Table of Contents

Introduction

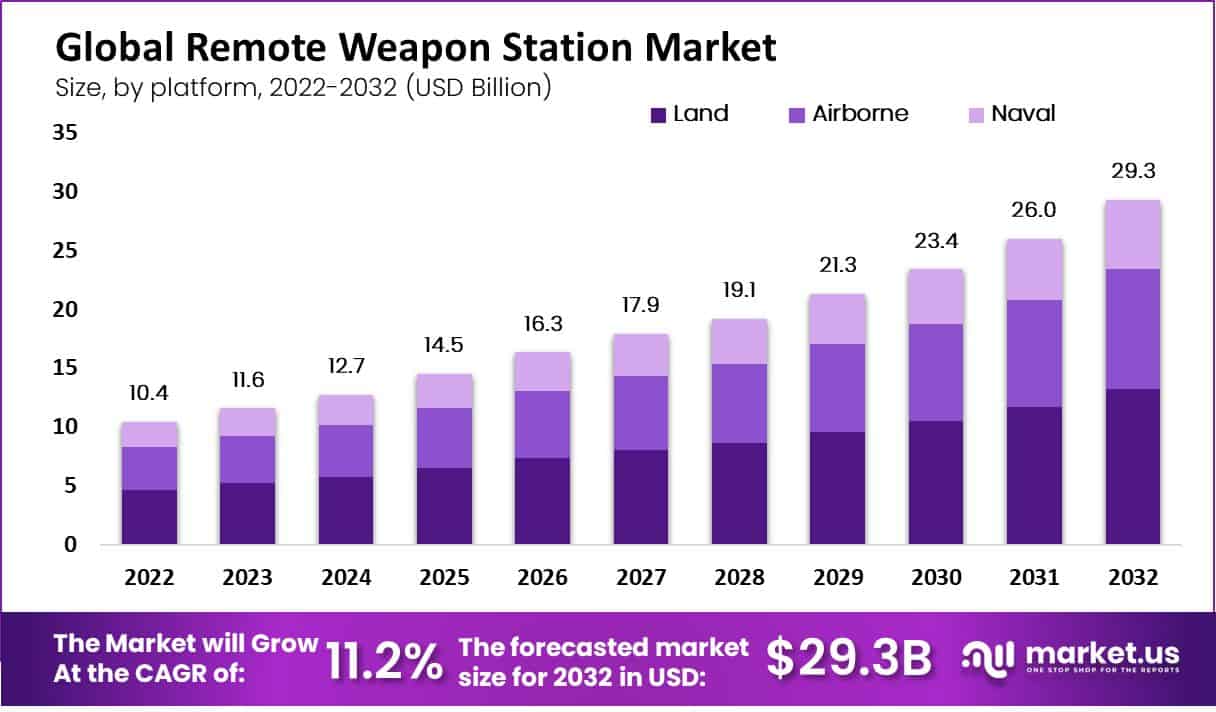

The Remote Weapon Station (RWS) market is poised for significant growth, projected to reach a value of USD 29.3 billion by 2032, with a remarkable CAGR of 11.2% during the forecast period. This market encompasses remotely operated weapons platforms installed on various platforms such as vehicles, ships, and land bases. These systems enable military personnel to operate firearms from a safe distance using joysticks or computers, enhancing safety by keeping operators protected from direct enemy fire.

A Remote Weapon Station (RWS) is a technologically advanced, weapon-bearing platform that is usually mounted on military vehicles or naval ships. The main purpose of an RWS is to enable the operator to engage targets from a distance without being physically at the weapon’s location. This system is controlled remotely, typically from inside the vehicle or ship, which provides safety and protection for the operator. The RWS is equipped with various sensors, cameras, and aiming devices, allowing for accurate targeting. It can be fitted with a range of weapons, from machine guns to missile launchers.

One of the key growth factors for the RWS market is the increasing demand for advanced military and security solutions. As armed forces around the world seek to enhance their capabilities, RWS technology offers a compelling solution. The ability to remotely operate and control weapons from a safe distance provides a tactical advantage, improving situational awareness and response time. Another factor driving the market growth is the rising need for border security and counter-terrorism measures. Remote weapon stations offer a means to effectively monitor and protect borders, critical infrastructure, and high-risk areas. Governments and security agencies are investing in these systems to bolster their defense capabilities and ensure the safety of their citizens.

However, amidst the growth, there are challenges that the market faces. One of the significant challenges is the high cost associated with the development and integration of advanced RWS technology. The incorporation of sophisticated sensors, cameras, and control systems requires substantial investment, limiting the affordability for some potential buyers.

Despite these challenges, there are opportunities for new entrants to capitalize on the RWS market. With advancements in technology, there is a growing demand for more compact, lightweight, and modular RWS solutions. Companies that can offer innovative and cost-effective products catering to these requirements have the potential to gain market share.

Key Takeaways

- The Remote Weapon Station market is projected to witness a substantial growth, with a predicted value of over USD 29.3 billion by 2032, reflecting a robust compound annual growth rate (CAGR) of 11.2% from 2023 to 2032.

- In 2022, the Land segment held a dominant position in the Remote Weapon Station market, capturing more than a 45% share.

- In 2022, the Moving segment held a dominant market position in the Remote Weapon Station market, capturing more than a 65% share.

- In 2022, the Remote-Controlled Gun Systems segment held a dominant market position in the Remote Weapon Station market, capturing more than a 39% share.

- In 2022, the Lethal Weapon segment held a dominant market position in the Remote Weapon Station market, capturing more than a 34% share.

- In 2022, the Military segment held a dominant market position in the Remote Weapon Station market, capturing more than a 76% share.

- In 2022, North America held a dominant market position in the Remote Weapon Station market, capturing more than a 38% share.

Remote Weapon Station

- The Remote Weapon Station (RWS) market is projected to grow significantly, reaching approximately USD 14.5 billion by 2025, with an annual growth rate of 11.2%. This growth is driven by increased investments and contracts in the defense sector.

- In 2022, the US Army awarded a substantial contract of around USD 1.5 billion to Kongsberg Defence & Aerospace. This contract is for continuing the supply of Common Remotely Operated Weapon Stations (CROWS), highlighting ongoing investments in military technology.

- In March 2023, another significant development occurred when General Dynamics European Land Systems (GDELS) awarded Elmet International SRL, part of Elbit Systems, a contract worth about USD 120 million. This contract is to provide unmanned turrets, Remote Controlled Weapon Stations (RCWS), and mortar systems for the Romanian Armed Forces to use on the ‘Piranha V’ Armored Personnel Carrier (APC).

- Furthermore, the global military spending in 2022 was around USD 2,240.1 billion, showing a 6% increase from the previous year. This indicates a robust funding environment that is likely to support the growth of the RWS market.

- The Indian Army also contributed to this growth by issuing a request for proposal in 2022 for the procurement of 90 Remote Weapon Station systems equipped with 12.7mm machine guns. This procurement falls under the Buy India category and is being expedited through a fast-track procedure. The plan is to integrate these RCWS with the armored personnel carrier Kalyani M4, enhancing the Indian Army’s operational capabilities.

Emerging Trends

- Integration of Artificial Intelligence and Machine Learning: There’s an increasing trend towards incorporating AI and ML into RWS to enhance operational effectiveness and decision-making in real-time scenarios.

- Increased Use in Non-Military Applications: RWS are being increasingly adopted by law enforcement and homeland security agencies, broadening their use beyond traditional military contexts.

- Technological Advancements in Sensor Systems: Innovations in sensor technologies are improving the accuracy and reliability of RWS, making them more capable in various operational environments.

- Expansion in Airborne Platforms: RWS are being increasingly fitted onto a variety of airborne platforms, including attack, utility, and transport helicopters, expanding their scope and versatility in operations.

- Adaptation to Modern Warfare Needs: The demand for RWS is growing due to their ability to offer high firepower with reduced risk to operators, meeting the needs of modern asymmetric and urban warfare scenarios.

Top Use Cases of Remote Weapon Stations

- Military Defense Operations: RWS are extensively used in military operations to enhance defensive and offensive capabilities without exposing personnel to direct combat.

- Border Security and Monitoring: Deployed on stationary structures or mobile platforms along borders, RWS provide effective surveillance and engagement capabilities to secure national boundaries.

- Protection of Naval Assets: RWS are used on warships to provide close-range defense against potential threats, enhancing the protection of naval vessels in conflict zones.

- Urban Security Operations: Law enforcement agencies use RWS for critical infrastructure protection and during tactical operations in urban settings, where precision and minimal collateral damage are crucial.

- Convoy Security: RWS provide security for military and civilian convoys traveling through hostile territories, enabling remote surveillance and engagement of threats from a safe distance.

Major Challenges

- Complex Supply Chains: The defense logistics supply chain faces significant complexities, including security threats and issues related to the sourcing, storing, and transporting of materials and equipment. These challenges can result in visibility gaps across the defense logistics supply chain, affecting the market growth.

- Technological Integration: There are ongoing challenges related to the integration of advanced technologies into existing military platforms. Ensuring compatibility and maintaining the effectiveness of new systems within old frameworks pose substantial difficulties.

- High Cost of Development and Maintenance: Developing and maintaining remote weapon stations involve significant costs, particularly because these systems often incorporate sophisticated technologies that require regular updates and maintenance.

- Regulatory and Political Constraints: The market is subject to stringent regulatory requirements and political challenges that can influence the production and deployment of remote weapon stations. These include international arms control agreements and national defense policies.

- Rapid Technological Obsolescence: The rapid pace of technological advancement means that remote weapon systems can quickly become obsolete. Staying current requires continuous research and development, which can be prohibitively expensive.

Market Opportunities

- Increased Defense Expenditures: Global increases in defense spending, particularly by NATO countries and major economies like the US, China, and India, provide a significant opportunity for market growth. These investments are often directed towards modernizing and enhancing military capabilities, including remote weapon systems.

- Advancements in Autonomous Technologies: The growing integration of autonomous technologies in military systems, such as unmanned aerial vehicles (UAVs), unmanned ground vehicles (UGVs), and unmanned maritime vehicles (UMVs), offers substantial opportunities for the expansion of the remote weapon station market.

- Focus on Naval and Airborne Platforms: Increasing threats from maritime piracy and aerial warfare are driving the demand for remote weapon stations on naval and airborne platforms. This trend is likely to continue as conflicts in maritime and air spaces escalate.

- Emerging Markets: Developing countries are increasingly focusing on strengthening their defense capabilities, which presents a lucrative opportunity for the expansion of the remote weapon station market in these regions.

- Integration with Networked Warfare Systems: There is a growing trend towards network-centric warfare, which relies on the integration of weapon systems into a unified network. Remote weapon stations that can be integrated into these networks are likely to see increased demand.

Recent Developments

- Kongsberg Defence & Aerospace Contracts: Kongsberg Defence & Aerospace secured a significant order from the US Army in September 2023, valued at $94 million, for the delivery of 409 Common Remotely Operated Weapon Stations (CROWS) as part of a larger five-year framework. This highlights the growing demand for remote weapon systems in defense applications, particularly in the United States.

- EOS Defence Systems Contracts: In April 2023, EOS Defence Systems received a second conditional contract to provide Ukraine with up to fifty Remote Weapon Systems (RWS), along with ammunition, spare parts, and related services. This deal, valued at up to USD 41 million, underscores the increasing adoption of RWS for border protection and national security purposes.

Conclusion

The remote weapon station (RWS) market is poised for growth, driven by global increases in defense budgets and the advancement of military technologies. However, the market faces significant challenges such as complex supply chains, technological integration issues, and the high costs associated with advanced technologies. Despite these obstacles, the increasing adoption of autonomous technologies and the strategic focus on enhancing naval and airborne defense capabilities present substantial opportunities. Continued innovation and adaptation to the evolving technological landscape will be crucial for companies operating in this space to capitalize on these opportunities and overcome the challenges they face.