Table of Contents

Introduction

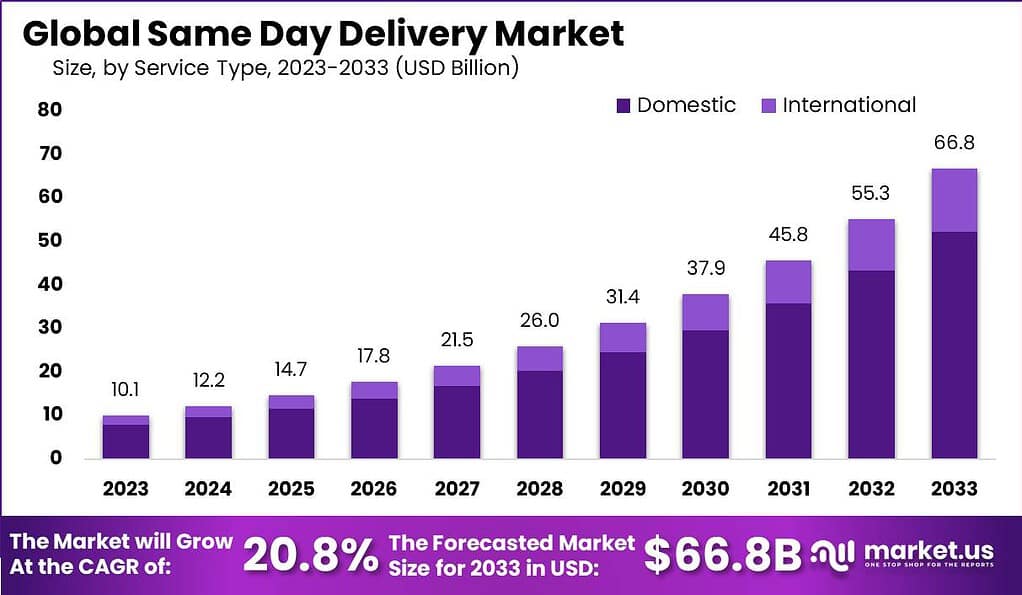

According to Market.us, The Same Day Delivery Market is forecasted to grow significantly, expanding from USD 10.1 Billion in 2023 to a staggering USD 66.8 Billion by 2033, at an impressive CAGR of 20.8% during the forecast period.

Same day delivery services have become a crucial element in the modern logistics and e-commerce sectors, catering to the growing demand for immediate delivery of goods. This service allows customers to receive their purchases within the same day of ordering, offering a significant convenience and enhancing customer satisfaction. The growth of same day delivery can be attributed to several factors, including advancements in technology, increased internet penetration, and the rising expectations of consumers for quicker delivery times. Businesses are increasingly adopting this model to stay competitive, leveraging sophisticated logistics networks and technology to ensure timely deliveries.

However, the implementation of same day delivery services also presents several challenges. These include the need for efficient logistics management, the requirement for a robust technological infrastructure to track and manage orders in real time, and the potential for increased costs associated with faster delivery options. Additionally, the environmental impact of increased deliveries and the pressure it places on couriers to meet tight deadlines are significant concerns. Despite these challenges, the demand for same day delivery services continues to grow, driven by the convenience it offers to consumers and the competitive advantage it provides to businesses in a rapidly evolving market landscape.

To learn more about this report – request a sample report PDF

Key Takeaways

- The Same Day Delivery Market is forecasted to grow significantly, expanding from USD 10.1 Billion in 2023 to a staggering USD 66.8 Billion by 2033, at an impressive CAGR of 20.8% during the forecast period.

- In 2023, the Domestic Segment held a commanding market position, capturing over 78.3% share. This dominance is fueled by increasing consumer demands for swift and efficient delivery services within their respective countries.

- The Retail Segment led the market in 2023, accounting for more than 27.2% share. This underscores the importance of immediacy in product delivery as a critical competitive edge in the rapidly transforming retail landscape.

- The Business to Consumer (B2C) Segment dominated in 2023, securing over 63.1% share. This highlights the growing preference for fast, doorstep deliveries, driven by the surge in online retail and e-commerce activities.

- North America emerged as a powerhouse in 2023, commanding an impressive 31.5% market share. The region’s advanced logistical network and consumer demand for immediate delivery contribute significantly to its market dominance.

- Major players like DHL, FedEx Corporation, and United Parcel Service control a significant portion of the market. Venture capital investments in same-day delivery startups nearly doubled in 2021, reflecting investor confidence in the sector’s growth potential.

Elevate Your Business Strategy! Purchase the Report for Market-Driven Insights!

Same Day Delivery Statistics

- By 2024, it’s estimated that over 60% of online shoppers will expect same-day delivery as a standard option.

- The adoption of same-day delivery services among e-commerce retailers is projected to increase by 45% between 2022 and 2024.

- Approximately 55% of retail businesses plan to offer same-day delivery for at least a portion of their product range by the end of 2024.

- It’s anticipated that by 2024, over 65% of same-day delivery providers will utilize artificial intelligence (AI) and machine learning (ML) for route optimization and demand forecasting.

- The use of crowdsourced delivery networks for same-day deliveries is expected to grow by 40% between 2022 and 2024.

- By 2024, over 60% of same-day delivery operations are projected to involve the use of autonomous vehicles or drones for last-mile delivery.

- Approximately 50% of retailers plan to integrate their same-day delivery services with in-store pickup options by the end of 2024.

- It’s estimated that by 2024, over 70% of same-day delivery providers will offer real-time tracking and visibility for customers.

- The adoption of micro-fulfillment centers and dark stores for same-day delivery is projected to increase by 35% among e-commerce retailers between 2022 and 2024.

- By 2024, over 55% of same-day delivery operations are expected to involve the use of electric vehicles or alternative fuel sources.

- Approximately 45% of retailers plan to offer same-day delivery for perishable and time-sensitive products by the end of 2024.

- It’s anticipated that by 2024, over 65% of same-day delivery providers will offer customizable delivery time slots and scheduling options.

- The use of locker systems and automated pickup points for same-day deliveries is expected to grow by 30% between 2022 and 2024.

- By 2024, over 60% of same-day delivery operations are projected to involve the use of advanced data analytics and predictive modeling.

- Approximately 40% of retailers plan to offer subscription-based same-day delivery services by the end of 2024.

- It’s estimated that by 2024, over 70% of same-day delivery providers will offer seamless integration with online ordering platforms and mobile apps.

- The adoption of sustainable packaging and eco-friendly delivery options for same-day services is projected to increase by 25% between 2022 and 2024.

Emerging Trends

- Rapid Adoption of Generative AI: The logistics market is increasingly incorporating generative AI to enhance operations, optimize routes, and forecast supply chain disruptions. This trend is facilitating more efficient and adaptive delivery systems.

- Quick Commerce: With rising consumer expectations for immediate gratification, e-commerce is shifting towards faster delivery models, facilitated by networks of micro fulfillment centers.

- Sustainable Delivery: A growing consumer preference for environmentally friendly delivery options is pushing companies to adopt more sustainable practices, such as using reusable packaging and reducing carbon footprints.

- Contactless Delivery: The pandemic has accelerated the adoption of contactless delivery methods, with nearly 40% of U.S. consumers preferring this option due to safety concerns.

Use Cases

- Efficiency in Operations: AI and advanced analytics are being used to predict delivery routes and manage inventory, saving millions in logistics costs.

- Gig Economy and Crowdsourcing: Leveraging the gig economy for last-mile deliveries optimizes routes and reduces emissions, though it presents challenges in tracking and accountability.

- Alternative Pickup and Delivery Options: Services like PUDO (Pick Up Drop Off) points and smart lockers are becoming more popular to avoid missed deliveries and streamline the process.

- Outsourcing Delivery Services: Many brands and retailers are outsourcing their delivery needs to specialized companies to improve efficiency and focus on core business operations.

Major Challenges

- Complex Logistics: Real-time product visibility, short fulfillment lead times, and flexible last-mile delivery remain significant hurdles while maintaining cost-efficiency.

- Building an Extensive Distribution Network: For same-day delivery to work at scale, a comprehensive, standardized distribution network close to densely populated areas is essential, yet challenging to establish.

- High Costs: The investment required to create a same-day delivery network is substantial, with costs often being passed to consumers, who are generally unwilling to pay high shipping fees.

- Technological Adaptation: Keeping up with the rapid pace of technological advancements, such as autonomous delivery vehicles and drones, requires ongoing investment and adaptation.

Market Opportunity

- Micro Fulfillment Centers: Investing in micro fulfillment centers near customers to reduce delivery times and costs, enhancing e-commerce and store fulfillment options.

- Subscription Services Growth: Capitalizing on the rising trend of subscription services, which offers predictable fulfillment dates and encourages bundling to reduce shipping costs.

- Autonomous Delivery: Planning for the future integration of autonomous delivery methods, which promises to lower costs and improve reliability once they become more widely adopted.

- Outsourcing Last-Mile Delivery: Partnering with third-party logistics providers can offer a cost-effective solution for e-commerce retailers without the infrastructure for in-house delivery, leveraging their expertise and technology.

Recent Developments

- In 2023, Naturepro partnered with ZFW Dark Stores in June to launch same-day deliveries across India.

- In 2023, Delhivery announced guaranteed same-day delivery services in 15 Indian cities in June.

- In 2023, Amazon launched same-day delivery services from selected retail stores for Prime members in some US metro areas in August, with plans for further expansion.

- In 2023, Shadowfax Technologies launched Shadowfax Express in November, offering same-day delivery for D2C brands in all Indian metro cities.

Top Company Profiles Analysis

Certainly, focusing on the Same Day Delivery market, here’s a brief overview of each company listed:

- DHL: A division of the German logistics company Deutsche Post DHL, DHL is a global leader in express and logistics, offering same-day delivery services for time-sensitive parcels and documents across the world.

- FedEx Corporation: An American multinational delivery services company headquartered in Memphis, Tennessee, FedEx offers a comprehensive suite of shipping services, including same-day delivery options, catering to both business and individual shipping needs.

- United Parcel Service (UPS): Based in the United States, UPS is a global package delivery and supply chain management company. It provides a variety of expedited shipping options, including same-day delivery services for urgent packages.

- Amazon.com, Inc.: As a leading online retailer and technology company, Amazon offers same-day delivery for a wide range of products to its Prime members in select areas, leveraging its vast logistics network.

- TNT Express: Now a part of FedEx, TNT Express is a Dutch courier and delivery services company. It specializes in express delivery and freight services, including same-day delivery solutions for urgent shipments.

- Aramex: Headquartered in Dubai, United Arab Emirates, Aramex is a global courier, and logistics services provider, offering innovative same-day and next-day delivery services within specific markets.

- Maplebear Inc. (operating as Instacart): An American company offering grocery delivery and pick-up service via its website and mobile app. Instacart provides same-day delivery from local supermarkets, enabling customers to shop online from home.

- Uber Technologies, Inc.: Primarily known for its ride-sharing service, Uber has expanded into the delivery market with Uber Eats and Uber Direct, offering same-day delivery options for food and parcels in many urban areas.

- Stuart Delivery: A London-based, on-demand logistics and delivery company that specializes in high-speed, same-day delivery services for businesses and retailers, utilizing a network of freelance couriers.

- Roadie Inc.: A delivery platform that connects people with items to send with drivers already heading in that direction, offering a personalized same-day delivery service for a wide range of goods.

- GetSwift Technologies Ltd.: An Australian technology company offering a cloud-based logistics and delivery management software designed to streamline operations for businesses requiring same-day delivery services.

- PostNord AB: A Swedish postal service company, formed from the merger of Posten AB and Post Danmark, providing a range of postal and logistics services, including same-day deliveries in specific Nordic regions.

Conclusion

In conclusion, the same day delivery sector represents a dynamic and increasingly essential aspect of the global e-commerce and logistics industry. While it brings significant benefits in terms of customer satisfaction and competitive edge, it also requires careful navigation of logistical, technological, and environmental challenges. As businesses strive to meet the high expectations of consumers for rapid delivery, the adoption of innovative solutions and sustainable practices will be crucial. The future of same day delivery looks promising, with potential for continued growth and evolution, offering both opportunities and challenges for businesses aiming to capitalize on this trend. Ultimately, the ability to efficiently manage same day delivery services will play a pivotal role in shaping the success of e-commerce entities and in satisfying consumer demands in the fast-paced digital age.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)