Table of Contents

Market Overview

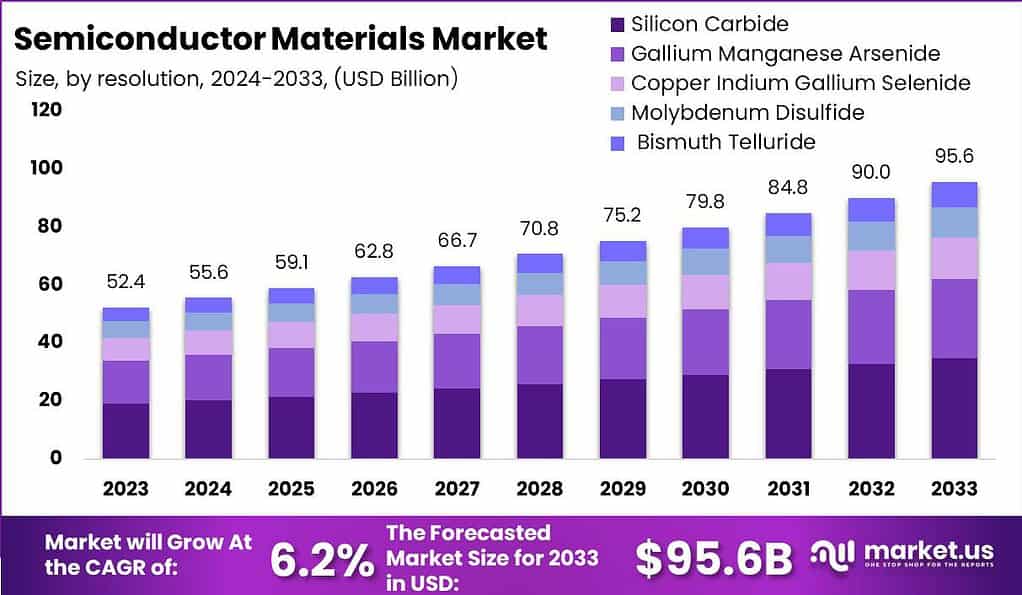

According to Market.us, The Sales of Semiconductor Materials is estimated to be worth USD 55.6 Billion in 2024. The market is expected to rise at a CAGR of 6.2% and reach a valuation of USD 95.6 Billion by 2033.

The Semiconductor Materials Market is poised for significant growth, driven by the escalating demand for electronic devices such as smartphones, tablets, and other smart technologies. This demand fuels innovation in semiconductor technology, leading to a steady need for high-quality semiconductor materials that are crucial for manufacturing efficient and miniaturized devices. Furthermore, advancements in sectors like automotive and industrial electronics are broadening the scope of applications for semiconductors, presenting substantial market opportunities.

Several growth factors contribute to the expansion of the semiconductor materials market. Firstly, the increasing demand for electronic devices and technological advancements drives the need for more advanced semiconductors. As consumer electronics become more sophisticated and connected, there is a growing demand for smaller, faster, and more energy-efficient semiconductors. This drives the demand for advanced semiconductor materials that can meet these requirements.

Secondly, the rise of emerging technologies such as artificial intelligence, the Internet of Things (IoT), and 5G is driving the demand for semiconductors. These technologies require powerful and efficient semiconductor components to process and transmit data. As these technologies continue to evolve and become more prevalent, the demand for semiconductor materials is expected to grow significantly.

Furthermore, the automotive industry presents a significant growth opportunity for the semiconductor materials market. Modern vehicles are increasingly equipped with advanced electronics, including driver assistance systems, infotainment systems, and electric vehicle components. These applications require semiconductors that can withstand harsh automotive environments and meet stringent performance and reliability standards.

However, the market faces challenges, including the fluctuating costs of raw materials and stringent environmental regulations which impact production processes. The need for continuous research and development to keep pace with rapid technological advancements also poses a hurdle, requiring heavy investments.

Despite these challenges, the semiconductor materials market offers promising opportunities. The rise of emerging technologies such as 5G, artificial intelligence, and the Internet of Things (IoT) opens new avenues for the use of semiconductors. Additionally, the increasing adoption of electric vehicles (EVs) and renewable energy solutions are expected to further drive the demand for semiconductor materials, presenting lucrative prospects for market expansion.

Key Takeaways

- The global semiconductor materials market is projected to reach a valuation of USD 95.6 billion by 2033, growing at a compound annual growth rate (CAGR) of 6.2% during the forecast period from 2023 to 2033. The market was valued at USD 52.4 billion in 2023.

- In terms of material type, the silicon carbide segment has dominated the market, holding a share of 36.5% in 2023.

- Regarding application, the fabrication segment has maintained a leading position, capturing a market share of 61.5% in 2023.

- The Asia-Pacific (APAC) region held a dominant market position in 2023, accounting for over 42.3% of the semiconductor materials market.

Semiconductor Materials Statistics

- The Semiconductor Market is forecasted to reach a valuation of approximately USD 1,307.7 billion by 2032, up from USD 625.2 billion in 2023. This market is expected to exhibit a compound annual growth rate (CAGR) of 8.8% during the forecast period from 2024 to 2033.

- The Global Semiconductor Intellectual Property (IP) Market stood at USD 6.4 billion in 2023 and is projected to achieve a growth rate of 6.7% over the forecast period, reaching an estimated USD 11.3 billion by 2032.

- The semiconductor materials market has demonstrated significant growth, starting with a valuation of USD 52.4 billion in 2023. Over the forecast period, this market is expected to maintain a steady climb, achieving a compound annual growth rate (CAGR) of 6.2%. By 2024, the market size is projected to increase to USD 55.6 billion, and this upward trend is set to continue, with the market reaching approximately USD 59.1 billion by 2025.

- Mid-decade, the market is expected to cross the USD 60 billion mark, settling at USD 62.8 billion in 2026. The growth trajectory remains robust through the latter part of the decade, with market sizes expected to be USD 70.8 billion by 2028 and USD 79.8 billion by 2030. This steady growth underscores the increasing demand and technological advancements within the semiconductor industry.

- By the end of the forecast period in 2033, the semiconductor materials market is anticipated to reach a peak of USD 95.6 billion. This continuous expansion highlights the dynamic nature of the semiconductor sector and reflects the ongoing innovation and development in materials such as silicon carbide, gallium manganese arsenide, and others which are crucial to advancing semiconductor technology.

- The market size for Global High-end Semiconductor Packaging is anticipated to be around USD 158 billion by 2033, starting from USD 35 billion in 2023, with a growth rate (CAGR) of 16.4% from 2024 to 2033.

- The semiconductor materials industry is expected to generate over 60,000 new jobs by 2025.

- According to the WSTS’s Spring 2024 forecast, there is an anticipated growth of 16.0% in the global semiconductor market compared to the previous year, bringing the market value in 2024 to an estimated USD 611 billion.

- For the year 2024, significant growth in the Integrated Circuit sector is forecasted, particularly in the Logic and Memory categories, with increases of 10.7% and 76.8%, respectively.

- A 30% enhancement in semiconductor performance efficiency has been observed over the past decade due to investments in material innovations.

- Europe accounts for approximately 10% of the global semiconductor materials market.

- Globally, the semiconductor materials industry employs over 300,000 individuals directly.

Emerging Trends

- Specialty Materials for Advanced Technologies: The industry is seeing increased demand for specialty materials essential for newer technologies like Gate-All-Around Field Effect Transistors (GAA-FET), 3D DRAM, and 3D NAND technologies. These require specialized materials such as EPI silicon/silicon germanium, EUV photoresist and developers, and various advanced chemical and physical vapor deposition (CVD/PVD) precursors.

- Sustainability Focus: There is a growing emphasis on sustainability within the semiconductor materials market. Efforts are increasing to develop environmentally friendly materials and processes, particularly in light of regulatory pressures around the use of certain hazardous substances.

- Global Supply Chain Rebalancing: The market is experiencing shifts due to geopolitical tensions and the need for supply chain resilience. This is leading to an increased focus on diversifying sources of critical materials like germanium and gallium, which are pivotal for semiconductor manufacturing.

- Increased R&D Investments: The sector is benefiting from substantial investments in research and development, driven by both private firms and government grants. This is particularly pronounced in regions leading the semiconductor industry such as the United States, China, and several European countries, which are also the hubs of patent creation and technological innovation.

- Nanoimprinting and Semiconductors for Space Applications: There is a burgeoning interest in nanoimprinting technologies and the development of semiconductors specifically designed for space applications. This trend is seeing increased investment and is expected to open up new avenues for market growth.

Top Use Cases for Semiconductor Materials

- Consumer Electronics: Semiconductor materials are crucial for the production of high-performance chips used in smartphones, tablets, and other consumer electronics. This remains one of the largest and most consistent drivers of demand in the semiconductor industry.

- Automotive Applications: With the automotive industry increasingly integrating advanced electronics for electric vehicles and autonomous driving technologies, there is a rising demand for semiconductor materials that can support these sophisticated systems.

- Data Centers and Networking: As global data consumption and the need for data centers grow, semiconductor materials are essential for developing the advanced networking equipment required to support increased data traffic and storage capabilities.

- Healthcare Devices: Semiconductors play a critical role in healthcare, particularly in the development of medical devices such as imaging systems and wearable health monitors, which rely on advanced materials for their electronic components.

- Renewable Energy Systems: Semiconductor materials are key to the renewable energy sector, particularly in the production of photovoltaic cells for solar panels and components for wind turbines. This use case is expected to expand as the global push for sustainable energy solutions intensifies.

Major Challenges

- Geopolitical Tensions: The semiconductor materials market faces significant geopolitical challenges, especially between major players like the US and China. These tensions strain critical supply chains for essential materials like germanium and gallium, intensifying the risks associated with rare earths supplies, which are predominantly controlled by China.

- Supply Chain Constraints: The market is grappling with lingering supply chain issues that pose challenges in scaling up production capacities. These constraints are exacerbated by geopolitical disputes which can lead to potential chokepoints as fabrication capacities expand.

- Regulatory and Environmental Hurdles: Increasing regulatory pressures, especially concerning environmental, health, and safety (EHS) standards, could complicate the expansion of material supplies. For instance, regulations targeting PFAS materials are pushing suppliers to develop and qualify alternative substances, adding to development timelines and costs.

- Technological Complexity and Innovation Demands: As the semiconductor devices move towards more advanced technologies like silicon carbide (SiC) and power electronics, the demand for materials with higher performance standards increases. This transition requires continuous innovation and adaptation in material science, posing a challenge for material suppliers to keep pace with the technological advancements.

- Talent and Expertise Shortages: The semiconductor industry is also struggling with a persistent shortage of skilled professionals, which could hinder growth and innovation. This challenge is expected to remain critical in the foreseeable future, impacting the ability to meet the rapidly evolving technological demands of the market.

Market Opportunities

- Expansion in Power Electronics: The growing demand for power electronics, driven by applications in electric vehicles and renewable energy systems, presents significant opportunities. Materials like silicon carbide (SiC) are increasingly favored for their ability to enable efficient energy conversion, handling higher temperatures and voltages, which are essential for modern power modules.

- Advancements in Consumer Electronics: The semiconductor materials market is buoyed by the booming consumer electronics sector. Innovations in smartphones, wearables, and smart home technologies continue to drive demand for advanced semiconductor materials that support increased functionalities and miniaturization.

- Growth in Automotive and Industrial Applications: The automotive sector, particularly with the rise of electric vehicles, along with industrial applications like motor drives, are rapidly expanding markets for semiconductor materials. These sectors require materials that can operate under higher power and thermal conditions.

- Regional Market Expansions: The Asia Pacific region, led by manufacturing powerhouses like China, offers expansive growth opportunities due to its substantial investments in semiconductor production facilities and technology. This regional dominance is expected to continue, fueled by local government policies and growing market demands.

- Innovations in Semiconductor Fabrication and Packaging: Ongoing technological advancements in semiconductor fabrication and packaging technologies provide a continuous stream of opportunities for material suppliers. Innovations in materials used for photolithography, etching, and packaging are critical to meeting the evolving specifications of the semiconductor industry.

Recent Developments

- January 2024: BASF SE announced the development of eco-friendly semiconductor materials, emphasizing sustainability and responsible sourcing. This initiative aims to cater to the increasing demand for environmentally conscious products and align with regulatory standards on sustainability.

- February 2024: Henkel AG launched a new line of high-purity adhesives for semiconductor applications. These adhesives are designed to meet the stringent purity requirements of the semiconductor industry, enhancing the performance and reliability of electronic components.

- March 2024: Avantor Performance Materials expanded its production capacity for high-purity chemicals used in semiconductor manufacturing. This expansion aims to address the growing demand for these critical materials and support the semiconductor industry’s rapid growth.

- April 2024: Air Liquide SA introduced a new gas purification technology to enhance the quality of gases used in semiconductor manufacturing. This development is expected to improve the performance and yield of semiconductor production processes.

- May 2024: Honeywell Electronic Materials unveiled a new range of electronic chemicals tailored for advanced semiconductor nodes. These chemicals are designed to support the miniaturization of semiconductor devices and the development of more complex chip architectures.

- October 2023: A startup introduced an innovative 3D printing technology for semiconductor materials, enabling rapid prototyping and customization of chip designs. This advancement is expected to streamline the production process and enhance the flexibility of semiconductor manufacturing.

- November 2023: DowDuPont invested in digital twins for semiconductor material production. This technology aims to optimize manufacturing processes by predicting potential issues and improving overall efficiency and yield. This initiative reflects the growing importance of digital technologies in enhancing production capabilities.

- December 2023: TSMC and Shin-Etsu Chemical partnered with leading universities to develop next-generation materials for quantum computing applications. This collaboration is set to pave the way for revolutionary advancements in computational power, underscoring the critical role of innovative materials in the future of computing.

Conclusion

The semiconductor materials market is navigating through a complex landscape characterized by technological advancements, regulatory challenges, and geopolitical tensions. While challenges such as supply chain constraints and talent shortages pose significant hurdles, the market is poised for growth driven by robust demand from sectors like consumer electronics, automotive, and renewable energy. The continuous innovation in material science and technology, coupled with the strategic expansion in high-growth regions, are pivotal in shaping the future of this dynamic industry. The market’s ability to adapt to these evolving demands and challenges will determine its trajectory in the coming years.