Table of Contents

Introduction

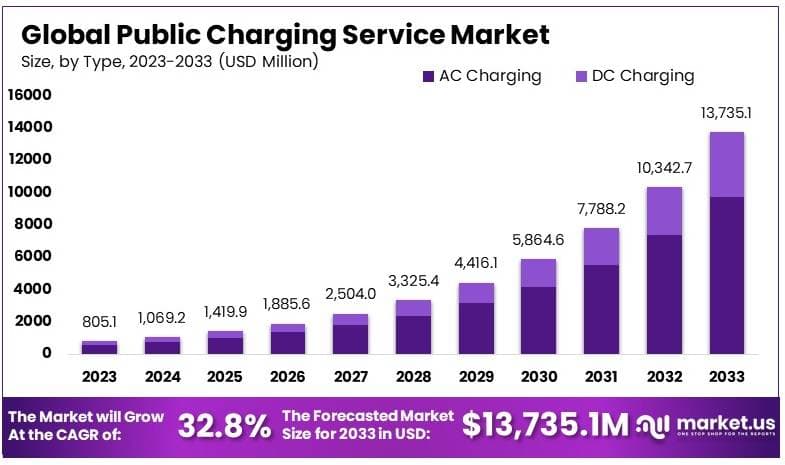

As per the latest insights from Market.us, The Global Public Charging Service Market is projected to reach a valuation of USD 13,735.1 Million by 2033, up from USD 805.1 Million in 2023, registering a Compound Annual Growth Rate (CAGR) of 32.8% over the forecast period from 2024 to 2033. As of 2023, North America holds a leading position, accounting for 34% of the market, primarily driven by the expansion of electric vehicle (EV) infrastructure and governmental incentives.

Public charging services provide power stations where electric vehicle (EV) owners can charge their vehicles when they are away from home. These stations are typically located in public places such as parking lots, shopping centers, and near highways. The idea is to make it convenient for EV drivers to find a place to recharge, especially during long trips or when they can’t access private charging options.

The market for public charging services is expanding as the number of electric vehicles on the road increases. Businesses and governments are investing in these services to support the growing demand for EVs. The availability of public charging stations is crucial for encouraging more people to buy electric vehicles, as it addresses concerns about range and the availability of charging points.

The demand for public charging services is driven by the continuous rise in electric vehicle sales. As more people choose EVs for their environmental benefits and lower operating costs, the need for more public charging stations grows. This demand is also fueled by the limited range of some electric vehicles, which necessitates frequent recharges on longer journeys.

Several factors contribute to the growth of the public charging service market. Government policies and subsidies that promote electric vehicles are significant growth drivers. Additionally, technological advancements that reduce charging time and increase charger compatibility across different EV models are making public charging more appealing. The expansion of urban areas and increasing consumer awareness about the benefits of electric vehicles also play crucial roles in market growth.

There are considerable opportunities in the public charging service market. One major opportunity lies in the development of faster and more efficient charging technologies, which could significantly reduce waiting times at charging stations. There’s also potential in expanding charging infrastructure into more rural and underserved areas, broadening the reach of EVs. Moreover, partnerships between charging service providers and commercial properties can open up new revenue streams and increase the visibility and accessibility of charging stations.

Key Takeaways

- The Public Charging Service Market was valued at USD 805.1 million in 2023 and is projected to reach USD 13,735.1 million by 2033, growing at a robust CAGR of 32.8% over the forecast period.

- In 2023, the AC Charging segment held a dominant market share of 71% in the type category, primarily due to its widespread compatibility with most electric vehicles.

- The Battery Electric Vehicles (BEVs) application segment led the market with a significant share of 68% in 2023, reflecting the increasing shift towards fully electric vehicles over hybrid options.

- Geographically, North America emerged as the leading region, capturing 34% of the market share in 2023. This leadership is attributed to the rapid expansion of EV infrastructure and supportive government incentives aimed at promoting the adoption of electric vehicles across the region.

Public Charging Service Statistics

The global Electric Vehicle (EV) Charging Infrastructure Market is expected to experience significant growth, reaching an estimated value of USD 224.8 billion by 2032, up from USD 25.2 billion in 2023, at a CAGR of 27.5% during the forecast period. This expansion is driven by the increasing adoption of electric vehicles and the subsequent need for widespread, accessible charging infrastructure.

India’s EV Charging Infrastructure

According to data from the Ministry of Power, as of February 2, 2024, there are 12,146 operational public EV charging stations across India, which represents an 84% increase from 6,586 charging stations in March 2023. Comparatively, in March 2022, there were only 1,742 public charging stations, reflecting rapid infrastructure growth in the country to support the rising number of electric vehicles.

As of March 2022, Vahan 4 data reported 10,76,420 electric vehicles in operation. NITI Aayog has highlighted that the required charging infrastructure varies significantly based on geography, usage patterns, and other factors, with estimates ranging from 1 charging point per 20 EVs to 1 charging point per 150 EVs.

UK’s EV Charging Expansion

In the UK, the EV charging sector is projected to grow to £3.9 billion (US$5.1 billion) by 2030. By April 2024, the number of public EV charging points in the UK had risen by 53% to reach 61,232, with Shell Recharge leading the market with 8,698 public chargers. Notably, 32% of all public chargers are concentrated in London, which has a density of 221 devices per 100,000 residents. However, nearly 59% of the UK’s public charging points are slow chargers, with a power rating below 8 kWh.

The UK also recorded 1.1 million fully electric cars on its roads as of April 2024, marking a 13% year-over-year increase. Despite this rise in public charging points, around 80% of EV owners still rely on home charging infrastructure, with an estimated 400,000 home charging points already installed across the country.

Global Comparisons

In Norway, the share of EVs in new car sales exceeds 90%, while Mexico lags behind with less than 2% of new sales being EVs. However, home charging is prevalent in both regions, with 82% of Norwegian EV owners and 71% of Mexican EV owners charging their vehicles at home.

In the United States, California leads in EV adoption, accounting for 37% of all EVs in operation nationwide. This is followed by New York, Florida, and Texas. Early in 2024, 23.5% of new car registrations in the US were plug-in electric vehicles, including hybrids.

Strategic Initiatives

To further accelerate the deployment of public EV charging stations in India, it has been proposed to provide a 20% rebate on Average Cost of Supply (ACoS) by DISCOMs to Public Charging Stations (PCS) during solar hours, with a 20% surcharge during non-solar hours. This policy aims to incentivize the development of a robust, energy-efficient charging network across the country.

Emerging Trends

- Rapid Infrastructure Expansion: The public charging infrastructure is seeing significant growth with increased focus on fast chargers, which grew by 55% in the previous year. Governments and industries are focusing on creating dense networks of chargers, especially in strategic locations like major transport routes and urban centers.

- Advancements in Technology: New technologies such as wireless charging and battery swapping are being tested and deployed. Battery swapping is notably expanding in markets like India and is seen as a viable alternative in places where charging infrastructure is less developed.

- Integration of Renewable Energy Sources: There is a growing integration of EV charging infrastructure with renewable energy sources, emphasizing sustainability and reducing the carbon footprint of electric vehicles and their supporting infrastructure.

- Vehicle-to-Grid (V2G) Systems: V2G technology, which allows EVs to return energy to the power grid, is expected to grow substantially. This not only helps in stabilizing the grid during peak demand but also offers a potential income stream for EV owners.

- Enhanced User Experience: Efforts are being made to simplify the charging process with more user-friendly payment solutions and improved station access, aiming to enhance the overall customer experience at public charging points.

Top Use Cases for Public Charging Services

- Urban Commuter Support: Public chargers are critical in supporting urban commuters who may not have access to private charging points. This is essential for the adoption of EVs in densely populated cities.

- Long-Distance Travel: With chargers becoming more widespread along highways and major transport routes, EVs are becoming a more viable option for long-distance travel, reducing range anxiety.

- Fleet Operations: Electric commercial fleets benefit from public fast-charging networks, which can dramatically reduce downtime for vehicles that need rapid recharging during operational hours.

- Support for Renewable Energy Transitions: Public charging stations that utilize renewable energy sources help in reducing the overall carbon emissions associated with electric vehicle charging.

- Community Energy Balancing: The deployment of V2G capable public charging stations provides a mechanism for balancing community energy needs, potentially stabilizing local grids and utilizing EV batteries as temporary energy storage solutions.

Business Benefits

The public charging service industry presents several compelling business benefits that are increasingly recognized as the electric vehicle (EV) market expands. Here’s an overview of the major advantages:

- Revenue Generation: Operators of public charging stations generate income primarily through the sale of electricity to EV owners. Models vary from owner-operators who handle all aspects of the charging service, to site hosts (like retail locations) that partner with charging providers to install equipment on their properties. This can also include earning revenues through additional services such as advertising and convenience offerings at the charging locations.

- Customer Attraction and Retention: Businesses that host charging stations can enhance customer attraction by appealing to EV owners who prefer locations that offer charging facilities. This is particularly beneficial for locations like shopping centers, hotels, and service stations where dwell time can be aligned with charging needs. Providing these facilities can set a business apart from competitors and improve customer loyalty and satisfaction.

- Enhanced Corporate Image: Installing EV chargers can bolster a company’s brand image by demonstrating a commitment to sustainability. This can appeal to environmentally conscious consumers and help businesses meet their corporate social responsibility goals(Atlas EV Hub).

- Workforce Benefits: For businesses with a significant number of employees, offering EV charging at the workplace can aid in recruitment and retention, particularly among younger, more environmentally conscious professionals. It signals a progressive, employee-focused company culture which is an attractive benefit for prospective and current employees.

- Access to Incentives: Many regions offer incentives such as tax credits, rebates, and grants for the installation of EV charging stations, which can significantly reduce the initial and ongoing costs associated with deploying these technologies.

- Energy Resilience and Cost Savings: Companies can achieve energy cost savings by adopting EVs in their fleets and using chargers that can act as energy storage solutions. In some cases, bi-directional chargers allow for energy to be sent back to the grid or used by the business during peak times, lowering energy costs and improving resilience against power outages.

Major Challenges

- Cost of Infrastructure: Establishing a comprehensive network of charging stations involves significant costs not only in terms of installation but also operation and maintenance. These high upfront investments may deter rapid expansion, particularly in less urbanized areas.

- Permitting and Regulatory Hurdles: The process of installing new charging stations is often slowed by complex permitting and regulatory frameworks, which can vary significantly between jurisdictions. This creates challenges for nationwide deployment and can add substantial time and cost to projects.

- Technology Integration and Upgrades: As electric vehicle (EV) technologies advance, existing charging infrastructures must adapt and upgrade to accommodate faster and more efficient charging technologies. This requires ongoing investment and technological updates, which can be a financial strain.

- Utility and Grid Management: The integration of a growing number of EVs and charging stations poses significant challenges to existing electrical grids, which may require upgrades to handle increased load and to ensure reliability and efficiency in energy distribution.

- Consumer Adoption and Accessibility: The uneven distribution of charging stations can deter potential EV buyers, who may have concerns about charging convenience and availability, especially in rural or underserved areas.

Top Opportunities

- Federal and State Incentives: With substantial support from government initiatives, such as federal funding and incentives for EV infrastructure development, there is a significant opportunity to accelerate the deployment of public charging stations across the nation.

- Partnerships and Collaborations: Collaborations between public agencies, private companies, and utility providers can leverage shared expertise and resources, thereby reducing costs and improving the efficiency of charging infrastructure deployment.

- Innovations in Charging Technology: Advancements in charging technology, such as high-speed charging, wireless charging, and bi-directional charging, offer opportunities to enhance the charging experience and integrate with smart grid technologies.

- Data Management and User Experience Improvements: Implementing software solutions that improve charger management, real-time data visibility, and user interface can enhance customer satisfaction and operational efficiency, driving further adoption.

- Expansion into New Markets: As EV adoption grows, there is significant potential for expansion into new markets, including suburban and rural areas, which are currently underserved by public charging infrastructure. This expansion can drive broader EV adoption and open new revenue streams for service providers.

Conclusion

In conclusion, the public charging service market is poised for significant expansion, driven by the surge in electric vehicle adoption and supported by advancements in charging technology. The growth of this market is not only a response to the current demand from EV owners for more accessible and efficient charging options but also a proactive step towards accommodating the future influx of electric vehicles on the road.

As this market continues to evolve, the focus on enhancing charging infrastructure and technology will be crucial in ensuring that the transition to electric vehicles is smooth and sustainable for consumers worldwide. Opportunities for growth and innovation remain abundant, promising a dynamic future for the public charging service sector.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)