Table of Contents

Introduction

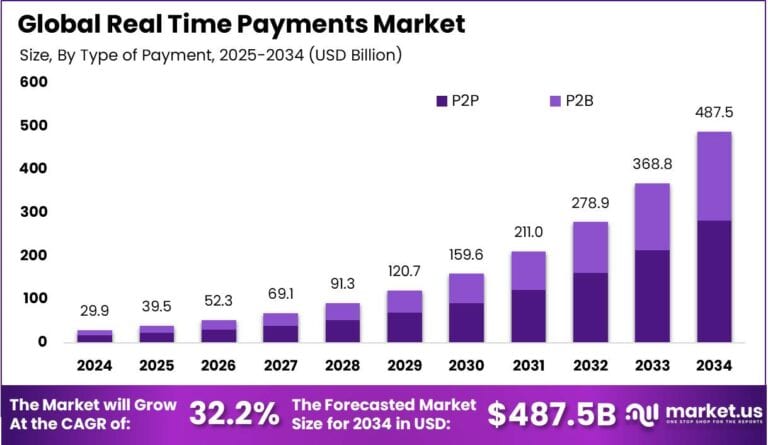

The global real-time payments market is forecasted to grow from USD 29.9 billion in 2024 to USD 487.5 billion by 2034, exhibiting a robust CAGR of 32.2%. In 2024, Asia-Pacific led the market with over 38% share, generating USD 11.3 billion in revenue. China’s segment accounted for USD 3.7 billion with a CAGR of 28.3%, driven by rapid digital payment infrastructure advancements. Increasing consumer demand for instant transactions and expanding mobile payment adoption are key factors propelling market expansion globally.

How Tariffs Are Impacting the Economy

Tariffs have created significant economic challenges by increasing the costs of imported technology and payment infrastructure components. Higher tariffs elevate manufacturing expenses, leading to increased prices for end-users and slowing consumer spending. Inflationary pressures driven by tariffs dampen economic growth and reduce investment capacity.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/real-time-payments-market/free-sample/

(Use corporate mail ID for quicker response)

Supply chain disruptions caused by tariffs force companies to seek alternative suppliers, often at higher costs or with longer delivery times. Retaliatory trade measures further complicate international commerce, creating uncertainty that stifles innovation and delays infrastructure projects. These effects collectively slow digital payment adoption and infrastructure modernization across markets reliant on imported technology.

Impact on Global Businesses

Global businesses in the payments ecosystem face rising costs due to tariffs on hardware and software components critical to real-time payment solutions. Supply chain shifts to diversify or localize production add operational complexities and capital requirements.

Financial institutions and fintech firms encounter delayed technology deployments and increased infrastructure costs, impacting service expansion and customer acquisition. Market volatility from tariff fluctuations forces cautious investment and strategic reevaluation. Particularly in emerging markets, elevated costs and supply uncertainty hinder the adoption of real-time payment systems, necessitating agile responses and innovation to maintain competitiveness.

Strategies for Businesses

Businesses mitigate tariff impacts by diversifying supply chains and increasing local manufacturing of key components. Investment in cloud-based and software-driven payment platforms reduces hardware dependency. Leveraging predictive analytics aids in forecasting tariff changes and optimizing procurement. Strategic partnerships with regional suppliers enhance supply stability.

Companies also focus on cost optimization through automation and process innovation. Engaging policymakers to influence trade policies complements operational strategies. Overall, adaptability, innovation, and supply chain resilience are essential to navigate tariff-induced challenges effectively.

Key Takeaways

- Real-time payments market expected to grow at a CAGR of 32.2% through 2034

- Tariffs increase costs and disrupt supply chains in payment technology

- Financial institutions face delayed deployments and higher infrastructure expenses

- Businesses respond with supply diversification and digital innovation

- Predictive analytics support strategic planning under tariff uncertainty

➤ Get full access now @ https://market.us/purchase-report/?report_id=148787

Analyst Viewpoint

The real-time payments market shows explosive growth fueled by digital transformation and consumer demand for instant transactions. Despite tariff-induced cost pressures, the market adapts through innovation, supply chain diversification, and cloud adoption. Investments in infrastructure modernization continue, particularly in Asia-Pacific. The future outlook remains highly positive, with increasing fintech penetration and cross-border payment innovations driving sustained expansion globally.

Regional Analysis

Asia-Pacific dominates with a 38% market share in 2024, led by China’s rapid digital payment infrastructure growth. Strong government support and increasing smartphone penetration boost adoption. North America and Europe maintain steady growth driven by mature financial markets and regulatory frameworks favoring real-time payments. Emerging markets in Latin America and Africa present high-growth potential due to increasing financial inclusion and mobile payment usage. Regional variations stem from technology readiness, regulatory environments, and consumer behavior.

➤ Discover More Trending Research

- Predictive Agents Market

- Smart Asset Management in Utility Market

- Task Management Agent Market

- Digital Subscriber Line (DSL) Chipsets Market

Business Opportunities

Opportunities abound in developing scalable, interoperable payment platforms catering to growing mobile and online commerce. Expansion into underserved regions with low banking penetration is promising. Integration with blockchain and AI enhances security and efficiency, attracting investments. Collaboration between fintech firms and traditional banks drives innovative service offerings. Demand for cross-border real-time payments opens new revenue streams. Additionally, developing cost-effective solutions for SMEs accelerates market adoption.

Key Segmentation

Component

- Software

- Hardware

- Services

Deployment Mode

- Cloud-based

- On-premises

Application

- P2P (Peer-to-Peer) Payments

- B2B (Business-to-Business) Payments

- C2B (Consumer-to-Business) Payments

End-User

- Banks and Financial Institutions

- Retailers

- Government Agencies

- Enterprises

Key Player Analysis

Market leaders focus on enhancing platform scalability, security, and interoperability to meet diverse customer needs. Investments in AI and blockchain improve transaction speed and fraud prevention. Strategic collaborations with telecom operators and fintech startups accelerate market penetration. Leaders prioritize cloud deployment models for flexibility and cost efficiency. Expanding regional footprints through partnerships and acquisitions supports growth in emerging markets. Comprehensive service portfolios and customer-centric innovations sustain competitive advantages.

Top Key Players in the Market

- ACI Worldwide, Inc.

- Fidelity National Information Services, Inc. (FIS Inc.)

- Finastra

- Fiserv, Inc.

- Mastercard, Inc.

- Montran Corp.

- PayPal Holdings, Inc.

- Temenos AG

- Visa Inc.

- Volante Technologies Inc.

- Wirecard AG

- Worldpay, Inc.

- Others

Recent Developments

In 2025, several providers launched AI-powered fraud detection integrated with real-time payment platforms. Expansion of cloud-based payment services accelerated in Asia-Pacific. Partnerships between fintechs and telecom operators facilitated mobile payment adoption in emerging economies.

Conclusion

The real-time payments market is set for transformative growth, driven by digital innovation and rising consumer expectations. While tariffs pose challenges, strategic adaptability and technological advancements ensure sustained expansion. Investments in infrastructure and emerging markets will propel the market forward.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)