Table of Contents

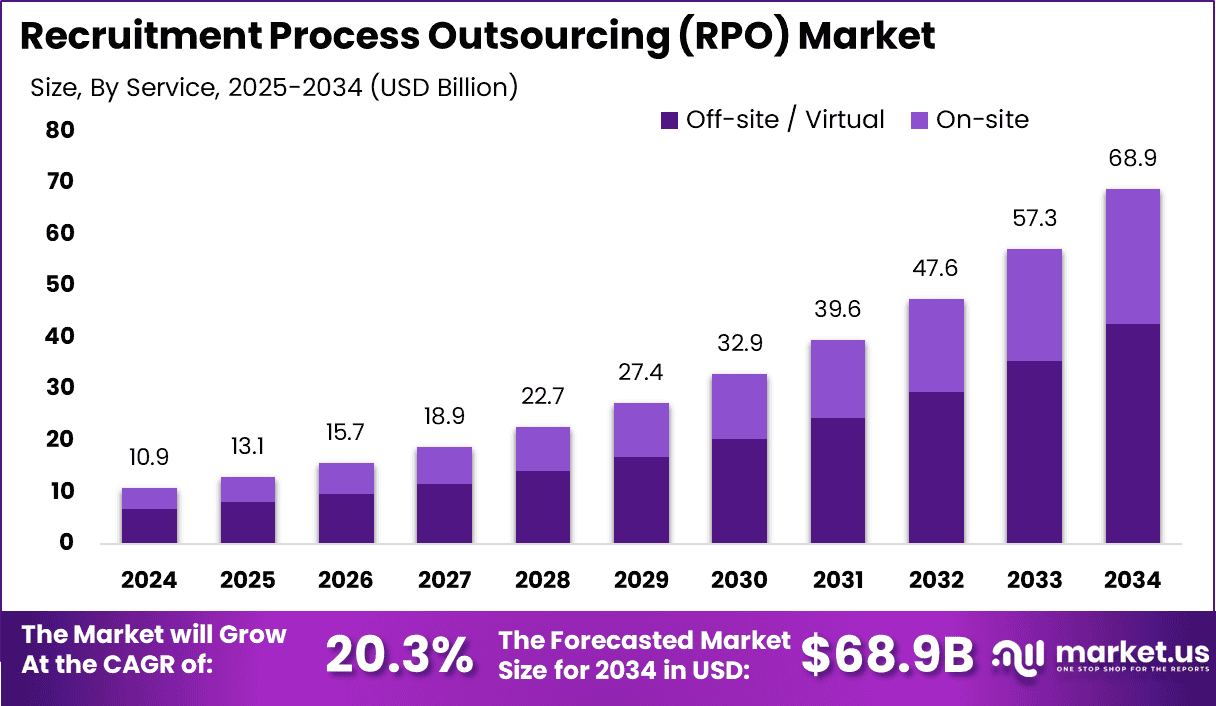

The global Recruitment Process Outsourcing (RPO) market is poised for significant growth, projected to reach USD 68.9 billion by 2034, up from USD 10.9 billion in 2024, reflecting a CAGR of 20.3%. North America led the market in 2024 with a 10% market share, generating USD 4.3 billion in revenue.

The U.S. RPO market alone is forecast to grow from USD 4.8 billion in 2025 to USD 21.1 billion by 2034, driven by a need for scalable, cost-effective recruitment solutions. Digital transformation and a focus on remote recruitment models are also fueling the market’s expansion, particularly in sectors like IT and telecommunications.

How Tariffs Are Impacting the Economy

The imposition of tariffs has significantly affected the global economy by driving up costs, creating supply chain disruptions, and reducing consumer purchasing power. In the U.S., tariffs on imported goods have increased the price of raw materials, components, and finished products, forcing businesses to adjust their pricing strategies.

Many industries, including manufacturing and technology, have experienced delays due to tariff-induced supply chain disruptions. Companies reliant on international suppliers have been particularly impacted, as tariff costs have added to production expenses. In response, businesses have explored alternatives like reshoring or diversifying suppliers to mitigate risks.

These tariff-related challenges have created inflationary pressure, resulting in higher operational costs across sectors. The tariff climate has forced businesses to reconsider their growth strategies and adapt to higher input costs, slower global trade, and a more uncertain economic environment. Despite some of these negative impacts, the push for more localized supply chains may eventually lead to long-term stability and operational resilience.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/recruitment-process-outsourcing-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

Tariffs have raised production and operational costs for businesses globally. Companies in industries like manufacturing, automotive, and technology are facing higher prices for imported materials and components.

These rising costs have been passed on to consumers, leading to higher prices for finished products and services. Additionally, businesses are reassessing their supply chains, exploring alternative sourcing strategies, or even reshoring manufacturing operations to reduce reliance on tariff-heavy regions. This shift has increased costs and slowed down production timelines.

Sector-Specific Impacts

In the RPO sector, industries like IT, telecommunications, and manufacturing have felt the impact of tariffs, as high demand for skilled talent has compounded talent shortages. Companies in these sectors are more likely to outsource recruitment to maintain operational flexibility and cost-effectiveness, especially as hiring costs rise due to tariffs on foreign products and materials.

These sectors rely heavily on specialized talent, and the ongoing talent shortage exacerbates the demand for efficient recruitment solutions. Tariffs have indirectly boosted the demand for RPO solutions, as companies look for ways to streamline their hiring processes.

Strategies for Businesses

To mitigate the impact of tariffs, businesses are adopting several strategies:

- Supply Chain Diversification: Seeking alternative suppliers and sourcing materials from tariff-exempt regions.

- Nearshoring and Reshoring: Moving production closer to domestic markets to reduce shipping and tariff-related costs.

- Automation: Investing in technology and automation to streamline operations and reduce dependence on human labor.

- Dynamic Pricing: Adjusting product prices to reflect increased costs while considering consumer sensitivity to price increases.

➤ Explore more strategies, get full access now @ https://market.us/purchase-report/?report_id=147689

Key Takeaways

- Market Growth: The global RPO market is expected to grow at a CAGR of 20.3%, reaching USD 68.9 billion by 2034.

- Regional Leadership: North America captured 10% of the global market share, generating USD 4.3 billion in revenue.

- Enterprise Solutions: Enterprise-based RPO solutions held more than 56% market share in 2024.

- Virtual RPO Dominance: Off-site/virtual RPO models dominated with over 62% of the market share in 2024.

- Sector-Specific Demand: The IT and Telecommunications sector led the market with 22% of the total share in 2024.

Analyst Viewpoint

The global RPO market is experiencing strong growth, fueled by the digital transformation of recruitment practices and the increasing need for scalable, cost-effective hiring solutions. North America remains a dominant force in the market, with continued investment in virtual recruitment platforms and enterprise solutions.

As businesses increasingly look for ways to improve hiring efficiency amidst a tightening talent pool, RPO solutions will continue to expand. The market’s outlook is positive, as organizations are recognizing the value of outsourcing recruitment to reduce overheads, improve hiring speed, and access specialized talent more effectively.

Regional Analysis

North America led the RPO market in 2024, capturing more than 34% of the market share and generating USD 4.3 billion in revenue. The U.S. market is expected to grow at a CAGR of 17.8%, reaching USD 21.1 billion by 2034, driven by demand for scalable recruitment solutions and increasing outsourcing among enterprises.

Europe and Asia-Pacific are also seeing strong growth in RPO adoption, as companies in these regions seek cost-effective hiring solutions to address talent shortages and improve recruitment efficiency. As global workforce dynamics evolve, the RPO market will likely continue expanding across all regions.

➤ Discover More Trending Research

- Real-time Monitoring Solutions For Cold Chain Market

- Crowdfunding Market

- Digital Inspection Market

- AI-powered Humanoid Robots Market

Business Opportunities

The growing demand for recruitment process outsourcing presents numerous business opportunities, especially in IT, telecommunications, and healthcare sectors, where specialized talent is in high demand. Additionally, as companies increasingly adopt remote hiring practices, there is a significant opportunity for businesses offering virtual RPO solutions to capture market share.

Developing AI-driven recruitment tools, providing talent pool access, and enhancing end-to-end recruitment capabilities are all areas where businesses can innovate. As companies look for ways to reduce recruitment costs and improve efficiency, RPO providers can create tailored solutions that cater to the specific needs of different industries.

Key Segmentation

The global RPO market is segmented by solutions, deployment models, and industries:

- Solutions: Enterprise-based RPO solutions dominate, accounting for over 56% of the market in 2024, as large businesses require comprehensive recruitment support.

- Deployment Models: Off-site/virtual RPO models hold over 62% of the market share, driven by the shift toward remote work and cloud-based recruitment solutions.

- Industries: The IT and Telecommunications sector leads with a 22% share, reflecting the high demand for skilled talent in digital fields.

Key Player Analysis

Leading companies in the RPO market focus on providing end-to-end recruitment services, offering scalable solutions for large enterprises. These firms leverage AI and data analytics to streamline the recruitment process, enhance candidate sourcing, and improve the hiring experience.

By offering virtual and enterprise-based RPO solutions, they cater to a diverse range of businesses, from small startups to large corporations. Additionally, they are investing in recruitment technology and building extensive talent networks to address skill gaps and talent shortages in various industries.

Top Key Players in the Market

- Randstad Sourceright

- ManpowerGroup Solutions

- Allegis Global Solutions

- Korn Ferry

- Hudson Global, Inc.

- Cielo, Inc.

- Alexander Mann Solutions

- IBM Talent Acquisition Optimization

- ADP RPO

- PeopleScout (TrueBlue Inc.)

- Pontoon Solutions

- AMS (formerly Alexander Mann Solutions)

- KellyOCG

- Seven-Step RPO

- Hays Talent Solutions

- Others

Recent Developments

In 2024, the U.S. RPO market grew significantly, driven by strong demand for scalable recruitment solutions, particularly in the IT and telecommunications sectors. The adoption of virtual RPO models and AI-driven recruitment tools is accelerating growth in the sector.

Conclusion

The RPO market is experiencing rapid growth, driven by the need for scalable and cost-effective hiring solutions. With North America leading the way, the market’s future is promising, as businesses increasingly embrace outsourcing to meet talent acquisition needs. The continued adoption of digital technologies will fuel future expansion and innovation in recruitment practices.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)