Table of Contents

Report Overview

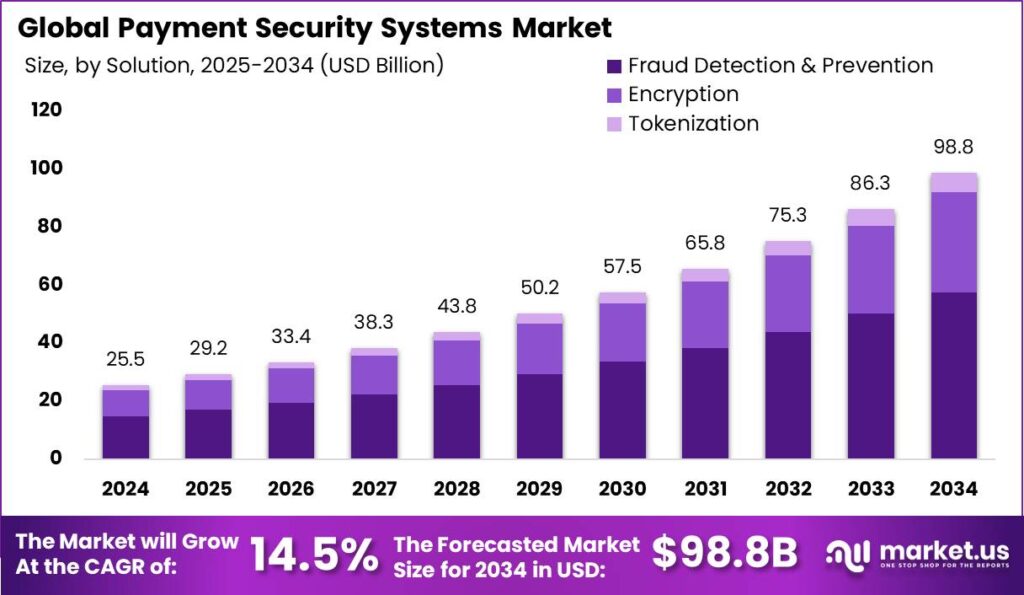

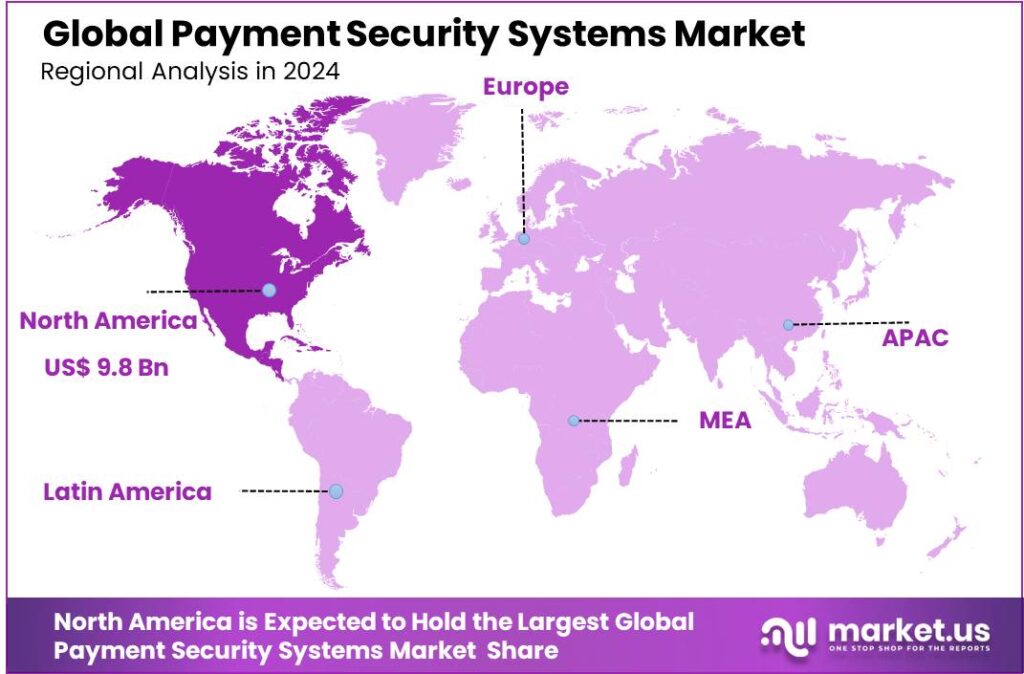

The Global Payment Security Systems Market is projected to experience substantial growth, reaching an estimated value of USD 98.8 billion by 2034, up from USD 25.5 billion in 2024. This growth is expected to occur at a robust CAGR of 14.5% during the forecast period from 2025 to 2034. In 2024, North America dominated the market, holding a significant share of 38.6% and generating USD 9.8 billion in revenue. Within this region, the U.S. market is forecasted to achieve USD 7.67 billion, maintaining a strong CAGR of 14.5%.

Payment security systems are essential technologies that protect digital transactions by ensuring the confidentiality, integrity, and authenticity of payment data. As digital payments grow, these systems use solutions like encryption, tokenization, authentication, and fraud detection to secure transactions across platforms such as online banking, mobile wallets, and POS terminals, safeguarding against fraud and cyberattacks.

The growth of the payment security market is driven by the rise in digital payments, which, while convenient, expose vulnerabilities and increase fraud risks. The adoption of new technologies like real-time payments and cloud-based solutions further heightens these concerns, emphasizing the need for advanced security systems to protect against fraud and ensure scalability, flexibility, and cost-efficiency.

Payment security systems are crucial in numerous sectors but are particularly vital in industries like banking and financial services, retail, and healthcare. These systems are employed to safeguard sensitive data and transaction processes, thus ensuring that businesses and consumers can engage in secure online transactions without the risk of data breaches or financial fraud.

Despite advancements, the payment security sector faces significant challenges. The increasing sophistication of cyberattacks and fraud schemes, especially those involving identity theft and social engineering, remains a major concern. Balancing enhanced security with a smooth user experience remains a challenge for payment providers, as stronger security measures can sometimes create friction during transactions.

In response to evolving threats, payment security is rapidly advancing with technologies like artificial intelligence (AI) and machine learning (ML) to improve fraud detection and prevention. These technologies analyze transaction patterns and detect anomalies more effectively. Additionally, advancements in encryption and tokenization play a key role in strengthening the security of digital payments.

The payment security market is growing globally, with North America leading due to high mobile payment adoption and major industry players. Meanwhile, the Asia Pacific region is experiencing rapid growth driven by increased digital payment adoption and rising disposable income, expanding the demand for secure payment solutions.

Key Takeaways

- The Global Payment Security Systems Market is projected to reach USD 98.8 billion by 2034, growing from USD 25.5 billion in 2024, with a CAGR of 14.50% from 2025 to 2034.

- In 2024, the Fraud Detection & Prevention segment was the largest, holding more than 58.4% of the market share.

- The POS-based/mobile-based segment dominated the market in 2024, capturing over 63.9% of the total share.

- Large Enterprises led the market, accounting for more than 69.1% of the payment security systems market in 2024.

- Retail & E-commerce also held a significant share in 2024, with more than 29.9% of the total market.

- North America was the leading region in 2024, with a market share of over 38.6%, contributing USD 9.8 billion in revenue.

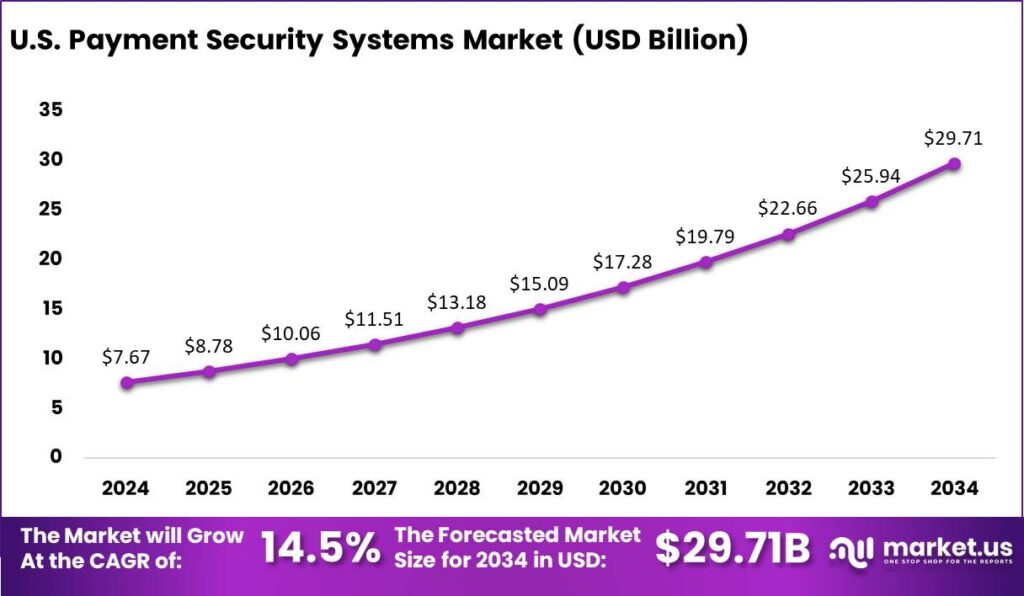

- The U.S. payment security systems market is expected to grow significantly, with a projected valuation of USD 7.67 billion, expanding at a CAGR of 14.5%.

Impact Of AI

- Enhanced Fraud Detection: AI-powered systems can detect suspicious behavior faster and more accurately than traditional methods. By analyzing patterns in transaction data, AI can identify unusual activities in real time. For example, if a user typically makes purchases in one country, AI can flag a sudden purchase from another continent as potentially fraudulent.

- Faster and Smarter Authentication: AI helps improve authentication methods, making them both secure and user-friendly. Biometric tools like facial recognition or fingerprint scanning are powered by AI, enabling users to log in or authorize payments quickly. These systems are harder to bypass, making payments safer.

- Predictive Risk Management: AI can predict potential risks by analyzing massive amounts of transaction data. It can anticipate fraudulent activities before they occur, allowing companies to take preventive actions. With this predictive ability, payment providers can block high-risk transactions automatically.

- Improved Customer Experience: AI enhances payment security without complicating the user experience. Smart algorithms can streamline processes like verifying transactions while ensuring that only legitimate activities are approved. This helps avoid unnecessary disruptions for customers, reducing frustration.

- Real-Time Monitoring: AI enables continuous monitoring of payments, ensuring that transactions are safe 24/7. Any abnormal behavior, such as a large number of transactions within a short period, can be flagged and blocked in real time, preventing potential financial losses.

U.S. Payment Security Systems Market

The U.S. payment security systems market is experiencing significant growth and is on track to reach a valuation of USD 7.67 billion in the near future. This impressive expansion is projected to unfold at a compound annual growth rate (CAGR) of 14.5%, indicating robust momentum in the sector. The growth can be attributed to increasing concerns about cybersecurity threats, the rise in digital transactions, and the growing need for secure payment solutions across various industries.

The growth of the U.S. payment security systems market is accelerating due to regulatory frameworks like PCI DSS, emerging compliance requirements, and the rise in data breaches and cyberattacks. These factors have driven businesses to adopt stronger security measures, increasing demand for technologies such as encryption, multi-factor authentication, tokenization, and other advanced fraud prevention solutions.

Payment security systems not only aim to protect financial transactions but also enhance customer trust, which is essential for maintaining competitiveness in the rapidly evolving digital landscape. As businesses continue to prioritize secure payment solutions, the market’s growth trajectory is set to accelerate, with new innovations expected to further shape its future.

In 2024, North America maintained a leading position in the payment security systems market, commanding a substantial market share of over 38.6%. The region’s revenue in this sector reached an impressive USD 9.8 billion, underscoring its dominance. This commanding presence is primarily driven by the region’s strong technological infrastructure, advanced payment processing systems, and widespread adoption of digital payment solutions across various industries.

The region’s proactive stance on cybersecurity, supported by regulatory frameworks like the General Data Protection Regulation (GDPR) in Europe and various industry-specific standards in the U.S., has encouraged businesses to implement advanced security measures. Moreover, North America’s high rate of technology adoption, particularly in financial services, retail, and e-commerce, has created a ripe environment for innovation in payment security. Companies in this region are leveraging cutting-edge technologies such as biometrics, AI-driven fraud detection, and tokenization to enhance transaction security. With these advancements, North America is poised to maintain its leadership, driving growth and shaping the future of payment security on a global scale.

Emerging Trends

- Biometric Authentication: Biometric authentication is becoming a major trend in payment security, as more businesses adopt fingerprint, face recognition, and voice recognition systems to authenticate transactions. This provides a more seamless and secure method compared to traditional passwords or PINs, reducing the chances of fraud. The global market for biometric payment systems is expected to grow as consumer trust in this technology increases.

- Tokenization Technology: Tokenization replaces sensitive payment information like credit card numbers with unique identifiers or tokens, ensuring that the original data remains secure and cannot be accessed. It helps reduce the risks of data breaches during transactions, making it an attractive option for both merchants and consumers. As data security threats evolve, tokenization is expected to become even more critical in protecting payment data.

- Contactless Payments: Contactless payments, where users simply tap their cards or smartphones to complete a transaction, have been growing in popularity due to their convenience and speed. The adoption of NFC (Near Field Communication) technology has made this method more secure, as it uses encryption to protect transaction data. This trend is accelerating, especially in light of the COVID-19 pandemic, which has boosted the demand for touch-free payment solutions.

- AI-Powered Fraud Detection: Artificial Intelligence is playing a significant role in enhancing payment security by using machine learning algorithms to detect fraud patterns in real-time. These AI systems can analyze vast amounts of transaction data to identify suspicious activity quickly, reducing the likelihood of fraudulent transactions. As cybercriminals develop more sophisticated techniques, AI’s role in proactive fraud prevention is only expected to grow.

- Blockchain for Payment Security: Blockchain technology offers an additional layer of security for payments by providing a transparent, immutable ledger of all transactions, reducing the risk of fraud and data manipulation. The decentralized nature of blockchain means there is no central point of failure, making it difficult for hackers to target. As businesses explore new ways to secure payment systems, blockchain is gaining traction as a viable solution.

Top Use Cases

- Fraud Prevention: Payment security systems are essential in detecting and preventing fraudulent transactions by monitoring payment activities in real-time. They use AI and machine learning algorithms to flag suspicious activities, helping businesses reduce financial losses. This proactive approach ensures customers feel safe when making purchases online.

- Secure Online Transactions: As e-commerce grows, ensuring secure online payments is critical. Payment security systems provide encryption and tokenization to protect sensitive data like credit card numbers during transactions. This reduces the risk of data breaches and boosts consumer confidence.

- PCI Compliance: Payment security systems help businesses adhere to the Payment Card Industry Data Security Standard (PCI DSS), which mandates securing customer payment data. By maintaining compliance, businesses avoid fines and penalties while ensuring trust with customers.

- Mobile Payment Security: With the rise of mobile wallets, payment security systems safeguard transactions on smartphones and tablets. These systems use biometric authentication, such as fingerprint scans or face recognition, to verify users’ identities, enhancing convenience and security.

- Cross-border Payment Protection: Payment security systems are designed to facilitate secure international transactions. They help businesses mitigate risks associated with currency conversions, fraud, and legal issues, ensuring smooth and secure payments across borders.

Market Opportunities

- Rising E-commerce Growth: As e-commerce continues to grow, the need for secure online transactions increases. With more consumers shopping online, businesses are looking to adopt advanced security solutions to protect sensitive payment information. This shift offers opportunities for innovative payment security technologies like encryption and biometrics.

- Integration of AI and Machine Learning: AI and machine learning can enhance fraud detection by analyzing vast amounts of transaction data in real time. As fraudsters become more sophisticated, businesses seek AI-driven solutions to predict and prevent fraudulent activities faster. This presents a significant growth area for payment security providers.

- Increasing Adoption of Contactless Payments: With the rise of contactless payment methods, there is a growing need for secure solutions that protect users from potential breaches. As more consumers use tap-to-pay technology, integrating secure protocols into these systems can offer strong market potential for payment security firms.

- Regulatory Compliance Demands: Governments and regulators around the world are tightening data protection and privacy laws, requiring businesses to implement secure payment systems. As companies strive to meet these regulations, there is a growing demand for compliant payment security solutions.

- Rise in Mobile Payments: With mobile wallets and mobile payment apps becoming more popular, securing mobile transactions is critical. As more people use their smartphones for payments, there’s a great opportunity for providers to offer mobile-specific security measures like biometric authentication and tokenization.

Major Challenges

- Fraud and Cyberattacks: Payment systems are prime targets for fraudsters and cybercriminals, who continuously develop new methods to breach security measures. Phishing, ransomware, and data breaches remain major threats, often leading to financial losses and damage to customer trust. As payment systems evolve, so do the tactics used by attackers, creating a constant game of cat and mouse.

- Compliance with Regulations: As global regulations surrounding payment security continue to change, businesses struggle to keep up with varying requirements in different regions. Compliance with standards such as GDPR, PCI DSS, and others is often complex, expensive, and time-consuming for companies, especially smaller ones. Failure to comply can lead to hefty fines and reputational damage.

- Data Privacy Concerns: With the increasing volume of personal data involved in transactions, safeguarding privacy has become a growing concern. Consumers are more aware of how their data is being used and are demanding stronger protections. Mismanagement of data or breaches can severely harm a company’s reputation and result in legal action.

- Integrating New Payment Technologies: The rise of innovative payment technologies, like blockchain and biometric authentication, introduces security risks that many traditional payment systems are not equipped to handle. While these technologies can provide enhanced convenience, their integration into existing systems can lead to vulnerabilities if not properly implemented. Organizations must balance the adoption of new tech with robust security protocols.

- User Education and Awareness: A significant challenge in payment security is educating consumers about safe payment practices. Many users are still unaware of the risks involved in online transactions and fall prey to scams like card skimming or fraudulent e-commerce sites. Regular education and awareness programs are crucial to ensure users take the necessary precautions when making payments online.

Market Opportunities for Key Players

- Rising Demand for Contactless Payments: The surge in contactless payment adoption is creating new opportunities for payment security systems. As more consumers and businesses opt for tap-and-go transactions, there’s an increased need for secure systems that protect payment data during these quick exchanges. Companies focusing on secure mobile wallets and contactless card transactions are poised to benefit from this trend.

- Growing E-commerce and Digital Transactions: The e-commerce boom continues to drive the need for secure online payment solutions. As online shopping becomes more common, the risk of cyber fraud grows. Companies that offer advanced fraud detection, encryption, and multi-factor authentication can tap into this expanding market. Integration with e-commerce platforms to provide seamless, secure checkouts will be key to capturing market share.

- Rise in Cybersecurity Threats and Fraudulent Activities: With an increasing number of cyberattacks targeting financial institutions and payment gateways, the need for stronger payment security solutions is critical. Payment security companies can capitalize on the growing concern around fraud and data breaches by providing next-generation threat detection systems, AI-powered fraud prevention tools, and advanced encryption techniques. As companies and consumers look for ways to safeguard their financial information, this market will see continued growth.

- Regulatory Changes and Compliance Demands: Global regulations such as the GDPR in Europe, PSD2 in the EU, and other data protection laws worldwide are pushing companies to invest in better security measures. Payment security companies that offer compliance-friendly solutions can position themselves as valuable partners for businesses navigating the complexities of these evolving regulations.

- Adoption of Biometric Authentication: The growing adoption of biometric authentication methods—such as facial recognition and fingerprints—presents a significant opportunity for payment security systems. As consumers prefer seamless and secure authentication methods for online and in-store purchases, companies that provide biometric authentication solutions will see rapid growth.

Recent Developments

- In November 2024, Maestro PMS took a major step forward in enhancing payment security by partnering with MezzoPay and TransForm. This collaboration empowers hotels with advanced technology, making payment processes smoother and more secure than ever before.

- In March 2024, Mastercard made a strategic move by agreeing to acquire threat intelligence company Recorded Future for $2.65 billion. This acquisition aims to bolster Mastercard’s cybersecurity services, offering real-time threat insights to further strengthen the security of its payment systems.

- Visa introduced an Extended Authorization Service that allows merchants to extend card-not-present transaction authorizations for up to 30 days, effective April 2024. This service aims to enhance transaction security while providing flexibility for merchants.

- To boost payment security, Bluefin and Sycurio joined forces in October 2024, merging Bluefin’s PCI-validated encryption with Sycurio’s multi-channel solutions. This powerful integration guarantees seamless, secure, and compliant payment experiences for businesses and their customers.

Conclusion

The payment security systems market is growing rapidly as the demand for secure online transactions increases, driven by the rise in digital payments and e-commerce. Key drivers include the growing concerns over cyber threats, advancements in authentication technologies, and the need for compliance with regulations such as GDPR and PCI DSS. Technologies like encryption, biometrics, and tokenization are central to securing payment data, while the adoption of Artificial Intelligence (AI) and machine learning is enhancing fraud detection and prevention systems.

In conclusion, the payment security systems market is poised for continued growth as both businesses and consumers prioritize secure digital transactions. As technology evolves, so too will the sophistication of payment security measures, fostering trust and driving further adoption of digital payment solutions across various sectors globally. Businesses that invest in advanced security systems will be better positioned to protect their customers’ data and maintain a competitive edge.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)