Table of Contents

Introduction

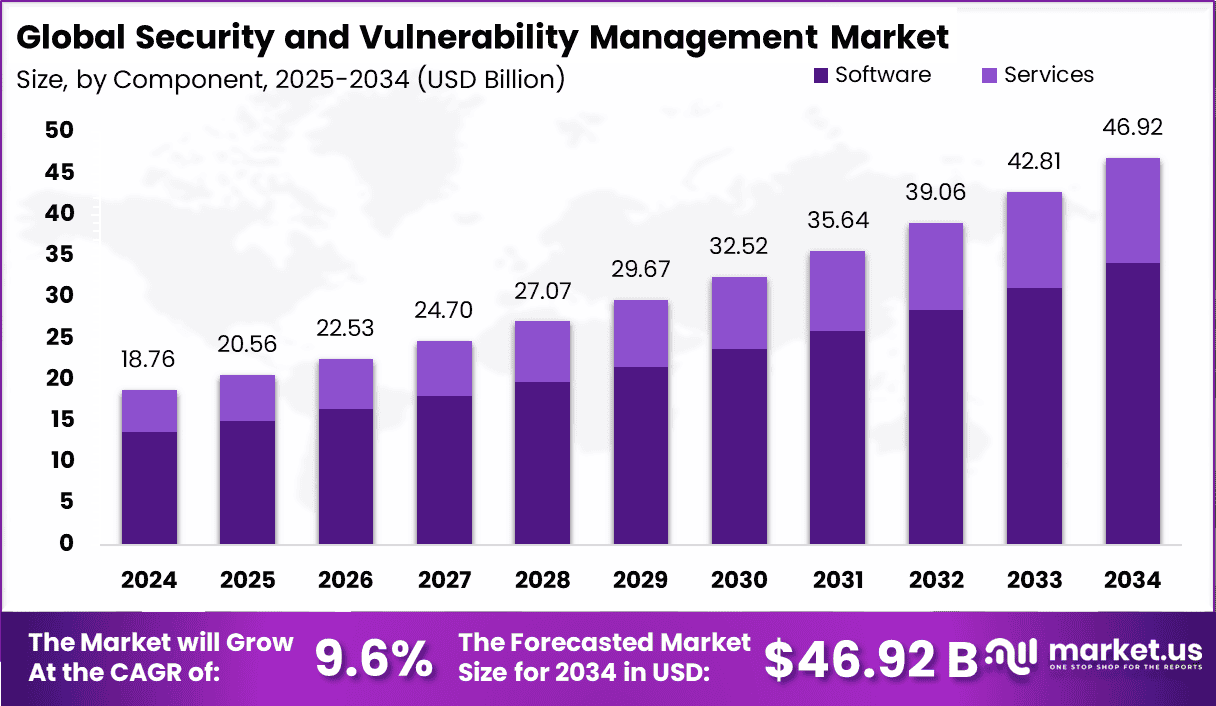

The Global Security and Vulnerability Management (SVM) Market is experiencing robust growth, with its size projected to increase from USD 20.56 billion in 2025 to approximately USD 46.92 billion by 2034, growing at a CAGR of 9.60% from 2025 to 2034. In 2024, the market was valued at USD 18.76 billion, driven by the growing demand for enhanced cybersecurity solutions and the increasing frequency of cyber threats. As businesses and governments recognize the importance of securing digital infrastructures, the adoption of security and vulnerability management solutions continues to rise.

How Growth is Impacting the Economy

The growth of the Security and Vulnerability Management market is significantly impacting the global economy by strengthening the digital infrastructure of organizations and governments. With increasing cybersecurity threats such as data breaches, ransomware attacks, and malware, businesses are focusing on proactive security measures to safeguard their data, networks, and systems. This has led to a growing market for security management solutions that help organizations identify and mitigate vulnerabilities.

The rising adoption of these solutions is also driving job creation in fields like cybersecurity and IT management, thus benefiting the digital economy. The increased reliance on cloud technologies and remote work has further fueled the demand for security tools that can secure both on-premise and cloud infrastructures. With cybersecurity threats constantly evolving, the need for advanced security solutions will continue to drive market growth and economic value.

➤ Unlock growth! Get your sample now! – https://market.us/report/security-and-vulnerability-management-market/free-sample/

Impact on Global Businesses

The expansion of the Security and Vulnerability Management (SVM) market is both a challenge and an opportunity for global businesses. As cyberattacks increase in frequency and sophistication, organizations are facing rising costs for advanced security solutions to protect their digital assets. This demand for cutting-edge cybersecurity tools is putting pressure on companies to invest heavily in the latest vulnerability management technologies. At the same time, cybersecurity businesses are witnessing growth in demand for their products and services.

The IT sector is particularly impacted, with companies needing to continuously adapt to new threats, forcing many to update and strengthen their security frameworks. Supply chain shifts also occur as vulnerabilities in third-party systems and vendor networks become more evident, urging organizations to adopt stronger risk management practices. Additionally, sectors such as healthcare, finance, and government are experiencing heightened pressure to comply with data protection regulations, increasing demand for vulnerability management services.

Strategies for Businesses

- Invest in Advanced Security Tools: Adopt comprehensive Security and Vulnerability Management (SVM) solutions to proactively identify and mitigate vulnerabilities.

- Enhance Employee Training: Educate employees on best practices for cyber hygiene and security awareness to reduce human error and internal risks.

- Adopt Cloud-Based Security Solutions: Implement cloud-native security tools that ensure scalability, flexibility, and efficient management of security risks.

- Focus on Compliance: Ensure compliance with relevant cybersecurity regulations such as GDPR, HIPAA, and PCI-DSS to mitigate regulatory risks.

- Continuous Vulnerability Scanning: Implement regular scanning tools to proactively identify weaknesses and patch vulnerabilities before exploitation.

Key Takeaways

- The SVM market is expected to grow from USD 20.56 billion in 2025 to USD 46.92 billion by 2034, at a CAGR of 9.60%.

- Rising cyber threats and digital transformations are driving the demand for security management solutions.

- Businesses are increasingly investing in cybersecurity tools to protect their data and infrastructure.

- Regulatory compliance and the adoption of cloud technologies are key factors impacting the market’s growth.

- Proactive vulnerability management is a crucial strategy to reduce business risks and improve overall security posture.

➤ Stay ahead—secure your copy now – https://market.us/purchase-report/?report_id=154714

Analyst Viewpoint

Present View: The SVM market is growing at a steady pace, driven by the increasing cybersecurity threats faced by organizations. As businesses accelerate their digital transformation, the demand for advanced security tools to safeguard assets continues to rise. This market is expected to experience continued demand, with a focus on both cloud security and on-premise vulnerability management.

Future View: With a CAGR of 9.60%, the market will continue to thrive, fueled by the growing threat landscape, regulatory requirements, and increasing adoption of cloud computing and remote work. As cyber threats evolve, businesses will seek out more dynamic, adaptive security solutions to stay ahead of the curve.

Use Case and Growth Factors

| Use Case | Growth Factors |

|---|---|

| IT Security | Increasing demand for proactive vulnerability management in IT infrastructures. |

| Healthcare | Need to comply with HIPAA and protect patient data from cyberattacks. |

| Financial Services | Rising threats to financial transactions and data protection regulations. |

| Government | Growing need to secure national infrastructure and sensitive data. |

| Retail | Rising e-commerce transactions and the need for secure payment systems. |

Regional Analysis

North America holds a dominant position in the Security and Vulnerability Management market, capturing 38.1% of the share in 2024, generating USD 0.4 billion in revenue. This is due to the region’s high adoption of cybersecurity solutions and the increasing need for businesses to protect digital assets. The European market is expanding, particularly driven by the enforcement of stringent data protection regulations like GDPR. The Asia-Pacific region is expected to experience significant growth as emerging economies adopt more sophisticated cybersecurity practices due to increasing cyber threats and cloud infrastructure growth.

Business Opportunities

The Security and Vulnerability Management market offers numerous business opportunities, especially for cybersecurity solution providers and IT consultants. Businesses can capitalize on the growing demand for cloud-based security tools and compliance solutions, particularly in industries such as healthcare, finance, and government. There is also increasing demand for AI-powered security solutions, which provide real-time vulnerability scanning and automated remediation. SMBs looking to strengthen their cyber defenses are seeking affordable, scalable solutions, creating further opportunities for service providers to cater to these growing needs.

Key Segmentation

The Security and Vulnerability Management market is segmented by:

- Deployment Type: On-premise solutions, cloud-based solutions.

- End-User Industry: IT and Telecommunications, Healthcare, Financial Services, Retail, Government, Energy.

- Security Type: Network Security, Application Security, Endpoint Security, Cloud Security.

- Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

Key Player Analysis

The SVM market is driven by cybersecurity companies that specialize in developing vulnerability management solutions and security tools. These players focus on providing comprehensive tools for network security, cloud security, and endpoint protection, offering services such as vulnerability scanning, patch management, and threat intelligence. Collaborations with cloud service providers and regulatory bodies are essential to expanding market reach and ensuring that solutions meet global compliance standards. Players are increasingly integrating AI and machine learning into their offerings to enhance real-time vulnerability detection and remediation.

- AT&T Intellectual Property.

- CrowdStrike

- Cisco Systems, Inc.

- Fortra, LLC

- IMB Corporation

- Microsoft Corporation Company Profile

- Qualys, Inc.

- Rapid7

- RSI Security.

- Tenable, Inc.

- CybeReady

- Balbix, Inc.

- Splunk LLC

- BlueVoyant

- Palo Alto Networks

- Wiz, Inc.

- Other Key Players

Recent Developments

- Introduction of AI-powered vulnerability scanning tools to improve threat detection.

- Strategic partnerships between SVM providers and cloud platforms to deliver integrated security solutions.

- Development of compliance-focused solutions to help businesses meet regulatory requirements like GDPR and HIPAA.

- Expansion of managed vulnerability services to provide organizations with ongoing security monitoring.

- Launch of end-to-end security platforms combining network security, endpoint protection, and cloud vulnerability management.

Conclusion

The Security and Vulnerability Management market is poised for substantial growth, driven by the increasing frequency and complexity of cyber threats. As businesses look to strengthen their digital security frameworks, the demand for advanced SVM solutions will continue to rise, creating significant opportunities for cybersecurity providers and investors.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)