Table of Contents

Introduction

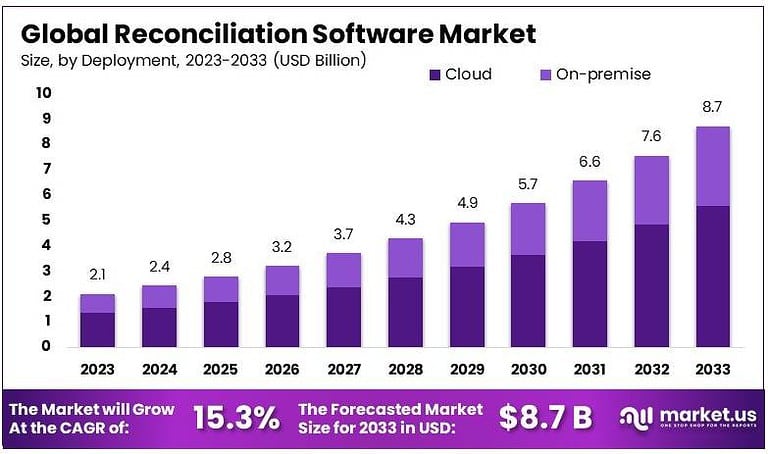

The Global Reconciliation Software Market is projected to reach USD 8.7 billion by 2033, rising from USD 2.1 billion in 2023, expanding at a CAGR of 15.3%. Growth is being driven by the increasing complexity of financial transactions, stricter regulatory requirements, and the need for accuracy in managing high-volume data. Industries such as banking, insurance, telecom, and e-commerce are adopting reconciliation software to automate manual processes, reduce errors, and enhance compliance. Cloud-based solutions and AI-powered analytics are further accelerating adoption, providing scalability and real-time transaction visibility.

How Growth is Impacting the Economy

The expansion of reconciliation software is significantly impacting the global economy by improving financial transparency and reducing operational risks. Automation of reconciliation processes lowers dependency on manual labor, cutting costs for enterprises while improving accuracy in financial reporting. The banking and financial services sector benefits through compliance with regulatory frameworks, strengthening investor confidence.

Additionally, adoption fuels investment in IT infrastructure, cybersecurity, and cloud platforms, creating new revenue streams and jobs in fintech. As businesses achieve higher efficiency and reduced fraud losses, economic stability is enhanced, contributing to sustainable growth across both developed and emerging markets.

➤ Unlock growth! Get your sample now! – https://market.us/report/reconciliation-software-market/free-sample/

Impact on Global Businesses

Businesses are experiencing rising technology adoption costs as they transition from legacy systems to AI-driven reconciliation platforms. Supply chain dynamics are shifting toward SaaS-based providers offering cloud-native reconciliation solutions. Sector-specific impacts are clear: financial institutions reduce fraud risks and improve compliance reporting; e-commerce platforms ensure error-free payment settlements; telecom companies automate billing reconciliations; and insurers improve claims management accuracy. Despite the initial investment burden, businesses benefit long-term from faster processing, enhanced accuracy, and reduced financial risks.

Strategies for Businesses

- Adopt cloud-based reconciliation platforms for scalability and cost efficiency.

- Integrate AI and machine learning tools to enhance fraud detection.

- Strengthen compliance frameworks to meet global financial regulations.

- Collaborate with fintech providers for tailored reconciliation solutions.

- Invest in employee training to optimize system usage and efficiency.

Key Takeaways

- Market projected to reach USD 8.7 billion by 2033, up from USD 2.1 billion in 2023.

- CAGR of 15.3% reflects strong demand for automated financial processes.

- Growth driven by regulatory compliance, digital payments, and data accuracy needs.

- Banking, e-commerce, and telecom remain primary adopters.

- AI, cloud adoption, and fraud detection integration are major growth drivers.

Analyst Viewpoint

The reconciliation software market is experiencing robust momentum as financial ecosystems become more complex and digitized. Presently, adoption is strongest in banking and fintech, while future growth lies in retail, telecom, and healthcare. As AI and blockchain integration advance, reconciliation systems will evolve into predictive, self-learning platforms, reducing risks and enhancing operational transparency. The outlook remains highly positive, with emerging economies providing fertile ground for adoption due to rapid digital payment growth.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=129671

Use Case and Growth Factors

| Use Case | Growth Factors Driving Adoption |

|---|---|

| Banking & Financial Services | Rising demand for compliance and fraud prevention |

| E-commerce Payments | High transaction volumes needing error-free settlement |

| Telecom Billing | Automation of large-scale billing reconciliations |

| Insurance Claims | Improved accuracy in claims validation |

| Corporate Accounting | Streamlined audit trails and financial reporting |

Regional Analysis

North America leads the market with strong adoption across BFSI, supported by robust fintech infrastructure and regulatory compliance needs. Europe follows with rapid adoption due to stringent financial regulations such as PSD2 and GDPR. Asia Pacific is expected to grow fastest, driven by rising digital payment penetration in India, China, and Southeast Asia. The Middle East is investing in reconciliation tools for banking modernization, while Latin America is expanding adoption due to growing e-commerce and fintech ecosystems.

Business Opportunities

Significant opportunities exist in AI-powered reconciliation solutions, blockchain integration for real-time settlements, and SaaS-based subscription models catering to SMEs. Growing demand in emerging economies offers room for cost-effective, scalable solutions. Expanding partnerships between fintech firms and banks further open opportunities for innovation. Cloud-native and mobile-enabled reconciliation tools also provide businesses with the flexibility to adapt quickly to transaction growth.

Key Segmentation

The market is segmented by component into software and services. By deployment, it includes cloud-based, on-premise, and hybrid platforms. By application, it covers banking, e-commerce, telecom, insurance, and corporate accounting. End-users range from large enterprises to SMEs, reflecting diverse adoption across financial ecosystems.

Key Player Analysis

Market leaders are investing in AI, machine learning, and blockchain to enhance reconciliation accuracy and fraud prevention. Strategic acquisitions and partnerships with banks and fintech firms expand product offerings and geographic reach. Emphasis on user-friendly interfaces and mobile integration is improving adoption among SMEs. Balancing innovation with compliance and security remains central to long-term success in this market.

- BlackLine, Inc.

- Oracle Corporation

- SAP SE Company Profile

- FIS Global

- Trintech, Inc.

- Kyriba Corporation

- ReconArt Inc.

- Xero Limited

- Broadridge Financial Solutions, Inc.

- SolveXia

- Tata Consultancy Services Limited

- SmartStream Technologies Ltd.

- Other Key Players

Recent Developments

- AI-driven reconciliation platforms launched for real-time fraud detection in 2023.

- Cloud-native reconciliation tools gained traction among SMEs for cost efficiency.

- Partnerships between banks and fintech firms expanded digital reconciliation adoption.

- Telecom operators integrated reconciliation software for large-scale billing accuracy.

- Regulators increased compliance requirements, fueling reconciliation automation.

Conclusion

The reconciliation software market is poised for strong growth, driven by increasing transaction volumes, compliance needs, and AI integration. With expanding use cases across industries and rapid adoption in emerging economies, the market is set to become a cornerstone of global financial transparency and efficiency.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)