Table of Contents

- Introduction

- Editor’s Choice

- Global Smart Manufacturing Market Overview

- Key Technologies Driving Smart Manufacturing

- Smart Manufacturing Investment Statistics

- Impact of Technological Needs in Terms of Costs

- Challenges in Smart Manufacturing

- New Trends in Smart Manufacturing

- Strategies and Responses from Manufacturers

Introduction

According to Smart Manufacturing Statistics, Smart manufacturing represents a contemporary industrial strategy that makes use of cutting-edge technologies like the Internet of Things (IoT), Artificial Intelligence (AI), big data analysis, automation, and additive manufacturing to optimize manufacturing processes, boost effectiveness, minimize downtimes, elevate quality control, and provide tailored solutions.

This transformative approach, although promising substantial advantages, presents difficulties such as initial capital requirements, concerns regarding data security, demands for workforce training, intricacies in integrating with existing systems, and adherence to regulatory standards. The prospects for smart manufacturing look positive, with continuous technological progress anticipated to enhance accessibility and play a crucial role in the ongoing transformation of manufacturing within Industry 4.0.

Editor’s Choice

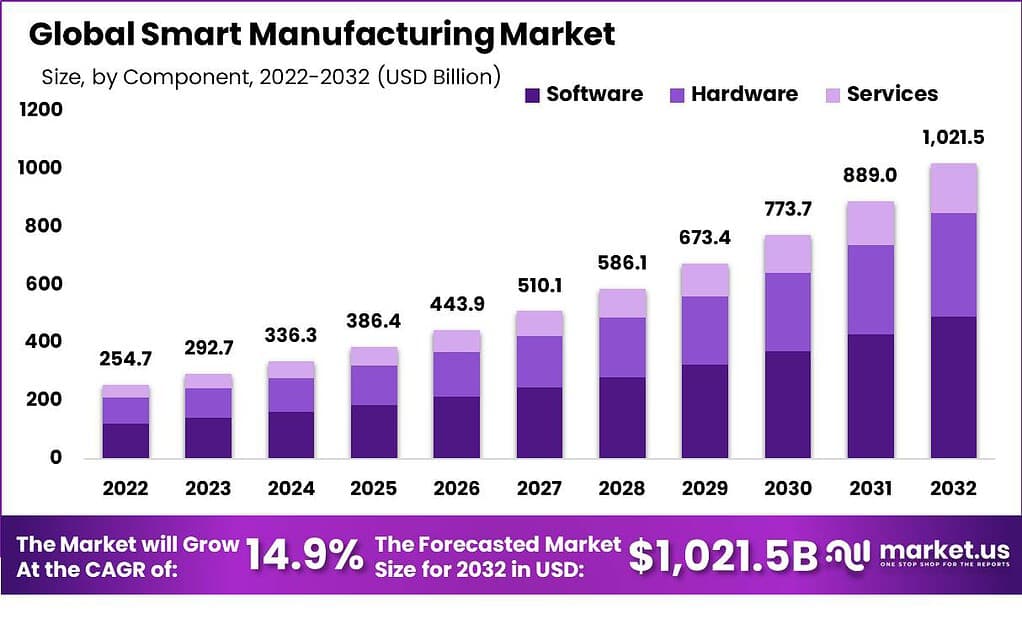

- The smart manufacturing market has been experiencing significant growth at a CAGR of 14.9%, with revenues reaching $254.7 billion in 2022.

- The market’s expansion remains robust, with revenues projected to reach $673.4 billion in 2029 and a significant milestone of $1,021.5 billion by 2032.

- On a global scale, investments in IoT technology are projected to reach a substantial figure of $1 trillion.

- Specifically, 70% of technology leaders anticipate that the AR market will exceed the VR market in revenue, with 49% believing this transition will happen within the next 3 to 5 years.

- The majority of investments, approximately 33%, are directed toward Process Automation, streamlining, and optimizing production processes.

- The global additive manufacturing sector is anticipated to witness substantial growth, with a projected increase of nearly 24% between 2023 and 2025.

- In July 2023, annual construction spending in manufacturing reached US$201 billion, marking a substantial 70% year-over-year growth and signaling positive prospects for the industry in 2024.

Global Smart Manufacturing Market Overview

Global Smart Manufacturing Market Size

- The smart manufacturing market has been experiencing significant growth at a CAGR of 14.9%, with revenues reaching $254.7 billion in 2022.

- As we look further ahead, the growth continues, with revenues expected to surpass the $500 billion mark in 2027 at $510.1 billion.

- The market’s expansion remains robust, with revenues projected to reach $673.4 billion in 2029 and a significant milestone of $1,021.5 billion by 2032.

Key Technologies Driving Smart Manufacturing

Internet of Things (IoT) and Sensors

- Companies engaged in the IoT sector are foreseen to achieve annual revenues exceeding $450 billion.

- The comprehensive IoT market, covering hardware, software, systems integration, and data services, is expected to attain a scale of approximately $520 billion.

- Regarding regional breakdown, the Asia Pacific region is poised to take the lead in IoT expenditure market share, accounting for a notable 35%.

- In close pursuit, North America is projected to contribute 27%. At the same time, the Europe, Middle East, and Africa (EMA) region is expected to account for 25% of the overall expenditure market share, following the Asia Pacific region.

Artificial Intelligence (AI) and Machine Learning

- The global artificial intelligence (AI) market is currently valued at more than $136 billion, and it is expected to experience extraordinary growth, expanding by over 13 times its current value in the next seven years.

- Specifically, the AI industry in the United States is projected to reach $299.64 billion by the year 2026. This expansion of the AI market is characterized by a remarkable compound annual growth rate (CAGR) of 38.1% from 2022 to 2030.

- Furthermore, it’s anticipated that by 2025, the AI sector will employ approximately 97 million individuals worldwide, indicating its substantial workforce involvement.

- The projected global market size for machine learning platforms will be $31.36 billion by 2028.

- 49% of respondents identified AI and ML projects as high-priority initiatives, with 28% considering their top priorities among their company’s IT projects in 2021.

Big Data Analytics

- The big data analytics market is projected to surpass $655 billion by 2029, showing significant growth from approximately $241 billion in 2021.

- In 2020, the predictive analytics market was valued at $5.29 billion, and it is expected to grow substantially, reaching $41.52 billion by 2028.

- Concurrently, the social media analytics market is growing, increasing from $7.01 billion in 2021 to $26.3 billion in 2028.

- Despite this robust market expansion, it’s important to highlight that the transformation process is still ongoing.

- While 57% of leading organizations claim to use data for innovation, only 27% believe they have fully established a “data-driven” organizational culture.

Augmented Reality (AR) and Virtual Reality (VR)

- In 2017, the Augmented Reality (AR) market was estimated to be worth around $3.5 billion, and it is on track for substantial expansion, with a projected value of an astounding $198 billion by 2025.

- However, an alternate source offers a slightly different forecast, suggesting that the AR market could reach $120 billion by 2020. Nevertheless, there is a consensus across various predictions that AR revenues will surpass those of Virtual Reality (VR).

- Specifically, 70% of technology leaders anticipate that the AR market will exceed the VR market in revenue, with 49% believing this transition will happen within the next 3 to 5 years.

- According to the 2019 Augmented Reality Report by Greenlight Insights, the AR market is expected to grow at a somewhat lower but impressive rate, reaching $31 billion by 2023.

Additive Manufacturing (3D Printing)

- The global additive manufacturing market is anticipated to witness substantial growth, with a projected increase of nearly 24% between 2023 and 2025.

- Additionally, the 3D printing market is set to expand significantly, almost tripling in size from 2020 to 2026.

- In 2019, the automotive and manufacturing sectors emerged as the most profitable global additive manufacturing segments.

- During the same year, South Korea led the list of countries with the highest expertise in additive manufacturing, followed by China and Canada.

- Nevertheless, it’s noteworthy that in 2019, more than half of all additive manufacturing companies were in Europe, while around 32% were based in the Americas, with only 13% in Asia.

Smart Manufacturing Investment Statistics

Technological Investments

- When it comes to investing in smart manufacturing technology, companies are allocating their resources strategically.

- The majority of investments, approximately 33%, are directed toward Process Automation, streamlining, and optimizing production processes.

- Cloud-based solutions, including software as a service (SaaS), account for a significant portion, standing at 30%, offering flexibility and accessibility.

- Another essential area of focus is the Industrial Internet of Things (IIoT) and Internet of Things (IoT), collectively representing 25% of investments, enabling connectivity and data-driven decision-making.

- Machine Integration is also a priority, with 24% of investments dedicated to seamless machinery coordination.

Impact of Technological Needs in Terms of Costs

- The annual impact of various technology needs, measured in millions of US dollars, reflects significant contributions to operations.

- Enhanced sensing and monitoring top the list with an annual impact of 10,910 million US dollars, closely followed by advances in analyzing data and trends at 10,134 million US dollars.

- The seamless transmission of digital information is another crucial factor, accounting for an annual impact of 10,310 million US dollars.

- Determining and implementing required action effectively contributes 9,411 million US dollars, showcasing the importance of swift decision-making and execution.

- Managing digital data streams through models plays a significant role with an annual impact of 8,922 million US dollars, while efficiently communicating information to decision-makers is valued at 7,717 million US dollars.

Challenges in Smart Manufacturing

Skills Shortage

- In recent years, the manufacturing sector in the United States has been experiencing a growing skills gap that has raised concerns about its impact on the industry’s productivity.

- Between 2018 and 2028, the manufacturing output as a percentage of the country’s GDP has steadily increased.

- In 2018, it stood at 48 billion USD; by 2028, it is projected to reach 454 billion USD. However, this growth is not without its challenges.

- The manufacturing output at risk due to a skills shortage has also increased during this period.

- In 2018, it was estimated at 48 billion USD. Still, by 2023, it is projected to reach a significant 207 billion USD, indicating a substantial gap between the industry’s output potential and actual performance.

New Trends in Smart Manufacturing

- In July 2023, annual construction spending in manufacturing reached US$201 billion, marking a substantial 70% year-over-year growth and signaling positive prospects for the industry in 2024.

- Despite this expansion, Deloitte’s analysis of the Purchasing Managers’ Index (PMI) data reveals that the manufacturing sector experienced periods of contraction throughout 2023.

- Manufacturing executives are notably confident in the potential of smart factory solutions as primary drivers of competitiveness over the next five years, with 86% expressing this belief.

- Additionally, manufacturers anticipate a potential 12% boost in labor productivity from the industrial metaverse, which could help address ongoing labor shortages.

- Deloitte’s analysis also indicates a 4% increase in average hourly earnings for employees between Q1 FY2022 and Q1 FY2023, along with a substantial 19% reduction in the average number of voluntary separations during the same period.

Strategies and Responses from Manufacturers

- The number of respondents indicating that they lack the necessary technology to outperform competitors has nearly doubled compared to the previous year’s survey.

- A significant 97% of participants have either adopted or intend to adopt smart manufacturing technology within the next 1-2 years.

- Additionally, over two-thirds of manufacturers believe technology can be highly beneficial or exceptionally beneficial in tackling workforce-related challenges.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)