Table of Contents

Introduction

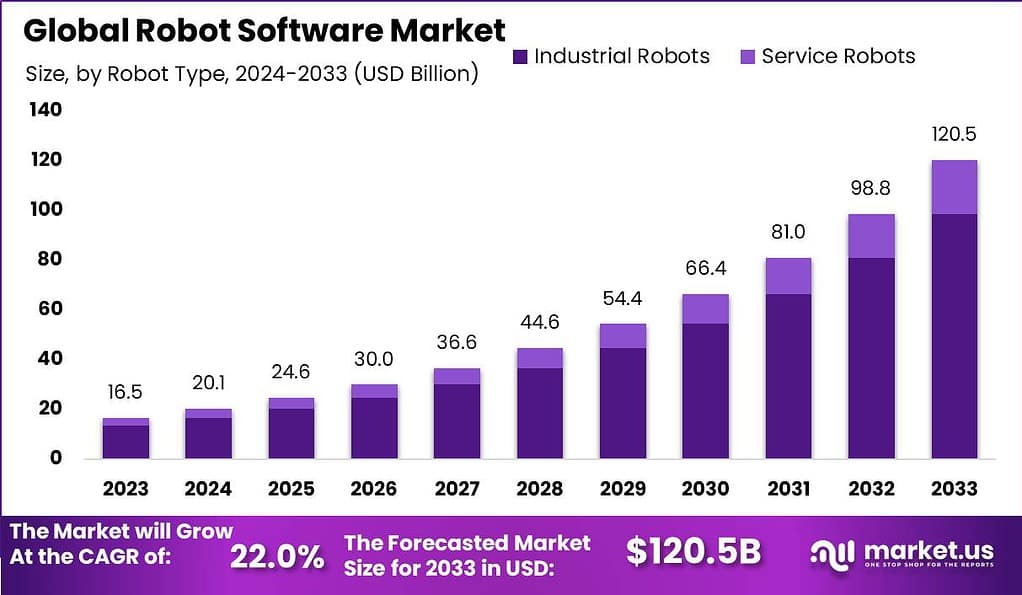

As per the Market.us report, the Global Robot Software Market is projected to grow from USD 16.5 billion in 2023 to approximately USD 120.5 billion by 2033. This growth represents a compound annual growth rate (CAGR) of 22.0% over the forecast period from 2024 to 2033.

Robot software refers to a set of coded commands or instructions that tell a mechanical device and electronic system, known together as a robot, what tasks to perform. Robot software is used to perform autonomous tasks and can be embedded systems, which are often designed to support specific tasks, or more generalized software, which is capable of managing various tasks.

The global market for robot software is undergoing significant growth, driven by the increasing adoption of robots across various sectors including manufacturing, healthcare, automotive, and defense. This market encompasses everything from simple control systems for basic robotic operations to highly complex algorithms that allow robots to perform tasks involving decision-making and learning.

Key drivers of growth in the robot software market include advancements in artificial intelligence and machine learning, increasing integration of robots in general workflow, and the ongoing trend towards automation and digitization in many industries. Challenges remain, notably in areas of security, complexity of software integration, and the initial high cost of setup. However, the potential for increased efficiency, productivity, and cost reduction continues to fuel the expansion and innovation within this market.

However, the market faces challenges such as the high cost of initial setup and the complexity involved in programming and integrating robotic systems. Additionally, concerns around data security and the safety of automated systems continue to be significant hurdles for wider adoption.

Despite these challenges, there are substantial opportunities in the robot software market. The increasing trend toward Industry 4.0 and the Internet of Things (IoT) offers potential for growth in smart manufacturing where robots can perform more coordinated and intelligent operations. There is also a growing interest in service robots for healthcare and domestic use, which could open new markets and drive further innovation in the sector.

Key Takeaways

- Data Management and Analysis Software segment took a leading role in the robot software market in 2023, holding over 36% of the market share. This type of software is essential for robots to function efficiently, enabling data-driven decision-making and predictive maintenance.

- Dominating the robot software market, the Industrial robots segment secured over 82% market share in 2023. Industries such as automotive, electronics, aerospace, and food and beverage heavily depend on these robots for enhanced automation, precision, and efficiency.

- In 2023, Large enterprises captured a significant portion of the market, with over 75% market share. These organizations typically have the financial means and the complex operational requirements that make substantial investments in robot software viable.

- The manufacturing industry was the leading sector in the robot software market in 2023, accounting for more than 78% market share. This sector utilizes robot software extensively to streamline production processes and heighten automation levels.

- The Asia-Pacific region held a predominant position in the market in 2023, with over 40% market share. The strong market presence is attributed to the region’s manufacturing hubs, investments in research and development, and a growing demand for automation.

- Major Market Players companies in the robot software market include ABB Ltd., Clearpath Robotics, NVIDIA Corporation, and CloudMinds Technology Inc. These firms are leading in innovation and driving competitive and market developments.

Robot Software Statistics

- The Global Robot Software Market is projected to grow significantly over the next decade, with a compound annual growth rate (CAGR) of 22.0%.

- In 2023, the market size is estimated at 16.5 billion USD, which is expected to increase to 20.1 billion USD in 2024, 24.6 billion USD in 2025, 30.0 billion USD in 2026, and 36.6 billion USD in 2027.

- The upward trend continues with projections of 44.6 billion USD in 2028, 54.4 billion USD in 2029, and 66.4 billion USD in 2030.

- By the beginning of the next decade, the market size is expected to reach 81.0 billion USD in 2031 and 98.8 billion USD in 2032. The forecasted market size for 2033 is a substantial 120.5 billion USD. This steady increase highlights the growing importance and integration of robot software in various sectors.

- The Motion Control Software in the robotics market size is expected to reach USD 60 billion by 2032, exhibiting an impressive CAGR of 19% between 2022 and 2032, from its current value of USD 13 billion in 2023.

- The Global Collaborative Robots Market size is expected to be worth around USD 23.5 Billion by 2033, from USD 1.5 Billion in 2023, growing at a CAGR of 31.7% during the forecast period from 2024 to 2033.

- The Smart Robots Market size is expected to be worth around USD 128.1 Billion by 2033, from USD 12.5 Billion in 2023, growing at a CAGR of 26.2% during the forecast period from 2024 to 2033.

- The Global Construction Robot Market size is expected to be worth around USD 8.0 Billion by 2033, from USD 1.4 Billion in 2023, growing at a CAGR of 19.1% during the forecast period from 2024 to 2033.

- There are currently over 3.4 million industrial robots in use worldwide.

- The global robot-to-human ratio in the manufacturing industry is 1 to 71.

- Industrial companies plan to invest 25% of their capital in industrial automation over the next five years.

- 14% of workers have lost their jobs to robots.

- According to an analysis by Deutsche Bank, Amazon’s cobots have reduced its operating expenses by 20%, and adding them to newly opened warehouses saves as much as $22 million in fulfillment costs each time.

- Robot installations hit an all-time high in 2021, with the International Federation of Robotics’ (IFR) data showing over 500,000 new industrial robots were installed that year. In North America, robot sales hit an all-time high for the second year in a row in 2022, according to the Associate for Advancing Automation (A3), bringing in $2.38 billion.

Emerging Trends in Robot Software

- AI and Machine Learning Integration: There’s a significant trend toward integrating AI and machine learning technologies into robot software. This integration enhances the capabilities of robots, allowing them to perform more complex tasks with greater efficiency and adaptability.

- Robotic Cybersecurity: As robots become more prevalent across various sectors, the need for robust cybersecurity measures to protect these systems from hacking and unauthorized access has become critical. This reflects a growing focus on developing advanced robotic cybersecurity solutions.

- Autonomous Mobile Robots (AMRs): The deployment of AMRs is on the rise, particularly in industries like logistics, manufacturing, and healthcare. These robots are designed to operate autonomously in dynamic environments, which greatly enhances efficiency and safety.

- Robotics as a Service (RaaS): This business model is gaining traction, offering robotics solutions on a subscription basis. RaaS allows companies to utilize advanced robotics technology without the heavy upfront investment typically associated with these systems.

- Advanced Simulation and Virtual Testing: The development and deployment of robots are increasingly supported by sophisticated simulation technologies that create realistic scenarios for robots to learn and adapt. This trend is facilitated by advances in cloud computing and GPU technologies, enabling virtual testing on a massive scale.

Top Use Cases for Robot Software

- Manufacturing Automation: Robot software is extensively used to automate various manufacturing processes, including assembly, painting, and inspection. This improves production efficiency and reduces the need for human labor in potentially hazardous environments.

- Healthcare Robotics: In healthcare, robots equipped with advanced software are used for tasks such as surgery, rehabilitation, and handling sensitive materials. This not only improves precision in medical procedures but also enhances patient care by reducing human error.

- Supply Chain and Logistics: Autonomous robots are increasingly used in warehouses for picking, packing, and sorting. This automation helps manage large volumes of goods with high efficiency and accuracy, optimizing the supply chain.

- Service Robots in Hospitality and Retail: Robots are being deployed in customer service roles in hotels and retail stores, where they can assist customers, manage inventory, and even handle check-ins and check-outs autonomously.

- Agricultural Robots: In the agriculture sector, robots are used for planting, harvesting, and monitoring crops. This use of robotic technology helps increase yield and efficiency while reducing the physical strain on farmers and minimizing the need for manual labor.

Major Challenges

- Integration Complexity: Integrating advanced robotic systems into existing infrastructures can be complex and costly. Companies often face challenges related to software compatibility, system configuration, and the seamless integration of new robotic capabilities with legacy systems.

- Cybersecurity Risks: As robots become more connected and autonomous, they also become more vulnerable to cyber-attacks. Ensuring the security of robotic systems and the data they handle is a significant challenge, requiring continuous advancements in cybersecurity measures.

- High Initial Investment: The upfront cost for robotic systems, including sophisticated software, can be prohibitively expensive for small to medium-sized enterprises. This financial barrier can slow down the adoption rate of advanced robotic technologies.

- Technical Skill Shortage: There is a shortage of skilled professionals who can design, program, and maintain advanced robotic systems. This gap can hinder the deployment of robotic solutions and slow down technological advancements in the field.

- Regulatory and Ethical Issues: The increasing use of robots raises various regulatory and ethical questions, particularly around privacy, safety, and the socio-economic impact of automation. Navigating these issues can be challenging for companies looking to expand their use of robotic technologies.

Market Opportunities

- Expansion into Emerging Markets: Developing countries present significant opportunities for the deployment of robotic solutions, especially in industries such as agriculture, healthcare, and manufacturing, where labor shortages are prevalent.

- Healthcare Applications: The ongoing technological advancements in robot software are opening up numerous opportunities in healthcare, including surgical assistance, patient care, and pharmacy automation, which can greatly enhance the efficiency and quality of care.

- Collaborative Robots (Cobots): Cobots designed to work alongside humans in a shared workspace are gaining popularity. They offer opportunities for automation in sectors where safety and human interaction are paramount, such as in personal care or light manufacturing.

- Robotics as a Service (RaaS): Offering robotics solutions via a subscription model can make advanced technology accessible to a broader range of businesses, creating a vast market for companies that can provide these services .

- Advanced Analytics and AI: Leveraging AI and analytics to enhance the capabilities of robots, such as predictive maintenance and optimized performance, presents a lucrative opportunity for software developers and system integrators.

Recent Developments

Partnerships, Collaborations, and Agreements

- ABB and METTLER TOLEDO: In February 2024, ABB Robotics and METTLER TOLEDO signed a Memorandum of Understanding (MOU) to integrate ABB’s robots with METTLER TOLEDO’s LabX™ management software. This collaboration aims to enhance automated laboratory workflows across various industries, improving productivity and data management while addressing labor shortages.

- ABB and Siemens: In May 2024, ABB expanded its electrification portfolio by acquiring Siemens’ Wiring Accessories business in China, which includes elements of software integration for advanced automation solutions .

Product Launches and Expansions

- ABB Robotics Facility in the US: In March 2024, ABB opened a refitted robotics headquarters and manufacturing facility in Auburn Hills, Michigan. This expansion supports the development and manufacturing of AI-enabled robotic solutions tailored to the US market, focusing on industries such as packaging, logistics, food and beverage, and automotive electric vehicle production.

- Alphabet’s Intrinsic Launch: In May 2023, Alphabet introduced “Flowstate,” a web-based developer environment aimed at helping non-experts build robotic systems. This product facilitates the creation and simulation of robotic workflows, making advanced robotics more accessible.

Acquisitions and Mergers

- ABB and Sevensense: In January 2024, ABB acquired Sevensense, a company specializing in AI-enabled 3D vision navigation technology for autonomous mobile robots (AMRs). This acquisition will integrate Sevensense’s technology into ABB’s AMR portfolio, enhancing speed, accuracy, and operational flexibility.

- Clearpath Robotics by Rockwell Automation: In November 2023, Rockwell Automation completed the acquisition of Clearpath Robotics, including its industrial division OTTO Motors. This acquisition enhances Rockwell’s autonomous material handling capabilities and aims to optimize production logistics across manufacturing plants.

Conclusion

The robot software market is rapidly evolving, driven by technological advancements and increasing demand across various sectors. While the market faces challenges such as integration complexity and cybersecurity risks, these are counterbalanced by significant opportunities, including expanding into emerging markets and the burgeoning field of collaborative robots. As companies continue to navigate regulatory landscapes and bridge skill gaps, the potential for growth and innovation in robot software remains substantial. Embracing these opportunities will be key to leveraging the full potential of robotics in transforming industries and enhancing human capabilities.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)