Table of Contents

Introduction

Set-Top Box Statistics: Set-top boxes (STBs) are crucial devices in the television sector. Decrypting digital signals and granting access to a diverse array of content.

Major participants in this fiercely competitive market encompass Cisco Systems, Technicolor, ARRIS International, and Huawei.

The worldwide STB industry has displayed consistent expansion due to the transition to digital broadcasting.

The adoption of 4K resolution, and the integration of intelligent features. Progressions like voice command and DVR functions have enriched user interactions.

Despite facing competition from streaming gadgets, STBs identify prospects in emerging markets and tailor solutions for content providers, marking it as a developing field.

Editor’s Choice

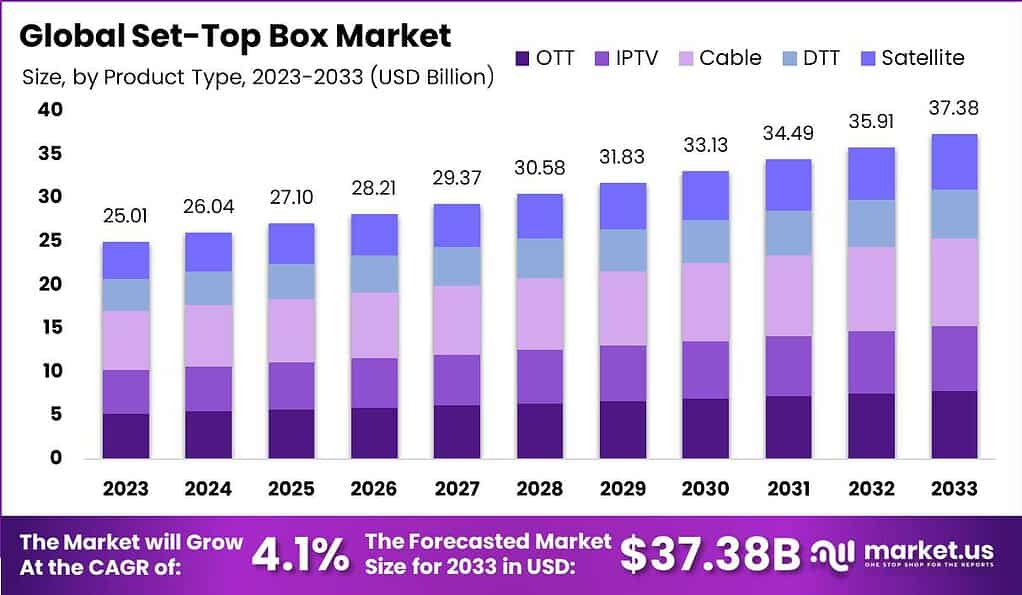

- The global set-top box market is poised for steady growth over the coming years at a CAGR of 4.1%, as indicated by the projected revenues.

- In 2023, the market is estimated to be worth approximately USD 25.01 billion.

- The majority of market share is attributed to offline channels, accounting for a substantial 78%.

- North America commands a substantial 22.0% market share, underscoring its significance as a key player in the industry.

- Among market players, Ecostar Corporation leads the pack with a significant market share of 14%, showcasing its prominence in the market.

- In the current landscape, approximately 32% of viewers opt to kickstart their video content experience by launching a smart TV app. Marking a substantial 10% increase from the 22% recorded in 2021.

- As of Q2 2021, Android TV’s middleware was present on approximately 26% of advanced set-top boxes worldwide. Which accounts for roughly 5% of all boxes, including older legacy devices.

Global Set Top Box Market Overview

Global Set Top Box Market Size

- The global set-top box market is poised for steady growth over the coming years at a CAGR of 4.1%, as indicated by the projected revenues.

- In 2023, the market is estimated to be worth approximately USD 25.01 billion.

- This upward trajectory is expected to continue, with the market revenue forecasted to reach USD 26.04 billion in 2024 and USD 27.10 billion in 2025.

- Over the subsequent years, the market is anticipated to experience consistent expansion, with revenues reaching USD 29.37 billion in 2027, USD 30.58 billion in 2028, and further climbing to USD 34.49 billion by 2031.

- This growth trend underscores the resilience and potential of the set-top box industry, with gradual but significant increases in market value projected throughout the forecast period. Ultimately culminating in a value of approximately USD 37.38 billion by 2032.

- These figures illustrate a positive outlook for the set-top box market, reflecting sustained demand and opportunities for industry players.

(Source: Market.us)

Global Set Top Box Market Share- By Distribution Channel

- In the global set-top box market, the distribution channels play a pivotal role in reaching consumers.

- The majority of market share is attributed to offline channels, accounting for a substantial 78%.

- This highlights the significance of traditional retail outlets and physical stores in distributing set-top box products to consumers.

- On the other hand, online distribution channels hold a noteworthy 22% market share.

- This segment represents the growing influence of e-commerce platforms and digital channels in catering to consumer demands for set-top boxes.

- The distribution channel landscape in the set-top box market reflects a balance between traditional brick-and-mortar retail and the evolving online landscape. Showcasing a dynamic marketplace that caters to a diverse range of consumer preferences and purchasing behaviors.

(Source: Market.us)

Regional Analysis of Set Top Box Market

- A comprehensive regional analysis of the set-top box market reveals distinct market shares across different geographical regions.

- North America commands a substantial 22.0% market share, underscoring its significance as a key player in the industry.

- Meanwhile, Europe holds a significant portion, accounting for 28.0% of the market, showcasing its robust presence in the market landscape.

- The Asia-Pacific (APAC) region emerges as a dominant force, boasting the largest market share at 35.0%. Reflecting its vast consumer base and growing demand for set-top box solutions.

- In Latin America, the market share stands at 7.5%, while the Middle East and Africa (MEA) region contributes 3.0% to the global market.

- This regional breakdown underscores the diversity and distribution of the set-top box market, with varying degrees of market penetration and growth potential across different parts of the world. Making it essential for industry stakeholders to adapt strategies tailored to each region’s unique dynamics.

(Source: Market.us)

Key Players in the Global Set Top Box Market

- The global set-top box market is characterized by a diverse landscape of key players. Each contributes to the industry’s growth and innovation.

- Among these, Ecostar Corporation leads the pack with a significant market share of 14%, showcasing its prominence in the market.

- Following closely behind are Skyworth Group and ARRIS International, with market shares of 12% and 11% respectively, demonstrating their substantial influence and competitive positions.

- Huawei Technologies Ltd. and Samsung Electronics Ltd. each hold a notable 10% market share, highlighting their strong presence in the market.

- HUMAX and CISCO Systems Inc. contribute 10% and 9% of the market share, respectively, further adding to the diversity of players in the sector.

- Additionally, DISH Network holds an 8% market share, while other key players collectively account for 15% of the market.

- This amalgamation of key players underscores a competitive and dynamic landscape within the global set-top box market. Where various companies with unique strengths and capabilities strive to meet consumer demands and shape the industry’s trajectory.

TV Set-top Box Shipments Statistics

- From 2012 to 2019, the global market for TV set-top boxes witnessed significant growth across various regions.

- In North America, the shipments of these devices steadily increased from 10.7 million units in 2012 to 17.5 million units in 2019, reflecting a consistent upward trend.

- Similarly, Europe experienced substantial growth in set-top box shipments, with numbers rising from 13.9 million units in 2012 to an impressive 38.7 million units in 2019.

- However, the most remarkable expansion was observed in the Asia Pacific region. Where shipments soared from 34.2 million units in 2012 to a staggering 139.5 million units in 2019. Underlining the growing demand for TV set-top boxes in this market.

- In Latin America, while the numbers started relatively low in 2012 at 1.1 million units. They steadily increased to reach 15 million units by 2019.

- These statistics indicate a global trend of increasing reliance on TV set-top boxes for accessing television content, with the Asia Pacific region leading the way in terms of growth and market expansion.

(Source: Statista)

Set-Top Box Consumer Preferences Statistics

- Examining the trends in how viewers initiate their video content viewing reveals notable shifts.

- In the current landscape, approximately 32% of viewers opt to kickstart their video content experience by launching a smart TV app. Marking a substantial 10% increase from the 22% recorded in 2021.

- Conversely, the set-top box, encompasses live TV, video-on-demand (VOD), and DVR functionality. Remains a preferred starting point for a significant portion of viewers at 30%.

- However, this figure represents a noteworthy decline from the 41% observed in 2021.

- These changing preferences underline the evolving dynamics of how audiences engage with video content. With smart TV apps gaining prominence over traditional set-top boxes.

(Source: Hub’s annual “Decoding the Default” study)

Advanced Set-top Box Statistics

Installed Advanced Set-top Box Statistics

- As of Q2 2021, Android TV’s middleware was present on approximately 26% of advanced set-top boxes worldwide. Which accounts for roughly 5% of all boxes, including older legacy devices.

- However, this statistic conceals a somewhat disputed situation: the share of Google’s platform in the overall advanced set-top box market declined from 40% in 2015.

- It faced growing competition from alternative solutions, notably the Reference Design Kit (RDK). A software platform endorsed by prominent cable companies, and advanced Linux-based options.

- These alternatives have become appealing choices for pay-TV operators seeking to maintain full independence and control over the operating system and user experience provided to their subscribers.

(Source: Dataxis)

Installed Advanced Set-top Box – By Regional Statistics

- Asia-Pacific leads in the deployment of Android pay-TV devices, accounting for nearly 70% of the total in Q2 2021.

- Meanwhile, in Europe, Android set-top boxes find favor among subscribers. This popularity in Europe can be attributed to the presence of numerous small and medium-sized operators keen on offering flexible services that cater to their customers’ desires for added options and applications.

- For entities with limited investment capabilities, Android TV presents an opportunity to deliver sought-after services at a reduced cost compared to a fully integrated development approach.

- In Latin America, Africa, and the Middle East, the adoption of advanced set-top boxes lags due to smaller pay TV markets and less prevalent OTT consumption compared to Europe and North America.

- In North America, the Reference Design Kit (RDK) has held a dominant position, thanks primarily to a handful of major operators like Comcast, Charter Group, and Rogers Group. Unlike Android TV, RDK has a smaller operator base.

- In 2021, Android TV established partnerships with approximately six times more pay-TV operators than RDK.

- Additional advanced middleware providers include Roku, Apple, and HarmonyOS, Huawei’s OS intended to replace Android OS.

- HarmonyOS, already widely deployed in smart devices, is poised to emerge as a formidable competitor in the ongoing battle for control over the TV ecosystem.

(Source: Dataxis)

Share of Worldwide Forecast – By Device Type (Installed base)

- Examining the share of the worldwide forecast for installed base by device type in 2017 and 2021 reveals interesting trends.

- In 2017, smart televisions constituted the majority, accounting for 73.5% of the installed base. By 2021, while still dominant, their share had decreased slightly to 70.7%.

- Streaming media players, on the other hand, occupied a smaller segment in 2017, with 6.3%, which further reduced to 3% by 2021.

- In contrast, set-top boxes experienced significant growth, rising from 14.7% in 2017 to 24.8% in 2021.

- Microgame consoles and other devices, while present, held relatively minor shares in both years, with a noticeable decrease in the case of microgame consoles from 5.1% in 2017 to 1.4% in 2021, and a marginal drop for other devices from 0.4% to 0.1% during the same period.

- These changes in device type distribution highlight the evolving landscape of consumer technology preferences and the increasing prominence of set-top boxes.

(Source: SDMC TV)

Set Top Box Energy Consumption in Households Statistics

- To enable the simultaneous viewing of different programs on multiple TVs, many households possess two or more Set-Top Boxes (STBs).

- This leads to an annual household energy consumption ranging from 300 to 400 kWh, approaching the energy usage of a new refrigerator in a year.

- When you factor in the energy consumed by the TV itself and other home entertainment devices. The total energy usage related to home entertainment components can easily surpass 1,000 kWh per year, equivalent to the energy consumed by two new refrigerators annually.

- This represents roughly 10% of a typical household’s electricity consumption. Exceeding the energy used to illuminate the entire home throughout the year.

Potential Energy Savings

- By making minimal changes without redesigning other Set-Top Box (STB) components, it’s possible to enhance power supply efficiency to 85%.

- This adjustment would result in initial savings of 156 million kWh in the first year and a cumulative impact of 1.4 billion kWh over four years.

- Alternatively, if STBs were to lower their power consumption to 5 watts in ready mode and 1 watt in sleep mode, which is a more ambitious approach than the European Code of Conduct recommendations, the first-year savings would be approximately 440 million kWh, with a cumulative impact of about 4.4 billion kWh over four years.

- If both of these strategies were combined, it would lead to a saving of 450 million kWh in the first year and 4.5 billion kWh over four years after implementation.

- On average, each box would save $12 per year on utility bills under this scenario.

(Source: Natural Resources Defense Council)

Recent Developments

Acquisitions and Mergers:

- Amazon acquires Eero for integration with Fire TV: In 2023, Amazon completed the acquisition of Eero, a mesh Wi-Fi router company, for $97 million. This acquisition aims to enhance Amazon’s Fire TV set-top box offerings by integrating seamless Wi-Fi capabilities for improved streaming and smart home connectivity.

- Comcast acquires Xumo: In 2023, Comcast acquired Xumo, a free ad-supported streaming platform, for $100 million. This acquisition is designed to integrate Xumo’s streaming service into Comcast’s set-top boxes, expanding its offering of free streaming content.

New Product Launches:

- Apple launches Apple TV 4K (3rd Gen): In late 2023, Apple launched the Apple TV 4K (3rd Generation), featuring an A15 Bionic chip for faster performance, 4K HDR support, and improved Siri voice control. The new set-top box offers a 20% faster user experience compared to its previous model.

- Google introduces Chromecast with Google TV 2nd Gen: In early 2024, Google introduced the Chromecast with Google TV (2nd Generation). Which offers 4K UHD streaming, Dolby Vision, and a new personalized interface powered by AI. The device is aimed at improving user experience with personalized recommendations based on viewing habits.

Funding:

- Roku raises $150 million for content and device development: In mid-2023, Roku, a leading set-top box and streaming device manufacturer. Raised $150 million to expand its hardware and content offerings. The funds will be used to enhance Roku’s user interface and develop new features, such as integrated gaming.

- Hathway raises $100 million for 4K set-top boxes: In 2023, Hathway, an Indian digital cable and broadband provider, secured $100 million to roll out 4K Ultra HD set-top boxes across India, improving user experience in high-definition entertainment.

Technological Advancements:

- AI-powered content recommendations: By 2025, 40% of set-top boxes are expected to feature AI-driven recommendation engines. Offering personalized content suggestions based on user behavior, aiming to enhance viewer engagement.

- Integration of cloud gaming: Set-top boxes are increasingly being integrated with cloud gaming services. By 2026, 25% of new set-top boxes will include gaming features, allowing users to stream high-quality games directly to their TVs without a console.

Conclusion

Set-Top Box Statistics – In conclusion, the Set-Top Box (STB) industry is evolving rapidly, shaped by changing consumer preferences and technological advancements.

Asia-Pacific leads in STB deployment, while North America relies on the Reference Design Kit (RDK). Competing middleware providers like Apple, Roku, and Huawei’s HarmonyOS are gaining ground.

Additionally, focusing on improving power supply efficiency can result in significant energy savings. Adapting to these shifts is essential for staying competitive and meeting consumer needs while also reducing environmental impact in this dynamic industry.

FAQs

A Set-Top Box (STB) is a device that connects to your television and allows you to access various types of content. Including cable or satellite TV, streaming services, and interactive applications.

STBs decode digital signals and display content on your TV screen. They can connect to the internet and access streaming services or use cable/satellite signals to provide television channels.

There are various types of STBs, including cable STBs, satellite STBs, and IPTV STBs. Each is tailored to specific methods of content delivery.

STBs offer access to a wide range of content, including live TV, on-demand shows, and streaming services. They often provide interactive features and high-definition viewing.

The energy efficiency of STBs can vary, but efforts are being made to improve power supply efficiency and reduce energy consumption in newer models.