Table of Contents

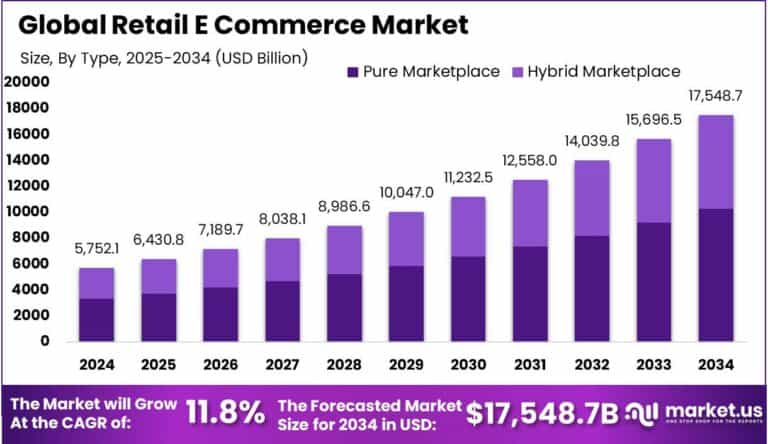

In 2024, the global retail e-commerce market was valued at approximately USD 5,752.1 billion and is projected to reach around USD 17,548.7 billion by 2034, expanding at a robust CAGR of 11.80% from 2025 to 2034. The U.S. market alone accounted for USD 1,692.8 billion, marking a CAGR of 10.6%, significantly influenced by digital transformation, mobile commerce, and AI-driven personalization. North America retained a leading position with a 32.7% market share. While technological advancements drive growth, macroeconomic challenges—especially tariffs—are reshaping the retail landscape and cross-border trade dynamics.

How Tariffs Are Impacting the Economy

Tariffs, particularly those introduced by the U.S. on Chinese imports, have led to rising consumer prices, increased manufacturing costs, and reshuffling of global trade partnerships. As of 2024, over US$550 billion in Chinese goods face U.S. tariffs, which has placed strain on retailers importing electronics, apparel, and consumer goods. Inflationary pressures have risen as businesses pass on increased costs to consumers.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/retail-e-commerce-market/free-sample/

Additionally, retaliatory tariffs from China and other nations have reduced American export competitiveness in key sectors such as agriculture and automotive. Tariffs also influence investor confidence, slowing capital investment and hiring activities. While some domestic industries benefit from reduced foreign competition, overall GDP growth has been marginally impacted. Prolonged tariff uncertainty has hindered long-term planning, especially for small and mid-sized e-commerce businesses dependent on global supply chains.

Impact on Global Businesses

Rising Costs & Supply Chain Shifts: Tariffs have caused global businesses to rethink sourcing strategies. Companies are shifting supply chains away from China to countries like Vietnam, India, and Mexico to mitigate cost escalation. These transitions, however, come with increased setup and compliance costs.

Sector-Specific Impacts:

- Consumer Electronics: Margins are under pressure due to higher import duties.

- Apparel and Footwear: Brands are relocating production hubs but face inventory delays.

- Automotive: Higher component costs are inflating vehicle prices.

- Agriculture: Retaliatory tariffs are shrinking U.S. exports to key Asian markets.

Strategies for Businesses

To counter tariff volatility, businesses are employing several strategic moves:

- Diversifying suppliers across multiple regions to de-risk operations.

- Investing in domestic manufacturing where feasible to reduce import reliance.

- Implementing dynamic pricing models to accommodate cost variations.

- Leveraging trade agreements such as USMCA to bypass tariffed routes.

- Enhancing logistics efficiency through digitization and automation.

These strategies are essential for maintaining competitiveness and profitability in a complex international trade environment.

Key Takeaways

- The global retail e-commerce market is projected to grow at a CAGR of 11.80% through 2034.

- Tariffs have increased costs, disrupted supply chains, and influenced global sourcing.

- North America leads the market, accounting for 32.7% of global revenue in 2024.

- Businesses are shifting operations to tariff-neutral regions.

- Dynamic pricing and supply chain agility are crucial for sustainability.

➤ Get full access now @ https://market.us/purchase-report/?report_id=148333

Analyst Viewpoint

The current global trade environment, while challenged by tariffs, presents new growth avenues for agile businesses. In the present landscape, companies adapting to new sourcing and pricing models are better positioned to thrive. Moving forward, regional trade partnerships, localized production, and tech-driven efficiencies are expected to mitigate long-term risks. Analysts anticipate a positive market trajectory, particularly as regulatory clarity improves and digital commerce continues to scale.

Regional Analysis

In 2024, North America led the retail e-commerce market with a 32.7% share, driven by widespread smartphone usage, high internet penetration, and strong logistics infrastructure. The Asia-Pacific region is witnessing the fastest growth, fueled by rising digital literacy, growing middle-class income, and mobile-first e-commerce platforms. Europe maintains a mature yet stable market, supported by cross-border regulations and advanced delivery systems. Latin America and Middle East & Africa are emerging as promising markets due to increasing urbanization and expanding digital access.

➤ Discover More Trending Research

- Hypersonic Missiles Market

- Database Security Market

- Cross-Border E-Commerce Logistics Market

- B2B Electronic Commerce Market

Business Opportunities

The evolving trade climate and booming e-commerce sector open numerous opportunities for businesses. Retailers can expand into untapped geographies using cross-border e-commerce strategies. Investment in last-mile delivery, AI personalization, and supply chain transparency tools offers strong returns.

Companies that focus on sustainable sourcing and ethical trade practices can build stronger customer loyalty. Niche segments such as eco-friendly products, direct-to-consumer models, and subscription-based services are gaining traction. Additionally, small and medium businesses can leverage platform-based sales models to globalize operations without heavy infrastructure investments.

Key Segmentation

The retail e-commerce market is categorized by product type, platform, payment method, and region.

- Product Type: Apparel & Accessories, Electronics, Personal Care, Home Décor, and Food & Beverage

- Platform: Desktop, Mobile

- Payment Method: Credit/Debit Card, Digital Wallets, Bank Transfers, Cash on Delivery

- Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

This segmentation enables targeted strategy formulation based on consumer behavior, technological infrastructure, and regional preferences.

Key Player Analysis

Leading companies in the retail e-commerce market are continuously innovating through AI, automation, and data analytics. These players focus on enhancing customer experience, expanding cross-border capabilities, and optimizing fulfillment speed. Strategic partnerships, acquisitions, and technology integrations are central to staying competitive. Investment in supply chain optimization, personalized marketing, and multichannel commerce is enabling companies to adapt quickly to trade fluctuations and shifting consumer expectations.

Recent Developments

E-commerce platforms are integrating AI-driven personalization, expanding fulfillment centers globally, and leveraging AR/VR to enhance online shopping experiences. Some are investing in blockchain-based supply chains for improved transparency.

Conclusion

Tariffs are reshaping global retail e-commerce, yet digital innovation and regional diversification are driving market resilience. Businesses that adapt to new realities with strategic agility will capture long-term growth.