Table of Contents

Introduction

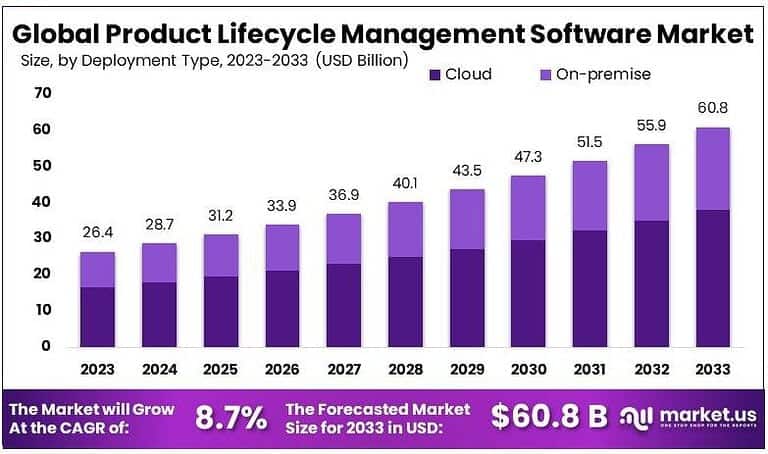

The global product lifecycle management (PLM) software market reached USD 26.4 billion in 2023 and is projected to grow at a CAGR of 8.7%, reaching approximately USD 60.8 billion by 2033. Growth is driven by rising product complexity, digital transformation, and the need for faster time-to-market. Industries such as automotive, aerospace, electronics, and healthcare are adopting PLM platforms to manage product data, enhance collaboration, and optimize R&D cycles. Cloud-based PLM deployment and AI-enabled design intelligence are reshaping global manufacturing ecosystems.

How Growth is Impacting the Economy

The expanding PLM software market is boosting global industrial productivity and innovation efficiency. By integrating digital twins, CAD, and simulation data, PLM systems streamline product design and reduce material waste—creating tangible cost savings for manufacturers. According to the World Economic Forum, digital engineering and lifecycle management can improve operational efficiency by 20–25%, translating into billions in global savings annually.

The market’s growth stimulates employment in IT, engineering, and data management, while also increasing software exports from innovation hubs such as the US, Germany, and Japan. Governments investing in Industry 4.0 initiatives are also witnessing higher SME participation in digital manufacturing. Overall, PLM adoption enhances national competitiveness by supporting sustainable product design and circular economy models.

➤ Unlock growth! Get your sample now! – https://market.us/report/product-lifecycle-management-software-market/free-sample/

Impact on Global Businesses

Rising software licensing costs, complex integration with legacy systems, and cybersecurity concerns are influencing corporate spending patterns. Global supply chain disruptions have pushed companies to adopt PLM systems with predictive analytics and risk management modules. In the automotive and aerospace sectors, PLM solutions are reducing prototype costs and enabling remote design collaboration.

Consumer electronics firms use PLM tools to manage rapid product iterations, while healthcare companies leverage digital validation and compliance tracking. However, small enterprises face financial challenges in transitioning from legacy product data systems to advanced, cloud-based PLM platforms due to high customization and maintenance costs.

Strategies for Businesses

To stay competitive, organizations are implementing strategies focused on efficiency and innovation:

- Adopting cloud-based and modular PLM platforms to enhance scalability

- Integrating PLM with ERP and CRM systems for unified data management

- Leveraging AI and digital twins to predict design outcomes and reduce errors

- Focusing on cybersecurity and compliance in regulated industries

- Partnering with software vendors and system integrators to optimize deployment

Key Takeaways

- Market projected to reach USD 60.8 billion by 2033 at 8.7% CAGR

- Growth led by digitalization and Industry 4.0 transformation

- Cloud-based PLM is gaining rapid traction in the manufacturing and design sectors

- Integration of AI and IoT is enhancing predictive lifecycle management

- Major opportunities in the automotive, aerospace, and electronics industries

➤ Stay ahead — Secure your copy now – https://market.us/purchase-report/?report_id=51847

Analyst Viewpoint

The PLM software market presents strong long-term potential as industries digitize end-to-end product processes. Presently, cloud adoption and remote collaboration are reshaping engineering workflows. In the next decade, PLM will evolve toward AI-driven lifecycle intelligence—integrating predictive design, supply chain transparency, and sustainability metrics. Analysts anticipate higher PLM penetration among SMEs due to low-code customization and SaaS pricing models. The future outlook remains highly positive, supported by global manufacturing digitalization and sustainability mandates.

Use Cases and Growth Factors

| Use Case | Growth Factor |

|---|---|

| Automotive Design Collaboration | Increased demand for real-time digital twin and 3D simulation |

| Aerospace Component Tracking | Need for compliance and traceability across complex supply chains |

| Electronics Product Development | Shorter innovation cycles and rapid prototyping |

| Medical Device Lifecycle Management | Regulatory compliance and quality control automation |

| Industrial Machinery Optimization | Integration of IoT for predictive maintenance and product design |

Regional Analysis

North America dominates the PLM market, driven by early adoption of digital manufacturing, major aerospace OEMs, and strong software R&D presence. Europe follows closely, with countries like Germany and France emphasizing Industry 4.0 and sustainable product development. The Asia Pacific region is growing rapidly, led by China, Japan, and India, due to expanding manufacturing bases and digital twin adoption. Latin America and the Middle East & Africa are emerging markets, showing potential in automotive assembly, oil & gas engineering, and electronics production, where PLM solutions enhance process efficiency.

➤ Don’t Stop Here — Check Our Library

Business Opportunities

The PLM software market presents vast opportunities across digital transformation initiatives. Companies offering AI-enabled product simulation, real-time design collaboration, and data-driven sustainability analytics are positioned for growth. With governments emphasizing smart factories and green manufacturing, vendors can tap into new partnerships with industrial and educational institutions. The transition from on-premise to SaaS-based PLM provides recurring revenue potential. Additionally, integration with AR/VR platforms for immersive product visualization represents a promising frontier.

Key Segmentation

The market can be segmented as follows:

- By Component: Software, Services (Implementation, Support & Maintenance, Consulting)

- By Deployment: On-Premise, Cloud-Based

- By Enterprise Size: Large Enterprises, Small & Medium Enterprises

- By Application: Design & Engineering, Manufacturing, Simulation & Testing, Maintenance, Compliance Management

- By End-User: Automotive, Aerospace & Defense, Electronics, Healthcare, Industrial Machinery, Consumer Goods

- By Region: North America, Europe, Asia Pacific, Latin America, Middle East & Africa

Key Player Analysis

Leading PLM solution providers are focusing on integrated ecosystems that merge CAD, CAM, and simulation with cloud collaboration. These players are enhancing user experience through intuitive interfaces and AI-based design recommendations. Strategic alliances with ERP and MES providers are enabling end-to-end product data synchronization. Continuous R&D investments in digital twin technology and 3D modeling tools are strengthening market positioning. Companies are also adopting sustainability analytics and material traceability modules to align with global ESG standards and circular economy goals.

- Dassault Systèmes SE (Dassault Group)

- PTC Inc.

- Siemens AG

- SAP SE

- Autodesk Inc.

- Oracle Corporation

- Infor (Koch Industries Inc.)

- ANSYS Inc.

- IBM Corporation

- Other Key Players

Recent Developments

- March 2025: Launch of an AI-driven PLM suite for predictive design automation.

- January 2025: Partnership announced to integrate PLM with additive manufacturing systems.

- October 2024: Cloud-based PLM platform introduced for SME manufacturers.

- July 2024: Collaboration formed to develop blockchain-based product traceability modules.

- May 2024: Integration of AR/VR design visualization into leading PLM software platform.

Conclusion

The global PLM software market is undergoing rapid transformation as digital engineering, cloud collaboration, and AI redefine product innovation. With strong growth prospects and continuous technological advancements, PLM remains central to the future of global manufacturing competitiveness and sustainable product development.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)