Table of Contents

Introduction

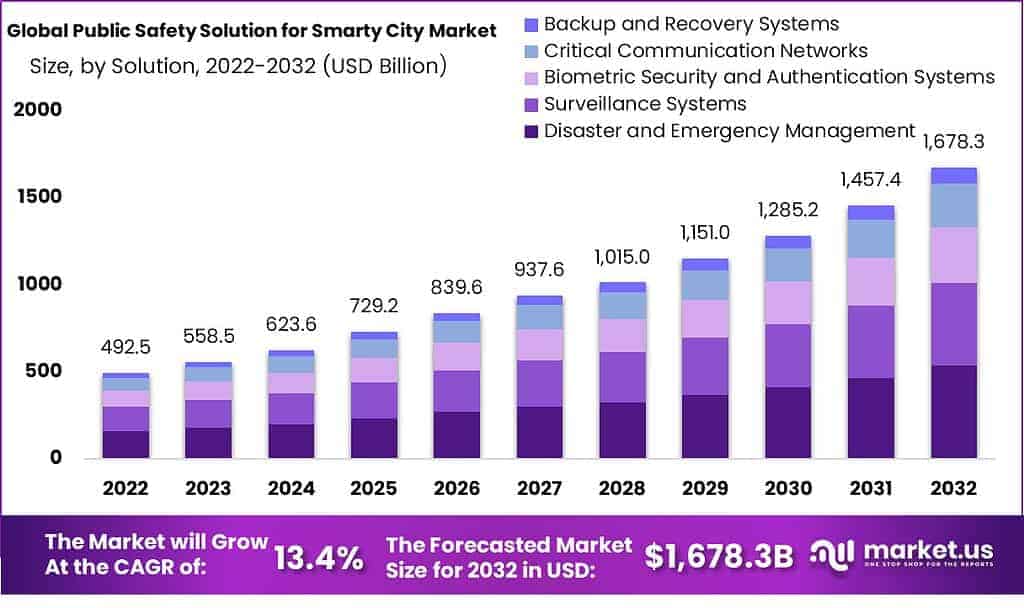

The Global Public Safety Solution for Smart City Market is anticipated to reach USD 1,678.3 billion by 2032, growing from USD 558.5 billion in 2023, at a CAGR of 13.4%. This expansion is fueled by increasing urbanization, rising crime rates, and governments investing in AI-driven surveillance, emergency response, and cybersecurity systems. In 2022, North America led the market with a 34.8% share, generating USD 171.5 billion. The convergence of IoT, big data, and smart infrastructure is transforming traditional city safety frameworks into proactive, tech-driven public safety ecosystems, ensuring real-time situational awareness and rapid response capabilities.

How Growth is Impacting the Economy

The fast-paced growth of public safety solutions is stimulating global economic development by attracting large-scale public and private investments. Urban infrastructure projects focused on AI surveillance, intelligent traffic management, and emergency response systems are generating employment across technology, construction, and security sectors. This ecosystem is fostering innovation in 5G, edge computing, and data analytics, all while increasing local government revenues through safer, smarter environments that attract foreign direct investments. Countries integrating such safety tech are reducing emergency response times, lowering crime costs, and ensuring business continuity—resulting in robust GDP contributions and better living standards for urban populations.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/public-safety-solution-for-smart-city-market/free-sample/

Impact on Global Businesses

The integration of smart public safety infrastructure is increasing operational costs for businesses—especially in deploying IoT surveillance, ensuring data compliance, and maintaining cybersecurity frameworks. However, these investments are reducing insurance costs, minimizing business disruption, and improving workforce security. Shifting supply chains are witnessing demand for smart sensors, AI video analytics, and command control centers, with Asia-Pacific emerging as a key hub for manufacturing. Industry-specific effects vary: retail chains are using predictive policing tech to curb theft, while transport sectors are optimizing smart traffic controls. Financial institutions are investing in anti-cybercrime frameworks tied to smart city networks.

Strategies for Businesses

Businesses must adopt data-driven public safety platforms integrated with predictive analytics and real-time alerts. Investing in cloud-based emergency response solutions and securing IoT endpoints will be critical. Companies should partner with local municipalities to pilot smart safety infrastructure and co-develop AI surveillance tools. Emphasis should be placed on compliance with local data privacy laws and securing public-private funding through smart city grants. Diversification into modular, scalable safety platforms helps address city-specific challenges. Proactive training for personnel in handling digital threat response systems can differentiate businesses and improve crisis preparedness in evolving urban landscapes.

Key Takeaways

- Global market to grow at 13.4% CAGR

- North America captured over 34.8% in 2022

- IoT, AI, and 5G are key technology drivers

- Supply chains shifting to smart device producers

- Sector-specific adoption reshaping urban safety frameworks

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=105930

Analyst Viewpoint

The current public safety landscape is undergoing rapid digital transformation, reshaping how cities respond to crime, traffic, and emergencies. Strong momentum is observed in North America and Asia-Pacific as smart city initiatives scale. Going forward, integration with AI, biometrics, and autonomous drone surveillance is projected to redefine city-wide safety frameworks. As smart urbanization accelerates, governments and enterprises will co-invest in robust infrastructure to ensure proactive and real-time public protection. This ecosystem is expected to mature into an autonomous, predictive safety grid, ultimately reducing societal risk and improving operational continuity for businesses and cities alike.

Use Case and Growth Factors

| Use Case | Growth Factor |

|---|---|

| AI-enabled emergency response systems | Government-led investments in smart city infrastructure |

| Predictive crime analytics | Rise in urban crime and digital surveillance demand |

| Intelligent traffic & disaster alerts | Climate adaptation and traffic congestion in mega-cities |

| Cybersecurity for municipal networks | Increased data threats and ransomware attacks |

| Smart crowd management at public events | Rising global events, stadium security, and civil protests |

Regional Analysis

North America held the leading share of 34.8% in 2022 due to early smart city adoption, government funding, and technological maturity. The U.S. and Canada are deploying AI-based emergency systems and gunshot detection across metro areas. Asia-Pacific is the fastest-growing region, driven by urban megaprojects in China, India, and South Korea. Europe follows with steady investment in predictive policing and transportation safety. The Middle East, particularly UAE and Saudi Arabia, is embracing smart surveillance to support Vision 2030 goals. Africa and Latin America are emerging markets, fueled by smart infrastructure funding and crime reduction programs.

➤ More data, more decisions! see what’s next –

- Insurance IT Spending Market

- Security Safes Market

- Generative AI in Gaming Market

- Generative AI in marketing Market

Business Opportunities

The market offers numerous growth avenues in predictive analytics, surveillance AI, and cybersecurity integration. Tech startups can collaborate with city authorities to offer modular, cloud-native safety solutions. Infrastructure companies can explore smart lighting and connected alarm systems. Public-private partnerships (PPPs) present investment opportunities to co-develop integrated control rooms and command centers. Companies that focus on real-time situational monitoring and anomaly detection will find traction among municipalities. Furthermore, global demand for drone surveillance and sensor-driven data mapping opens up B2G (business-to-government) opportunities across emerging and developed cities, reshaping future security architecture.

Key Segmentation

The market is segmented by Component (Solution, Services), Application (Emergency Management, Critical Infrastructure Protection, Public Transportation Security, Disaster Management, Law Enforcement), and End-User (Municipal, Homeland Security, Industrial). Solutions dominate the component segment due to the high deployment of AI surveillance, gunshot detection, and integrated control rooms. Emergency management and law enforcement hold the largest shares under applications, driven by rising urban crime and natural disasters. Among end-users, municipal governments lead due to funding for smart city safety initiatives. Services are also growing, especially in consulting and system maintenance.

Key Player Analysis

The market is composed of global and regional players offering end-to-end smart safety solutions. Companies are focusing on developing AI-driven surveillance systems, cybersecurity tools, and integrated public command centers. They are also expanding through strategic city partnerships, cloud-based deployments, and vertical-specific customization. Innovations in real-time data fusion and edge-based analytics are becoming key differentiators. Some firms are entering through smart traffic or disaster alert segments before expanding into full-scale command systems. Competitive strength depends on the ability to scale, comply with local policies, and integrate with existing infrastructure.

- Harris Corporation

- IBM Corporation

- Cisco Systems Inc

- Schneider Electric SE.

- Honeywell International Inc

- NEC Corporation

- Thales Corporation

- Northrop German Corporations

- Motorola Solutions Inc.

- ABB Limited

- Ericsson Inc.

- Emerson Electric Co.

- Other Key Players

Recent Developments

- August 2025: A major firm partnered with a U.S. city to implement real-time AI surveillance in downtown areas.

- June 2025: A startup launched a predictive analytics tool for emergency response used in Asian smart cities.

- April 2025: A European company introduced 5G-enabled wearable cams for law enforcement.

- February 2025: Integration of autonomous drone surveillance in a Middle Eastern smart city for traffic monitoring.

- January 2025: Launch of a unified emergency command platform across 50+ Indian cities under the Smart City Mission.

Conclusion

With urban risks increasing, public safety solutions are becoming foundational to smart cities. Technology-led security models are enabling governments and businesses to create resilient, data-informed, and safer urban environments.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)