Table of Contents

Market Overview

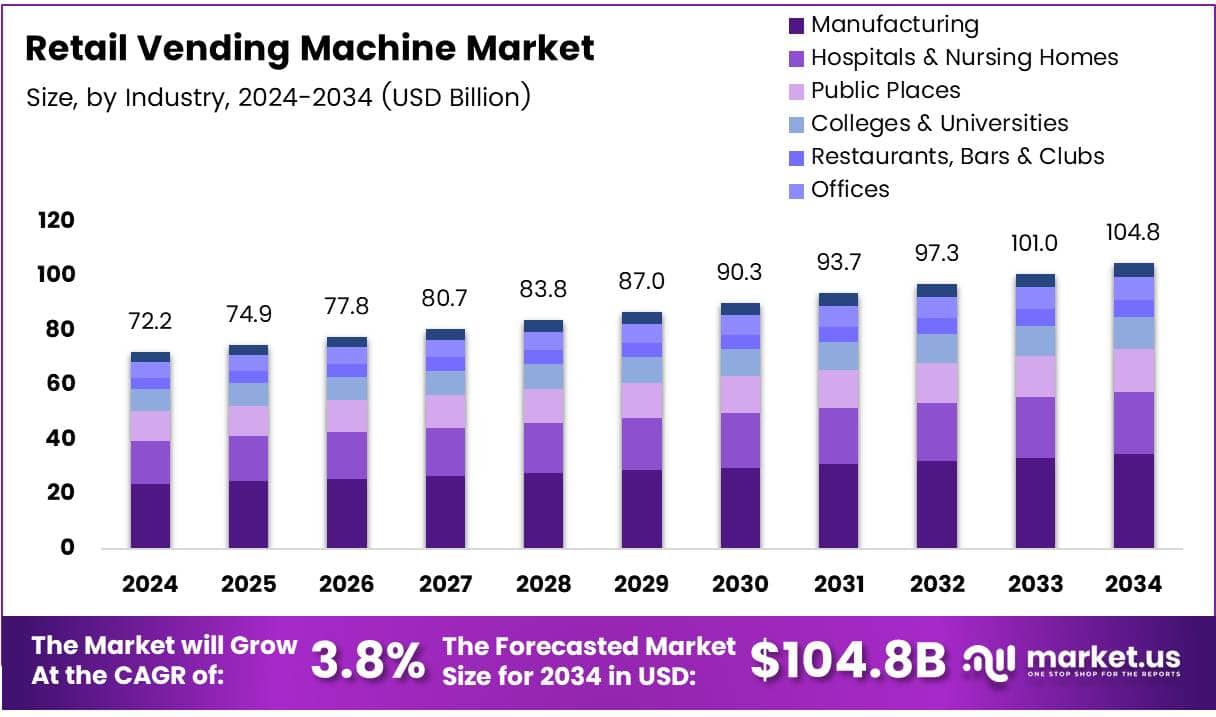

The Global Retail Vending Machine Market size is expected to be worth around USD 104.8 Billion by 2034, from USD 72.2 Billion in 2024, growing at a CAGR of 3.8% during the forecast period.

The retail vending machine market is growing fast due to rising demand for convenience. Consumers prefer 24/7 access and contactless buying options. Vending machines now outperform traditional stores with over 80% success rate. This makes them a strong player in modern retail formats.

Smart vending tech boosts this growth. Features like cashless payments and inventory tracking improve user experience. The U.S. has about 1.8 million vending machines, or 1 machine for every 23 people. This shows how deeply vending has entered daily life.

Governments support vending through smart city projects and automation funding. Regulations are tightening, especially around food safety and machine hygiene. This ensures consumer trust and long-term market stability.

New businesses in vending also see fast returns. With expert support, ROI often comes within 12 to 18 months. This attracts startups and investors looking for low-risk retail options.

The vending market offers strong growth and reliable income. It suits busy urban areas and tech-driven buyers. As trends shift toward speed and ease, vending machines will lead the future of retail.

Key Takeaways

- Global Retail Vending Machine Market size is expected to reach USD 104.8 Billion by 2034, growing at a CAGR of 3.8% from 2025 to 2034.

- Manufacturing sector held the highest share in 2024, accounting for 36.2% of the market by industry.

- Beverages, especially soft drinks, led the product vending segment with a 45.2% market share in 2024.

- Cashless payment mode dominated the payment segment with a 75.6% share in 2024, driven by mobile and contactless payment trends.

- Asia Pacific (APAC) was the largest regional market with a 57% share, valued at USD 41.1 Billion in 2024.

Market Drivers

- Convenience and Accessibility: Vending machines offer on-the-go purchasing options, which align with the fast-paced lifestyles of modern consumers. They eliminate the need for human interaction, reducing transaction time and offering 24/7 availability.

- Technological Advancements: The integration of IoT (Internet of Things), AI (Artificial Intelligence), and touchless payment technologies is making vending machines more efficient and customer-friendly. Real-time tracking of inventory and predictive maintenance are now possible, enhancing operational effectiveness.

- Changing Consumer Preferences: There is a growing preference for self-service options, particularly among younger, tech-savvy consumers. Vending machines cater to this demand by offering a wide array of products without the need for store personnel.

- Expansion of Product Offerings: Modern vending machines now sell much more than snacks and beverages. Items like electronics, cosmetics, and hygiene products are increasingly available, which expands their appeal and use cases.

- Cost-Efficiency for Businesses: For retailers, vending machines present a low-overhead business model. They require minimal space and staffing, making them ideal for deployment in high-traffic areas without the cost of running a full retail store.

Market Restraints

- High Initial Investment: Advanced vending machines equipped with AI and IoT capabilities require a significant upfront investment, which may deter small-scale businesses.

- Maintenance and Vandalism Issues: Regular maintenance is essential to ensure functionality, and machines placed in unsecured locations may be vulnerable to tampering or theft.

- Regulatory Compliance: Vending operators must comply with food safety, payment security, and other regulatory standards, which can add operational complexities.

Segmentation Insights

Industry Analysis

Manufacturing led with 36.2% share in 2024. Used for snacks, drinks in factories. Hospitals need 24/7 supply. Airports, stations see high use. Colleges install for student ease. Offices and bars prefer self-service.

Product Vending Machines Analysis

Beverages dominated with 45.2% share. Soft drinks most popular. Snacks growing in offices, schools. Electronics offer gadgets. Frozen meals, ice cream rising. Pharma machines serve public needs.

Payment Mode Analysis

Cashless led with 75.6% share. Mobile, card, QR widely used. Urban areas prefer digital. Cash slowly fading. Digital offers speed and safety.

Regional Insights

Asia Pacific

Asia Pacific leads with 57% share, valued at USD 41.1B. Growth driven by automation and rising middle class. High demand in food, electronics, and personal care sectors.

North America

Strong market due to cashless and smart tech. Focus on convenience and digital upgrades. Steady growth expected.

Europe

Stable market with good infrastructure. Demand rising for healthy and eco-friendly vending. Urban areas drive growth.

MEA

Growth seen in UAE, Saudi Arabia. Vending used in malls, airports, tourist spots. Automated retail rising.

Latin America

Small but growing market. Urbanization and new lifestyles boost demand. Vending adoption increasing.

Competitive Landscape

- Innovation: Introducing AI-powered and touchscreen-enabled machines with custom interfaces.

- Partnerships: Collaborating with product brands and payment gateway providers to enhance offerings.

- Sustainability: Developing energy-efficient models and integrating eco-friendly packaging solutions.

Trends and Future Outlook

- Increased Adoption of Contactless Technologies

- Rise of Healthy and Organic Product Offerings

- Use of AI for Personalized Marketing

- Sustainable Vending Solutions with Solar Power or Low-Energy Designs

- Integration with Mobile Apps and Loyalty Programs

Recent Developments

- In Jan 2024, InReach acquired Delaware–based K&R Vending Services, expanding its regional footprint and enhancing its service capabilities across the Mid-Atlantic region. This strategic move strengthens InReach’s presence in the corporate vending and micro-market space.

- In Oct 2024, Fas International Spa, a Vicenza-based leader in the automated retail sector, acquired 35% of Alturas Sistemi Srl. The investment aims to drive innovation and deepen Fas International’s technological integration within vending software systems.

- In May 2025, Five Star Breaktime Solutions completed the acquisition of PB&J Vending, a move designed to boost its service offerings in the Southwestern U.S. This deal supports Five Star’s aggressive growth strategy in the full-line vending and micro-market segments.

Conclusion

The retail vending machine market is rapidly evolving, driven by technological advancements and growing consumer demand for convenience and self-service solutions. With expanding product offerings, smarter machines, and increasing adoption across various sectors and regions, vending machines are becoming a vital part of modern retail. While challenges such as high initial costs and regulatory requirements persist, the market’s future remains promising, fueled by innovation and changing consumer behaviors.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)