Table of Contents

Market Overview

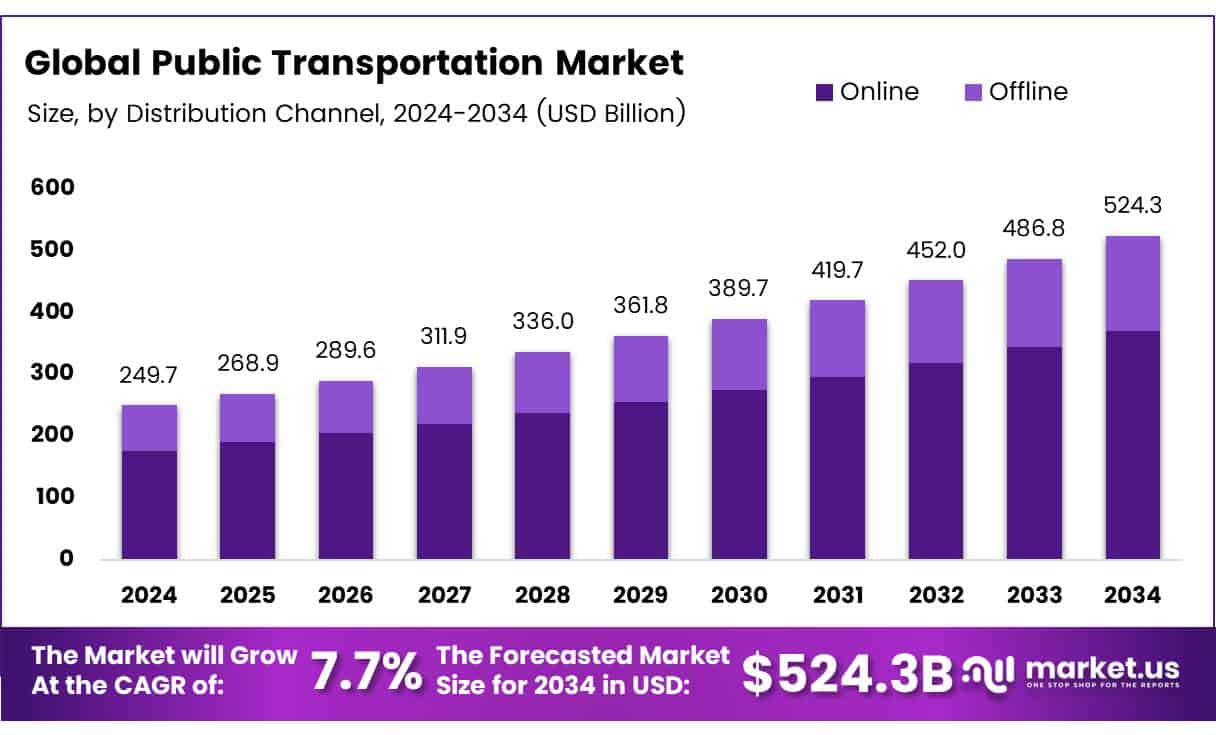

The Global Public Transportation Market size is expected to be worth around USD 524.3 Billion by 2034, from USD 249.7 Billion in 2024, growing at a CAGR of 7.7% during the forecast period.

The Public Transportation Market is growing due to rising urban populations. Cities need better transport to reduce traffic and pollution. In 2024, Americans made 9.9 billion public transport trips. This shows strong demand for shared and eco-friendly travel. More people now prefer buses, trains, and metros over private cars.

Governments support this shift with high funding. 23 percent of federal highway dollars go to public transit. This funding boosts new projects and modern systems. Smart cards, real-time tracking, and cleaner buses improve service quality. These upgrades attract more riders every year. Regulations are also helping market growth. Cities set strict emission rules and traffic limits. This pushes more people toward public transport. Many regions now invest in electric and hybrid fleets. These reduce pollution and cut fuel costs.

There is big opportunity in smart city plans. Transport is central to these digital upgrades. Public-private partnerships also drive growth. Tech firms now join with transit operators to improve service. The market will grow fast in coming years. Demand for affordable and green travel keeps rising. With strong investment and better tech, public transport is set to expand worldwide.

Key Takeaways

- The global public transportation market is expected to reach USD 249.7 billion by 2034, up from USD 524.3 billion in 2024, growing at a CAGR of 7.7% from 2025 to 2034.

- Online platforms led the distribution channel segment in 2024 due to increased accessibility and convenience.

- Road transportation dominated the mode type segment in 2024 with a 55.1% market share, driven by extensive road infrastructure.

- Asia Pacific held the largest regional share at 45.6%, valued at USD 112.3 billion in 2024.

Market Drivers

- Rapid urban population growth is increasing demand for efficient and high-capacity public transit systems in densely populated cities.

- The need to reduce greenhouse gas emissions is pushing governments to adopt low-emission and electric public transport solutions.

- Rising cost of private vehicle ownership is encouraging more people to switch to affordable public transportation options.

- Government investments in modernizing, expanding, and electrifying public transit networks are accelerating market growth.

Challenges

- High capital investment and long planning cycles make infrastructure development slow and complex.

- Funding limitations, bureaucratic delays, and political opposition often hinder timely execution of transit projects.

- Issues like overcrowding, service disruptions, and poor maintenance negatively impact passenger satisfaction and ridership.

- Safety concerns and inconsistent service quality can reduce public trust in transit systems.

Segmentation Insights

Distribution Channel Analysis

In 2024, online platforms led the public transportation market due to their convenience, real-time updates, and contactless payments. While offline ticketing still exists, especially in low-internet areas, digital channels are growing faster and are key to future growth.

Mode Type Analysis

Road transport dominated the market in 2024 with 55.1% share, thanks to wide road networks and affordable bus services. Rail came second, offering reliable high-capacity travel. Other modes like water, air, and cable cars held smaller shares but remain vital in specific regions.

Regional Insights

Asia Pacific

Asia Pacific leads the market with 45.6% share (USD 112.3 billion) due to rapid urban growth and strong investment in public transit, especially in China, India, and Japan. Electric buses and metro expansion are key growth drivers.

North America

North America is growing steadily as the U.S. and Canada invest in electric transit and smart mobility. Cities like New York and Toronto focus on green, accessible public transport.

Europe

Europe’s growth is driven by strict green regulations. Countries like Germany and the U.K. invest in hydrogen buses and rail systems to cut emissions.

Middle East & Africa

MEA is seeing more demand in cities like Dubai and Riyadh. Urban growth and traffic issues are leading to better public transport investment.

Latin America

Latin America is growing slowly, with Brazil and Mexico improving urban transit. Population growth is pushing investment in sustainable transport.

Recent Developments

- On December 7, 2023, Sembcorp announced the 100% acquisition of two special purpose vehicles (SPVs) owned by Leap Green Energy. This strategic move strengthens Sembcorp’s renewable energy portfolio, specifically in the wind energy sector.

- On July 2, 2024, Thoma Bravo completed its acquisition of Everbridge Inc. in an all-cash transaction valued at approximately USD 1.8 billion. The deal enhances Thoma Bravo’s presence in critical event management and public safety software solutions.

- In January 2024, FirstGroup plc signed an agreement to acquire York Pullman Bus Company Ltd. The acquisition is aimed at expanding FirstGroup’s regional transport operations and strengthening its footprint in the UK bus services market.

Conclusion

The global public transportation market is set to grow from USD 249.7 billion in 2024 to USD 524.3 billion by 2034, driven by urbanization, government funding, and demand for eco-friendly travel. Smart tech, electric fleets, and online ticketing are improving service and boosting ridership. Asia Pacific leads the market, while North America and Europe grow with green investments. Challenges like high costs and slow project timelines remain, but rising public-private partnerships and smart city plans will fuel continued growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)