Table of Contents

Introduction

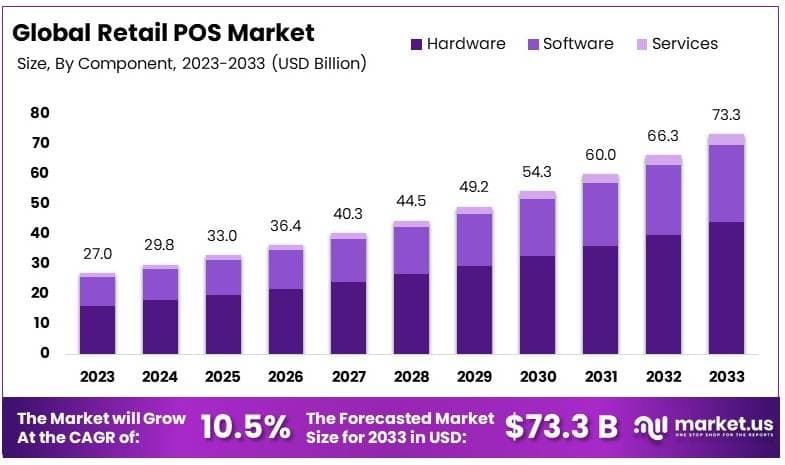

According to Market.us, The Global Retail POS Market size is projected to reach approximately USD 73.3 Billion by 2033, up from USD 27.0 Billion in 2023, exhibiting a Compound Annual Growth Rate (CAGR) of 10.5% during the forecast period from 2024 to 2033. In 2023, the Asia-Pacific region dominated the market, accounting for 34.8% of the global share.

This dominance is primarily attributed to the rapid expansion of the retail sector within the region. The substantial growth in Asia-Pacific is driven by increasing technological adoption and the growing need for efficient transaction processes in retail environments, marking significant market trends and opportunities for development in this area.

The demand for retail POS systems is significantly influenced by the need for efficient transaction management and improved customer service in retail businesses. As retailers seek to optimize checkout processes and enhance customer interactions, POS systems become indispensable tools. This demand is further driven by the evolving retail landscape, where omnichannel retailing and the shift towards digital transactions have become prominent.

Retailers are increasingly adopting modern POS systems that support mobile payments, e-commerce integration, and real-time inventory tracking to meet the demands of a tech-savvy consumer base and stay competitive in a rapidly changing market. Several key factors contribute to the growth of the retail POS market. Technological advancements are at the forefront, providing more robust, integrated, and user-friendly POS solutions.

The rise of mobile POS solutions has allowed businesses to enhance operational flexibility and improve customer interactions on the sales floor. Additionally, the increased emphasis on data-driven business strategies has made POS systems crucial for gathering valuable customer insights and sales data. Regulatory changes, such as those requiring secure payment processes, and the global expansion of retail chains also play significant roles in driving the demand for advanced POS systems.

The retail POS market is ripe with opportunities, particularly through the integration of emerging technologies like artificial intelligence (AI) and machine learning, which can offer predictive analytics and personalized shopping experiences. The expansion into untapped markets in developing regions presents another significant opportunity, as these areas witness increased retail formalization and digitalization.

Furthermore, the growing trend towards eco-conscious consumerism pushes the development of POS systems that support sustainable practices, such as digital receipts and reduced paper usage. These factors create openings for market entrants and provide existing players with chances to innovate and expand their market presence.

Key Takeaways

- The Retail POS Market was valued at USD 27.0 Billion in 2023 and is projected to reach USD 73.3 Billion by 2033, expanding at a CAGR of 10.5%.

- In the component segment, Hardware led with a 59.5% share, underscoring its critical function in enabling physical transactions.

- Fixed POS systems dominated the type segment with 58.1%, preferred for their dependability in high-volume retail settings.

- Supermarkets and Hypermarkets held the largest portion of the end-user segment at 42.9%, reflective of their substantial transaction volumes.

- Regionally, Asia-Pacific was the frontrunner, capturing 34.8% of the market, propelled by swift growth in the retail sector

Retail POS Statistics

- The Global POS Terminals Market is projected to reach USD 234.8 billion by 2033, expanding at a CAGR of 9.8% from 2023 to 2033, starting from USD 92.2 billion in 2023. Approximately 80% of transactions utilize POS systems. Retailers employing Artificial Intelligence extensively report a 15% reduction in operational costs and a revenue increase of at least 10%.

- Around 45% of retailers acknowledge higher employee retention and profit margins due to automation. The Global mPOS Terminal Market is poised to achieve a valuation of USD 106.8 billion by 2033, growing from USD 38.3 billion in 2023 with a 10.8% CAGR.

- The Point of Sale (PoS) Display Market is anticipated to grow to USD 30.3 billion by 2033, from USD 13.2 billion in 2023, advancing at an 8.7% CAGR; North America leads with a 34.5% market share, equivalent to revenues of USD 4.55 billion.

- Automation in retail enhances innovation by 42%, notably higher among Australian retailers at 45%. In collaboration with Wakefield Research, Square’s survey of retail owners and consumers across the U.S., Canada, the UK, and Australia highlights automation’s role in improving customer experience for 47% of respondents.

- Over the next year, 51% of retailers focus on in-store enhancements, while 49% prioritize expanding online services. The AI in Retail Market is forecasted to surge to USD 127.2 billion by 2033 from USD 9.3 billion in 2023, soaring at a 29.9% CAGR.

- The Retail Analytics Market could reach USD 39.6 billion by 2032, ascending from USD 5.7 billion in 2022 at a 22% CAGR. Deloitte anticipates mobile commerce to constitute up to 70% of total e-commerce sales by 2024.

- Mobile POS adoption is significant among small to mid-sized brands, constituting 79% with annual sales under $10 million, while large enterprises make up 21%. Forbes highlights that 61% of retailers are considering cloud-based POS solutions as a strategic priority.

Emerging Trends

- Mobile and Cloud-based POS Systems: The transition to cloud-based POS systems is accelerating, enabling real-time access to data and operational flexibility. Mobile POS solutions are also expanding, reflecting their cost-effectiveness and convenience for enhancing customer experiences.

- Data-driven Customization: Retailers are increasingly leveraging data analytics integrated into POS systems to offer personalized shopping experiences and promotions, optimizing both inventory management and customer satisfaction.

- Advanced POS Hardware: The evolution of POS hardware continues with features like integrated biometrics and enhanced durability, aiming to streamline operations and improve the customer transaction experience.

- Omnichannel Integration: POS systems are playing a crucial role in creating seamless omnichannel experiences, where physical and digital shopping environments are interconnected, offering a unified customer view across all platforms.

- AI and Machine Learning: AI integration into POS systems is growing, aiding in everything from inventory management to customer service enhancements. This trend is significant for ensuring clean, actionable data flows through retail operations.

Top Use Cases

- Enhancing Customer Experience: POS systems are increasingly used to improve customer engagement through personalized recommendations and loyalty rewards, driven by data analytics capabilities.

- Streamlining Payments: Integration of modern payment methods like BNPL (Buy Now, Pay Later), contactless, and mobile payments are becoming standard, helping attract a broader customer base and improving checkout efficiencies.

- Inventory and Supply Chain Management: Real-time inventory tracking enabled by advanced POS systems helps retailers optimize stock levels and respond quickly to supply chain demands, reducing overheads and enhancing service levels.

- Operational Efficiency: Mobile POS systems contribute to operational agility, allowing sales processing from anywhere within the store or remotely, which is particularly beneficial for small to medium-sized businesses.

- Security and Compliance: As POS systems collect sensitive customer data, enhanced security features and compliance with data protection regulations are pivotal. This includes encryption and secure data handling practices to prevent breaches.

Major Challenges

- Rising Raw Material Costs: Retailers are grappling with increased costs for raw materials, which are crucial for product manufacturing. Deciding whether to absorb these costs or pass them on to consumers presents a significant challenge, impacting profit margins and pricing strategies.

- Logistical Challenges: Effective supply chain management remains critical due to potential disruptions from geopolitical tensions, labor strikes, and other factors. These disruptions can lead to stock shortages and impact the retailer’s reputation if products are not available for consumers.

- Technological Disruptions: Retailers must continuously adapt to technological advancements to stay competitive. This involves not only investing in new technologies but also anticipating future trends to keep their operations, marketing, and sales effective.

- Cybersecurity Threats: As digital interactions increase, so does the risk of cyberattacks. Retailers, who manage large volumes of consumer data, must strengthen their cybersecurity measures to protect against financial and reputational damage.

- Omnichannel Integration Challenges: Consumers expect a seamless shopping experience across online and offline channels. Retailers face the challenge of integrating their operations across these channels to provide a unified customer experience, which is crucial for retaining customer loyalty.

Top Opportunities

- Embracing Generative AI: The adoption of artificial intelligence technologies offers significant opportunities for retailers to streamline operations, enhance productivity, and create engaging customer experiences, which can drive financial growth and long-term success.

- Enhanced Customer Experience: There is a growing trend towards personalizing the customer experience to align with changing consumer expectations. Retailers focusing on delivering exceptional and authentic customer interactions are likely to see improved brand loyalty and trust.

- Sustainability Initiatives: Consumers are increasingly aware of the environmental and ethical impacts of their purchases. Retailers who invest in sustainable practices and transparently communicate these efforts can attract a larger base of eco-conscious customers.

- Direct-to-Consumer Models: By reducing reliance on intermediaries, retailers can offer lower costs and increased transparency, gaining a competitive advantage. This shift allows retailers to build direct relationships with their customers, enhancing loyalty and trust.

- Training and Upskilling Employees: Investing in comprehensive training programs that enhance digital literacy and customer service skills can help retailers improve service quality and operational efficiency. Well-trained employees are crucial for delivering a consistent and high-quality customer experience across all touchpoints.

Recent Developments

- Diebold Nixdorf: In early 2024, Diebold Nixdorf launched its new modular POS system, BEETLE M, which offers enhanced flexibility, power, and sustainability. This is part of their ongoing efforts to integrate AI-powered solutions into retail POS systems, designed for scalability in the evolving retail environment.

- VeriFone: VeriFone has been expanding its cloud-based POS offerings, which are becoming popular due to the growing demand for efficient and mobile solutions. The company is also focusing on enhancing payment security features to meet the rising demand for secure digital transactions in retail.

- Lightspeed POS: In late 2023, Lightspeed introduced new inventory management tools within its POS system, specifically tailored to help retailers optimize stock levels across multiple locations. This launch is aligned with the company’s push towards integrating more data-driven insights into POS systems to support better decision-making.

- Toshiba Corporation: Toshiba is focusing on expanding its retail solutions portfolio through strategic partnerships with AI and cloud technology firms, helping retailers adopt more advanced POS systems. The company’s latest offerings target improved customer engagement and operational efficiency, particularly in large retail chains.

Conclusion

In conclusion, the Retail POS market demonstrates robust growth prospects, underpinned by the rapid digitalization of the retail sector and the evolving consumer demand for more efficient, secure transaction methods. As retailers increasingly turn to innovative technologies to enhance customer experiences and streamline operations, POS systems are becoming indispensable tools.

The market’s expansion is further facilitated by the advent of cloud-based solutions, which democratize access to advanced technologies for a broader spectrum of businesses, from small enterprises to large chains. This trend is expected to continue, propelled by ongoing technological advancements and the growing imperative for retailers to adopt flexible, scalable solutions that can adapt to dynamic market conditions and consumer preferences.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)