Table of Contents

Introduction

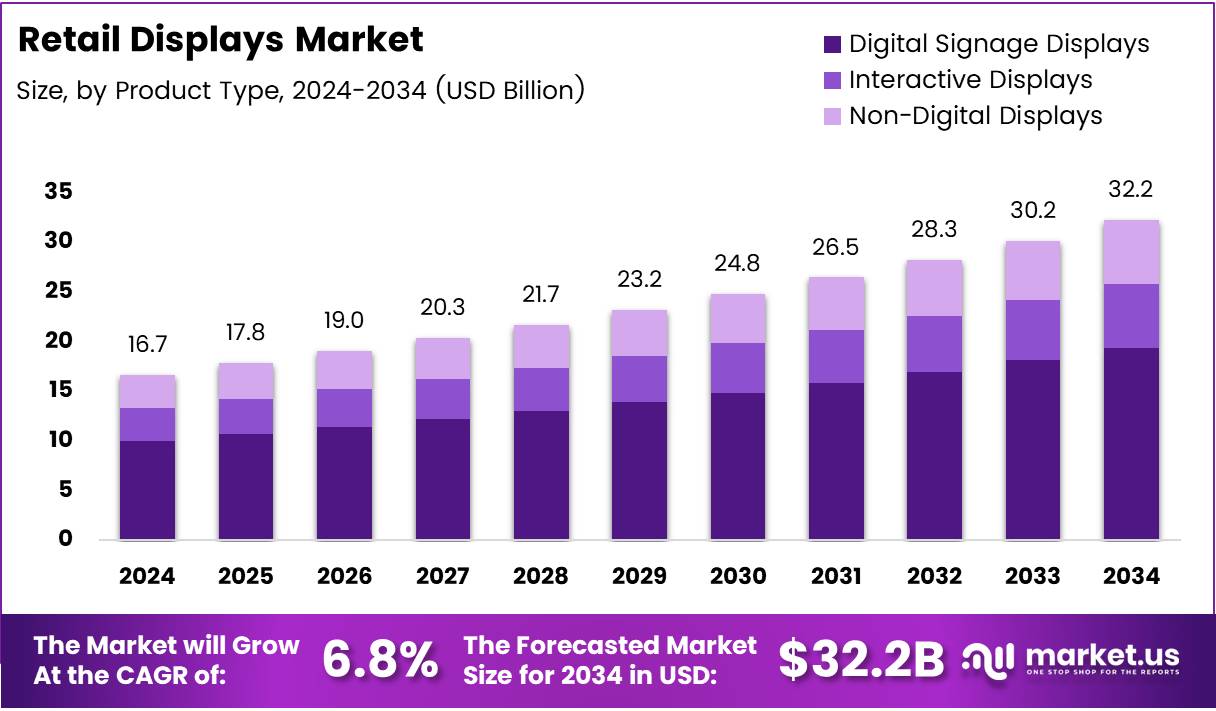

The Global Retail Displays Market is set to witness significant expansion, projected to reach USD 32.2 Billion by 2034 from USD 16.7 Billion in 2024. This remarkable growth, at a CAGR of 6.8% during 2025–2034, highlights the increasing integration of digital and interactive technologies in retail environments worldwide.

As consumer expectations evolve, retailers are embracing smart and adaptive display technologies to enhance brand visibility and drive engagement. These innovations transform traditional shopping spaces into interactive and data-driven environments that connect brands with shoppers at the point of purchase, fostering stronger conversions and customer loyalty.

Moreover, global investments in digital transformation, sustainability, and eco-friendly retail infrastructure are reshaping the future of visual merchandising. Governments, manufacturers, and retailers are collaborating to implement energy-efficient and recyclable display solutions, ensuring innovation, compliance, and long-term operational efficiency across regions.

Key Takeaways

- The Global Retail Displays Market is projected to reach USD 32.2 Billion by 2034, growing from USD 16.7 Billion in 2024 at a CAGR of 6.8%.

- Digital Signage Displays dominated the Product Type segment in 2024 with a 49.3% share, driven by real-time content and interactive promotions.

- LCD technology led the Display Technology segment with a 39.4% share, favored for cost-efficiency and clarity.

- Point of Sale (POS) Displays captured 26.6% of the Application segment, leveraging impulse buying behavior.

- Retail Stores accounted for 44.8% of the End-Use segment, reflecting investments in in-store engagement.

- North America dominated the market with a 39.2% share, supported by advanced retail networks and strong consumer spending.

Market Segmentation Overview

By Product Type, Digital Signage Displays dominated with 49.3% share in 2024, fueled by their ability to deliver real-time, customized content. Meanwhile, interactive displays gained traction for enhancing customer experience, while non-digital displays maintained relevance among small retailers seeking cost-effective merchandising tools.

By Display Technology, LCD technology led the segment with 39.4% market share, offering cost-efficient and high-definition visuals. LED displays are rapidly expanding due to superior brightness and durability, while OLED displays are gaining prominence in luxury retail for their flexibility and premium appeal.

By Application, POS Displays held a leading position with 26.6% share, significantly influencing last-minute purchasing decisions. Other key applications such as POP Displays and Interactive Advertising continue to drive engagement, reinforcing brand visibility and customer interaction across multiple retail formats.

By End-Use, Retail Stores dominated with 44.8% share, as businesses increasingly invest in enhancing in-store experiences. Other sectors, including hospitality, healthcare, and transportation, are adopting digital signage solutions to streamline communication and promote offerings effectively.

Drivers

Increasing Adoption of Digital Signage and Interactive Retail Displays: Retailers worldwide are embracing digital signage and interactive display systems to captivate customers, deliver personalized recommendations, and enhance the shopping experience. These systems provide dynamic, real-time updates, creating immersive store environments that boost dwell time and conversion rates.

Integration of AI and IoT Technologies: The convergence of AI and IoT in retail displays allows brands to analyze customer behavior and adjust promotional content instantly. This data-driven approach enables targeted marketing, ensuring retailers can effectively engage with shoppers and improve overall sales performance.

Use Cases

In-Store Experience Enhancement: Retail displays are revolutionizing how brands interact with customers. Interactive touchscreens, motion-based advertisements, and digital signage deliver immersive experiences that attract attention and inform purchasing decisions, resulting in stronger customer loyalty and increased sales conversions.

Omnichannel Brand Consistency: Retailers utilize display networks to ensure brand consistency across online and offline platforms. Digital signage seamlessly integrates with e-commerce systems, offering synchronized promotions and unified messaging, thus bridging the gap between digital engagement and physical retail presence.

Major Challenges

Limited Space in Small Retail Outlets: Smaller stores often face challenges installing large or interactive display systems due to spatial constraints. This limitation reduces the potential reach of advanced visual merchandising technologies among independent retailers, impacting market penetration.

Technological Obsolescence and Environmental Impact: The fast-paced evolution of display technologies shortens product life cycles, leading to higher replacement costs and electronic waste. Managing disposal and ensuring sustainability compliance pose financial and environmental hurdles for manufacturers and retailers alike.

Business Opportunities

Expansion in Emerging Economies and Tier-2 Cities: The rapid digitalization of retail across emerging markets offers substantial opportunities for display manufacturers. As younger, tech-savvy consumers demand interactive experiences, retailers in these regions are investing in affordable and scalable display systems.

Adoption of Energy-Efficient and Modular Solutions: The shift toward sustainable display technologies such as LED and OLED systems opens new business prospects. Modular and recyclable designs offer flexibility for retailers to update layouts cost-effectively while aligning with global green initiatives.

Regional Analysis

North America: Accounting for 39.2% of the global market share, North America leads due to strong consumer spending and the widespread adoption of advanced retail technologies. Retailers in the U.S. and Canada continue to integrate AI-enabled displays and digital signage to boost shopper engagement and operational efficiency.

Asia Pacific: The Asia Pacific region is witnessing rapid growth driven by expanding modern retail infrastructure and rising disposable incomes. Countries such as China, Japan, and South Korea are leading investments in smart display technologies, making the region a major hub for innovation and retail transformation.

Recent Developments

- In July 2025, TRG (The Royal Group) acquired Trans World Marketing, expanding its capabilities in end-to-end retail experiences and enhancing its global in-store marketing portfolio.

- In August 2025, Prometheus Retail Solutions acquired PackagingARTS to strengthen its position in luxury wine and spirits retail, combining creative packaging with immersive display strategies.

- In October 2024, DGS Retail completed the acquisition of SMS Display, forming the Agility Retail Group to unify innovation in retail display systems and store fixture manufacturing.

Conclusion

The Global Retail Displays Market stands at the forefront of the retail revolution, powered by technological innovation, sustainability, and enhanced consumer engagement. With digital and interactive displays becoming essential tools for brand storytelling, the market is poised for sustained growth and transformation over the coming decade.

As retailers worldwide focus on delivering personalized, data-driven, and eco-conscious shopping experiences, the integration of smart display technologies will redefine in-store marketing strategies. The future of retail displays lies in combining creativity, technology, and sustainability to build immersive environments that connect brands and consumers seamlessly.