Table of Contents

Introduction

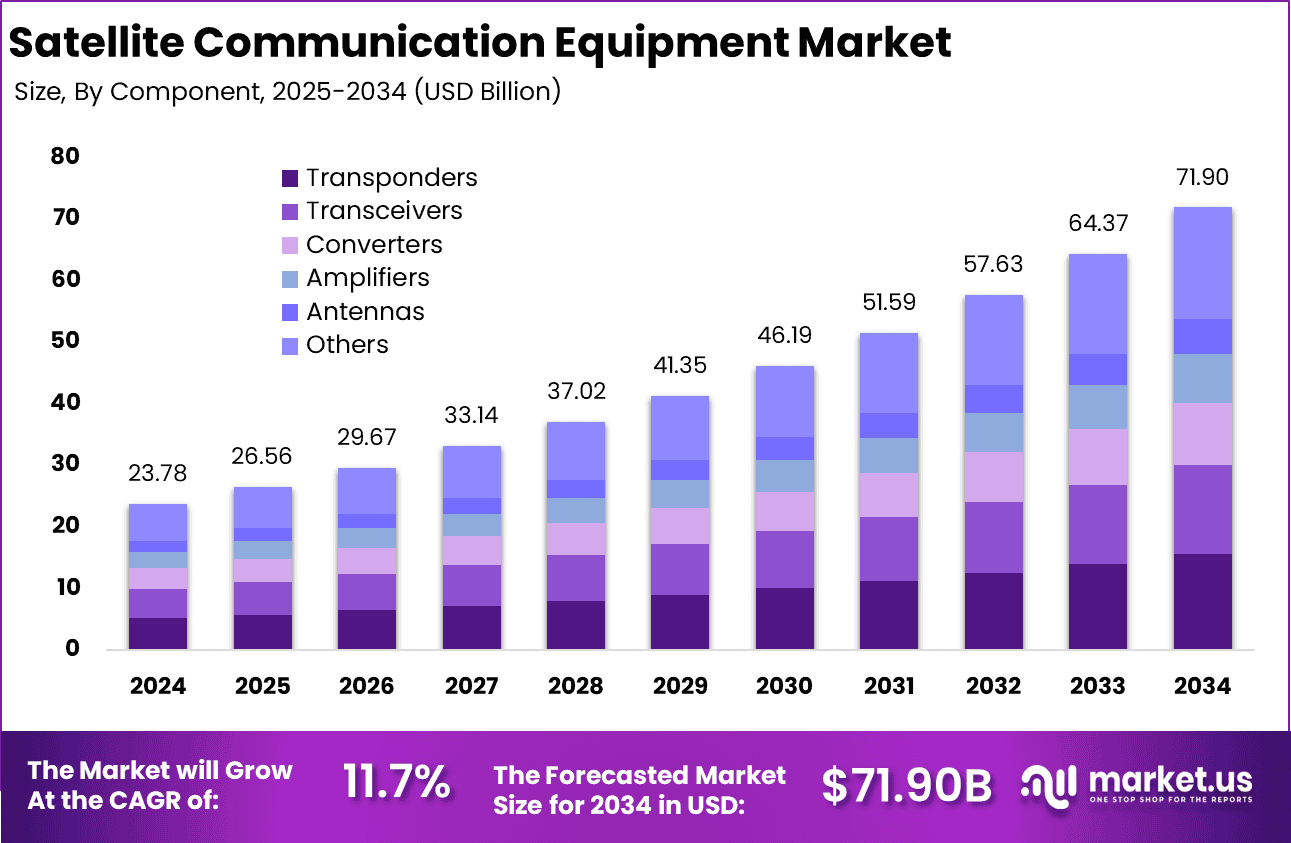

The Global Satellite Communication Equipment Market is expected to grow from USD 23.78 billion in 2024 to USD 71.90 billion by 2034, expanding at a CAGR of 11.7% over the forecast period (2025–2034). In 2024, North America dominated with a 41.8% revenue share, valued at USD 9.94 billion. This growth is driven by rising demand for uninterrupted communication in defense, maritime, aviation, and disaster recovery applications. Increased deployment of low-earth orbit (LEO) satellites, advancements in antenna technology, and integration with 5G are further accelerating equipment adoption.

How Growth is Impacting the Economy

The expansion of satellite communication equipment is positively influencing global economic development. It supports digital inclusion by extending broadband coverage to rural and remote areas. Governments are investing in satellite constellations to enhance national security, weather forecasting, and navigation. The commercial sector benefits from the rise of satellite-based Internet of Things (IoT) applications, particularly in agriculture, logistics, and mining.

This stimulates job creation across manufacturing, launch services, satellite operations, and maintenance. Additionally, satellite communication underpins disaster resilience and emergency response networks, indirectly reducing economic disruptions during crises. The sector also attracts private investment and partnerships, contributing to innovation-driven GDP growth across developed and developing economies.

➤ Unlock growth! Get your sample now! – https://market.us/report/satellite-communication-equipment-market/free-sample/

Impact on Global Businesses

The market’s growth is causing shifts in supply chains and cost structures for businesses. Rising demand for high-throughput satellites and phased-array antennas increases pressure on component suppliers, particularly in semiconductors and RF systems. The defense and aerospace sectors experience elevated procurement costs and lead times. Telecommunications firms are diversifying their infrastructure by incorporating satellite links for backhaul and redundancy. In the maritime and aviation industries, real-time tracking and connectivity have become mandatory, pushing operators to upgrade onboard systems. Moreover, media companies rely on satellites for uninterrupted broadcasting, especially in emerging markets with limited terrestrial coverage.

Strategies for Businesses

Businesses are focusing on vertical integration to manage supply chains more effectively—satellite operators are developing in-house terminals while manufacturers are partnering with launch providers. Strategic alliances with government space agencies and defense departments help secure long-term contracts. Companies are also investing in software-defined payloads, adaptive beamforming technologies, and miniaturized terminals to reduce deployment costs. Diversifying product portfolios to serve both commercial and military clients helps manage risk. Subscription models for satellite broadband and equipment-as-a-service are emerging as key monetization strategies. Regulatory compliance and spectrum licensing are also core to market entry in emerging economies.

Key Takeaways

- Global market to reach USD 71.90 billion by 2034, growing at 11.7% CAGR

- North America leads with USD 9.94 billion in 2024 (41.8% share)

- LEO satellite deployment and 5G integration are key drivers

- Defense, aviation, and maritime sectors show high equipment demand

- Shift toward modular, software-defined, and portable terminal systems

➤ Stay ahead — Secure your copy now – https://market.us/purchase-report/?report_id=160024

Analyst Viewpoint

The satellite communication equipment market is entering a transformative phase, driven by space commercialization, cross-sector digitalization, and global connectivity goals. Presently, market momentum is strongest in North America due to early adoption in defense and telecom. Looking ahead, Asia Pacific and Middle East markets will witness accelerated growth, backed by national space programs and rural internet initiatives. With increasing investments in reusable launch technologies, ground station automation, and mini-satellites, the future outlook remains positive. The market is expected to become more competitive as innovation lowers entry barriers and fosters cross-border partnerships.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| Military & Defense | Secure communication, surveillance, mission-critical deployment |

| Maritime Communication | Navigation safety, real-time tracking, IoT-based fleet monitoring |

| Aviation Connectivity | In-flight Wi-Fi, cockpit communication, regulatory mandates |

| Emergency Response | Disaster recovery, network redundancy, remote area connectivity |

| Media Broadcasting | Global content delivery, remote production, live event uplink/downlink |

Regional Analysis

North America is the market leader with a 41.8% share in 2024, attributed to high defense budgets, NASA’s satellite programs, and early private sector investment in space communication. The region also benefits from partnerships between commercial providers and governmental agencies like the U.S. Space Force. Asia Pacific is the fastest-growing region, with emerging economies like China, India, and Japan investing in space exploration and rural broadband. Europe follows closely, with key contributions from ESA-backed projects and commercial satellite ventures. The Middle East and Africa show promise, especially in oilfield monitoring, navigation, and border security use cases.

➤ Don’t Stop Here — Check Our Library

- Decentralized Cloud Storage Market

- Content Security Market

- Handheld Point of Sale (POS) Market

- Enhanced Cloud Host Market

Business Opportunities

The satellite communication equipment market presents wide-ranging opportunities across commercial and government segments. Startups can develop compact, energy-efficient terminals for remote locations. There is strong potential in ground station modernization, LEO-based broadband kits for off-grid homes, and mobile terminals for field applications. Government contracts offer long-term revenue streams, especially for defense-grade hardware and spectrum leasing. With growing demand for space-based asset tracking, SaaS platforms integrated with satellite data also present value-added service opportunities. Collaborations with telecom operators, especially for backhaul connectivity, create cross-industry growth avenues.

Key Segmentation

The market is segmented by product type, application, frequency band, and end-user. By product, key categories include antennas, transceivers, modems, satellite phones, and networking equipment. Applications include broadcasting, navigation, data communication, remote sensing, and emergency services. Frequency bands span C-band, Ku-band, Ka-band, and X-band, with Ka-band seeing rapid adoption due to high data throughput. End-users include defense agencies, maritime operators, aviation firms, telecom providers, media houses, and emergency response teams. Innovations are focusing on portable and ruggedized terminals, particularly for military and humanitarian missions.

Key Player Analysis

Leading players are expanding their presence through R&D investments and global partnerships. Many are enhancing compatibility with next-gen LEO and GEO constellations. Development of hybrid systems capable of switching between terrestrial and satellite links is gaining traction. Some firms are introducing AI-powered ground control solutions for predictive maintenance and resource optimization. Companies are also participating in government-backed space missions to ensure long-term revenue visibility. In emerging markets, players are offering tailored solutions with lower CapEx through leasing models and modular deployment kits. The industry remains innovation-intensive, favoring companies with strong IP portfolios and adaptive manufacturing capabilities.

- Echostar Corporation

- L3Harris Technologies Inc.

- Thales S.A.

- RTX

- General Dynamics Corporation

- Cobham Satcom

- Honeywell International Inc.

- Viasat, Inc.

- Gilat Satellite Networks

- Aselsan A.Ş

- Iridium Communication Inc.

- Intellian Technologies Inc.

- ST Engineering

- SpaceX

- Elbit Systems Ltd.

- Campbell Scientific, Inc.

- ND SatCom GmbH

- Others

Recent Developments

- In April 2025, a leading defense contractor unveiled a portable satellite modem with encrypted communication for tactical units

- In June 2025, a major aerospace firm launched a software-defined antenna system for LEO satellite compatibility

- In March 2025, an alliance was formed between telecom operators and satellite equipment firms to expand rural coverage in Southeast Asia

- In February 2025, a startup introduced plug-and-play terminals for remote IoT sensor networks

- In January 2025, a public-private initiative in Europe funded the development of dual-use (military & commercial) communication payloads

Conclusion

The satellite communication equipment market is poised for robust growth, fueled by demand for secure, global, and uninterrupted communication. As innovation accelerates and global investments rise, the sector is expected to play a pivotal role in digital transformation and resilient connectivity worldwide.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)