Table of Contents

Market Overview

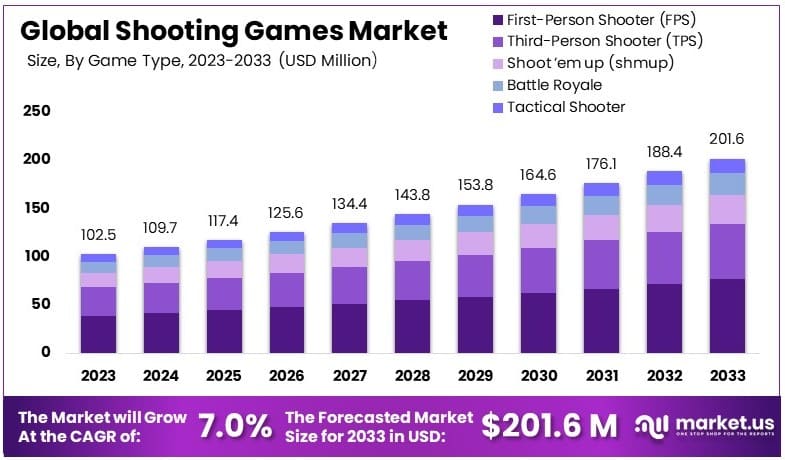

The Global Shooting Games Market is projected to reach a valuation of approximately USD 201.6 million by 2033, up from USD 102.5 million in 2023. This represents a steady growth rate of 7.0% CAGR from 2024 to 2033. Such growth indicates a robust expansion within the industry, fueled by increasing consumer interest and technological advancements in gaming. North America stands out as a leader in this market, holding a 31% share, which equates to about USD 31.78 million. This dominance is supported by a strong gaming culture and the presence of major industry players in the region.

Shooting games are a popular subgenre of action video games where the gameplay predominantly revolves around weapon-based combat. These games challenge the player’s reflexes, speed, and spatial awareness, often across various subgenres like “shoot ’em ups,” “run and gun,” and light gun games. Players might engage in these battles across diverse environments, either alone or with others in multiplayer settings. The genre spans everything from high-action games to more strategic, tactical play.

The market for shooting games has been growing due to its widespread appeal across different age groups and the continuous enhancement of user experience with technological advancements. This genre remains one of the most popular types of video games, contributing significantly to the billion-dollar revenues of the gaming industry globally. With innovations in graphics, gameplay mechanics, and narrative integration, shooting games are becoming increasingly immersive and realistic, driving further market growth.

The demand for shooting games is bolstered by the continuous evolution of game development technologies. Innovations such as virtual reality (VR) and augmented reality (AR) are transforming how players experience these games, making them more engaging and immersive. Moreover, the integration of artificial intelligence (AI) for more intelligent and unpredictable game scenarios has enriched gameplay, drawing more players to the market.

For businesses within the gaming industry, shooting games offer several benefits. They are a substantial source of revenue due to their ability to attract large player bases and sustain their engagement through in-game purchases and updates. Furthermore, shooting games often lead to community and brand loyalty, which can be leveraged for marketing new titles or expansions. The competitive nature of these games also opens opportunities for partnerships with brands and sponsors, particularly within the eSports arena.

Key Takeaways

- According to the research conducted by Market.us, the Shooting Games Market was valued at USD 102.5 million in 2023. It is projected to grow significantly, reaching USD 201.6 million by 2033, with a compound annual growth rate (CAGR) of 7.0% over the forecast period.

- In terms of game types, First-Person Shooter (FPS) emerged as the dominant segment in 2023, capturing 38% of the market share. This is largely attributed to its engaging and immersive gameplay, which continues to attract a wide audience.

- When it comes to platforms, console gaming took the lead in 2023, accounting for 40% of the market. This dominance is driven by its strong and loyal user base, alongside advanced features that enhance the overall gaming experience.

- Geographically, North America stood out as the largest market in 2023, holding a 31% share, valued at USD 31.78 million. The region’s leadership is fueled by the growing popularity of gaming and high consumer spending on entertainment.

Shooter Games Revenue and Usage Statistics

The landscape of first-person shooter (FPS) gaming in the United States reveals a dynamic and engaged audience demographic. As of 2024, roughly 33% of FPS players fall within the 30 to 39 age bracket. This maturity in the gaming community suggests a deep-rooted affection for the genre, likely nurtured during the early days of iconic series like Call of Duty. Meanwhile, the younger generation, particularly those aged 20 to 29, constitutes another 30% of this audience, highlighting the genre’s continued appeal to newer gamers.

The FPS genre remains a cornerstone of the video gaming industry, with titles like PUBG Mobile leading the pack. This game alone boasts an impressive 120 million average monthly users. Close on its heels are Free Fire and Call of Duty: Mobile, which attract 80 million and 53 million users respectively. These numbers not only reflect the games’ global appeal but also their ability to captivate a diverse range of players.

However, it’s not all upward trends in this sector. The shooter game sub-sector experienced a significant downturn in 2022, generating $4.6 billion in revenue – a 27% decrease from the previous year. This dip could be indicative of various market challenges, including increased competition and changing player preferences.

| App | Revenue ($mm) |

|---|---|

| PUBG Mobile | 1121 |

| Free Fire | 310 |

| Call of Duty: Mobile | 306 |

| Knives Out | 208 |

| CrossFire | 187 |

| Brawl Stars | 172 |

| Free Fire MAX | 137 |

| War Robots | 80 |

| World of Tanks Blitz | 38.6 |

| Zooba | 38.6 |

Report Segmentation

Game Type Analysis

First-Person Shooter (FPS) dominates with 38% due to immersive gameplay and strong multiplayer communities. Technological advancements in gaming hardware and online infrastructure are enhancing the immersive quality of FPS games and making them more accessible to a broad audience. This is further bolstered by the popularity of eSports and competitive gaming events, which attract viewers globally and stimulate continual interest in FPS titles.

The FPS market is not without its challenges; concerns over the violent content in these games have led to regulatory scrutiny in some regions. Moreover, the high cost of game development and the need for continual content updates to keep players engaged add to the operational challenges faced by developers.

Innovation is a key trend in the FPS segment, with developers integrating cutting-edge technologies like virtual reality (VR) and augmented reality (AR) to deliver more engaging and immersive gaming experiences. This technological push is opening up new opportunities for growth, particularly in markets that are rapidly adopting VR and AR technologies.

Platform Analysis: Dominance of Consoles

Consoles remain the leading platform for gamers, capturing 40% of the market due to their high-performance capabilities and the exclusive titles they offer. The growth in this segment is significantly driven by technological advancements in console hardware, which are increasingly incorporating VR and AR features to enhance the gaming experience.

The console market’s strength is further supported by the high revenues generated by console sales and the popularity of console-based gaming in regions with high internet penetration and robust gaming cultures, such as North America and Asia-Pacific. This has established consoles as a preferred platform for both developers and gamers, looking for rich, engaging experiences.

Moreover, the FPS games on consoles benefit significantly from the strong multiplayer communities that form around popular titles, driving prolonged engagement and revenue through in-game purchases and subscriptions.

Key Market Segments

By Game Type

- First-Person Shooter (FPS)

- Third-Person Shooter (TPS)

- Shoot ’em up (shmup)

- Battle Royale

- Tactical Shooter

By Platform

- PC (Personal Computer)

- Console

- Mobile

- Other Platforms

Regional Analysis

North America continues to be a strong player in the global shooting games market, holding a substantial market share. In 2023, North America led with a 31% share, translating to USD 31.78 million in revenue. This dominance is attributed to several factors, including high disposable incomes, advanced gaming infrastructure, and a robust culture of gaming across the region.

The U.S. plays a pivotal role in this market, hosting a large base of eSports players and game developers that drive innovation and market growth. Major game developers in the region, such as Valve Corporation and Electronic Arts, contribute significantly to the development and distribution of popular shooting games, continually enhancing the gaming experience with new features and technologies.

The presence of competitive gaming events and conventions also significantly contributes to the market’s dynamics, promoting a vibrant community of gamers who are keen on the latest and most competitive gaming experiences. The high internet penetration and widespread availability of advanced gaming systems enable gamers to access a diverse array of shooting game titles, further cementing North America’s leading position in the global market.

Growth Factors and Emerging Trends

The shooting games market is experiencing rapid growth, driven by several key factors. Technological advancements in graphics and game development are enhancing the visual and interactive elements of games, making them more appealing to a broader audience. The rise of eSports, with its significant prize pools and widespread viewer engagement through platforms like Twitch and YouTube, has also played a crucial role in promoting shooting games.

Emerging trends are shaping the future of the shooting games industry. Hybrid gameplay mechanics that blend shooting with other genres, such as rhythm-based games, are creating unique gaming experiences. Additionally, the use of immersive technologies like virtual reality (VR) and augmented reality (AR) is becoming more common, offering players new ways to experience game worlds.

Business Benefits

The market’s expansion offers substantial business benefits. For developers and publishers, the broad appeal of shooting games opens up diverse revenue streams, from direct game sales to in-game purchases and advertising. The competitive nature of these games makes them ideal for eSports, attracting sponsorships and media rights deals. Moreover, the social aspects of multiplayer and online games help in building strong, engaged communities, driving player retention and ongoing engagement.

Opportunities and Challenges

The market’s growth is not without challenges. Regulatory issues concerning the depiction of violence and game addiction pose potential restrictions in various regions. Technological advancements, while beneficial, also require developers to continuously invest in and adapt to new technologies.

However, the opportunities in the market are significant. The integration of AI and cloud computing can lead to more immersive and accessible gaming experiences. Cross-platform gaming potential is expanding, allowing players on different devices to interact and play together, broadening the market reach. Additionally, the global expansion into emerging markets like Asia and the Middle East offers vast new audiences for shooting games.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2023) | USD 102.5 Million |

| Forecast Revenue (2033) | USD 201.6 Million |

| CAGR (2024-2033) | 7.0% |

| Base Year for Estimation | 2023 |

| Historic Period | 2018-2023 |

| Forecast Period | 2024-2033 |

Conclusion

In conclusion, the shooting games market exhibits significant growth potential, driven by continuous technological advancements and the burgeoning eSports scene. These games not only captivate a diverse player base with their immersive and challenging gameplay but also serve as a lucrative avenue for the gaming industry. As virtual and augmented reality technologies advance, they promise to enhance the sensory experience of gaming, making shooting games even more engaging.

Businesses within this sector can leverage these trends for increased revenue through strategic expansions and partnerships, tapping into the sustained popularity and community loyalty that shooting games foster. Thus, the future of the shooting games market looks promising, with innovations and community engagement at its core.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)