Table of Contents

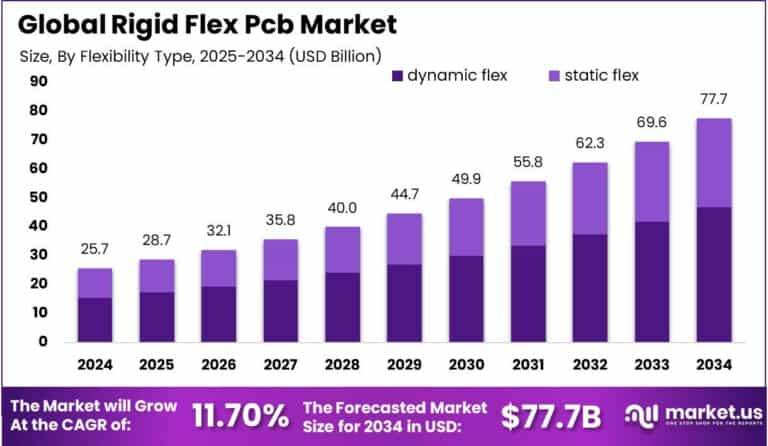

The global Rigid Flex PCB Market is expected to grow from USD 25.7 billion in 2024 to USD 77.7 billion by 2034, at a CAGR of 11.70%. In 2024, the Asia-Pacific region dominated the market, holding over 35.3% of the share, which translates to approximately USD 9 billion in revenue.

This growth is fueled by the increasing adoption of rigid flex PCBs in various sectors, particularly in automotive, consumer electronics, and telecommunications. Multi-layer flex and dynamic flex segments lead the market, with FR4 materials continuing to dominate, while China is expected to be a key growth driver with a projected CAGR of 12.4%.

How Tariffs are Impacting the Economy

Tariffs have a significant impact on the economy, particularly in industries relying on international supply chains. For sectors like rigid flex PCBs, tariffs on raw materials, such as FR4, could raise production costs, which may be passed on to consumers. This leads to inflationary pressures, reducing consumer spending power, and potentially lowering demand for electronics that use rigid flex PCBs.

Furthermore, tariffs can disrupt established supply chains, leading to delays and inefficiencies as businesses seek new suppliers or production locations. In the electronics sector, where profit margins are often thin, such cost increases can significantly affect profitability.

Retaliatory tariffs also exacerbate the situation, as global trade relations become more strained, leading to additional uncertainty in pricing and availability of key materials. Companies that rely on global suppliers for materials may face disruptions in their ability to fulfill orders, which can hinder growth and lead to further economic ripple effects.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/rigid-flex-pcb-market/free-sample/

Impact on Global Businesses

(Rising Costs & Supply Chain Shifts + Sector-Specific Impacts)

Businesses worldwide face rising production costs due to tariffs on raw materials, which directly affect sectors such as electronics, automotive, and telecommunications that rely on rigid flex PCBs. The automotive sector, which holds more than 28.7% of the market share in rigid flex PCBs, could see price hikes in electric vehicles (EVs) and smart systems due to the increased cost of essential components.

Supply chain shifts are expected as businesses explore alternate suppliers or local production facilities to mitigate tariff impacts. However, this comes with challenges such as the high cost of reconfiguring supply chains or the risk of lower-quality products.

Tariffs on materials like FR4, a key material used in rigid flex PCBs, could also disrupt production schedules and raise costs for manufacturers. Consequently, businesses may need to adapt their strategies, from negotiating with suppliers to revising pricing models for their end products.

Strategies for Businesses

To mitigate the effects of rising costs and supply chain disruptions caused by tariffs, businesses in the rigid flex PCB market should consider diversifying their supply chains and sourcing from regions with lower tariffs. Exploring local production facilities or outsourcing to lower-cost countries may help companies reduce dependency on international suppliers. Implementing automation and technology improvements in manufacturing can also help minimize labor costs and improve efficiency.

For businesses in the automotive sector, it may be beneficial to invest in alternative materials or technologies that could reduce reliance on components affected by tariffs. Companies could also explore strategic partnerships with suppliers or technology developers to reduce costs and enhance product offerings. Additionally, businesses may need to adjust pricing strategies to reflect increased costs while maintaining competitiveness, ensuring that they don’t lose market share due to rising prices.

➤ Explore more strategies get full access now @ https://market.us/purchase-report/?report_id=144006

Key Takeaways

- Tariffs increase the cost of raw materials, directly impacting the production costs for rigid flex PCBs.

- The automotive sector, reliant on rigid flex PCBs, could face higher prices for smart systems and EVs.

- Supply chain disruptions force businesses to rethink supplier relationships and sourcing strategies.

- Diversifying supply chains, localizing production, and investing in automation are key strategies to mitigate tariff impacts.

- Companies may need to adjust pricing strategies to maintain profitability while keeping products competitive.

Analyst Viewpoint

Currently, tariffs are a challenge for businesses in the rigid flex PCB market, increasing costs and disrupting global supply chains. However, companies that proactively adjust by diversifying their supply chains and leveraging automation to enhance production efficiency will be better equipped to handle these challenges.

In the long term, the market’s continued growth, especially in high-demand sectors like automotive and telecommunications, will drive demand for rigid flex PCBs, creating opportunities for businesses that innovate and adapt to shifting global trade dynamics. As the tariff situation stabilizes, companies in this sector will benefit from their resilience and flexibility.

Regional Analysis

Asia-Pacific dominated the global rigid flex PCB market in 2024, accounting for 35.3% of the market share, translating to USD 9 billion in revenue. China, with a market valuation of USD 3.62 billion in 2024, is a key growth driver, with a projected CAGR of 12.4%.

The region’s dominance is driven by the increasing demand for rigid flex PCBs in consumer electronics, automotive, and telecommunications industries. Other regions, such as North America and Europe, also show steady growth, driven by continued investments in advanced technologies, especially in the automotive and consumer electronics sectors.

➤ Discover More Trending Research

E-scooter Rental Apps Market

Power Electronic Testing Market

Machine Learning in E-commerce Market

Manga Market

Business Opportunities

The rigid flex PCB market presents significant opportunities in industries such as automotive, consumer electronics, and telecommunications. The growing demand for electric vehicles (EVs) and advanced driver-assistance systems (ADAS) presents an opportunity for companies in the automotive sector to expand their use of rigid flex PCBs.

Additionally, as consumer electronics demand continues to rise, there are opportunities for manufacturers to provide flexible and durable PCB solutions for devices like smartphones, wearables, and other portable electronics. The increasing trend of miniaturization in electronics further drives the demand for high-density PCBs, offering growth opportunities in the rigid flex PCB market.

Key Segmentation

- By Type: The multi-layer flex segment held a dominant share in 2024, with a 30.7% share, driven by the growing demand for high-density, high-performance PCBs in industries like automotive and telecommunications.

- By Material: The FR4 segment dominated with 33.4% of the market share in 2024 due to its cost-effectiveness and widespread use in rigid flex PCBs.

- By End-User Industry: The automotive segment is a leading end-user of rigid flex PCBs, accounting for over 28.7% of the market share, driven by the rise in electronic systems for vehicles.

- By Region: Asia-Pacific leads the market, with China expected to grow at a CAGR of 12.4%, making it a crucial region for future growth.

Key Player Analysis

Players in the rigid flex PCB market focus on developing high-performance, cost-effective products tailored to industries such as automotive, telecommunications, and consumer electronics. These companies are increasingly investing in R&D to develop more efficient production processes and improve product quality.

Strategic partnerships with electronics manufacturers and component suppliers help businesses in the rigid flex PCB market mitigate risks related to rising material costs and tariffs. Additionally, players are diversifying their product portfolios to cater to emerging industries, such as electric vehicles and IoT, where demand for advanced PCBs is growing rapidly.

Top Key Players in the Market

- Zhen Ding Technology Holding Limited

- Nippon Mektron, Ltd.

- Sumitomo Electric Industries, Ltd.

- Unimicron Technology Corporation

- Interflex Co., Ltd.

- Young Poong Electronics Co., Ltd.

- TTM Technologies, Inc.

- Multek (a Flex Company)

- Shengyi Technology Co., Ltd.

- AT&S Austria Technologie & Systemtechnik AG

- Meiko Electronics Co., Ltd.

- Kinwong Electronic Co., Ltd.

- Sierra Circuits, Inc.

- Eltek Ltd.

- Jabil Circuit, Inc.

- Samsung Electro-Mechanics

- Würth Elektronik GmbH & Co. KG

- Shenzhen Kinwong Electronic Co., Ltd.

- Flex PCB (Printed Circuits LLC)

- Others

Recent Developments

Recent developments in the rigid flex PCB market include advancements in materials like high-performance FR4 and multi-layer flex options, as well as increased demand from the automotive and telecommunications sectors. Companies are also focusing on expanding their production capacity to meet growing demand, especially in emerging markets like China.

Conclusion

The rigid flex PCB market is set for robust growth, driven by demand from industries such as automotive, telecommunications, and consumer electronics. While tariffs and rising material costs present challenges, businesses that innovate and adapt their supply chains will thrive. The future of the market looks promising, with continued expansion opportunities in Asia-Pacific and other emerging regions.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)