Table of Contents

Introduction

The Global Smart Door Lock Market is projected to grow significantly, reaching an estimated value of USD 10.9 billion by 2033, up from USD 2.3 billion in 2023. This growth represents a robust compound annual growth rate (CAGR) of 16.8% over the forecast period from 2024 to 2033.

A smart door lock is an advanced locking mechanism that leverages wireless communication protocols, such as Bluetooth, Wi-Fi, or Z-Wave, to provide enhanced security and convenience. These locks allow users to control access to their doors through smartphones, keypads, or biometric authentication methods like fingerprint scanning.

Beyond traditional functionality, smart locks often integrate with broader smart home ecosystems, offering features such as remote locking and unlocking, real-time access monitoring, and automated locking schedules. Their ability to combine security with connectivity makes them a key component in the growing Internet of Things (IoT) landscape.

The smart door lock market refers to the global industry focused on the development, production, and distribution of intelligent locking solutions for residential, commercial, and institutional applications. This market encompasses a diverse range of products, including standalone smart locks, integrated locks for smart home ecosystems, and enterprise-grade solutions for secure facility management. The smart door lock market is shaped by advancements in IoT technologies, growing consumer awareness about smart home products, and increasing demand for security solutions that offer both functionality and user-friendly interfaces.

Several factors are driving the growth of the smart door lock market. The rise in urbanization and smart city initiatives globally has boosted the demand for connected devices, with smart locks being a critical element of smart home security systems. Additionally, growing security concerns among homeowners and businesses have propelled the adoption of innovative solutions that provide real-time monitoring and control.

Advances in wireless technology and increasing smartphone penetration are also contributing to the growth of this market, as they make remote access and management of smart locks more practical and accessible to a broad consumer base. Furthermore, the declining cost of IoT components and sensors has helped manufacturers develop cost-effective solutions, further accelerating market growth.

The demand for smart door locks is expanding across various sectors, driven primarily by the residential segment, where homeowners are seeking enhanced convenience and security. The hospitality industry is another significant driver, as hotels adopt smart locks to streamline guest experiences with keyless entry systems. Commercial and institutional sectors are also showing increasing interest, particularly for managing large-scale access control in offices, schools, and healthcare facilities. The rising awareness of smart technologies, coupled with a growing preference for customizable and scalable security solutions, has reinforced demand globally.

The smart door lock market offers considerable opportunities, particularly in emerging markets where urbanization and digital transformation are on the rise. Governments and private developers investing in smart city projects present a lucrative avenue for market growth. Additionally, the integration of AI and machine learning technologies into smart locks—enabling features like behavior-based access control and predictive maintenance—offers significant potential for innovation.

Partnerships between smart lock manufacturers and IoT platform providers could unlock new revenue streams by offering subscription-based services for remote management and analytics. Moreover, the evolving demand for eco-friendly and energy-efficient solutions may lead to the development of sustainable smart lock systems, opening a new frontier in product differentiation.

Key Takeaways

- The smart door lock market was valued at USD 2.3 billion in 2023 and is expected to reach USD 10.9 billion by 2033, growing at a CAGR of 16.8%.

- In 2023, deadbolt locks held 27% market share, favored for their strong security in homes and businesses.

- Biometric locks led with a 35% share, driven by the rising demand for advanced security features.

- Wi-Fi technology dominated in 2023 due to its easy integration with smart home systems.

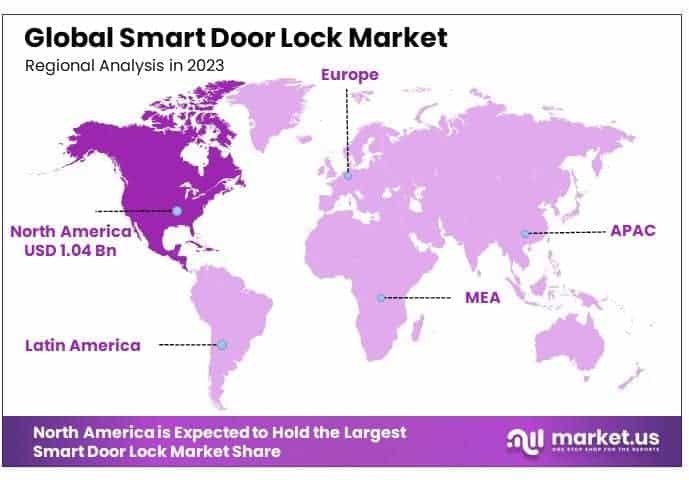

- North America led the market with 45% share, driven by the high adoption of smart home technologies.

Smart Door Lock Statistics

- 55.7% of women lock their front doors while at home, compared to 44.3% of men.

- 61.1% of women post on social media when away from home, which may alert burglars.

- Homes without security systems are 300% more likely to be burglarized.

- 46.9% of people do not have a home security system installed.

- 34% of burglars enter through the front door.

- 81% of homebuyers view smart home technology as important.

- 80% of smart locks include app-based remote control features.

- 70% of people forget to lock their doors when leaving home.

- 60% of people have found their doors unlocked upon returning.

- Around 2 million people lock themselves out of their homes annually.

- Doors and windows cause 20-30% of home heat loss.

- About 30% of burglars use unlocked doors or windows to enter homes.

- There are 3.5 billion smartphone users globally, accounting for 45.4% of the population.

- Smart speakers are adopted by 28% of U.S. households, surpassing smart locks.

- Over 12 million U.S. homes already use smart locks.

- Over 70% of consumers prefer keyless entry systems for convenience and security.

- 72% of users prefer smart locks that retain a traditional design.

- 37% of home insurance providers offer discounts for homes with smart locks.

Emerging Trends

- Increased Integration with IoT Ecosystems: Smart door locks are increasingly becoming a central component of IoT-enabled smart homes. They now seamlessly integrate with devices like smart thermostats, cameras, and voice assistants such as Alexa or Google Assistant, offering users full control of home security via mobile apps. By 2023, over 58% of smart home systems in developed regions included smart locks as part of their connected ecosystem.

- Adoption of Biometric Authentication: Fingerprint recognition and facial recognition are emerging as key features in smart locks. These technologies provide enhanced security compared to traditional PIN codes or mechanical keys. Approximately 25% of new smart door locks launched in 2022-2023 were equipped with biometric capabilities, emphasizing the shift toward higher security standards.

- Shift Toward Cloud-Based Security Solutions: Many smart locks now rely on cloud computing for secure data storage and remote control functionalities. Cloud-based solutions also enable real-time alerts and activity logs, which have become essential for users who want to monitor access remotely. This trend is particularly popular in urban areas, where over 60% of homes with smart locks use cloud-based apps for control.

- Energy-Efficient and Battery-Powered Designs: Manufacturers are designing smart locks with energy-efficient mechanisms, ensuring that batteries last longer (up to 12-18 months). Many devices now include low-power communication technologies like Bluetooth Low Energy (BLE), catering to sustainability-conscious consumers and reducing long-term operational costs.

- Expansion of Commercial and Multi-Unit Applications: While residential usage remains dominant, smart door locks are rapidly penetrating commercial and multi-unit housing sectors, such as rental apartments and co-working spaces. This shift is driven by the need for keyless access, centralized management systems, and flexibility in granting time-limited access for multiple users. These applications now account for nearly 35% of the smart lock market’s installations globally.

Top Use Cases

- Residential Security Enhancements: Homeowners adopt smart locks primarily to strengthen security. These devices offer keyless entry through PIN codes, biometrics, or mobile apps, significantly reducing the risk of traditional key theft or lock picking. Studies indicate that 70% of smart lock installations occur in single-family homes.

- Short-Term Rentals and Hospitality Industry: Property owners in the vacation rental market, such as Airbnb hosts, leverage smart locks to streamline guest check-ins. Temporary access codes are provided, reducing the need for physical keys and enhancing convenience. It is estimated that over 40% of vacation rental properties in North America now use smart lock systems.

- Workplace and Office Access Management: Businesses increasingly adopt smart locks to enhance workplace security and streamline employee access. Smart locks can manage time-sensitive access permissions and provide logs of entry events. This feature is especially popular among co-working spaces, where 30-40% use such systems for user flexibility.

- Elderly and Disability-Friendly Solutions: Smart locks improve accessibility for elderly or disabled individuals by enabling hands-free operation via voice commands or automated unlocking through geofencing. Devices with such functionality are gaining popularity, with nearly 20% of new smart locks offering accessibility-focused features.

- Package Delivery Security: As e-commerce grows, smart locks are used to secure in-home or in-garage package deliveries. Partnerships with logistics companies, such as those enabling Amazon Key deliveries, have popularized this use case. Reports suggest that by 2024, nearly 10% of smart lock users will use these systems for package deliveries.

Major Challenges

- High Initial Costs: Smart locks are significantly more expensive than traditional locks, with prices ranging between $150 to $500, excluding installation costs. This higher price point limits adoption, particularly in developing markets where affordability is a key concern.

- Cybersecurity and Privacy Risks: The reliance on connectivity makes smart locks vulnerable to hacking. In 2022 alone, there were multiple instances of smart lock systems being compromised, raising concerns among consumers about data privacy and unauthorized access.

- Dependence on Stable Internet Connections: Many smart locks require reliable Wi-Fi or Bluetooth connections for real-time access and notifications. Connectivity issues can result in users being locked out or unable to monitor activity remotely, which is especially problematic in rural or underserved areas.

- Battery Life Limitations: Despite advancements, battery-powered smart locks require regular maintenance. On average, users need to replace batteries every 12-18 months, but frequent use can drain batteries faster. A dead battery can leave users locked out without a backup solution.

- Complex Installation and Compatibility Issues: Some smart locks require professional installation, adding to the overall cost. Additionally, not all locks are compatible with older door designs or existing home systems, creating a barrier for users in retrofitting their homes with new technology.

Top Opportunities

- Rising Demand in Emerging Markets: With urbanization accelerating in countries like India, Brazil, and Indonesia, there is a growing interest in smart home solutions, including smart locks. Over 70 million middle-class households in these regions are projected to adopt smart home devices by 2030, offering significant growth potential.

- Expansion of Rental and Multi-Family Housing Market: Landlords and property managers are adopting smart locks to enhance security and convenience for tenants. With over 25% of the global population living in rented accommodations, this sector offers untapped opportunities for the adoption of centralized access control systems.

- Growing Interest in Sustainability Features: Energy-efficient smart locks with eco-friendly materials are gaining traction among environmentally conscious consumers. The market for energy-efficient smart devices, including smart locks, is expected to grow as green building certifications become mandatory in several countries.

- Advances in 5G Technology: The rollout of 5G networks enables faster and more reliable connectivity for smart locks. This advancement enhances real-time functionalities like instant notifications, remote access, and video streaming through connected cameras, creating a better user experience.

- Development of Subscription-Based Service Models: Manufacturers are beginning to offer subscription-based models for advanced features, such as enhanced security monitoring and cloud storage for activity logs. These models create recurring revenue streams and encourage users to remain within a specific brand’s ecosystem. For instance, subscriptions as low as $10 per month can generate substantial revenue while ensuring customer retention.

North America Smart Door Lock Market

North America Leads the Smart Door Lock Market with Largest Market Share of 45%

North America emerged as the leading region in the global smart door lock market in 2023, capturing a dominant 45% market share and generating an estimated revenue of USD 1.04 billion. The region’s leadership is underpinned by a high adoption rate of smart home technologies, robust consumer demand for advanced home security solutions, and widespread connectivity infrastructure. Countries like the United States and Canada are key contributors to this growth, driven by increasing investments in IoT-enabled home automation and heightened awareness regarding property safety.

Additionally, the rapid urbanization in metropolitan areas and the rising penetration of 5G networks have further fueled the adoption of smart door locks. The North American market is further supported by strong distribution networks and the presence of leading smart lock manufacturers, solidifying its position as a dominant force in the global landscape.

Key Player Analysis

- Samsung Electronics Co., Ltd.: Samsung is a dominant player in the smart lock market, leveraging its technological prowess and global brand presence. The company’s smart locks, such as the Samsung SHP-DP609, combine advanced biometric security with Bluetooth and Wi-Fi connectivity, allowing remote access via smartphones. Samsung’s focus on integrating these locks into its SmartThings ecosystem has strengthened its position in the smart home sector. As of 2023, Samsung captured a significant share of the market in Asia-Pacific and North America, with its sales surpassing 4 million units annually.

- Honeywell International, Inc.: Honeywell has established itself as a key player in smart locks by combining its expertise in industrial automation and consumer IoT. The company’s products, such as the Honeywell Electronic Digital Deadbolt, emphasize durability, data encryption, and easy integration with home automation platforms. Honeywell reported revenue from its home security segment exceeding $1.3 billion in 2022, a substantial portion attributed to smart locks. Its strong foothold in North America and Europe positions it as a trusted brand among enterprise and residential customers.

- Panasonic Corporation: Panasonic has carved a niche in the market by developing high-quality, IoT-enabled locks tailored for urban smart homes and apartments. The Panasonic Smart Door Lock series features PIN codes, RFID, and smartphone control, offering versatility and convenience. With a focus on Japan and Southeast Asia, Panasonic’s smart lock sales exceeded 3.5 million units in 2023, contributing significantly to its broader smart home solutions revenue. The company’s innovations are aimed at balancing user experience with security.

- Godrej Group: Godrej, an established leader in home security, has gained prominence in the smart lock market, especially in India and the Middle East. Its flagship products, such as the Godrej Smart Lock Advantis, integrate biometric fingerprint access, RFID cards, and Wi-Fi control, catering to both premium and mid-range segments. In 2023, Godrej reported a 22% year-over-year growth in its smart lock division, driven by increasing urbanization and consumer preference for secure, connected homes.

- Xiaomi Corporation: Xiaomi, known for its cost-effective smart home products, is a growing competitor in the smart lock market. Its Mi Smart Door Lock Pro, priced competitively at under $200, features 3D face recognition, fingerprint access, and integration with the Xiaomi Home ecosystem. By leveraging its vast global distribution network and focus on affordability, Xiaomi sold over 6 million smart locks in 2023, making it a leader in emerging markets, particularly in China and Southeast Asia.

Recent Developments

- In January 15, 2024 – Samsung Electronics introduces its cutting-edge Smart Lock Galaxy Access Pro at CES 2024. This advanced lock integrates AI-driven fingerprint scanning, smartphone control via SmartThings, and multi-level encryption, enhancing home security while ensuring user convenience. Samsung aims to set new benchmarks in the connected home ecosystem with this launch.

- In March 22, 2024 – August Home, a leader in smart home solutions, expands its portfolio with the launch of the August Wi-Fi Smart Lock 3rd Gen. The device offers improved battery life, advanced voice control integration, and upgraded auto-lock features. August Home continues to strengthen its position in the premium smart lock segment with this release.

- In April 9, 2024 – Schlage unveils Encode Plus 2.0 at a press event in New York. The new smart lock introduces NFC-enabled unlocking and compatibility with Apple’s HomeKit ecosystem. Schlage aims to attract tech-savvy homeowners seeking effortless security solutions that integrate seamlessly with smart home systems.

- In July 10, 2024 – Huawei debuts its VisionLock Pro in the Chinese market, combining facial recognition, voice authentication, and tamper-proof materials. The VisionLock Pro is part of Huawei’s broader strategy to expand its IoT product portfolio and enhance smart home adoption.

Conclusion

The smart door lock market is poised for substantial growth, driven by advancements in IoT technologies, rising consumer demand for enhanced security, and the increasing integration of smart locks into connected home ecosystems. As urbanization accelerates and digital transformation spreads globally, the adoption of smart locks is becoming more prevalent across residential, commercial, and institutional sectors.

These devices address modern security needs with features like biometric authentication, remote access, and real-time monitoring, while also catering to user preferences for convenience and customization. Despite challenges such as high initial costs and cybersecurity concerns, innovations in connectivity, sustainability, and AI-driven functionalities continue to unlock new opportunities. The market’s trajectory reflects a strong shift toward smarter, more secure living environments, positioning smart door locks as a vital element in the evolving IoT landscape.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)