Table of Contents

Introduction

According to Smart Card Statistics, Smart cards are compact devices featuring a microprocessor or memory chip designed for secure data storage and processing.

They are integral to sectors like identification, where they securely store certificates and cryptographic keys for access control and digital services.

In finance, smart cards, such as EMV cards, safeguard payment information with dynamic authentication, reducing fraud risk.

They also play key roles in telecommunications through SIM cards. Healthcare with electronic health records, and transportation for fare collection systems.

Smart cards can be either contact-based, requiring insertion into a reader, or contactless, utilizing RFID for wireless communication. Ensuring secure transactions and data integrity across diverse applications.

Editor’s Choice

- The global smart card market revenue is projected to reach USD 29.6 billion by 2033.

- However, The smart card market is characterized by a diverse range of key players. Each holds varying shares of the market. CPI Card Group Inc. leads with an 18% market share.

- In 2008, the smart card manufacturing market was led by Gemalto, which held a dominant 35% market share.

- The global smart card market is dominated by the Asia-Pacific (APAC) region. Which holds the largest share at 39.4%.

- In the Asia-Pacific region, the cashless transaction volume was USD 494 billion in 2020 and is projected to increase to USD 1,032 billion by 2025 and USD 1,818 billion by 2030.

- The history of smart cards is marked by significant milestones in technological advancement and widespread adoption across various sectors globally. It all began in the 1970s when patents were filed in Japan and France. Laying the groundwork for what would become the smart card.

- In the United States, the Federal Information Processing Standard (FIPS) 201-3 establishes guidelines for Personal Identity Verification (PIV) cards used by federal employees and contractors to access secure facilities and systems.

Global Smart Card Market Overview

Global Smart Card Market Size

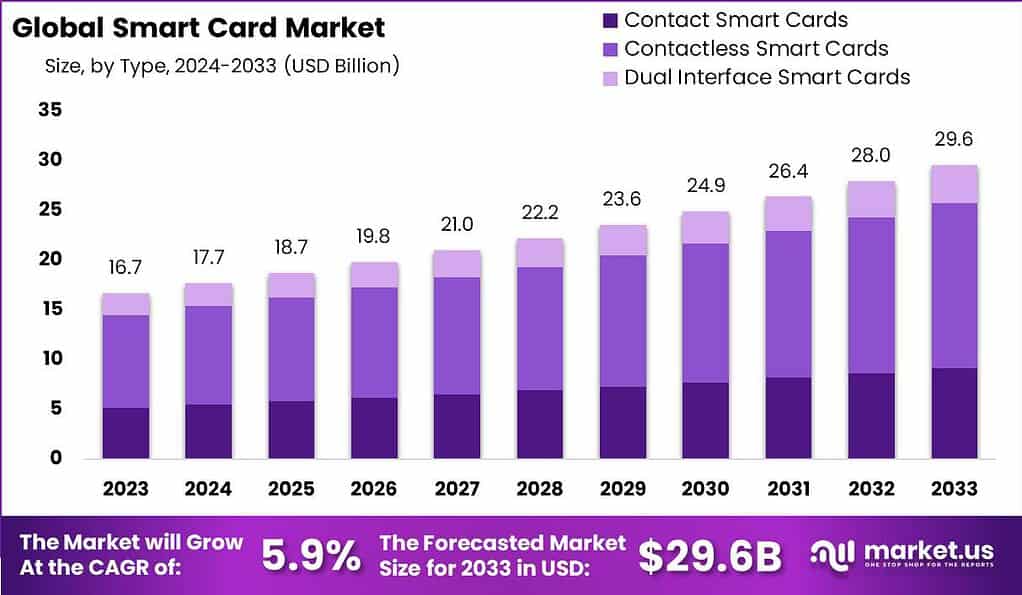

- The global smart card market revenue is projected to exhibit steady growth from 2023 to 2033 at a CAGR of 5.9%.

- In 2023, the market revenue stood at USD 16.7 billion and is anticipated to increase incrementally each year.

- The growth trajectory is expected to persist, culminating in market revenues of USD 28.0 billion in 2032 and reaching USD 29.6 billion by 2033.

Competitive Landscape of the Global Smart Card Market

- The smart card market is characterized by a diverse range of key players. Each holds varying shares of the market.

- CPI Card Group Inc. leads with an 18% market share, followed closely by American Express Company at 17%.

- Atos SE and NXP Semiconductors NV each command a 9% share, while Inside Secure SA holds 10%.

- Giesecke & Devrient (G&D) GmbH and Infineon Technologies AG both account for 8% of the market.

- Gemalto NV has a 7% share, and Texas Instruments Inc. holds 6%.

- Additionally, other key players collectively contribute to 8% of the market share.

Market Share of Smart Card Manufacturers

- In 2008, the smart card manufacturing market was led by Gemalto, which held a dominant 35% market share.

- However, Giesecke & Devrient and Oberthur Technologies each accounted for 14% of the market, reflecting a significant competitive presence.

- Sagem Orga contributed to 8% of the market share.

- The 21% remaining is divided among various other manufacturers. Indicating a diverse and competitive landscape within the smart card industry at that time.

Regional Analysis of the Global Smart Card Market

- The global smart card market is dominated by the Asia-Pacific (APAC) region. Which holds the largest share at 39.4%.

- North America follows with a market share of 26.5%, while Europe accounts for 23.0% of the market.

- South America, the Middle East, and Africa (MEA) regions have smaller shares, contributing 6.4% and 4.7%, respectively.

Factors Driving the Demand for Smart Cards

Rise in Cashless Transactions

- The volume of cashless transactions is expected to grow significantly across all regions from 2020 to 2030.

- In the Asia-Pacific region, the transaction volume was USD 494 billion in 2020 and is projected to increase to USD 1,032 billion by 2025 and USD 1,818 billion by 2030.

- Africa’s cashless transaction volume, starting at USD 59 billion in 2020, is expected to reach USD 105 billion by 2025 and USD 172 billion by 2030.

- Europe saw a transaction volume of USD 229 billion in 2020. Which is anticipated to grow to USD 375 billion by 2025 and USD 522 billion by 2030.

- In Latin America, the volume is projected to rise from USD 73 billion in 2020 to USD 111 billion in 2025 and USD 165 billion in 2030.

- The USA and Canada had a combined transaction volume of USD 180 billion in 2020. With forecasts predicting an increase to USD 258 billion by 2025 and USD 349 billion by 2030.

Cashless Payment Adoption

- In 2020, preferences for cashless payment varied significantly across different countries.

- South Korea led with 77% of respondents favoring cashless transactions, followed by Sweden at 74% and Russia at 72%.

- The United Kingdom saw a preference rate of 70%, while both France and China reported 67%.

- In Spain, 61% of respondents preferred to pay without cash, and in Japan, this figure was 60%.

- The United States had a slightly lower rate at 58%, while India stood at 52%.

- Germany had 49% of respondents favoring cashless payments, and the Philippines reported the lowest preference at 33%.

Adoption of Mobile Payments

- The adoption of mobile payments in the United States has shown a steady increase from 2016 to 2022.

- In 2016, there were 18.8 million users, representing a penetration rate of 5.8%.

- In 2022, the adoption reached 36.3 million users, achieving a penetration rate of 10.8%.

Rise in E-commerce Sales

- Retail e-commerce sales worldwide have experienced remarkable growth from 2014 to 2023.

- In 2014, global e-commerce sales amounted to USD 1,336 billion.

- By 2023, global retail e-commerce sales are projected to reach USD 6,542 billion.

Rise in Mobile Transactions

- The volume of mobile payment transactions has shown substantial growth from 2016 to 2022.

- In 2016, the transaction volume was USD 230,365 million.

- The growth accelerated in 2021, with the volume rising to USD 1,326,790 million, and in 2022, it further expanded to USD 1,693,009 million.

History of Smart Cards

- The history of smart cards is marked by significant milestones in technological advancement and widespread adoption across various sectors globally.

- It all began in the 1970s when patents were filed in Japan and France. Laying the groundwork for what would become the smart card.

- By the early 1980s, field trials of IC cards in banking and telecommunications began in France, leading to successful implementations in ATM cards and phone cards by mid-decade.

- The late 1980s saw pivotal developments with large-scale applications such as the U.S. Department of Agriculture’s smart card and the introduction of smart-card-based driver’s licenses in Turkey.

- The 1990s witnessed explosive growth, from electronic benefits transfer systems in the U.S. to nationwide prepaid card projects in Denmark.

- The establishment of EMV standards in 1994 by Europay, MasterCard, and Visa further standardized microchip-based bank cards globally.

- Into the 21st century, smart cards expanded into diverse applications, including telecommunications, military ID cards, and contactless payment systems.

- Initiatives like the Estonia citizen smart card in 2002 and the deployment of EMV cards worldwide by 2014 underscored their increasing ubiquity and security features.

Technical Specification of Smart Cards

- Smart cards are sophisticated portable storage devices that come in various types. Including contact, contactless, and dual-interface models, each with distinct technical specifications.

- Contact smart cards feature a physical contact pad that connects with a card reader.

- In contrast, contactless smart cards use an embedded antenna for radio frequency communication, enhancing convenience and hygiene, especially post-pandemic.

- However, Dual-interface cards combine both technologies for maximum versatility.

- The memory capacity of smart cards ranges from up to 256 KB of RAM for volatile storage to several megabytes of non-volatile flash memory.

- They utilize microprocessors varying from 8-bit to 32-bit, produced by companies like Infineon Technologies and NXP Semiconductors, running on operating systems such as Java Card and MULTOS.

- Encryption standards like AES, DES, and RSA ensure data security, making smart cards ideal for applications in banking, telecommunications, and secure identification.

Smart Card Schemes

- Smart card schemes vary significantly by company, each offering unique specifications tailored to different applications.

- Thales, for instance, provides smart cards used in banking, loyalty programs, access control, and eID with features like advanced encryption (AES, RSA) and compliance with EMV standards for secure transactions.

- Banco Santander’s University Smart Card serves multiple functions, including student identification, access control, and payment capabilities, as well as integrating EMV and contactless technologies.

- In Bangladesh, the TakaPay card, developed by Fime, focuses on local transactions to minimize foreign exchange costs and enhance financial security, following similar initiatives in neighboring countries.

- SmartCitizen specializes in local government schemes, offering cards that facilitate electronic service delivery and improve citizen accessibility.

Regulations for Smart Cards

- Moreover, Regulations for smart cards vary significantly by country, reflecting different security, usage, and compliance requirements.

- In the United States, the Federal Information Processing Standard (FIPS) 201-3 establishes guidelines for Personal Identity Verification (PIV) cards used by federal employees and contractors to access secure facilities and systems.

- In the European Union, the EMV standard, developed by Europay, MasterCard, and Visa, governs the interoperability and security of smart payment cards, ensuring secure transactions across member states.

- In the Philippines, the SIM Registration Act mandates the registration of all SIM cards, including those embedded in smart cards, to combat fraud and enhance security.

- South Africa’s smart ID card system, introduced by the Department of Home Affairs, integrates biometric data to improve identity verification and reduce fraud.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)