Table of Contents

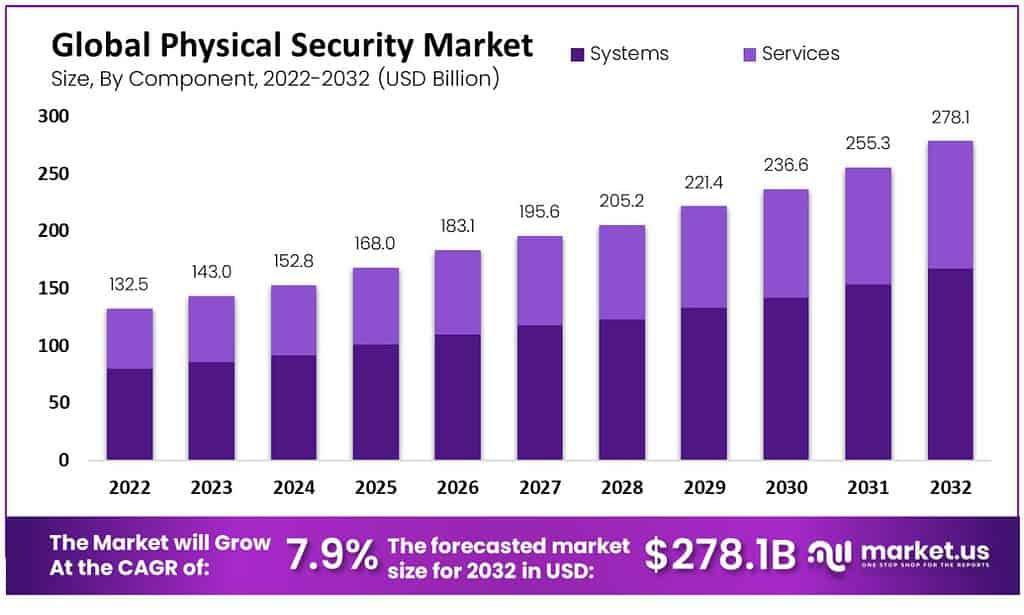

The Physical Security Market has been witnessing significant developments and is poised for further growth, driven by several factors despite facing challenges. Valued at USD 143.5 billion in 2023, the market is expected to expand at a CAGR of 7.9%, reaching USD 278.1 billion by 2032. This growth trajectory highlights the increasing demand for solutions that can safeguard physical assets, personnel, and infrastructure against potential threats and breaches.

The market is being propelled by various growth factors. The integration of Artificial Intelligence (AI) and cloud-based solutions is enhancing the efficacy and reach of physical security measures. AI has become an indispensable tool in improving detection accuracy and reducing response times to security incidents, leading to a surge in AI adoption across security systems. Furthermore, the move towards cloud-based security systems is gaining momentum, providing scalability, enhanced cybersecurity measures, and cost efficiencies. Supply chain constraints and labor shortages have also influenced the market, driving the need for more efficient project management and skilled labor.

Governments worldwide are heavily investing in modernizing and reinforcing their security apparatus to combat rising crime rates and security breaches, further propelling the market’s growth. Strict regulations and policies for physical security installations, such as the Payment Card Industry Data Security Standard (PCI DSS), underscore the emphasis on robust security measures. The market’s expansion is also fueled by the rising concern for employee safety and infrastructure protection across various organizations, highlighting the importance of physical security solutions in today’s volatile environment.

Key Takeaways

- The global sales of physical security are anticipated to reach USD 278.1 Billion by 2032, exhibiting an impressive 7.9% Compound Annual Growth Rate (CAGR) over the forecast period.

- In 2023, the global Physical Security market was valued at USD 143.5 Billion, highlighting a significant demand for physical security solutions worldwide.

- The market is projected to witness a substantial CAGR of 7.9% from 2023 to 2032, reflecting the growing need for robust security measures.

- The system segment, including components like video surveillance systems, physical access control systems, and fire and life safety, accounted for a dominant 60% share of global revenue in 2022.

- The services segment is expected to experience significant growth, with system integration and remote monitoring services leading the market with a combined market share of 43%.

- North America leads the global physical security market with a substantial market share of 36.4%, driven by advanced security system adoption and increased emphasis on compliance and regulations.

- The Asia Pacific region is poised for rapid growth, forecasted to experience a 5.2% CAGR between 2023 and 2032, fueled by rising demand for smart security solutions, particularly in countries like China and India.

Physical Security Statistics

- On average, security breaches caused by physical security issues cost about $4.36 million each and are behind 10% of harmful breaches.

- 80% of data breaches involve personal information of customers.

- 43% of organizations find it challenging to ensure the safety of remote workers, and 36% struggle with protecting physical access to company data.

- 91% of respondents believe that a technology-based industry standard is important for identifying and managing physical security risks.

- 40% of companies have updated their security policies due to physical security concerns, increasing their use of security guards and cameras.

- Nearly 20% of businesses surveyed reported an increase in physical security incidents compared to the previous year.

- 39% of companies are fast-tracking updates to their physical security measures in response to cybersecurity trends.

- 54% of those surveyed by Genetec see access control as a key focus area in 2021.

- 8.8% of physical security professionals are Asian, and 9.4% are Hispanic or Latino.

- 48% of physical security experts have a bachelor’s degree.

- White individuals make up 70.4% of the physical security workforce.

Use Cases

- Retail Security Enhancement: Retailers have significantly reduced shoplifting incidents by deploying cameras with two-way audio linked to monitoring centers. These systems can alert staff about suspicious activity, allowing them to intervene directly and deter potential thefts by informing the perpetrators that they are being watched and that law enforcement has been notified.

- Operations Control and Efficiency: In addition to enhancing security, physical security systems, particularly those integrated with analytics, provide valuable insights into operations. For example, in retail settings, cameras can detect long checkout lines and alert management to allocate additional staff. They can also generate heat maps to identify high-traffic areas, helping businesses optimize store layouts and product placements.

- Damage Assessment and Quality Control: Rental car companies and manufacturers are utilizing cameras to assess vehicle damage before and after rentals and to detect production line defects, respectively. These applications highlight the capacity of intelligent cameras to perform tasks with high precision, surpassing human capabilities in consistency and attention to detail over time.

- Enhancing Physical and Cybersecurity: The interconnection between physical security and cybersecurity is increasingly recognized. Proper physical access controls and surveillance are crucial for preventing unauthorized network access, essentially safeguarding digital assets from physical entry points. This holistic approach to security underscores the necessity of integrating physical security measures with cybersecurity strategies.

- Comprehensive Protection Strategies: Effective physical security measures are categorized into four main areas: Deter, Detect, Delay, and Respond. This framework ensures a multi-layered defense strategy, incorporating everything from perimeter defenses and access controls to intrusion detection systems and emergency response protocols. Technologies such as CCTV, motion sensors, and advanced access control systems play pivotal roles across these categories, emphasizing the importance of a well-rounded security plan.

Recent Developments

- Honeywell Acquires Carrier’s Global Access Solutions: Honeywell purchased Carrier’s Global Access Solutions for $4.95 billion, aiming to bolster its building automation capabilities. This acquisition includes hardware and software solutions, bringing the LenelS2 brand, Onity brand electronic locks, and Supra brand of electronic real estate lockboxes under Honeywell’s umbrella.

- ADT Sells Commercial Business to GTCR: ADT Inc. sold its commercial security, fire, and life safety unit to private equity firm GTCR for $1.6 billion. The business unit, known as ADT Commercial, will operate independently and rebrand as Everon.

- Bosch Plans to Sell Building Technologies Products: Bosch announced its intention to sell most of its Building Technologies division’s product business to focus on its regional integrator business. This includes seeking a buyer for its Video, Access and Intrusion, and Communication business units.

- Motorola Acquires IPVideo Corp.: Motorola Solutions acquired IPVideo Corp., known for creating the HALO Smart Sensor, an intelligent sensor that detects health and safety threats. This acquisition extends Motorola’s physical security offerings.

- IDIS and Costar Technologies Merge: Korean video manufacturer IDIS acquired Costar Technologies, building on their long-term ODM relationship. This merger is expected to enhance IDIS’ growth strategy in the U.S., leveraging Costar’s extensive distribution network.

- SECOM Invests in Brivo and Eagle Eye Networks: SECOM CO., LTD made a significant investment of $192 million in Eagle Eye Networks and Brivo, providers of cloud video surveillance and access control technologies, respectively. This investment is one of the largest in cloud physical security to date.

- ACRE Acquires PremiSys Portfolio: ACRE expanded its portfolio by acquiring the PremiSys software and hardware from IDenticard. This acquisition is aimed at enhancing ACRE’s offerings in healthcare, education, data centers, and senior living facilities.

- Qognify Becomes Part of Hexagon: Qognify, specializing in video management and enterprise incident management solutions, joined Hexagon’s Safety, Infrastructure & Geospatial division following its acquisition. This move is set to enhance Hexagon’s capabilities in real-time monitoring and security.

- ASSA ABLOY’s Acquisition Spree: ASSA ABLOY continued its acquisition trend by adding companies like Ghost Controls and Securitech Group to its portfolio, strengthening its position in mature markets by adding complementary products and solutions.

Key Companies Analysis

- Honeywell International Inc. has made significant contributions to the physical security market, notably with its acquisition of Carrier’s Global Access Solutions for $4.95 billion. This move is aimed at enhancing Honeywell’s building automation capabilities, bringing under its umbrella the LenelS2 brand, Onity electronic locks, and the Supra brand of cloud-based electronic real estate lockboxes. Furthermore, Honeywell has launched Pro-Watch 5.5, the latest version of its Integrated Security Suite, designed for enterprise and critical infrastructure markets to protect people, property, and ensure compliance with industry regulations.

- Robert Bosch GmbH significantly contributes to the physical security market through a comprehensive range of products and solutions. They offer video systems, intrusion alarm systems, access control systems, fire alarm systems, public address systems, conference solutions, management software, and various services. Bosch’s solutions are designed to ensure safety, security, and communication needs across different industries, including airports, energy, manufacturing, and more. Their offerings are known for incorporating advanced technologies, emphasizing sustainability, and focusing on long-term energy efficiency.

- Genetec Inc. has made significant contributions to the physical security market through its innovative solutions and strategic insights. As a technology leader specializing in unified security, public safety, operations, and business intelligence solutions, Genetec has been pivotal in guiding the industry’s adoption of cloud and hybrid solutions. Their comprehensive 2024 State of Physical Security report, drawing from insights of over 5,500 physical security leaders worldwide, underscores the rapid shift towards cloud-based solutions in the physical security domain.

Key contributions by Genetec include:

- Advocating for Cloud Adoption: Genetec’s research shows a significant jump in the adoption of cloud-based physical security solutions, with 44% of end users integrating cloud or hybrid solutions into their setups. This reflects a growing confidence in cloud solutions’ cybersecurity measures and a decline in cyber concerns that previously deterred organizations from cloud adoption.

- Promoting Hybrid Solutions: The company has highlighted the benefits of hybrid-cloud deployments, which combine local infrastructure with cloud capabilities, allowing organizations to remain agile and adaptable. This approach is increasingly preferred, with 60% of survey respondents indicating their organization aims for a strategy that blends on-premises and cloud-based solutions.

- Fostering IT and Physical Security Collaboration: The increasing interconnectedness of IT and physical security teams, as noted in Genetec’s report, points to a future where these departments work closely to optimize security measures. This collaboration is crucial for managing cybersecurity threats and ensuring comprehensive data protection.

- Recognition as Industry Leader: Genetec has been recognized as the fastest-growing access control software provider globally. This accolade from research organization Omdia highlights Genetec’s influential role in the market and its commitment to innovation and quality in access control solutions.

Conclusion

The Physical Security Market is at a pivotal juncture, with technological advancements and government initiatives driving growth, despite challenges related to system integration and costs. As the market evolves, the emphasis on innovation, particularly in AI and cloud-based solutions, is expected to open new avenues for market expansion and enhance the effectiveness of physical security measures globally.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)