Table of Contents

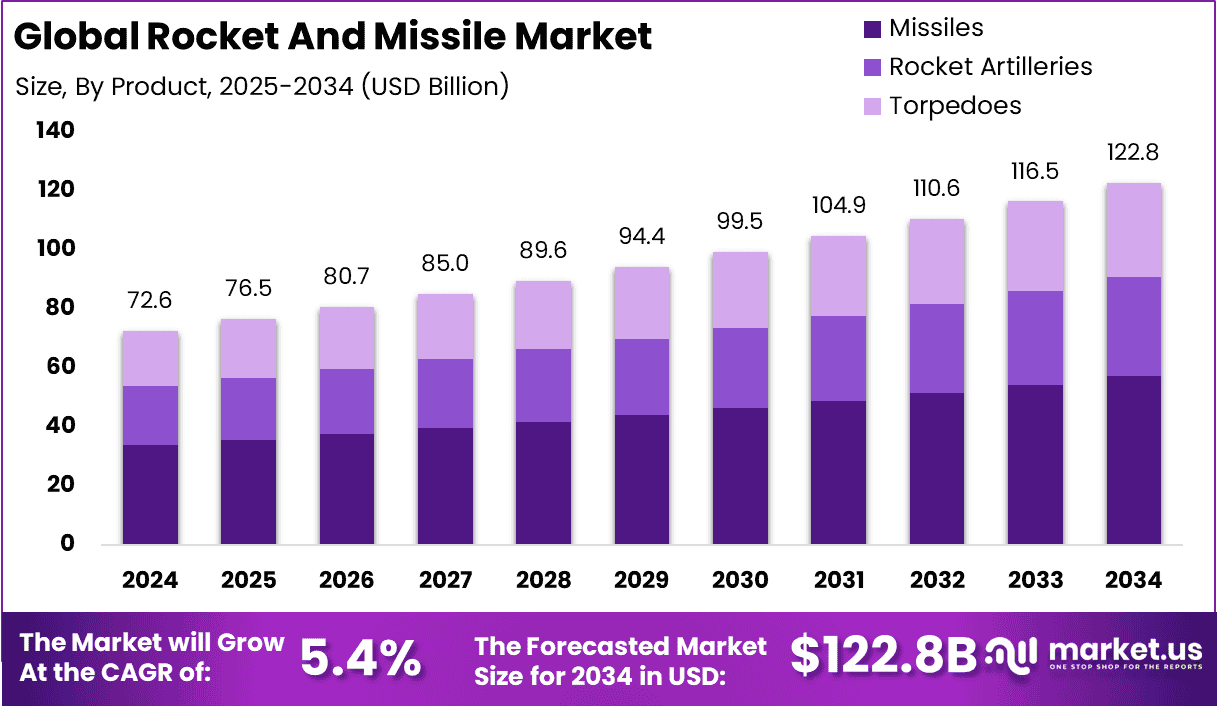

The global Rocket and Missile market was valued at USD 72.6 billion in 2024 and is projected to reach USD 122.8 billion by 2034, growing at a CAGR of 5.4% during 2025–2034. North America dominates the market with a 36.4% share, generating approximately USD 26.42 billion in revenue in 2024. Growth is driven by increasing defense budgets, geopolitical tensions, and technological advancements in missile guidance and propulsion systems. Rising demand for advanced defense mechanisms and strategic military capabilities continues to propel investments worldwide.

How Tariffs Are Impacting the Economy

Tariffs imposed on imported aerospace components and raw materials have increased costs for rocket and missile manufacturers, particularly in the U.S. and allied countries. As of 2024, tariffs on metals like titanium and aluminum—critical for missile airframes—have elevated production expenses by 7-12%. These cost hikes can delay procurement and deployment of defense systems.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/rocket-and-missile-market/free-sample/

Additionally, retaliatory tariffs from trade partners complicate the supply of high-tech components, affecting international collaborations and joint ventures. Increased tariffs reduce profit margins for defense contractors and elevate the cost burden on governments, potentially limiting defense modernization programs. Although tariffs aim to protect domestic industries, they inadvertently strain global defense supply chains, delaying innovation and raising prices for end users.

Impact on Global Businesses

Rising Costs & Supply Chain Shifts: Increased tariffs on aerospace-grade metals and electronic components have compelled companies to diversify sourcing from tariff-affected countries like China to lower-tariff regions such as Southeast Asia and Eastern Europe. This transition involves reengineering supply chains, which can increase lead times and operational costs.

Sector-Specific Impacts:

- Guidance Systems: Dependence on imported microelectronics faces cost pressure.

- Propulsion Technology: Tariffs on specialized fuels and alloys impact manufacturing.

- Defense Contracts: Higher production costs may lead to scaled-back government orders.

- Export Controls: Tariff-related trade restrictions disrupt international sales and joint projects.

Strategies for Businesses

To navigate tariff challenges, businesses are focusing on:

- Supplier Diversification to reduce exposure to high-tariff regions.

- Investment in Domestic Manufacturing for critical components.

- R&D in Alternative Materials to reduce reliance on costly imports.

- Strategic Stockpiling to mitigate supply chain disruptions.

- Enhanced Digital Supply Chain Management for agility and cost control.

These strategies support resilience, reduce vulnerability to tariff fluctuations, and ensure steady delivery of defense solutions.

Key Takeaways

- Rocket and missile market projected to reach USD 122.8 billion by 2034 at 5.4% CAGR.

- North America leads with a 36.4% market share in 2024.

- Tariffs increase costs on metals and electronic components, affecting production timelines.

- Supply chain diversification and domestic sourcing are critical mitigation strategies.

- Innovation in materials and digital supply management essential for future growth.

➤ Get full access now @ https://market.us/purchase-report/?report_id=148409

Analyst Viewpoint

Currently, the rocket and missile market faces moderate cost pressures due to tariffs and geopolitical shifts. However, the overall outlook remains optimistic as governments continue to prioritize defense modernization. Analysts expect that increased investment in domestic manufacturing and innovative technologies like hypersonics and AI-guided systems will drive market growth. The focus on resilient supply chains and international collaboration will further sustain momentum, positioning the industry for steady expansion through 2034.

Regional Analysis

North America dominates the rocket and missile market, driven by strong defense budgets and advanced aerospace technology infrastructure. Europe is focused on modernizing its missile systems amid rising security concerns. The Asia-Pacific region is emerging rapidly, propelled by increased military spending in China, India, and Southeast Asia. Latin America and the Middle East are expanding missile capabilities in response to regional threats. Investments in localized production and R&D are accelerating market penetration in these regions.

➤ Discover More Trending Research

- AMHS for Semiconductor Market

- Digital Advertising Agencies Market

- Zero Trust Security Models in ERP Market

- Voice-Activated Apps Market

Business Opportunities

Opportunities abound in the development of hypersonic missiles, unmanned aerial vehicle (UAV) payloads, and next-gen propulsion systems. Rising defense budgets, particularly in emerging economies, open prospects for export and joint ventures. Digital transformation in supply chain and manufacturing processes offers efficiencies and cost savings. Additionally, the growing demand for missile defense systems and cyber-physical integration creates niches for innovative startups and technology providers focused on software, sensors, and AI-driven targeting.

Key Segmentation

The global rocket and missile market can be segmented by:

- Type: Ballistic Missiles, Cruise Missiles, Air-to-Air Missiles, Surface-to-Air Missiles, Anti-Ship Missiles

- Range: Short Range, Medium Range, Long Range

- Propulsion: Solid Propellant, Liquid Propellant, Hybrid Propellant

- End-User: Military, Homeland Security, Defense Contractors

- Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa

This segmentation supports focused development and marketing strategies across product lines and geographies.

Key Player Analysis

Market leaders emphasize technological innovation, precision guidance, and propulsion advancements to maintain competitive advantages. They invest heavily in R&D for hypersonic and AI-enabled missile systems, secure strategic partnerships with governments, and expand manufacturing capabilities globally. These players also focus on compliance with export controls and dual-use regulations while optimizing cost structures through supply chain digitization and automation.

Recent Developments

Recent advancements include the launch of next-generation hypersonic missile prototypes, integration of AI for target acquisition, and deployment of advanced missile defense systems. Additionally, increased investment in satellite-guided navigation and propulsion technology is driving market innovation.

Conclusion

The global rocket and missile market is poised for steady growth amid rising defense spending and technological progress. While tariffs present challenges, strategic supply chain management and innovation will enable businesses to capitalize on emerging defense needs worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)