Table of Contents

Market Overview

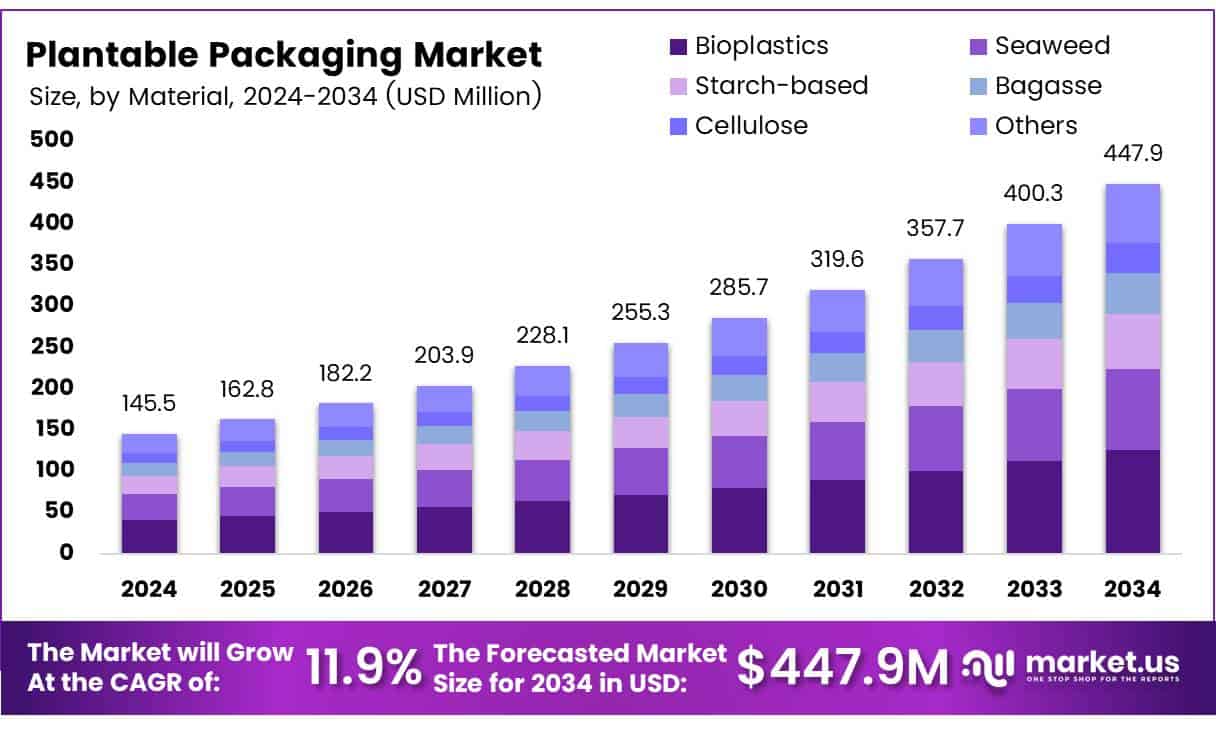

The Global Plantable Packaging Market size is expected to be worth around USD 447.9 Million by 2034, from USD 145.5 Million in 2024, growing at a CAGR of 11.9% during the forecast period.

The Plantable Packaging Market is growing with demand for eco-safe solutions. This packaging can biodegrade and grow into plants. It reduces waste and supports green living.

Global bioplastics production reached 2.47 million tonnes. Packaging leads the segment with 45% or 1.12 million tonnes. Plantable packaging is a key part of this rising trend.Consumers now prefer sustainable and zero-waste products. Brands use plantable packaging to boost image and cut plastic use. It offers both function and environmental value.

Governments ban single-use plastics in many regions. They support plant-based and compostable packaging innovation. Grants and R&D funding help market expansion. Plantable packaging suits food, cosmetics, and retail items. It is safe, compostable, and easy to use. Seeds in the packaging grow into herbs or flowers.

The market has high growth potential worldwide. Eco-packaging attracts green buyers and builds loyalty. Companies adopting it gain early mover advantage. Strict rules push industries toward low-impact solutions. Plantable packaging meets both legal and eco targets. The future of packaging is plant-based and circular. Businesses must invest now to lead this green shift. Growth is not just in profits but in plants too.

Key Takeaways

- The Global Plantable Packaging Market is projected to grow from USD 145.5 Million in 2024 to USD 447.9 Million by 2034, at a CAGR of 11.9%.

- Bioplastics dominate the material segment, driven by rising demand for sustainable alternatives.

- Flexible Packaging leads the type segment due to its efficient material use and ease of transport.

- The Food and Beverage sector holds 49.2% of the market by application, fueled by eco-conscious consumers.

- Europe leads the regional market with a 36.1% share, supported by strong regulations and environmental awareness.

Market Drivers

Rising Demand for Sustainable Alternatives

Growing concerns over plastic pollution have triggered a global shift in consumer behavior and corporate responsibility. Plantable packaging appeals to eco-conscious brands and customers alike, offering a solution that aligns with sustainability goals and environmental ethics.

Regulatory Pressure and Government Policies

Many governments are enforcing bans and restrictions on plastic packaging, especially single-use variants. These regulations are encouraging companies to explore biodegradable and innovative alternatives like plantable packaging.

Brand Differentiation Through Green Packaging

Businesses are using eco-packaging as a brand strategy to stand out in competitive markets. Plantable packaging not only enhances brand image but also improves customer engagement, offering a unique and interactive post-use experience.

Increased Adoption in Niche Markets

Sectors such as cosmetics, gourmet food, eco-friendly gifting, and artisanal goods are adopting plantable packaging to align with their environmentally responsible brand narratives and appeal to conscious consumers.

Support from Eco-Conscious Startups

A surge in eco-entrepreneurship is fueling innovation in materials, design, and scalability of plantable packaging. Startups are experimenting with locally sourced seeds, handmade processes, and region-specific planting techniques.

Market Challenges

Plantable packaging is more susceptible to moisture and environmental damage compared to plastic. This restricts its use in certain sectors where packaging needs to withstand long storage or transportation conditions.

Compared to conventional packaging materials, plantable packaging tends to have higher production and handling costs, which may deter mass adoption, particularly in cost-sensitive industries.

The effectiveness of seed germination depends on storage and climate conditions. If not stored or used properly, the seeds may not grow, defeating the purpose of plantable packaging.

While small-scale businesses and artisans readily adopt plantable packaging, large-scale industrial adoption is still limited due to challenges in automated production, standardization, and quality control.

Segmentation Insights

Material Analysis

Bioplastics lead with 38% share in 2024 due to eco-friendly use. Seaweed, starch, bagasse, and cellulose also grow for their natural, sustainable properties.

Type Analysis

Flexible packaging dominates for its low material use and easy transport. It’s popular in food, personal care, and pharma. Rigid packaging is used less due to cost and weight.

Application Analysis

Food & beverage leads with 49.2% share in 2024. Cosmetics use plantable packs for brand value. Industrial and pharma sectors slowly adopt for sustainability and compliance.

Regional Insights

Europe leads the market with a 36.1% share (USD 52.3 million) in 2024, driven by strong environmental rules and high consumer awareness.

North America sees strong growth thanks to eco-friendly trends and policies against plastic waste, especially in retail and healthcare.

Asia Pacific is growing fast due to rising pollution concerns and manufacturing strength, led by China and India.

Middle East & Africa is an emerging market, driven by new sustainability efforts and better waste management systems.

Latin America is gaining momentum as environmental activism grows, supported by both government and business interest in sustainable solutions.

Competitive Landscape

Material Innovation: Experimentation with new biodegradable binders, native seed varieties, and water-soluble substrates.

Brand Collaborations: Partnerships with eco-conscious brands to co-develop packaging solutions tailored to their product and sustainability goals.

Customization and Design Flexibility: Offering branding, printing, and storytelling on plantable materials helps companies enhance customer experience and brand loyalty.

Local Sourcing and Handmade Production: Many players emphasize local raw material sourcing and handcrafted techniques to support environmental and social impact goals.

Future Outlook

The future of plantable packaging appears bright, with innovations expected in durability, cost efficiency, and scalability. As environmental concerns rise and sustainable practices become mainstream, plantable packaging is likely to shift from a niche offering to a competitive alternative in the broader packaging market.

Greater collaboration between material scientists, packaging firms, and brands will play a key role in optimizing design and expanding its application across industries. Ultimately, plantable packaging represents not just a packaging solution, but a movement toward greener, regenerative consumerism.

Recent Developments

In September 2024, Dharaksha Ecosolutions, featured on Shark Tank India, secured ₹24.8 crores in funding to scale its eco-friendly packaging solutions, supporting the transition to sustainable alternatives to thermocol.

In September 2024, the biotech-driven startup also closed ₹24.8 crores in seed funding, aimed at expanding its biodegradable packaging operations and R&D capabilities.

In June 2025, Teknor Apex acquired Danimer Scientific, a leading bioplastics firm, to enhance its portfolio of sustainable polymer solutions and accelerate growth in the green materials sector.

In July 2025, FirmaPak announced the acquisition of California-based Lighthouse, strengthening its presence in the sustainable food packaging market across North America.

Conclusion

The Plantable Packaging Market is rapidly emerging as a transformative force in sustainable packaging, combining eco-innovation with consumer engagement. Driven by regulatory pressure, growing environmental awareness, and demand for circular solutions, the market is poised for strong expansion. While challenges like cost and durability remain, ongoing material innovation and supportive policies are helping scale adoption. Businesses that embrace plantable packaging now will not only reduce environmental impact but also gain brand loyalty and a competitive edge in the green economy.