Table of Contents

Introduction

Retail Analytics Statistics: Retail analytics involves collecting and analyzing data to make informed business decisions in the retail sector. It helps retailers enhance the customer experience, optimize inventory, and improve pricing strategies.

Key components include data collection, descriptive, predictive, and prescriptive analytics, as well as customer and store analytics.

Challenges include data quality and privacy considerations. Future trends point to increased use of AI, IoT integration, personalization, and sustainability efforts.

In summary, retail analytics is essential for retailers, driving operational efficiency and profitability while shaping the industry’s future.

Editor’s Choice

- The retail analytics market is experiencing robust growth at a CAGR of 22%.

- In 2022, the retail analytics market generated approximately USD 5.7 billion in revenue.

- In 2022, the total market revenue stood at USD 5.7 billion. With an equal split between services and software, both amounting to USD 3.0 billion.

- Cloud-based deployments dominate this landscape, commanding a significant 63% market share. Highlighting the growing trend of businesses adopting cloud technology for their retail analytics needs.

- In the realm of retail, demographic data takes the lead, comprising a substantial 71% of the information gathered.

- A significant portion, approximately 69%, of consumers allocate most of their disposable income each month to in-store purchases.

- In 2016, a study conducted by Javelin Strategy & Research highlighted the substantial financial burden that fraud imposes on retailers. Equating to more than 7.5% of their yearly earnings.

Retail Analytics Market Statistics

Global Retail Analytics Market Size Statistics

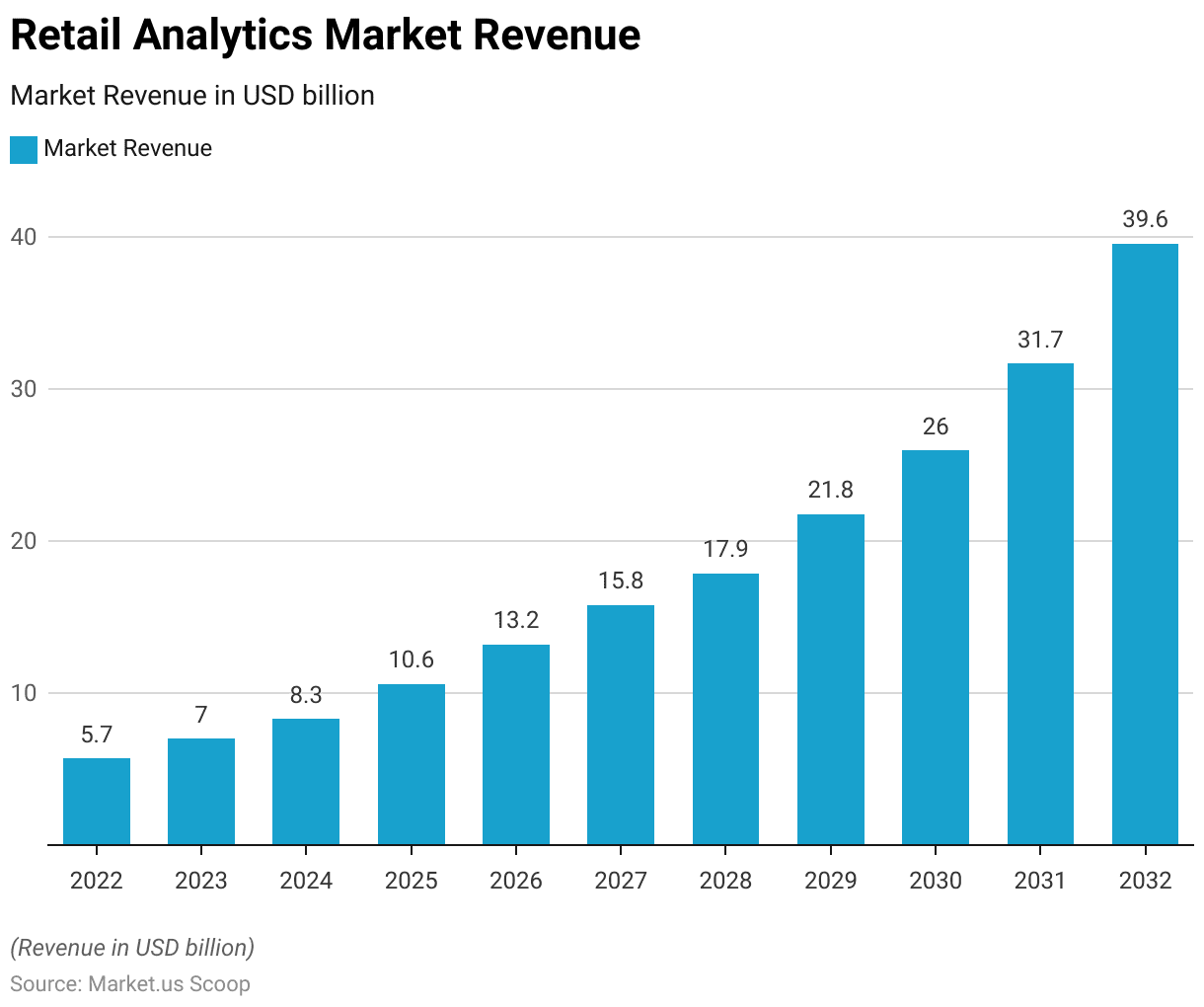

- The retail analytics market is experiencing robust growth at a CAGR of 22%. With its revenue projected to witness significant expansion over the next decade.

- In 2022, the market generated approximately USD 5.7 billion in revenue.

- This figure is expected to escalate steadily, reaching USD 7.0 billion in 2023 and further rising to USD 8.3 billion in 2024.

- The momentum continues with forecasted revenues of USD 10.6 billion in 2025 and USD 13.2 billion in 2026.

- By 2027, the retail analytics market is poised to surpass USD 15.8 billion, demonstrating consistent growth.

- The upward trajectory remains intact in the following years. With projected revenues of USD 17.9 billion in 2028 and a significant leap to USD 21.8 billion in 2029.

- The market’s growth becomes even more pronounced as we look further into the future. With estimates suggesting a revenue of USD 26.0 billion in 2030, USD 31.7 billion in 2031, and a substantial USD 39.6 billion in 2032.

- These impressive figures indicate the increasing significance of retail analytics in the ever-evolving landscape of the retail industry. Underlining its critical role in optimizing operations and decision-making processes.

(Source: Market.us)

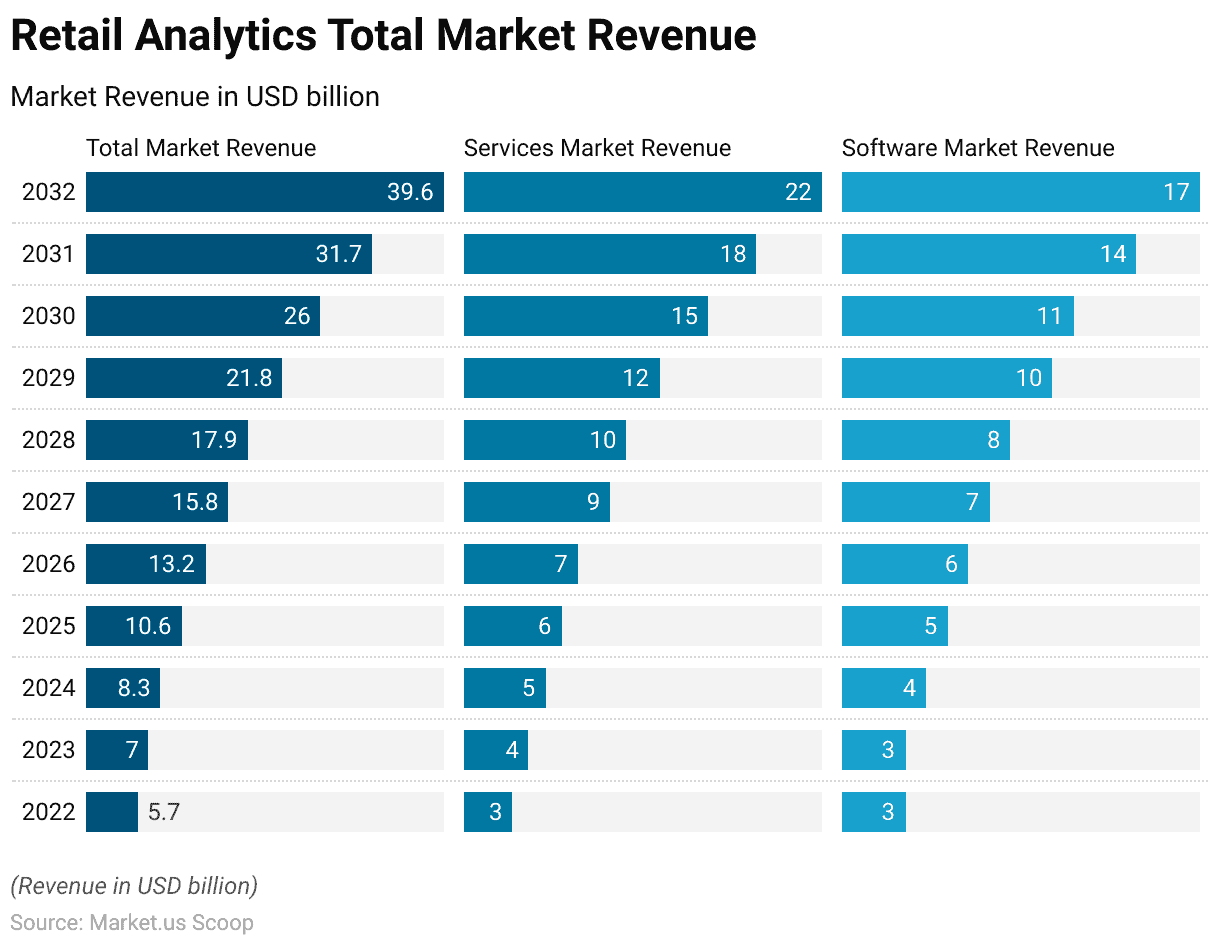

Global Retail Analytics Market Size – By Solution Statistics

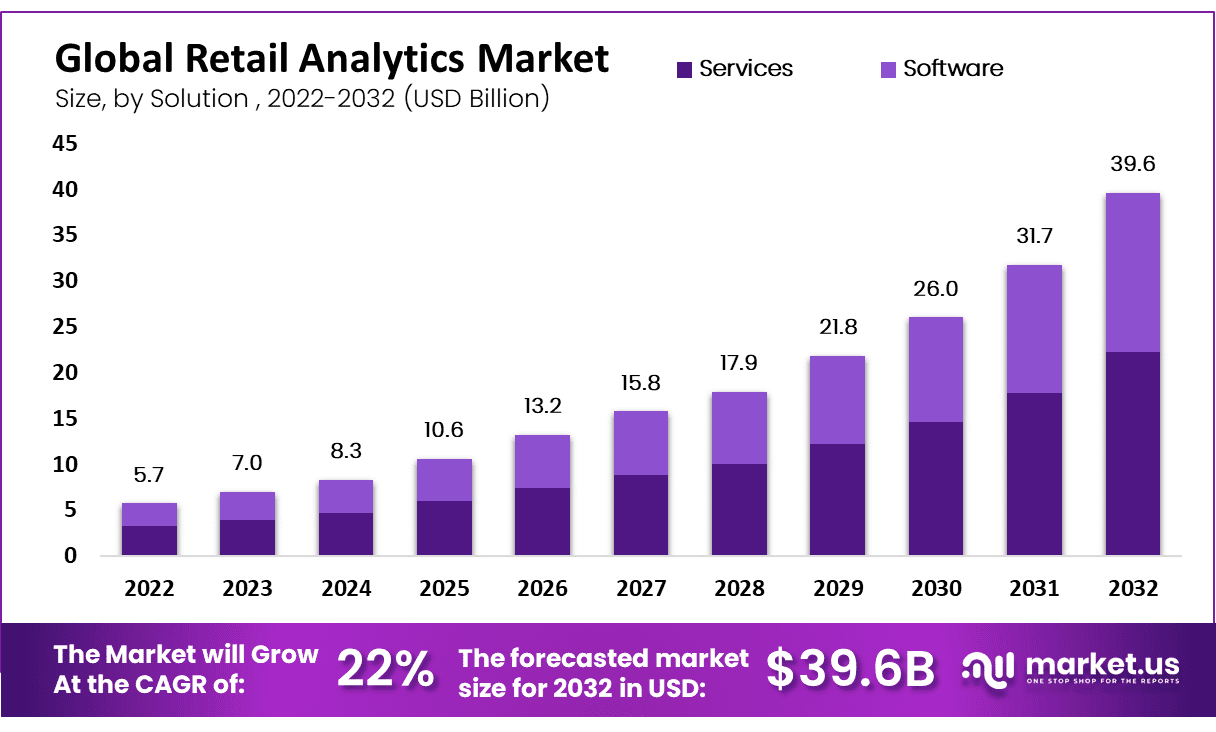

- The global retail analytics market is poised for remarkable growth, as indicated by the revenue figures for the coming years.

- In 2022, the total market revenue stood at USD 5.7 billion. With an equal split between services and software, both amounting to USD 3.0 billion.

- The following years are expected to witness substantial expansion. With 2023 is forecasted to reach USD 7.0 billion in total market revenue. With services and software contributing USD 4.0 billion and USD 3.0 billion, respectively.

- As we look ahead, 2024 is anticipated to see a further increase, with total market revenue reaching USD 8.3 billion. Services account for USD 5.0 billion, and software for USD 4.0 billion.

- The trend continues, with total market revenues of USD 10.6 billion in 2025, USD 13.2 billion in 2026, and USD 15.8 billion in 2027.

- By 2028, the market is expected to surpass USD 17.9 billion in total revenue. With services and software contributing USD 10.0 billion and USD 8.0 billion, respectively.

- The growth trajectory remains consistent, reaching USD 21.8 billion in 2029, USD 26.0 billion in 2030, and USD 31.7 billion in 2031.

- The market is set for a significant milestone in 2032, with total revenue projected at USD 39.6 billion, supported by services at USD 22.0 billion and software at USD 17.0 billion.

- These figures underscore the increasing importance of retail analytics solutions. Both in terms of services and software, in the ever-evolving retail landscape. Businesses recognize the value of data-driven insights for optimizing their operations and decision-making processes.

(Source: Market.us)

Global Retail Analytics Market Share – By Deployment Type Statistics

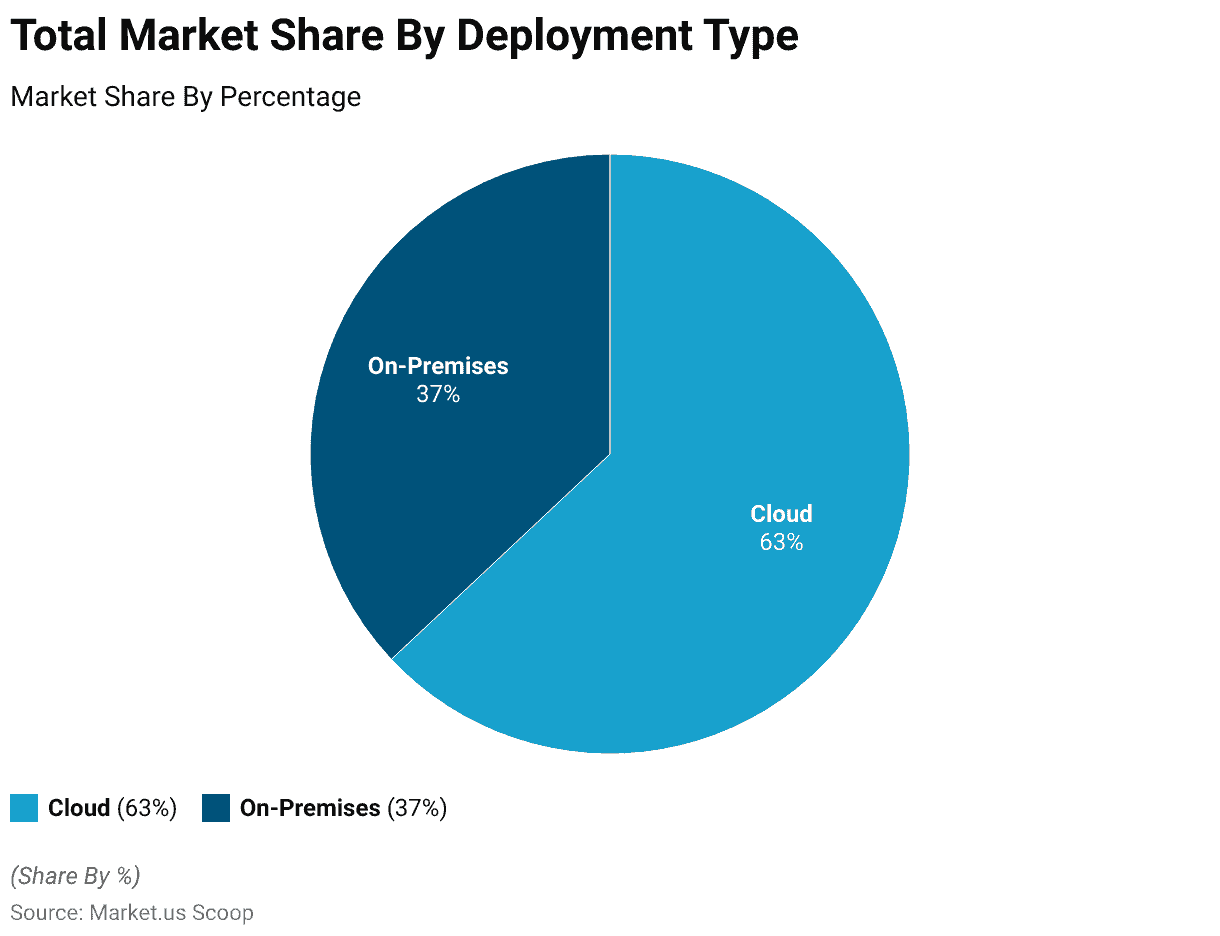

- The global retail analytics market is characterized by two primary deployment types. Namely cloud and on-premises solutions, each contributing distinct market shares.

- Cloud-based deployments dominate this landscape, commanding a significant 63% market share. Highlighting the growing trend of businesses adopting cloud technology for their retail analytics needs.

- Cloud solutions offer flexibility, scalability, and accessibility, making them increasingly appealing to retailers seeking real-time insights and data management.

- On the other hand, on-premises deployments maintain a respectable 37% market share. This signifies that a substantial portion of the market still values the control and security that come with housing analytics solutions within their infrastructure.

- This dual approach to deployment types underscores the diverse requirements and preferences within the retail industry. As businesses navigate the dynamic demands of data analytics to enhance their operational efficiencies and decision-making capabilities.

(Source: Market.us)

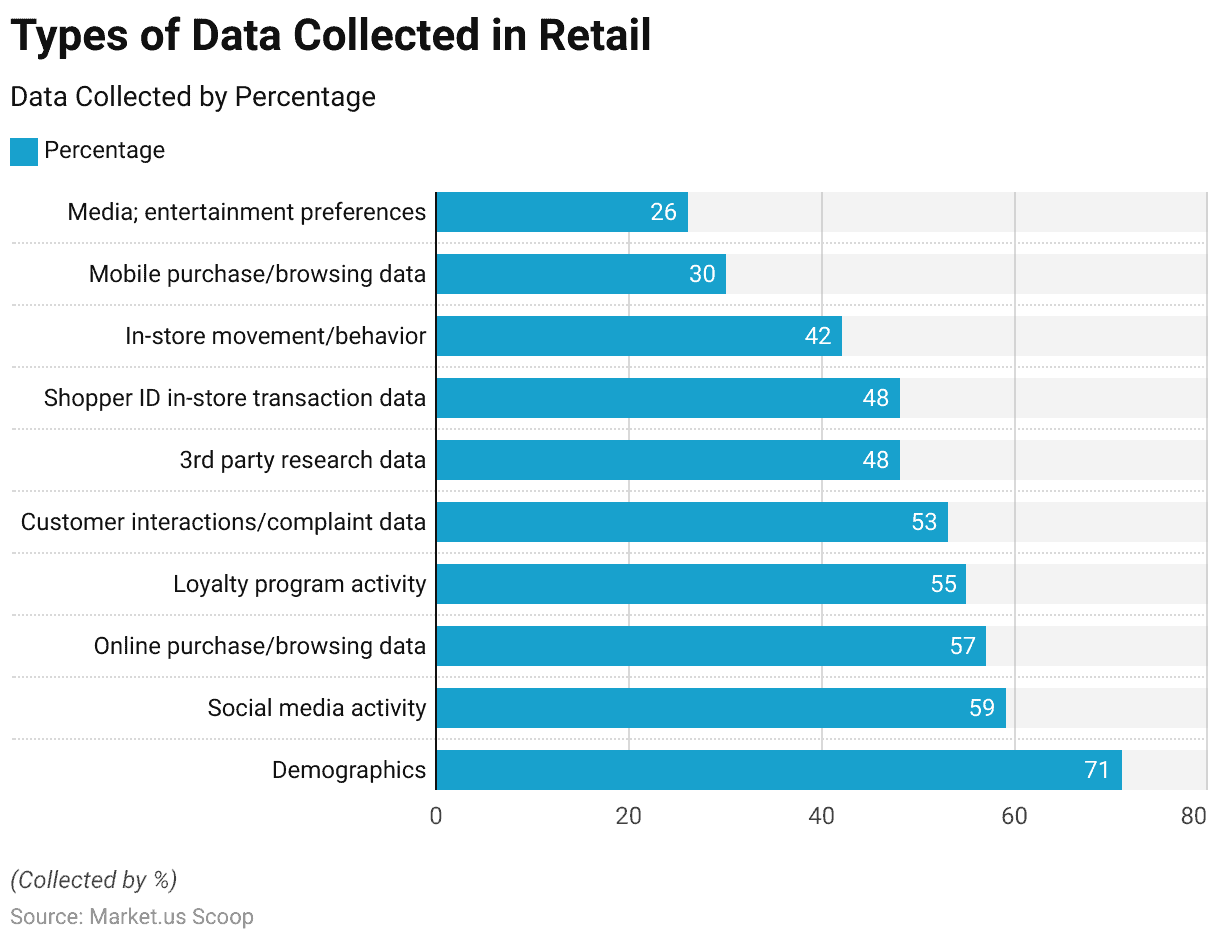

Types of Data Collected in Retail

- In the realm of retail, a diverse array of data types is collected to gain insights into consumer behavior and preferences.

- At the forefront, demographics data takes the lead, comprising a substantial 71% of the information gathered. This data provides crucial insights into the age, gender, and location of customers. Helping retailers tailor their offerings to specific consumer segments.

- Social media activity closely follows, with 59%, indicating the growing significance of online presence and sentiment analysis in shaping marketing strategies.

- Online purchase and browsing data, at 57%, offer invaluable insights into customers’ online shopping habits. Aiding in personalized recommendations and targeted marketing campaigns.

- Loyalty program activity data, at 55%, helps retailers reward and retain loyal customers effectively.

- Additionally, customer interactions and complaint data (53%) provide valuable feedback for improving customer service and overall satisfaction.

- Third-party research data (48%) and shopper ID in-store transaction data (48%)offer a holistic view of consumer preferences and shopping behavior.

- In-store movement and behavior (42%) data aids in optimizing store layouts and product placements.

- Mobile purchase and browsing data (30%) provide insights into the mobile shopping experience. While media and entertainment preferences (26%) help retailers align their offerings with customers’ broader interests.

- This diverse collection of data types underscores the importance of data-driven decision-making in the dynamic and competitive retail landscape. Allowing businesses to tailor their strategies and offerings to meet ever-evolving consumer demands.

(Source: Alteryx, Inc.)

Customer Retail Preferences Statistics

- A significant portion, approximately 69%, of consumers allocate most of their disposable income each month to in-store purchases.

- However, following the onset of the pandemic, around 40% of US shoppers decreased their overall retail expenditures.

- Before the pandemic, customers emphasized that the ability to try out products in a physical store held three times the influence compared to other factors when making a purchase decision.

- Furthermore, an overwhelming 87% of customers expressed their interest in gaining exclusive access to items or sales events hosted in physical retail stores.

- An equally high percentage, 81%, indicated their willingness to attend parties organized by these stores. While 80% expressed their readiness to participate in product demonstrations or tutorials hosted by physical retailers.

- Additionally, 71% of customers stated their inclination to engage in games or competitions organized by brick-and-mortar stores.

- Notably, a significant 82% of shoppers attended a retail-related event in the year 2018.

- Certainly, the pandemic naturally led to shifts in consumer habits. In the United States, there was a substantial 60.4% increase in Click-and-Collect sales in 2020 when compared to the previous year, 2019.

- Additionally, a noteworthy 89% of US shoppers are inclined to favor retail brands that contribute positively to the world.

(Source: Score-2019, GroundTruth-2021)

Mobile Retail Analytics Statistics

- Certainly, the majority, which is 65%, of e-commerce website visits originate from mobile devices.

- In terms of actual sales, 53% of e-commerce transactions are generated from these mobile sessions.

- Notably, fashion retailers achieve a high conversion rate of 89.3% when it comes to turning mobile website traffic into successful sales.

- Certainly, a significant 79% of individuals who use smartphones have completed an online purchase through their mobile devices within the past half-year.

- Approximately 37% of smartphone users also engage in in-store mobile payments at least once every six months.

- Forecasts indicate a substantial growth of 33% in the worldwide mobile payments market by the year 2022.

- Furthermore, it is projected that mobile payment applications will be responsible for managing an estimated $14 trillion in transactions annually by 2022.

(Source: SaleCycle, 2020, OuterBox-2021, Growcode-2020, Payments Industry Intelligence)

E-commerce Analytics Statistics

- With the rapid expansion of global internet accessibility. Which now spans more than five billion users worldwide, there is a continuous surge in online shopping.

- In the year 2022, the estimated value of e-commerce sales in the retail sector surpassed a remarkable 5.7 trillion U.S. dollars on a global scale, and these numbers are poised for further growth in the forthcoming years.

- As of 2022, the predominant share of online purchases across the globe is facilitated through online marketplaces.

- In the realm of online retail traffic, Amazon stands as the top contender, holding the leading position. This Seattle-based e-commerce titan offers a diverse array of services encompassing e-retail, computing solutions, consumer electronics, and digital content.

- Notably, in April 2023, Amazon’s .com website recorded an impressive 5.9 billion direct visits.

- However, when measured in terms of gross merchandise value (GMV). Amazon ranks third, trailing behind its Chinese counterparts, Taobao and Tmall.

- These two platforms are under the management of Alibaba Group, an e-commerce leader in Asia and a prominent online commerce provider.

- A highly noticeable trend in the e-commerce landscape is the remarkable surge in mobile device usage. By the year 2023, smartphones took the lead, contributing to more than 70% of all global retail website visits.

- Consequently, they also played a pivotal role in driving the majority of online purchases when compared to desktop computers and tablets.

- Notably, mobile commerce, often referred to as m-commerce, enjoys significant popularity in Asia, where countries such as China and South Korea are responsible for generating more than two-thirds of their total online sales through mobile devices.

(Source: Statista)

Fraud Detection in Retail Analytics Statistics

- In 2016, a study conducted by Javelin Strategy & Research highlighted the substantial financial burden that fraud imposes on retailers, equating to more than 7.5% of their yearly earnings.

- Managing card-related fraud and addressing disputed credit card transactions, a process known as chargeback management, places a significant strain on their operational budgets, accounting for anywhere from 14% to 23% of expenditures.

- Another factor contributing to revenue depletion is the occurrence of false positives, which constitute 2.8% of lost revenues.

- Furthermore, Card Not Present (CNP) fraud, where scammers exploit online payment methods to circumvent face-to-face verification during point-of-sale transactions, is forecasted to result in a substantial cost of $71 billion for the global retail industry over the next five years.

- In 2021, Juniper’s predictions indicate that Card Not Present (CNP) fraud cases will predominantly originate from the United States and Asia, accounting for a combined 80%.

- Within the United States, Aite Group, a financial research firm, envisions that the adoption of EMV chip technology may trigger a rise in online fraud, similar to the 79% increase experienced in the United Kingdom during the initial three years of chip card implementation nearly a decade ago.

- The retail industry’s reluctance to upgrade outdated payment security systems exacerbates the situation, particularly in the delayed introduction of 3-D Secure 2.0 anti-fraud technology, which numerous retailers have deferred for an extended period.

- As outlined by Visa, 3-D Secure 2.0 applications establish an “authentication data connection linking digital merchants, payment networks, and financial institutions to enhance the scrutiny and exchange of transaction-related details.”

- Additionally, this upgraded Visa payment framework takes into account a tenfold increase in contextual data, encompassing device attributes, biometric markers, and payment history, thus delivering a more precise assessment of fraud risk.

(Source: Thomson Reuters)

Recent Developments

Acquisitions and Mergers:

- Microsoft acquires Nuance Communications: In 2023, Microsoft completed its $19.7 billion acquisition of Nuance Communications, a leader in AI and speech recognition technology. This acquisition enhances Microsoft’s retail analytics capabilities by improving customer insights and personalized retail experiences through advanced AI-driven analytics.

- IBM acquires Turbonomic: In 2023, IBM acquired Turbonomic, an AI-powered application resource management (ARM) platform, for $1.5 billion. This acquisition helps IBM expand its AI and retail analytics services, enabling retailers to optimize customer experiences, predict trends, and manage operations more efficiently.

New Product Launches:

- Google launches AI-driven Retail Search: In 2023, Google introduced Retail Search, an AI-powered tool designed to improve product discovery for online retailers. The new tool enhances search functionality on e-commerce platforms by providing personalized product recommendations. Resulting in higher conversion rates and improved customer satisfaction.

- Salesforce launches Consumer Goods Cloud for retail analytics: In 2024, Salesforce launched the Consumer Goods Cloud, specifically aimed at helping retail businesses use data analytics to understand consumer behavior. Optimize inventory management, and boost in-store efficiency through real-time insights.

Funding:

- Trax raises $640 million for retail analytics innovation: In 2023, Trax, a leader in retail computer vision solutions, secured $640 million in funding to enhance its AI-powered retail analytics tools. The funds will be used to improve shelf monitoring and stock management solutions, giving retailers more accurate and actionable insights into their inventory.

- SoundCommerce raises $15 million for retail data integration: In early 2024, SoundCommerce, a data integration and retail analytics platform, raised $15 million to expand its data-driven solutions. The platform helps retailers unify customer data and operational data to improve decision-making and predict consumer demand.

Technological Advancements:

- AI and machine learning transforming retail analytics: AI and machine learning are becoming central to retail analytics. By 2025, over 50% of retailers are expected to adopt AI-driven analytics solutions to predict consumer demand, enhance personalization, and optimize supply chains, reflecting the growing importance of data-driven decision-making.

- Real-time analytics for inventory management: Real-time inventory management is becoming critical for retailers. By 2026, 35% of retailers are projected to adopt real-time analytics tools to track stock levels and avoid supply chain disruptions, improving efficiency and customer satisfaction.

Conclusion

Retail Analytics Statistics – In conclusion, retail analytics is a vital resource for modern retailers. It empowers them to improve customer experiences, optimize operations, and drive profitability.

Despite challenges, such as data quality and privacy, its significance remains undeniable. Looking ahead, the integration of AI and IoT promises to further transform the retail landscape.

In this ever-evolving market, the effective utilization of retail analytics is key to staying competitive and meeting customer expectations.

FAQs

Retail analytics is the process of collecting, analyzing, and interpreting data related to a retailer’s operations and customers to make informed business decisions.

Retail analytics is crucial for retailers as it helps improve the customer experience, optimize inventory, enhance pricing strategies, and increase sales and profitability.

The key components of retail analytics include data collection, descriptive analytics, predictive analytics, prescriptive analytics, customer analytics, store analytics, and e-commerce analytics.

Retail analytics can provide valuable insights into customer behavior, help identify trends, improve inventory management, enhance marketing efforts, and optimize store operations.

Challenges in retail analytics include data quality, data integration, talent acquisition, and ethical considerations related to customer data privacy.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)