Table of Contents

Report Overview

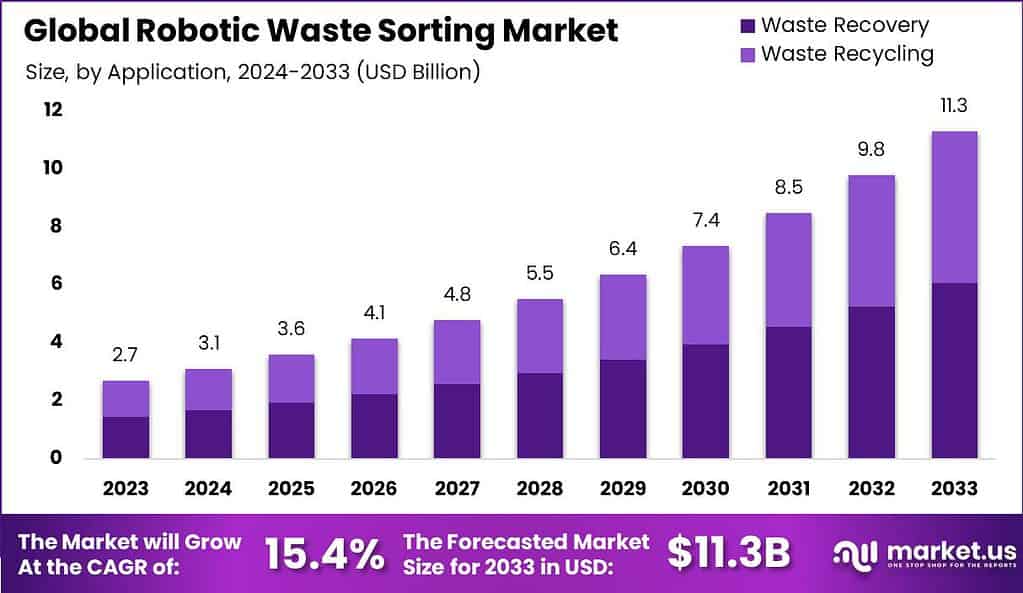

The global robotic waste sorting market is anticipated to grow significantly, increasing from approximately USD 2.7 billion in 2023 to nearly USD 11.3 billion by 2033, registering a strong CAGR of about 15.4% during the forecast period from 2024 to 2033. This growth is being driven by rising environmental concerns, stricter regulations on waste management, and the demand for automated, efficient recycling processes that reduce human intervention and improve material recovery rates.

In 2023, Europe led the market, capturing more than 32.5% of the global share with revenue around USD 0.8 billion. The region’s dominance can be attributed to its advanced waste management policies, high adoption of sustainable technologies, and strong focus on circular economy initiatives that encourage investments in robotic sorting systems.

Key Takeaways

- In 2023, the global robotic waste sorting market was valued at approximately USD 2.7 billion and is projected to reach about USD 11.3 billion by 2033, growing at a CAGR of 15.40%. The market is showing steady expansion due to rising automation needs in waste management.

- The plastic products sorting segment led the market in 2023, holding over 43.5% share. This reflects increasing focus on plastic recovery to address environmental concerns.

- The waste recovery segment also dominated, accounting for more than 53.6% of the market. Growing emphasis on resource recovery and circular economy practices is driving demand here.

- Among end users, the municipal segment secured the largest share of around 48.5%, indicating high adoption by public waste management authorities.

- Europe led the global market in 2023 with a share of 32.5%, generating approximately USD 0.8 billion in revenue, supported by stringent recycling regulations and sustainability goals.

Emerging Trend Analysis

An important emerging trend in the robotic waste sorting market is the integration of artificial intelligence with advanced vision and sensor systems. Recent developments include the use of hyperspectral imaging and deep learning models capable of distinguishing complex materials such as multilayer plastics and textiles on fast-moving conveyor belts with high precision. Multi-sensor fusion combining near-infrared, optical, and AI-driven analytics is becoming more common, making sorting more efficient and accurate.

This trend is enabling a clear shift from manual and semi-automated sorting lines to fully automated material recovery facilities. Municipal and industrial waste operators are increasingly adopting these systems to improve recovery rates, lower contamination, and comply with strict recycling regulations. The result is a steady rise in installations of retrofitted and integrated robotic systems, indicating a strong market transition toward technology-driven operations.

Driver Analysis

The growth of this market is primarily driven by the increasing volume of waste combined with tightening environmental regulations. Rising urban populations and expanding industrial activity have put significant strain on waste management systems, making manual processes insufficient. Regulations mandating higher recycling rates and reduced landfill usage are encouraging operators to invest in advanced robotic solutions that deliver consistent, high-quality sorting.

Another strong driver is the need to address labor shortages and improve operational efficiency in waste facilities. Robotic systems can operate continuously, achieve higher pick rates, and maintain consistent performance without the risks associated with manual labor. These advantages help reduce operating costs and improve material recovery economics, which strengthens the case for investment in robotic sorting solutions.

Restraint Analysis

A significant restraint in the robotic waste sorting market is the high initial capital expenditure required for equipment and system integration. Smaller operators in particular face difficulties in justifying the upfront investment compared to conventional methods. In markets with limited financial resources or where material value recovery is lower, the return on investment may not be immediately attractive.

Technical barriers also persist, including the need for reliable connectivity and robust cybersecurity. As these robotic systems become more connected through industrial internet-of-things platforms, they become vulnerable to cyber threats. Mitigating these risks adds additional costs and complexity, which can slow adoption and raise concerns among potential users.

Opportunity Analysis

There is a growing opportunity in offering robotic waste sorting as a service through subscription-based models. By shifting from capital investment to operational expenditure, robotics-as-a-service and leasing models lower the financial barrier for adoption. This model enables smaller and mid-sized operators to deploy advanced solutions without bearing the full upfront cost, expanding the potential market.

Additional opportunities are emerging in specialized waste streams such as electronic waste and textiles. Recent advancements in data augmentation and AI training methods are making it feasible to identify and sort niche materials more effectively. These technological improvements open new verticals for robotic sorting and allow companies to diversify their applications beyond conventional municipal waste.

Challenge Analysis

One of the main challenges in scaling robotic waste sorting solutions is the lack of industry-wide standards and interoperability between systems from different vendors. Without standardized protocols, integrating multiple robotic units into existing infrastructure or across various facilities can become complicated and costly. This limitation hinders seamless scaling of operations.

Another significant challenge lies in overcoming cultural and organizational resistance. Concerns about workforce displacement and skepticism toward robotic technologies often lead to hesitance in adoption. Addressing these concerns through employee retraining, education, and clear communication of benefits is critical to fostering acceptance and ensuring successful implementation.

Key Market Segments

By Sorting Type

- Plastic Products Sorting

- Metallic Waste Sorting

- Wood and Bricks Sorting

- Others

By Application

- Waste Recovery

- Waste Recycling

By End-users

- Muncipal

- Industrial

- Others

Top Key Players in the Market

- General Kinematics Corporation

- AMP Robotics Corp.

- ABB Ltd.

- Clean Robotics

- Bollegraaf Recycling Machinery

- Greyparrot

- Zen Robotics Oy

- Tomra

- Machinex Industries Inc.

- Waste Robotics Inc.

- Other Key Players

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 2.7 Bn |

| Forecast Revenue (2033) | USD 11.3 Bn |

| CAGR (2024-2033) | 15.4% |

| Base Year for Estimation | 2023 |

| Historic Period | 2019-2022 |

| Forecast Period | 2024-2033 |

| Report Coverage | Revenue Forecast, Market Dynamics, COVID-19 Impact, Competitive Landscape, Recent Developments |

| Segments Covered | By Sorting Type (Plastic Products Sorting, Metallic Waste Sorting, Wood and Bricks Sorting, Others), By Application (Waste Recovery, Waste Recycling), By End-users (Muncipal, Industrial, Others) |

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)