Table of Contents

Introduction

According to Market.us experts, The Restaurant Point of Sale Terminal Market size is expected to be worth around USD 51.3 Billion by 2033, up from USD 22.7 Billion in 2023, growing at a CAGR of 8.5% during the forecast period from 2024 to 2033.

A Restaurant Point of Sale (POS) Terminal is a system used in the hospitality sector to manage transactions. It combines software and hardware to handle order entries, payment processing, and the integration of different service areas in a restaurant, such as the kitchen and the dining area. Modern POS systems are digital and can be operated via touchscreens, designed to streamline operations, manage inventory, record sales data, and improve customer service by reducing waiting times and errors.

The Restaurant Point of Sale Terminal Market refers to the sector involved in manufacturing, distributing, and providing services related to POS systems specifically for the restaurant industry. This market includes traditional cash registers, touchscreen terminals, mobile devices used as ordering systems, and comprehensive management systems that integrate with other restaurant technology such as kitchen display systems and customer relationship management (CRM) tools.

The demand for Restaurant Point of Sale Terminals is driven by the need for efficient operational workflows in restaurants. Increasing technological adoption in the hospitality industry, along with the rising number of dining establishments, are key drivers. There is also a growing trend towards cloud-based POS systems that offer scalability, remote access to data, and integration with third-party applications. Enhanced customer experience, provided by seamless transaction processes and reduced wait times, further propels the demand for advanced POS systems.

The market opportunity for Restaurant Point of Sale Terminals is substantial, particularly in emerging markets where the digital transformation of restaurants is still underway. Opportunities also exist in the development of POS systems that cater to niche markets such as food trucks, pop-up restaurants, and small cafes that require flexible, cost-effective solutions. Additionally, the integration of artificial intelligence for predictive analytics, and customer service enhancements like facial recognition for personalized service, represent future pathways for growth in this sector. The ongoing shift towards eco-friendly practices in business operations opens up avenues for developing energy-efficient and sustainable POS hardware and software solutions.

Key Takeaways

- The Global Restaurant Point of Sale Terminal Market is projected to reach a valuation of USD 51.3 Billion by 2033, up from USD 22.7 Billion in 2023, reflecting a robust CAGR of 8.5% during the forecast period from 2024 to 2033.

- In 2023, the Fixed POS Terminals segment asserted a dominant position within the market, accounting for more than 63.1% of the total market share.

- The Front End segment also dominated the market in 2023, capturing over 70.5% of the Restaurant Point of Sale Terminal Market.

- The Full-Service Restaurants (FSR) segment held a significant market share in 2023, commanding more than 43.9% of the total market.

- Geographically, North America led the market in 2023, representing more than 36.0% of the market share, with revenues approximating USD 8.1 Billion.

Restaurant Point of Sale Terminal Statistics

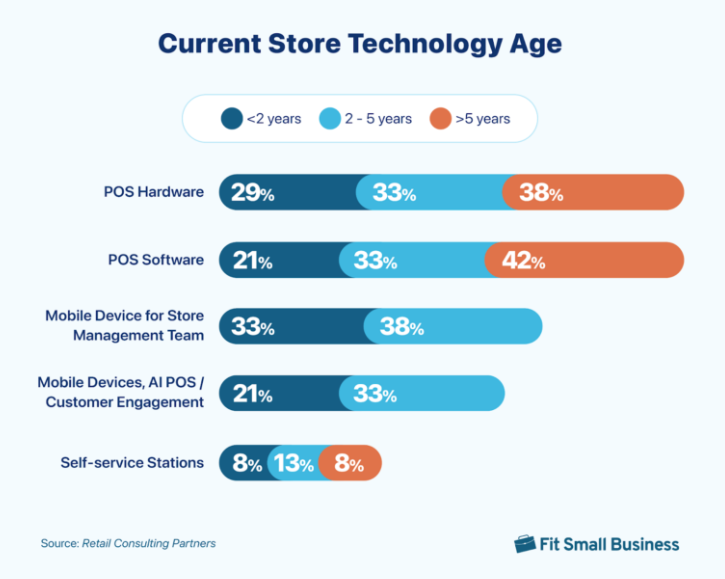

- 21% of retailers are currently using POS software adopted within the last two years, while 29% are using recently adopted POS hardware. A significant 40% of POS software and nearly the same percentage of POS hardware have been in use for over five years.

- Approximately 40% of independent restaurant owners are seeking advanced features in their POS systems, such as menu costing, employee scheduling, and inventory management.

- Nearly 46% of restaurateurs plan to upgrade their POS systems to enhance omnichannel experiences, focusing on improved data gathering and expanded payment options.

- Fixed POS terminals are projected to capture a robust market share of 54% in the upcoming years.

- The adoption of EMV-compliant POS terminals has surged by 590% over the past five years.

- The average acceptance rate of Apple Pay at POS terminals in the US stands at 65%.

- According to 6sense, Square holds over 27% of the market share in the POS systems market, closely followed by Toast with nearly 24%. Lightspeed, First Data (now Fiserv), and Clover complete the top five.

- The total transaction value for mPOS payments is expected to reach approximately $3.79 trillion globally in 2024.

- In 2024, the average mobile transaction value in the US is anticipated to be nearly $11,000. By 2028, the total number of mobile payments users is projected to surpass 101 million.

- As of December 2023, Apple Pay is the leading mobile payment brand in the US, utilized by 60% of respondents in restaurants and retail settings. CashApp follows closely at 59%, with PayPal at 58%.

- According to The Motley Fool, data from POS transactions constitute 51% of the most valuable data for retailers, encompassing metrics such as average transaction value, sales per category, and sales per employee.

- 52% of businesses have fully adopted cloud-based POS systems.

- An additional 40% of businesses are planning to transition to cloud-based POS systems in the near future.

Current State of Store Technology

Source: fitsmallbusiness.com

Growth Factors

Several factors contribute to the growth of the Restaurant POS Terminal Market:

- Technological Advancements: Innovations such as integration with mobile devices, contactless payments, and customization options for menus and service management enhance operational efficiency.

- Increase in Quick Service Restaurants (QSRs): The expansion of fast-food chains and casual dining restaurants globally increases the need for robust POS systems.

- Regulatory Compliance: Compliance with financial regulations and the necessity for accurate sales tracking encourage restaurant owners to adopt modern POS systems.

- Consumer Expectations: Higher consumer expectations for quick service and transaction safety push restaurants to upgrade their POS technology.

- Data Analytics: The ability to gather and analyze customer data for personalized marketing and operational improvements is a significant growth driver.

Emerging Trends

- Integration with Online Ordering Platforms: As the dining landscape evolves, POS systems are increasingly integrating with online ordering platforms to manage in-house and delivery orders more effectively, streamlining operations and boosting revenue.

- Adoption of Mobile POS Systems: Mobile POS systems are rising in popularity due to their flexibility and efficiency, enabling transactions beyond traditional counter setups, which is especially useful in outdoor or pop-up venues.

- Enhanced Payment Security with Blockchain: More restaurants are starting to use blockchain technology to secure transactions and enhance customer trust, particularly for loyalty programs and payment processing.

- Cloud-based POS Solutions: There’s a shift towards cloud-based POS systems that offer real-time data access, scalability, and easier integration with other services, allowing for more robust data management and operational flexibility.

- AI-Driven Personalization: Utilizing artificial intelligence, POS systems are increasingly capable of offering personalized dining experiences by suggesting menu items based on past orders or customer preferences, thus enhancing the customer service experience.

Top Use Cases

- Streamlined Order Management: POS systems allow for direct order input into kitchen display systems, reducing errors and speeding up service, which is crucial during peak dining hours.

- Efficient Table Management: Advanced POS solutions help optimize seating arrangements and track dining durations, improving turnover rates and customer satisfaction.

- Dynamic Inventory Management: Real-time tracking of ingredient usage helps restaurants manage stock levels effectively, minimizing waste and ensuring menu item availability.

- Multi-Channel Sales Management: Modern POS systems manage sales across in-store, online, and mobile platforms, providing a unified view of business operations and customer interactions, which is essential for omnichannel marketing strategies.

- Enhanced Customer Relationship Management (CRM): POS systems can integrate with CRM platforms to better track customer preferences and habits, tailor marketing efforts, and improve service delivery, ultimately boosting loyalty and repeat business.

Major Challenges

- High Initial Costs and Maintenance: Deploying and maintaining POS systems requires significant upfront investment and ongoing costs, which can be a deterrent, especially for smaller establishments.

- Complex Integration: Integrating POS systems with other business software like inventory management and accounting poses technical challenges that can lead to operational inefficiencies and data discrepancies.

- Security Concerns: With rising cyber threats, ensuring the security of transaction and customer data remains a critical challenge for POS systems, making robust security measures a necessity.

- Technical Training and Support: The need for continuous staff training on updated POS software and troubleshooting can strain resources, highlighting the importance of user-friendly systems and reliable customer support.

- Adapting to Consumer Preferences: Restaurants must continually adapt their POS systems to align with evolving consumer preferences, such as the increasing demand for contactless payments and mobile ordering.

Top Opportunities

- Expansion in Quick Service Restaurants (QSR): The growth of QSRs globally presents significant opportunities for POS system deployment to streamline operations and enhance customer service efficiency.

- Cloud-Based Solutions: Cloud-based POS systems offer scalability, real-time data access, and cost-effectiveness, appealing to a broad spectrum of restaurants, from small independents to large chains.

- Mobile POS Systems: The increasing popularity of mobile POS systems allows for greater service flexibility and operational efficiency, supporting tasks like tableside ordering and payment processing.

- Self-Service Kiosks: The rising consumer preference for self-service options in dining experiences can drive the adoption of self-service kiosk technology in POS systems, enhancing customer throughput and satisfaction.

- Integration with Online Ordering and Delivery Platforms: As online food delivery continues to grow, POS systems that integrate seamlessly with these platforms can improve order accuracy and reduce operational bottlenecks.

Recent Developments

- In January 2024, ParTech, Inc., a leading provider of restaurant point-of-sale (POS) systems, introduced the PAR Wave – a cutting-edge all-in-one touch panel specifically engineered for the hospitality industry. The PAR Wave is designed to integrate performance, security, and functionality, offering a sleek and modern design that aligns with the evolving needs of restaurant operations.

- In April 2024, the U.S. Department of Commerce reported that restaurants, including DineSecure, are required to update their Point of Sale (POS) systems to comply with the new Data Privacy Act. This act enforces stricter data encryption and customer consent protocols aimed at enhancing data protection.

- In June 2023, Oracle introduced the MICROS Workstation 8 Series, targeting the retail and hospitality industries. This new workstation is characterized by its contemporary design and enhanced features, aimed at optimizing operational efficiency. The launch reflects Oracle’s strategic focus on providing advanced technological solutions to streamline business processes in these sectors, reinforcing its commitment to innovation and customer-centric solutions in the competitive market landscape.

Conclusion

The restaurant POS terminal market faces notable challenges, primarily related to cost, integration complexity, and security. However, these are countered by significant opportunities, particularly through the adoption of cloud and mobile technologies that enhance operational flexibility and customer engagement. The rapid expansion of QSRs and the growing preference for digital transactions and self-service options also fuel the demand for advanced POS solutions. Moving forward, leveraging these opportunities while addressing the inherent challenges will be crucial for stakeholders in the POS market to thrive.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)