Table of Contents

Introduction

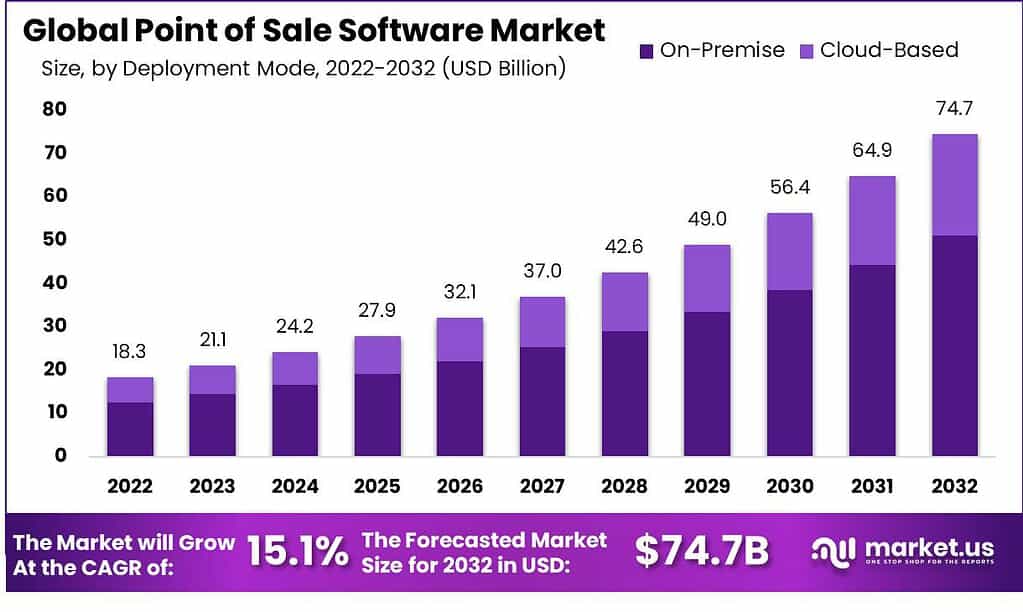

The Point of Sale (POS) Software Market is experiencing robust growth, projected to escalate from USD 21.1 billion in 2023 to USD 74.7 billion by 2032. This growth, registering a Compound Annual Growth Rate (CAGR) of 15.1%, is fueled by the increasing demand for efficient transaction processing and advanced analytics in the retail and hospitality sectors. The integration of POS software with other business tools, like Customer Relationship Management (CRM) and inventory management systems, alongside the rising trend of digitalization across these sectors, plays a significant role in this market expansion.

Point of Sale (POS) software is a computerized system used by businesses to manage sales transactions and streamline their operations. It serves as a central hub for processing payments, tracking inventory, generating reports, and managing customer data. The POS software market has witnessed significant growth in recent years, driven by several factors and presenting numerous opportunities for businesses.

One of the key growth factors in the POS software market is the increasing adoption of digital payment methods. With the rise of e-commerce and mobile payment solutions, businesses are recognizing the need for flexible and secure payment processing capabilities. POS software provides seamless integration with various payment options, including credit cards, digital wallets, and contactless payments, enabling businesses to cater to diverse customer preferences.

Key Takeaways

- The Point of Sale (POS) Software Market is set for substantial growth, with an estimated value of USD 74.7 billion by 2032, expanding at a CAGR of 15.1% during the forecast period from 2023 to 2032.

- A significant shift in the retail industry towards cloud-based POS systems is evident, with 55% of retailers adopting these systems in 2022, a notable increase from 43% in the previous year. This move signifies the industry’s trend towards leveraging cloud technology for enhanced operational efficiency and customer service.

- The on-premise deployment mode is leading the market, holding a substantial revenue share of 68.4%. This preference is particularly strong among larger enterprises that prioritize greater control and customization of their POS systems, underscoring the need for security and compliance in substantial business operations.

- In the application segment, fixed POS systems dominate, capturing a major revenue share of 55.7%. These systems, characterized by their stability and robust functionality, are preferred for businesses with high transaction volumes or those requiring industry-specific features.

- Large enterprises are significant contributors to the POS software market, commanding a major revenue share of 60.1%. The complexity and scale of operations in these organizations drive the demand for advanced POS solutions capable of managing multiple locations, inventory, and analytics.

- The retail segment leads the industry verticals in adopting POS systems, holding a major revenue share of 32.6%. Retailers rely heavily on POS software for efficient transaction processing, inventory management, and to enhance customer experience, showcasing the sector’s pivotal role in driving market growth.

- North America holds a major revenue share of 37.8%, dominating the POS software market. This dominance is attributed to the region’s quick adoption of digital payment methods, a large and diverse retail landscape, and a strong emphasis on data security and regulatory compliance.

Point of Sale Software Statistics

- 46% of small businesses plan to invest in POS software updates or replacements in 2023.

- A 2022 report highlights 60% of retailers see POS upgrades as crucial, with a focus on flexible solutions.

- The U.S. POS market is forecasted to grow from ~USD 5.7 billion in 2023 to ~USD 14.0 billion by 2030.

- Year-on-year growth for mobile payment transactions stands at 40.2%. Early adopters of mobile POS systems navigated pandemic challenges more effectively.

- 61% of retailers are considering cloud-based POS systems, as reported by Forbes.

- POS systems are predominantly used by small and mid-sized brands, making up 79%, while large enterprises account for 21%.

- 23% of mobile POS users report the inability to accept payments using the tool.

- Currently, 46% of retailers do not use mobile POS for transaction processing.

- In 2023, 57% of businesses value integration with third-party applications and services as a key selection criterion for POS software.

- By 2024, 41% of retailers plan to adopt POS software with advanced payment processing features to meet the demands of tech-savvy consumers

Elevate Your Business Strategy! Purchase the Report for Market-Driven Insights

Emerging Trends

- Adoption of Cloud-based Software: Cloud-based POS systems are gaining traction, offering enhanced flexibility, scalability, and cost savings over traditional on-premises setups.

- Mobile Payment Integration: Incorporating mobile payment options like Apple Pay and Google Pay into POS systems is increasingly common, reflecting consumer demand for convenience.

- Artificial Intelligence and Machine Learning: These technologies are being leveraged for customer data analysis, inventory management, and personalized customer experiences.

- Increased Use of Self-service Technologies: Self-service kiosks are becoming more prevalent in dining and retail, streamlining operations and improving customer satisfaction.

- Rise of Omnichannel Capabilities: Ensuring a seamless shopping experience across online, mobile, and in-store channels is a key focus, driven by consumer expectations for integrated retail experiences.

Use Cases

- Enhanced Customer Experience: POS systems enable personalized shopping experiences, crucial for meeting consumer expectations and driving satisfaction.

- Efficient Inventory Management: Leveraging real-time data analytics for inventory tracking helps businesses optimize stock levels and reduce waste.

- Streamlined Operations: From mobile ordering to payment processing, POS software simplifies various aspects of business operations, enhancing overall efficiency.

- Data-driven Decision Making: The analytics capabilities of POS systems provide valuable insights into sales trends, customer preferences, and operational efficiencies.

- Improved Security: Future integrations with biometric and blockchain technologies promise to enhance transaction security and customer trust.

Major Challenges

- High Initial Investment: The cost of implementing advanced POS systems can be prohibitive for small businesses.

- Complex Integration: Integrating POS software with existing business systems and technologies requires significant technical expertise and resources.

- Security Concerns: Ensuring data security and compliance with regulations remains a significant challenge, especially with the adoption of new technologies like biometrics and blockchain.

- Training Requirements: Staff may need extensive training to fully leverage the capabilities of advanced POS systems, adding to operational costs.

- Infrastructure Dependencies: The effectiveness of cloud-based and data-intensive POS systems is contingent on reliable internet connectivity and robust IT infrastructure.

Market Opportunity

- Growing Demand for Contactless Transactions: The shift towards contactless payments, accelerated by the COVID-19 pandemic, presents significant opportunities for POS software development.

- Expansion in Emerging Markets: Rising digital payment adoption in Asia Pacific and other emerging regions offers a vast market for POS solutions.

- Retail Sector Innovation: The continuous evolution of retail, including the rise of omnichannel shopping and personalized marketing, drives the need for versatile POS systems.

- Healthcare Sector Adoption: The need for efficient payment and patient management systems in healthcare facilities opens new avenues for POS software application.

- Technological Advancements: Ongoing innovations in AI, machine learning, and IoT provide a fertile ground for developing next-generation POS systems that can address current limitations and unlock new capabilities.

Recent Developments

- In January 2023, SAP introduced the U.S. market to its point-of-sale application, SAP Customer Checkout, partnering with camera manufacturer Leica Camera AG. This expansion is part of SAP’s globalization strategy, emphasizing user-friendly and modern POS solutions.

- Oracle Corporation: February 2023: Launched Oracle Retail Xstore Cloud, a comprehensive cloud-based POS solution for omnichannel retail experiences.

Conclusion

In conclusion, the POS software market is experiencing robust growth due to factors such as the increasing adoption of digital payment methods, the demand for real-time data and analytics, and the integration of POS software with other business systems. This market offers ample opportunities for businesses across various industries, particularly with the emergence of cloud-based solutions. Careful consideration of business requirements and thorough evaluation of POS software providers are essential for successful implementation and utilization of these systems.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)