Table of Contents

Introduction

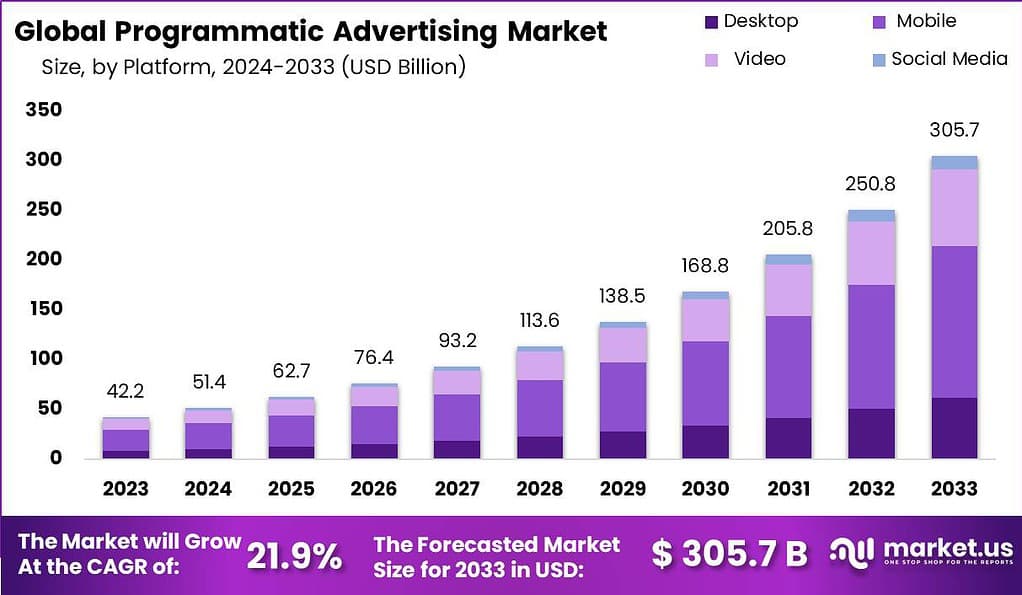

According to Market.us, The Global Programmatic Advertising Market is projected to experience significant growth, escalating from USD 42.2 Billion in 2023 to an estimated USD 305.7 Billion by 2033. This market is anticipated to advance at a Compound Annual Growth Rate (CAGR) of 21.9% during the forecast period spanning from 2024 to 2033.

Programmatic advertising is a digital advertising technique that uses automated systems and algorithms to buy and sell ad space online. It involves the use of technology to efficiently and effectively target specific audiences and deliver personalized ads in real-time. In simple terms, programmatic advertising is like a high-tech auction where advertisers and publishers come together to buy and sell ad space. Instead of negotiating deals manually, computers and algorithms do the work. Advertisers can specify their target audience, budget, and other preferences, and the system automatically finds the best ad slots that match those criteria.

To learn more about this report – request a sample report PDF

The programmatic advertising market refers to the industry surrounding programmatic advertising. It includes various players such as advertisers, publishers, ad networks, and technology providers. The market has experienced significant growth in recent years due to the increasing adoption of programmatic advertising by businesses. One of the main advantages of programmatic advertising is its efficiency. It eliminates the need for manual negotiations and streamlines the ad buying process. Advertisers can reach a wide range of websites and apps through a single platform, making it easier to manage and optimize campaigns.

Key Takeaways

- The Programmatic Advertising market, valued at USD 42.2 billion in 2023, is forecasted to surge to USD 305.7 billion by 2033, demonstrating a robust Compound Annual Growth Rate (CAGR) of 21.9% during the period from 2024 to 2033. This substantial growth is indicative of the evolving digital marketing landscape and the increasing automation of ad purchasing.

- Real-Time Bidding (RTB): This segment is leading the market with a considerable share of 45%, highlighting its prominence in facilitating instant programmatic ad transactions.

- Platform Analysis: The mobile platform claims the largest share of the market, accounting for 50% in 2023. This dominance reflects the shift towards mobile-first strategies in digital advertising due to the increasing usage of mobile devices.

- Ad Format: Within ad formats, the display segment has held the majority, dominating with a 40% market share in 2023. This demonstrates the ongoing preference for visual engagement through display ads in programmatic advertising.

- Moreover, global programmatic budgets are poised to grow significantly, with an anticipated increase of over USD 300 billion within the next four years. This forecasted rise underscores a substantial expansion in both the adoption of and investment in programmatic advertising platforms and technologies globally, as organizations continue to seek more efficient and targeted advertising solutions.

Programmatic Advertising Statistics

- 64% of companies report that the most significant benefit of programmatic advertising is improved targeting capabilities.

- 65% of advertisers intend to increase their budget for programmatic advertising over the next 12 months.

- Programmatic ads will represent 88% of all digital display ad spending in the U.S., totaling about $81.00 billion by 2023.

- 83% of marketers consider programmatic advertising important or very important to their strategies.

- In Canada, programmatic ads make up approximately 84% of all display advertising.

- In the U.S., around 69% of display ads are delivered programmatically.

- U.S. spending on programmatic ads for connected TV (CTV) is set to reach $21.5 billion this year, marking a 25% increase from the previous year. This method is becoming crucial for gaining a competitive edge, especially during the holiday season.

- Programmatic podcast advertising in the U.S. is also on the rise, expected to grow by 41.3% this year, reaching $166.3 million.

- The U.S. programmatic digital out-of-home (DOOH) advertising is forecasted to grow by 48.2% this year, achieving a total of $660 million. This channel is rebounding strongly after significant declines during the pandemic and can be a key component of advertising strategies, particularly around the holidays.

- By 2024, 91.3% of all U.S. digital display advertising spend will be programmatic, though not every digital channel is equally penetrated by programmatic advertising.

- Video ads currently account for over 50% of programmatic ad spending.

- About 50% of programmatic ad budgets are directed towards mobile platforms.

- Mobile programmatic ad spending is projected to exceed $32 billion by 2023.

- Connected TV (CTV) is expected to capture 49% of the total U.S. programmatic video ad spend.

- Over 60% of total digital advertising spend is now through programmatic channels.

- 78% of U.S. companies have adopted programmatic advertising technologies.

Emerging Trends

- Increased Use of AI and Machine Learning: Artificial intelligence and machine learning are set to revolutionize programmatic advertising by automating processes and enhancing audience targeting and ad personalization.

- Rise of Privacy-First Advertising: Advertisers are adapting to stricter privacy regulations by developing targeting methodologies that respect user privacy without relying on third-party cookies.

- Expansion of CTV and OTT Advertising: Connected TV and Over-The-Top media services are becoming key channels for programmatic ads, with their viewership offering new engagement opportunities.

- Interactive and Immersive Ad Formats: The use of augmented and virtual reality in ads is growing, providing more engaging and memorable ad experiences.

- Adoption of Programmatic Direct and PMPs: There’s a shift towards programmatic direct deals and private marketplaces, offering advertisers greater control over ad placements and improved transparency.

Top Use Cases

- Enhanced Personalization and Targeting: AI-driven algorithms are increasingly used to create highly personalized ads based on user behavior and preferences, improving engagement and conversion rates.

- Efficient Media Buying: Programmatic platforms facilitate the buying and management of ad campaigns across multiple channels, optimizing media spend and campaign performance.

- Brand Safety and Compliance: With the shift towards privacy and data compliance, programmatic advertising is becoming more secure, helping brands maintain trust and meet regulatory standards.

- Cross-Channel Marketing: Advertisers are integrating campaigns across mobile, desktop, CTV, and digital out-of-home to provide a seamless user experience and enhance brand recognition.

- Real-Time Measurement and Attribution: Advanced attribution models in programmatic advertising allow for precise measurement of campaign effectiveness and ROI, helping advertisers make data-driven adjustments.

Major Challenges

- Ad Fraud: Ad fraud is a significant challenge costing the industry billions annually. Common schemes include domain spoofing, bot traffic, ad injections, ad stacking, and cookie stuffing. These fraudulent activities inflate ad costs and undermine campaign integrity.

- Privacy and Data Compliance: Managing user consent under privacy regulations like GDPR and CCPA is problematic. Advertisers often struggle with the transparency and tracking of consent across programmatic platforms, making compliance challenging.

- Technology Integration and Complexity: The programmatic ecosystem involves complex integrations between demand-side platforms, supply-side platforms, and data management platforms. These integrations can be difficult to manage and optimize, especially as the volume and variety of data increase.

- Transparency and Visibility: There is a need for greater transparency in the transactions between advertisers and publishers. Issues such as undisclosed margins and unclear ad placement can affect trust and effectiveness.

- Quality of Ad Placements: Ensuring the quality of ad placements remains a concern, with issues like ad viewability and brand safety impacting campaign performance and brand reputation.

Market Opportunities

- Growth of CTV and OTT: The expanding market for Connected TV (CTQ and over-the-top (OTT) media services presents a significant opportunity for targeted, efficient programmatic advertising.

- Advanced Targeting Capabilities: The use of AI and machine learning in programmatic advertising enhances targeting and optimization capabilities, enabling advertisers to reach the right audience with high precision.

- Programmatic Audio and Video: Increasing consumption of digital audio and video content, including podcasts and streaming services, opens up new avenues for programmatic audio and video advertising.

- Private Marketplaces (PMPs): The rise of PMPs offers advertisers and publishers controlled environments to negotiate premium ad inventory, enhancing the value and effectiveness of the exchanges.

- Innovative Ad Formats and Integration: Innovations in ad formats and the integration of emerging technologies like 5G and AR/VR into programmatic platforms can enhance user engagement and open up new advertising opportunities.

Recent Developments

- Dentsu Acquires Tag Worldwide (March 2023): Dentsu Group acquired Tag Worldwide, enhancing their digital marketing production capabilities. This move allowed Dentsu to offer high-quality content at scale, bolstering their creative and media optimization services globally.

- Juicebox Acquires Island Media (November 2023): Digital agency Juicebox acquired a significant stake in Island Media, an Indonesian branding and digital agency. This acquisition aims to expand Juicebox’s capabilities and foster innovation through diverse talents and regional market insights.

- Omnicom Acquires Ptarmigan Media (July 2023): Omnicom Media Group acquired Ptarmigan Media, a specialist in financial services advertising. This acquisition strengthens Omnicom’s expertise and scale in financial services, offering enhanced media buying capabilities.

- WPP Merges Wunderman Thompson and VMLY&R (January 2024): WPP merged two of its major agencies, Wunderman Thompson and VMLY&R, forming a new entity known as VML. This merger aims to streamline operations and enhance service offerings across digital, creative, and media buying segments.

Conclusion

In conclusion, programmatic advertising has experienced remarkable growth due to its efficiency, precise targeting, and real-time optimization capabilities. While challenges such as ad fraud and brand safety persist, they create opportunities for new entrants to develop innovative solutions and disrupt the market. As businesses increasingly recognize the benefits of programmatic advertising, the market is expected to continue expanding, offering a promising landscape for both established players and newcomers alike.

The programmatic advertising market, while facing challenges such as ad fraud and the complexity of its technological landscape, holds substantial growth potential. Innovations in AI, along with the rise of CTV and digital audio/video content, are shaping the future of advertising. Effective utilization of these technologies, coupled with enhanced transparency and compliance measures, can lead to more efficient and impactful advertising campaigns. For advertisers willing to navigate these complexities, programmatic advertising offers a powerful tool for reaching audiences with precision and scale.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)