Table of Contents

Introduction

Smart contracts in parametric insurance are fundamentally rewriting how insurance policies are managed and paid out. These digital agreements are built on blockchain technology and designed to automatically execute when specific, objective conditions are met. In simple terms, a smart contract acts as a programmable insurance policy: once a predefined event occurs, like a certain amount of rainfall, the contract analyzes the data and, if the parameters are satisfied, it immediately releases the payment to the insured. All of this happens without intermediaries or lengthy paperwork, significantly reducing administrative delays and uncertainty.

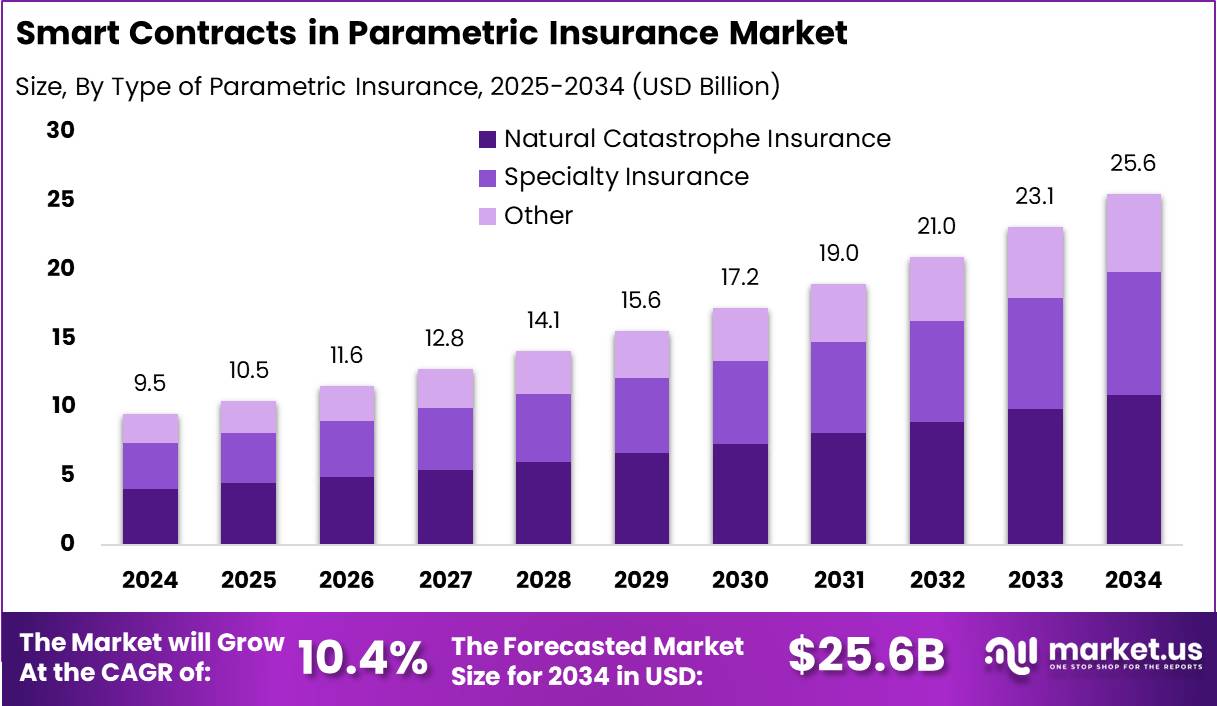

From 2025 to 2034, the market is expected to grow at a CAGR of 10.4%, signaling strong long-term confidence in the role of smart contracts within insurance ecosystems. By 2034, the market is projected to reach approximately USD 25.6 billion, up from USD 9.5 billion in 2024. This growth reflects a broader industry shift toward data-driven risk assessment and instant claims processing, especially in sectors vulnerable to natural disasters and economic volatility.

A key feature of smart contracts is their reliance on external trusted data sources known as oracles. These oracles deliver real-world information to the blockchain in real time. For example, if a satellite weather feed reports rainfall above 50 millimeters within 24 hours, and this threshold is written into the contract, the insurance payout is executed immediately. This offers not only greater speed but also enhanced transparency and reduced fraud risk. By removing subjective human assessment, disputes are minimized and policyholders receive compensation based purely on data-driven parameters.

According to Market.us, The Global Smart Contracts Market is showing strong momentum, valued at USD 1.9 billion in 2024 and expected to grow at a CAGR of 25.8% through 2033. Growth is driven by the need for secure, automated digital agreements in sectors like finance, logistics, and decentralized apps. These contracts reduce manual processes, increase transparency, and enable faster execution without third parties.

Similarly, The Parametric Insurance Market is also expanding steadily, set to reach USD 40.6 billion by 2033, up from USD 15.8 billion in 2023, at a CAGR of 9.9%. North America led with 35% market share and USD 5.5 billion revenue in 2023, backed by a strong insurance infrastructure and early use of parametric models for faster payouts in disaster scenarios.

Key Takeaways

- The smart contracts in parametric insurance market is showing clear signs of rapid expansion. By 2034, the market is expected to reach USD 25.6 billion, growing from USD 9.5 billion in 2024. This growth is projected at a steady CAGR of 10.4% from 2025 to 2034.

- In 2024, North America held a dominant position, capturing 35.6% of the global market. This translates to USD 3.3 billion in revenue generated from the region alone.

- The United States has emerged as a key contributor, with its market valued at USD 2.7 billion in 2024. This market is forecasted to grow at a CAGR of 8.9%, underlining the country’s strong adoption of parametric models.

- On the basis of components, Parametric Insurance Software claimed the largest market share in 2024. This segment held a commanding 78.4% share, driven by increasing digitization and automation in policy issuance and claims.

- Among applications, Natural Catastrophe Insurance stood out as the leading segment. It accounted for 42.7% of the total market share in 2024, highlighting the growing need for swift financial response mechanisms in climate-related events.

- In terms of technology, Blockchain-based Smart Contracts emerged as the most widely used. These contracts secured a 55.6% share in 2024, favored for their transparency, automation, and fraud resistance in parametric payouts.

- By end user, Corporations held the largest share of 48.6% in 2024. The corporate sector is increasingly adopting parametric insurance solutions to cover climate risk, supply chain disruptions, and operational losses.

The application of blockchain ensures that smart contracts are tamper-proof, traceable, and automatically enforced once conditions are met. This architecture allows parametric policies to be highly efficient in sectors such as agriculture, travel, and disaster relief where timely payouts are critical. Moreover, operational overheads are reduced, and the customer experience improves through reduced wait times. The result is a more resilient and cost-effective insurance model that aligns well with digital transformation strategies.

Smart contracts deliver three key advantages in parametric insurance. First, they slash the time it takes to issue payments from weeks to mere minutes because everything happens automatically when the event occurs. Second, they drive down operational costs since there is almost no paperwork or administrative work required. Third, they create a transparent claims environment, as the contract code and data sources are visible to everyone, reducing disputes and boosting trust between insurers and policyholders.

Real-world innovation is driving the adoption of these solutions in areas such as agriculture and natural disaster coverage, where speed and certainty of financial relief are essential. Still, implementing smart contracts does come with challenges, including the need for robust data quality and the complexity of blockchain for non-technical users. Despite these hurdles, the shift to automated, transparent, and data-driven insurance is well underway, promising to reshape industry standards and improve the experience for everyone involved.

Report Scope

| Report Features | Description |

|---|---|

| Market Value (2024) | USD 9.5 Bn |

| Forecast Revenue (2034) | USD 25.6 Bn |

| CAGR (2025-2034) | 10.4% |

| Base Year for Estimation | 2024 |

| Historic Period | 2020-2023 |

| Forecast Period | 2025-2034 |

Emerging Trend Analysis

Integration with Advanced Data Analytics and AI

One notable trend shaping smart contracts in parametric insurance is the integration of advanced data analytics and artificial intelligence. Insurers are now harnessing these technologies to create highly responsive and accurate risk assessment models. With AI-driven analysis, smart contracts can better predict and automate payouts by processing streams of data from sources like sensors, satellites, or weather stations. This automation not only sharpens the precision of parametric triggers but also makes insurance products more adaptive to real-life conditions, enabling faster settlements for policyholders.

Driver Analysis

Demand for Efficient and Transparent Claims Processing

A powerful driver behind the rise of smart contracts in parametric insurance is the growing demand for efficient, straightforward, and transparent claims processes. Traditional claim handling often involves delays, paperwork, and back-and-forth communication. Smart contracts automate these steps, so claims get triggered and processed automatically once predefined parameters – like rainfall levels or wind speeds – are met. This immediate response builds trust among customers, minimizes disputes, and encourages a fair insurance practice grounded in objective data.

Restraint Analysis

Complexity and Trust Issues

Despite the technological benefits, one of the main restraints holding back the wider adoption of smart contracts in parametric insurance is the complexity of the technology itself and a lack of general understanding. Many potential users, both policyholders and providers, find the concept of self-executing digital contracts difficult to grasp. This uncertainty can lead to hesitance, with some preferring familiar traditional insurance methods. There are also concerns around how data, which triggers automated payouts, is sourced and managed, making people wary of losing control over claims processes.

Opportunity Analysis

Expansion into New, High-Risk Markets

Smart contracts give insurers the ability to design flexible insurance products tailored for markets that were previously underserved because of high risk or lack of traditional data structures. Through automated and objective payouts, parametric insurance can now cover regions prone to natural disasters or irregular weather, providing crucial support quickly where it’s needed most. This approach brings new financial security to individuals and communities that were once excluded from conventional insurance systems.

Challenge Analysis

Navigating Evolving Regulatory and Legal Frameworks

A significant challenge in deploying smart contracts within parametric insurance is navigating the rapidly changing regulatory and legal landscape. The technology is advancing much faster than regulations can keep up, and existing insurance laws are not always equipped to address blockchain-based, automated processes. Insurers, regulators, and policyholders all face uncertainty as they work to ensure contracts are legally sound, enforceable, and secure. Industry-wide standards and transparent guidelines are needed to build confidence and support further growth in this innovative space.

In essence, smart contracts are breathing new life into parametric insurance by making it faster, fairer, and more accessible. They offer clear, actionable agreements that both parties can rely on, using technology to cut out complexity and get financial help where it’s needed, when it’s needed, without the usual hurdles or misunderstandings.

Top Key Players in the Market

- Swiss Re

- Munich Reinsurance America, Inc.

- AXA SA

- Zurich American Insurance Company

- Allianz

- QBE Insurance Group Ltd.

- Sompo Holdings, Inc.

- Beazley Group

- Arbol

- Raincoat

- Others

Source: https://market.us/report/smart-contracts-in-parametric-insurance-market/