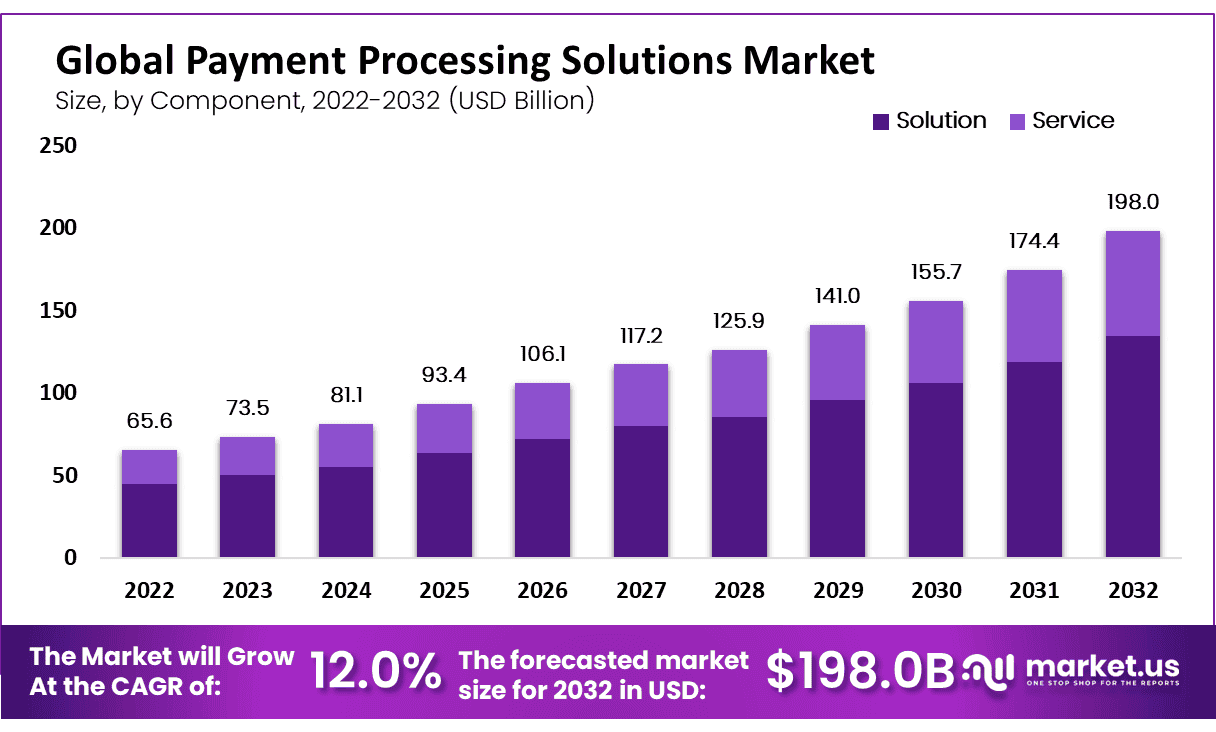

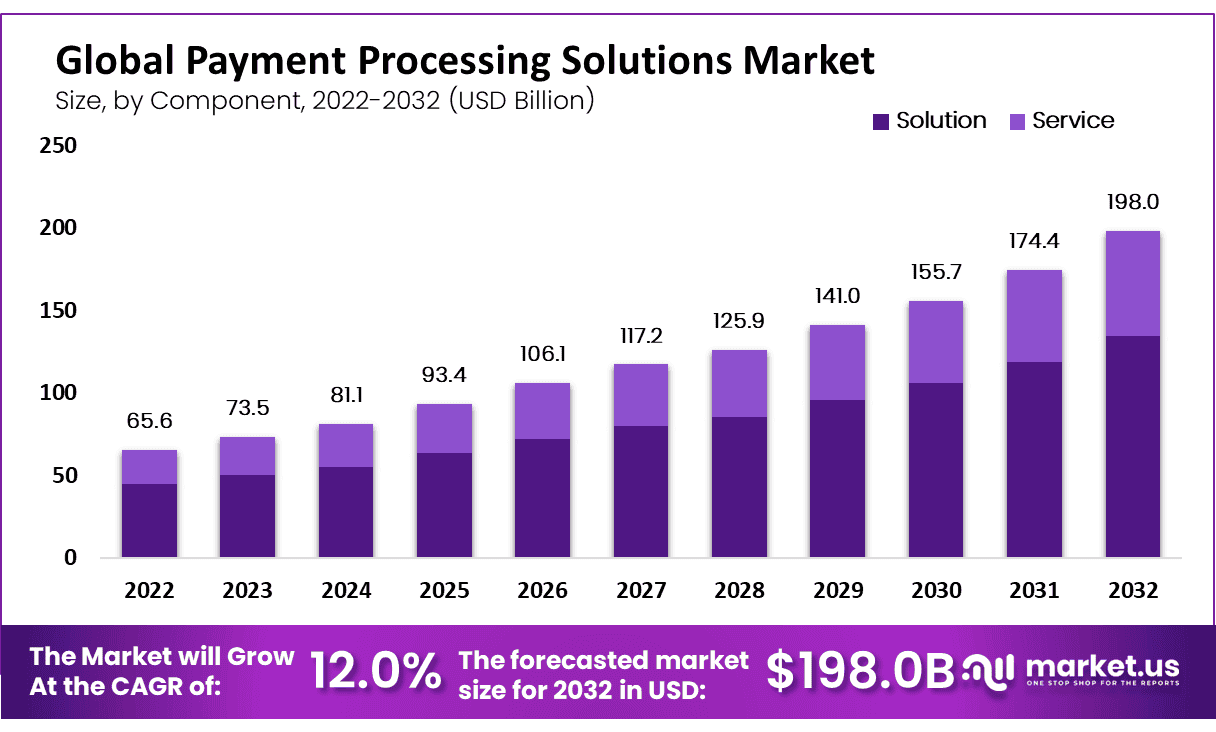

- The payment processing solutions market is experiencing robust growth. Evidenced by its steady CAGR of 12.00%.

- In 2022, the market generated a substantial revenue of USD 65.6 billion.

- This positive momentum is expected to continue, with projected revenues of USD 73.5 billion in 2023, USD 81.1 billion in 2024, and USD 93.4 billion in 2025, reflecting a clear upward trajectory.

- By 2026, the market is set to cross the USD 100 billion mark, with an estimated revenue of USD 106.1 billion.

- The growth trend persists in the following years, with revenues of USD 117.2 billion in 2027, USD 125.9 billion in 2028, and a significant milestone of USD 141 billion in 2029.

- The market is anticipated to reach USD 155.7 billion in 2030, USD 174.4 billion in 2031, and a remarkable USD 198 billion in 2032.

- This consistent growth signifies the increasing importance of payment processing solutions in the global economy, driven by technological advancements and changing consumer preferences.

(Source: Market.us)

Transaction Volume Payment Processing Solutions Statistics

- Global revenue and transaction growth bounced back from the 5% decline caused by the pandemic in 2020 and reached a new high, totaling $2.1 trillion.

- When considering the 11% increase in 2021, the overall revenue growth over the past two years averaged 3%, which, while below the long-term trend, exceeded the concerns of many.

- This resilience in the payments industry was evident as electronic payment transactions increased by 19% in 2021, aligning with the growth rates seen before the pandemic.

- Global e-commerce, mainly driven by China, witnessed substantial growth of around 17%, making up approximately half of global retail e-commerce sales.

- The most significant impact of COVID-19 was observed in cash usage. Which saw a steep 15% decline in 2020.

- However, despite reopening physical stores in 2021. The expected resurgence in cash usage did not materialize.

(Source: McKinsey)

Regional Variances in Payment Processing Solutions Statistics

Asia Pacific

- The Asia Pacific region is poised to witness a substantial surge in real-time payment transactions, with volumes expected to grow significantly from 49.2 billion in 2022 to 96.2 billion by 2027.

- This growth reflects a noteworthy compound annual growth rate (CAGR) of 14.1%.

- Globally, 2022 saw a remarkable increase in real-time payment transactions, totaling 195 billion, marking an impressive year-on-year growth of 63.2%.

- Particularly noteworthy is Indonesia, a major country in the region, which has recently embraced real-time payments (RTP) and is set for rapid expansion with an exceptional CAGR of 81.9% anticipated between 2022 and 2027.

- This positions Indonesia’s BI-FAST as one of the world’s fastest-growing and most successful RTP systems, with crucial ISO 20022-based real-time infrastructure provided by ACI.

- In Malaysia, the RTP volume is projected to grow substantially. With a CAGR of 19.7% expected from 2022 to 2027.

- The driving forces behind this expansion include increasing consumer awareness, a preference for mobile payments, developing B2B use cases like Request to Pay, and the establishment of cross-border QR-code payment connections linking Malaysia with Indonesia, Singapore, and Thailand.

- Thailand, ranking fourth globally in RTP transaction volume in 2022. Recorded 13.9 billion transactions through its RTP system, PromptPay.

- Thailand is also expected to lead APAC in adopting RTP by consumers, with each Thai citizen projected to make an average of 43.6 real-time monthly transactions by 2027.

- Thailand’s National ITMX has successfully implemented real-time ISO 20022 bulk payments, with ACI’s support, further bolstering the growth of RTP in the region.

(Source: Electronic Payments International)

North America

Payment Processing Solutions Statistics for Online Purchases

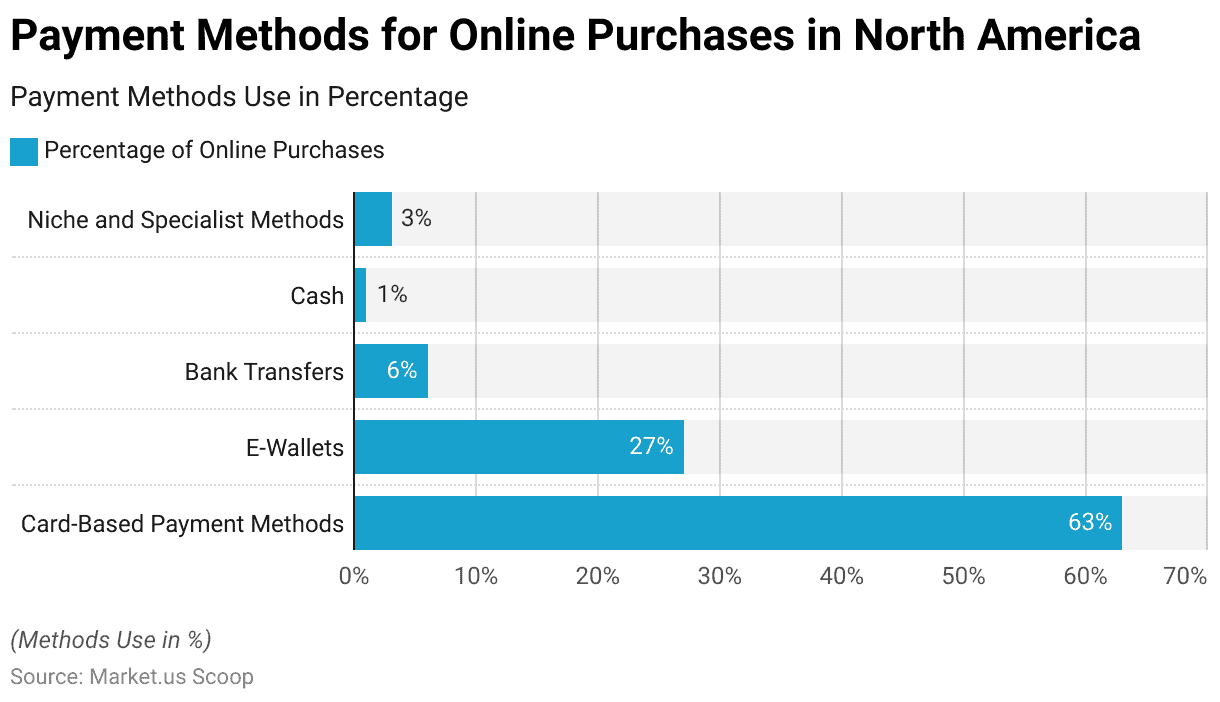

- Online shoppers in North America utilize various payment methods to purchase online.

- The most prevalent method is card-based payments, accounting for 63% of all online transactions. E-wallets are also widely used, comprising 27% of online purchases. Providing consumers with a convenient and secure digital payment option.

- Bank transfers are chosen for 6% of transactions, offering an alternative to traditional card payments.

- Though less common, cash payments still contribute to 1% of online purchases.

- Additionally, niche and specialist payment methods are employed for 3% of transactions, reflecting the diversity of options available to North American consumers when making online payments.

(Source: Ppro)

Credit Card Market Share in North America

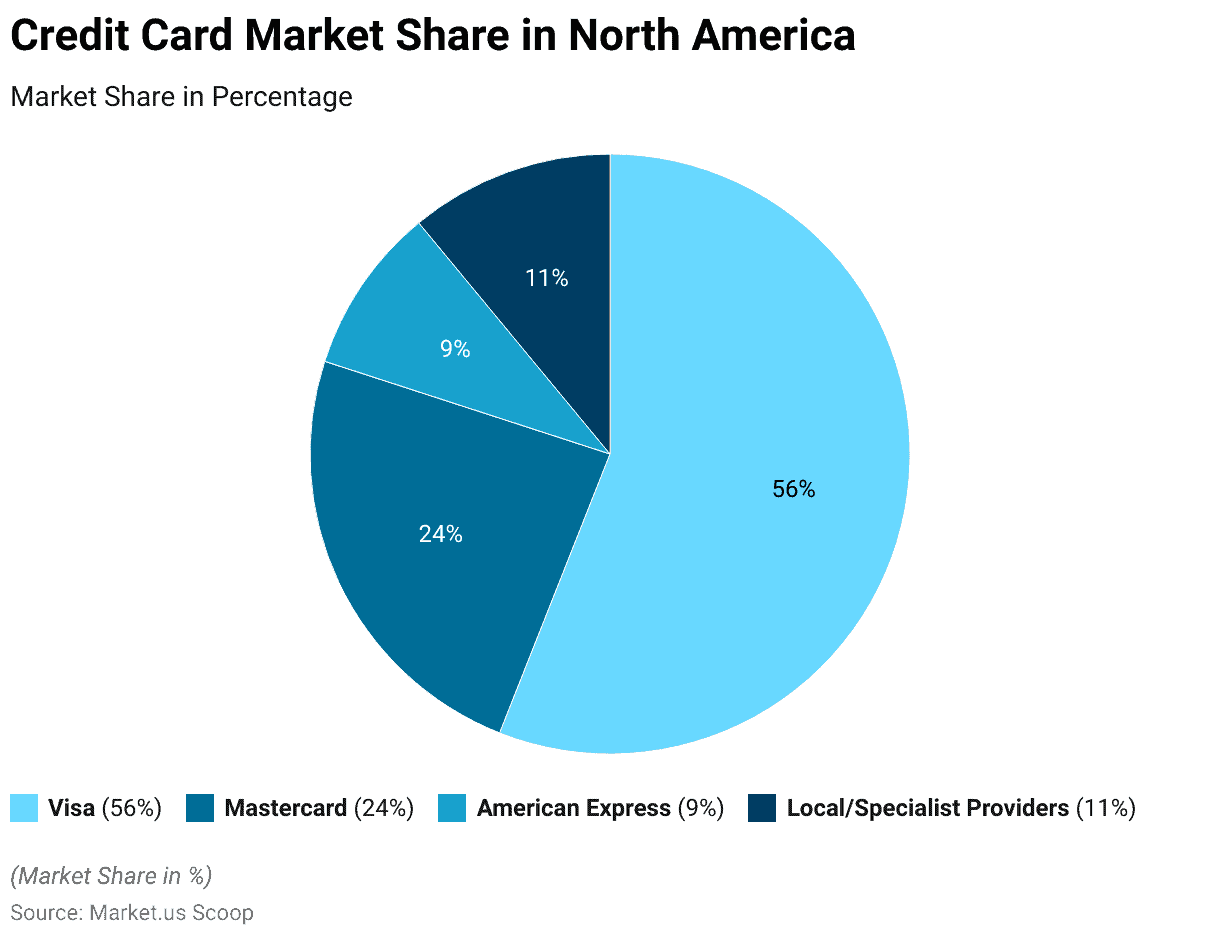

- Within North America’s credit card market, there is a market share distribution among various providers.

- Visa is dominant, commanding 56% market share. Making it the region’s most widely used credit card provider.

- Mastercard follows with a 24% market share. Also holding a significant presence in the North American credit card landscape.

- American Express captures a noteworthy 9% market share. Catering to a specific segment of consumers who value its premium services.

- Furthermore, local and specialist credit card providers collectively contribute 11% of the market share, offering specialized options and catering to niche markets.

- This diverse landscape reflects the choices available to consumers when selecting their preferred credit card provider in North America.

(Source: Ppro)

Europe

- In 2021, the Eurozone witnessed a substantial rise in non-cash transactions, marked by a 12.5% increase in the total number of transactions, reaching 114.2 billion, and a remarkable 18.6% surge in the total value, which amounted to €197.0 trillion compared to the previous year.

- Card payments notably constituted 49% of the total transactions, while credit transfers and direct debits accounted for 22% and 20%, respectively.

- More specifically, credit transfers within the Eurozone grew by 8.6% to 25.1 billion, amassing a total value of €184.2 trillion, with electronic initiation becoming increasingly prevalent.

- Direct debits also saw an uptick of 5.8% to 23.2 billion, totaling €7.3 trillion.

- Card transactions similarly experienced a substantial increase of 17.3% to 56.3 billion, with a cumulative value of €2.3 trillion, resulting in an average of approximately €40 per card transaction.

- Additionally, the number of payment cards equipped with payment functionality in the Eurozone expanded by 4.6% to reach 637.7 million in 2021, averaging nearly 1.9 per Eurozone resident.

- Importantly, the distribution of these payment services exhibited notable variations among Eurozone countries in 2021, with Portugal leading in card payments at around 72%, Finland in credit transfers at approximately 38%, and Germany in direct debits at about 43% concerning the total number of non-cash transactions.

(Source: European Central Bank)

Middle East & Africa

- Even before the outbreak of the COVID-19 pandemic, digital payments were on a rapid rise in the United Arab Emirates (UAE) and Saudi Arabia.

- In the UAE, consumer digital payment transactions grew by over 9% annually between 2014 and 2019, outpacing Europe’s average yearly growth of 4 to 5%.

- Saudi Arabia witnessed even more astonishing growth, with card payments surging by a staggering 70% between February 2019 and January 2020.

- The pandemic further fueled this trend. According to a survey conducted by McKinsey among payment experts. 80% of respondents estimated that non-cash payments in the region had surged by more than 10% due to the pandemic, with 43% believing that the increase exceeded 20%.

- Notably, in some countries like Saudi Arabia, digital point-of-sale (POS) transactions doubled in the year leading up to January 2021.

- Crucially, these payment experts foresee a lasting shift towards digital payments. In the survey, 90% predicted that at least half of the new digital payment users would continue to use digital methods rather than return to cash.

- Moreover, over half of the respondents expected robust growth in non-cash payments to persist over the next five years. Resulting in a cumulative increase of more than 50% in digital transactions compared to 2020 levels across the region.

(Source: McKinsey)

Recent Developments

Acquisitions and Mergers:

- PayPal acquires Paidy: In 2023, PayPal finalized the acquisition of Paidy, a Japanese buy-now-pay-later (BNPL) platform, for $2.7 billion. This acquisition helps PayPal expand its payment processing capabilities in Japan. Tapping into the growing demand for flexible payment solutions in e-commerce.

- Square acquires Afterpay: In 2023, Square (now Block) completed its $29 billion acquisition of Afterpay, a leading BNPL provider. This move allows Square to integrate Afterpay’s installment payment solutions into its payment processing platform. Catering to both consumers and merchants looking for flexible payment options.

New Product Launches:

- Stripe launches Stripe Terminal in 2024: Stripe introduced its Stripe Terminal to offer in-person payment solutions for businesses. The product enables merchants to accept payments through various methods, including credit cards, digital wallets, and mobile payments, expanding Stripe’s influence in brick-and-mortar retail.

- Visa launches Visa Acceptance Cloud: In late 2023, Visa launched the Visa Acceptance Cloud, a cloud-based platform designed to simplify payment acceptance for small businesses. The service allows merchants to process payments through a cloud environment. Reducing the need for traditional payment terminals.

Funding:

- Rapyd raises $300 million in Series E funding: In 2023, Rapyd, a global payment platform, secured $300 million in funding to expand its payment processing solutions worldwide. The funding is aimed at enhancing Rapyd’s financial services in emerging markets and developing new tools for cross-border payments.

- Checkout.com raises $1 billion in funding: In 2023, Checkout.com, a global payment processor, raised $1 billion in funding, bringing its valuation to $40 billion. The funds will be used to expand its payment infrastructure globally, with a focus on digital wallets, cryptocurrency, and real-time payments.

Technological Advancements:

- AI-Powered Fraud Detection in Payment Processing: AI and machine learning are increasingly being used in payment processing to detect and prevent fraud. By 2025, over 50% of payment processors are expected to adopt AI-driven tools for real-time fraud detection and to enhance the security of online transactions.

- Cryptocurrency Integration in Payment Solutions: Payment processors are starting to integrate cryptocurrency payment options, with more businesses accepting digital currencies. By 2025, it is expected that 30% of global merchants will accept cryptocurrency as part of their payment offerings. Driven by growing consumer demand and technological advancements.

Market Dynamics:

- Growth in the Payment Processing Market: The growth is fueled by the increasing adoption of digital payments, e-commerce growth, and the expansion of contactless payment technologies.

- Rising Adoption of Digital Wallets: Digital wallets, such as Apple Pay, Google Pay, and PayPal, are becoming more popular with consumers. By 2025, digital wallets are expected to account for over 55% of all e-commerce payments globally. Reflecting a shift towards more convenient and secure payment methods.

Conclusion

Payment Processing Solutions Statistics – In summary, payment processing solutions are the linchpin of modern finance. Facilitating secure and efficient transactions across diverse sectors and regions.

These solutions have evolved from traditional cash-based systems to today’s digital, mobile, and contactless methods.

The statistics and trends indicate rapid growth in the global payment processing market. Spurred by the COVID-19 pandemic’s impact on digital payments.

Regions like Asia Pacific and the Middle East are witnessing significant digital payment expansion, reshaping consumer behaviors and payment methods.

Card-based payments, e-wallets, and alternative options like Buy Now and Pay Later (BNPL) are rising. Along with real-time payments and contactless technology adoption.

Security, compliance, and innovation remain paramount as these solutions advance, and experts predict a lasting shift toward digital payments. Underscoring the industry’s need to stay at the forefront of technological progress.

FAQs

Payment processing solutions are a set of technologies and services that enable the secure and efficient transfer of funds between individuals, businesses, and financial institutions. They encompass various payment methods, including credit card transactions, digital wallets, and mobile payments.

Payment processing solutions facilitate the authorization, authentication, and settlement of financial transactions. The solution verifies the payer’s credentials and checks for available funds when a payment is made. It securely transfers the money from the payer to the payee, all while ensuring data privacy and security.

Payment processing solutions support various payment methods, including credit cards, debit cards, and electronic funds transfers (EFTs). Digital wallets like PayPal and Apple Pay, mobile payment apps, and emerging technologies like cryptocurrencies.

Businesses benefit from payment processing solutions by offering customers convenient payment options. Reducing the risk of fraud through secure transactions, and streamlining their financial operations. These solutions also enable businesses to expand their customer base by catering to various payment preferences.

A payment gateway is a crucial component of payment processing solutions. It acts as the intermediary between a merchant’s website or point of sale and the financial institutions involved in the transaction. Payment gateways securely transmit transaction data, authorize payments, and facilitate the transfer of funds.