Table of Contents

Introduction

A smart E-drive, or electronic drive system, is an integral component of electric and hybrid vehicles. It comprises an electric motor, power electronics, and battery pack, working collectively to drive the vehicle’s wheels. The advanced electronics control the speed and torque of the motor, ensuring optimal efficiency and performance. Smart E-drives are designed to enhance the energy efficiency of vehicles while reducing their environmental impact, making them a crucial technology in the shift towards sustainable transportation.

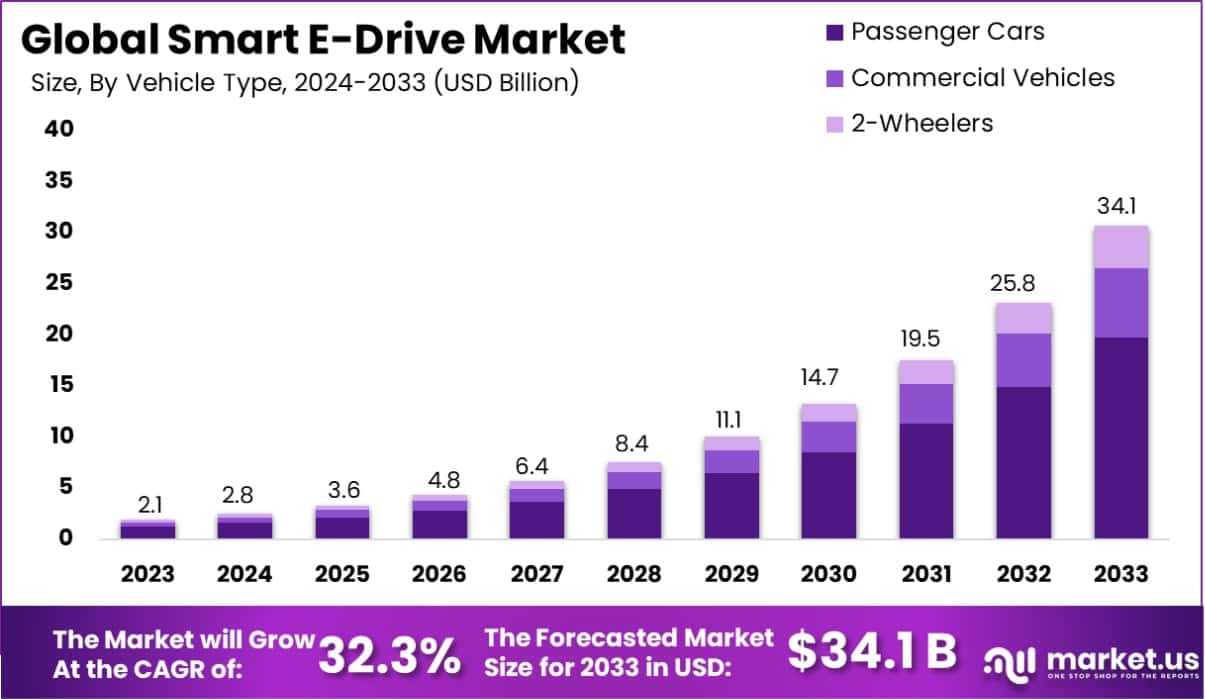

According to Market.us, The Global Smart E-Drive Market is projected to escalate from a valuation of USD 2.1 billion in 2023 to approximately USD 34.1 billion by 2033. This growth represents a robust Compound Annual Growth Rate (CAGR) of 32.8% over the forecast period from 2024 to 2033. This substantial expansion underscores the accelerating adoption of electric vehicles and the integration of advanced drive technologies in response to increasing environmental sustainability initiatives globally.

The Smart E-Drive market is witnessing significant growth, driven by the rising demand for electric vehicles (EVs) and hybrid electric vehicles (HEVs) globally. This market expansion can be attributed to increasing environmental concerns, stringent government regulations on vehicle emissions, and advancements in battery technology which improve the range and performance of electric vehicles. Market dynamics are further influenced by investments in automotive technology and the integration of IoT and AI, which enhance the functionality and efficiency of smart E-drives.

The competitive landscape is characterized by innovation and collaboration among automotive manufacturers and technology providers, aiming to capitalize on the growing trend of electrification in the transportation sector. The demand for smart E-drives is primarily fueled by the global push towards electrification of transport as a measure to reduce carbon emissions and dependence on fossil fuels. This demand is further bolstered by consumer preferences shifting towards electric vehicles due to their lower operating costs and increasing availability of charging infrastructure.

Additionally, technological advancements such as improved battery life, enhanced motor efficiency, and smarter power management systems contribute to the growing appeal of EVs equipped with smart E-drives. Governments around the world are supporting this shift with incentives, subsidies, and stringent regulatory frameworks, which encourage both manufacturers and consumers to move towards more sustainable transportation options.

The smart E-drive market presents substantial opportunities for various stakeholders, including automotive OEMs, technology developers, and battery manufacturers. There is a significant opportunity for innovation in the design and integration of more compact, efficient, and powerful E-drive systems that can be adapted across different vehicle platforms.

Furthermore, as the automotive industry continues to evolve towards autonomous and connected vehicles, the integration of smart E-drive systems with these technologies opens new avenues for growth. The market also benefits from the growing trend of vehicle electrification in emerging economies, where there is a rapid expansion of automotive production capabilities and infrastructure development. This global transition towards electric vehicles represents a long-term growth opportunity for companies investing in smart E-drive technology.

Key Takeaways

- The Global Smart E-Drive Market is projected to experience substantial growth, with its valuation expected to escalate from USD 2.1 billion in 2023 to approximately USD 34.1 billion by 2033. This represents a robust compound annual growth rate (CAGR) of 32.8% during the forecast period from 2024 to 2033.

- In the vehicle-type segmentation, Passenger Cars emerged as the leading category within the Smart E-Drive Market in 2023, securing a dominant share of over 58%. This segment’s predominance underscores its pivotal role in the market’s expansion.

- Regarding the Electric Vehicle (EV) type, Battery Electric Vehicles (BEVs) were the foremost contributors, holding a commanding market share exceeding 51% in 2023. This dominance is indicative of the growing inclination towards fully electric vehicles, which are pivotal in driving the demand for smart e-drives.

- In the application spectrum, the E-Axle application was preeminent, accounting for more than 55% of the market share in 2023. The significant share held by E-Axle highlights its critical function and integration within the smart e-drive systems.

- From a components perspective, EV Batteries stood out as the leading segment, capturing over 36% of the market share in 2023. The substantial share held by EV batteries emphasizes their essential role in the functionality and efficiency of electric vehicles.

- In terms of drive type, Front Wheel Drive configurations were predominant, garnering a market share of more than 43%. This configuration’s widespread adoption is reflective of its efficiency and reliability in vehicle performance.

- Geographically, the Asia Pacific region dominated the market, holding a 45% share and generating revenue of USD 0.93 billion in 2023. This significant market share is driven by the rapid advancements and adoption of electric vehicle technologies within the region, highlighting its leadership in the global smart e-drive market.

- In 2023, the global electric vehicle (EV) market demonstrated significant growth, predominantly driven by substantial registration increases in three major regions: China, Europe, and the United States. According to data from the International Energy Agency (IEA), these regions collectively represented nearly 95% of the global sales volume for new electric cars.

- Specifically, China led with approximately 8.1 million new registrations, accounting for around 60% of the global total. Europe followed with nearly 3.2 million new electric cars, contributing about 25% to the global market. The United States also showed notable growth, with around 1.4 million new registrations, making up 10% of the global share.

- This surge in registrations brought the total number of electric cars globally to approximately 40 million by the end of 2023, marking a significant increase in the global fleet and highlighting a robust expansion trend within the electric vehicle sector. This growth trajectory underscores the accelerating shift towards sustainable transportation solutions across key global markets.

Smart E-Drive Statistics

- Global Trends: Approximately 1-in-4 new cars sold globally in 2023 were electric. This statistic emphasizes a substantial market shift towards electric vehicles (EVs). Norway led with over 90% of new car sales being electric, followed by China at almost 40%.

- U.S. Market Dynamics: The U.S. experienced significant growth in EV and hybrid sales, with nearly 918,500 light electric vehicles sold in 2022. This trend underscores the increasing acceptance and demand for electric mobility solutions in the U.S. market.

- Model Availability: By the end of 2023, there were 70 different battery electric vehicle (BEV) models available in the U.S., reflecting a broadening of the market with 20 new models introduced that year.

- Price Trends: The average transaction price for BEVs decreased to $50,798 in December 2023, marking a 24.2% decrease from the peak in mid-2022. This reduction in prices could make EVs more accessible to a broader consumer base.

- Sales Performance: Electric car sales globally neared 14 million in 2023, with 95% of these sales occurring in China, Europe, and the United States. This highlights the concentrated growth of EV markets in these regions.

- Year-on-Year Growth: Electric car sales in 2023 were 3.5 million higher than in 2022, representing a 35% year-on-year increase. This growth rate is more than six times higher than that of 2018, demonstrating significant market expansion over a five-year period.

- Weekly Registrations: There were over 250,000 new registrations per week in 2023, a figure that surpasses the annual total of new registrations in 2013. This comparison illustrates the rapid adoption and normalization of electric vehicles in the automotive market.

- Market Share of Electric Cars: Electric cars accounted for about 18% of all cars sold in 2023, up from 14% in 2022 and only 2% five years earlier, in 2018. Battery electric cars made up 70% of the electric car stock in 2023, indicating a preference for fully electric models over hybrids.

- U.S. Market Share: Combined sales of hybrid vehicles, plug-in hybrid electric vehicles, and battery electric vehicles in the United States rose to 16.3% of total new light-duty vehicle (LDV) sales in 2023. By the second quarter of 2024, this figure had increased to 18.7%, showing continuous growth in the sector.

Emerging Trends

- Eco-Friendly Initiatives: With the global shift towards sustainability, there’s a significant focus on developing eco-friendly vehicles. This has spurred the demand for smart e-drives as they are crucial in reducing vehicle emissions and enhancing energy efficiency.

- Integration of Advanced Software: Software-defined electric propulsion is gaining traction. Advanced software algorithms are used to optimize power delivery, enhance energy management, and offer personalized driving experiences. This also includes capabilities for remote software updates, which are increasingly becoming a standard feature in smart e-drives.

- Solid-State Batteries: Companies are investing in the next generation of battery technology – solid-state batteries. These promise higher energy density, faster charging times, and increased safety, potentially revolutionizing the smart e-drive sector.

- Silicon Carbide Power Electronics: Replacing traditional silicon with silicon carbide in power electronics reduces energy losses and supports faster charging. This technology is notable for its efficiency and performance enhancements, crucial for improving smart e-drives’ overall functionality.

- Vehicle-to-Grid (V2G) Technology: Smart e-drives are evolving to support bi-directional charging, allowing electric vehicles to return power to the grid. This not only benefits the electrical grid during peak demands but also offers potential revenue streams for vehicle owners.

Top Use Cases for Smart E-Drives

- Passenger Electric Vehicles: Dominating the market, these vehicles benefit significantly from smart e-drive technologies, which provide better mileage per charge and improved vehicle performance.

- Commercial Electric Vehicles: The integration of smart e-drives in commercial vehicles is enhancing their operational efficiency, making them more attractive for businesses focusing on cost-effectiveness and reduced environmental impact.

- High-Performance Vehicles: Companies like Rimac are leveraging smart e-drive technology to deliver exceptional performance in luxury electric vehicles, pushing the boundaries of what electric drivetrains can achieve.

- Hybrid Electric Vehicles (HEVs): Smart e-drives are integral in HEVs, managing the interaction between electric and conventional power sources to optimize fuel efficiency and reduce emissions.

- Autonomous Vehicles: The precision control offered by smart e-drives is critical for the operation of autonomous vehicles, ensuring smooth power delivery and enhanced vehicle control essential for safety and reliability in self-driving modes.

Major Challenges

- High Initial Costs: Electric vehicles (EVs), integral to the smart e-drive market, tend to have higher initial purchase prices primarily due to the expensive materials and processes involved in battery production. This factor remains a significant barrier to consumer adoption despite potential long-term savings on fuel.

- Limited Charging Infrastructure: The lack of widespread and accessible public charging facilities continues to deter potential customers, contributing to range anxiety. The development of adequate charging infrastructure is crucial to support the widespread adoption of EVs.

- Grid Capacity Limitations: As EV adoption increases, there is a pressing need for enhanced power generation capacity to prevent straining the electric grid. This challenge necessitates considerable upgrades to existing grid infrastructures to handle the increased load from widespread EV usage.

- Technological Integration: The integration of advanced technologies such as autonomous driving systems into smart e-drives requires extensive testing and regulatory approvals, which can delay product launches and increase development costs.

- Consumer Awareness and Education: Despite the environmental and economic benefits of EVs, a significant portion of potential consumers remains unaware of these advantages. Educational initiatives are required to bridge this knowledge gap and foster broader acceptance and adoption of smart e-drive technologies.

Top Opportunities

- Regulatory Support and Emission Standards: Increasingly stringent global emissions regulations are driving the automotive industry toward electrification, presenting significant growth opportunities for the smart e-drive market. Government incentives and subsidies for EVs further bolster this trend.

- Advancements in Battery Technology: Improvements in battery technology that enhance energy density and reduce costs are key enablers for the next generation of smart e-drives. These advancements are essential for extending the driving range and reducing the overall vehicle cost, making EVs more appealing to a broader consumer base.

- Increase in Fuel Economy and Vehicle Efficiency: Innovations aimed at improving fuel economy and overall vehicle efficiency continue to create lucrative opportunities in the smart e-drive market, particularly in passenger vehicles.

- Market Expansion in Young Demographics: Young, environmentally-conscious consumers are increasingly interested in adopting EVs, driven by a desire for sustainable and innovative transportation solutions. This demographic shift offers a growing market segment for smart e-drives.

- Integration with Renewable Energy Initiatives: The alignment of EV growth with renewable energy targets, such as solar and wind power, to charge electric vehicles, presents a dual opportunity for environmental sustainability and market growth, fostering a more integrated approach to green transportation.

Recent Developments

- Bosch has focused on expanding its smart mobility portfolio. In 2023, Bosch announced its investment in advanced electrification technologies, particularly hydrogen fuel cells and electric drives, to enhance smart E-drive systems. Bosch’s strategy centers around adapting to the EV market transformation by offering more efficient and scalable electric solutions.

- Continental AG has been investing in smart E-drive innovations as well. The company has launched new electrified axle platforms and has been involved in several partnerships aimed at advancing sustainable mobility. In September 2023, Continental AG announced a collaboration to develop highly efficient electric powertrains, which will likely enhance smart E-drive performance.

- Magna International introduced new technologies for electric vehicles in 2023, including its ClearView vision system designed for Dodge Ram pickup trucks. This system integrates camera and mirror technologies, improving visibility and vehicle safety, which is crucial for advanced electric driving experiences.

- Schaeffler has made moves to merge with Vitesco Technologies in 2023, creating a mega-supplier focused on electrified drive solutions. The merger is expected to rival industry giants like Bosch and ZF Friedrichshafen, positioning the company as a key player in the smart E-drive market.

- ZF Friedrichshafen continues to lead in electric drive technologies, focusing on the development of electric axle systems for passenger cars and commercial vehicles. In early 2023, the company expanded its E-drive solutions to include more cost-effective and flexible electric motors.

Conclusion

The smart E-drive market is poised for substantial growth, driven by the global trend towards vehicle electrification in response to environmental concerns and evolving regulatory landscapes. As demand for electric and hybrid vehicles continues to climb, opportunities for innovation and expansion within this sector are expanding. Manufacturers and technology developers are positioned to benefit from advancements in smart E-drive systems, which are critical to the enhanced performance and efficiency of electric vehicles. With ongoing technological advancements and supportive government policies, the smart E-drive market is expected to thrive, offering significant advantages to stakeholders involved in the sustainable transformation of transportation.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)