Table of Contents

- Introduction

- Editor’s Choice

- Smart Manufacturing Market Statistics

- Key Technologies Driving Smart Manufacturing Statistics

- Smart Manufacturing Investment Statistics

- Impact of Technological Needs in Terms of Costs

- Challenges in Smart Manufacturing Statistics

- New Trends in Smart Manufacturing Statistics

- Strategies and Responses From Manufacturers

- Conclusion

- FAQs

Introduction

Smart Manufacturing Statistics: Smart manufacturing represents a contemporary industrial strategy using cutting-edge technologies.

Like the Internet of Things (IoT), Artificial Intelligence (AI), big data analysis, automation, and additive manufacturing.

To optimize manufacturing processes, boost effectiveness, minimize downtimes, elevate quality control, and provide tailored solutions.

This transformative approach, although promising substantial advantages, presents difficulties. Such as initial capital requirements, concerns regarding data security, demands for workforce training, intricacies in integrating with existing systems, and adherence to regulatory standards.

The prospects for smart manufacturing look positive, with continuous technological progress anticipated to enhance accessibility. Which plays a crucial role in the ongoing transformation of manufacturing within Industry 4.0.

Whereas, Industry 5.0 represents the next evolution in the industrial sector, focusing on the integration of advanced technologies and human creativity.

Editor’s Choice

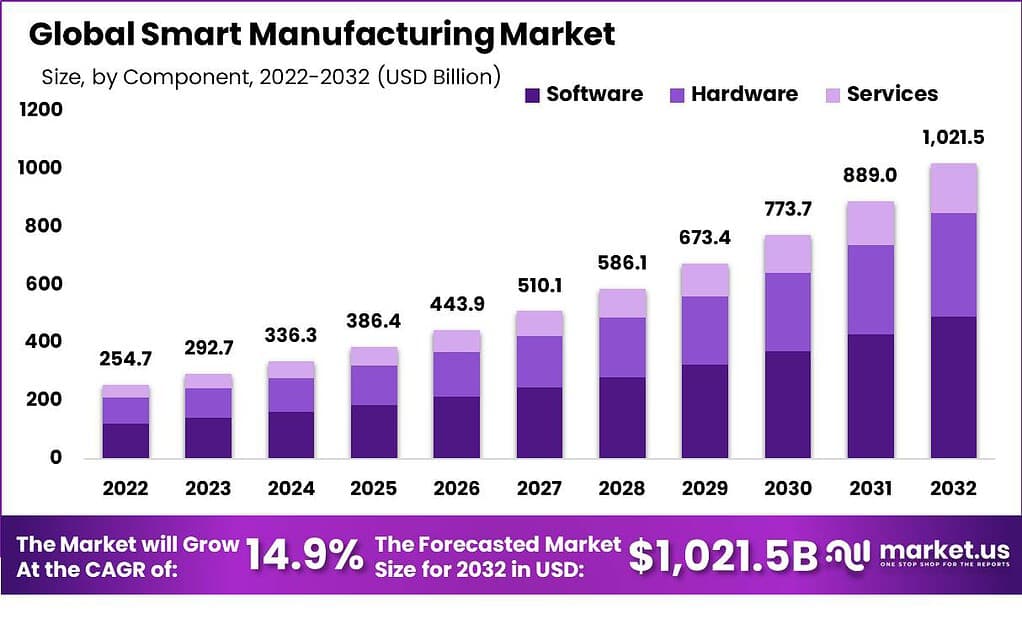

- The smart manufacturing market has been experiencing significant growth at a CAGR of 14.9%. With revenues reaching $254.7 billion in 2022.

- The market’s expansion remains robust, with revenues projected to reach $673.4 billion in 2029 and a significant milestone of $1,021.5 billion by 2032.

- On a global scale, investments in IoT technology are projected to reach a substantial figure of $1 trillion.

- Specifically, 70% of technology leaders anticipate that the AR market will exceed the VR market in revenue. With 49% believing this transition will happen within the next 3 to 5 years.

- The majority of investments, approximately 33%, are directed toward Process Automation, streamlining, and optimizing production processes.

- The global additive manufacturing sector is anticipated to witness substantial growth, with a projected increase of nearly 24% between 2023 and 2025.

- In July 2023, annual construction spending in manufacturing reached US$201 billion, marking a substantial 70% year-over-year growth and signaling positive prospects for the industry in 2024.

Smart Manufacturing Market Statistics

Global Smart Manufacturing Market Size

- The smart manufacturing market has been experiencing significant growth at a CAGR of 14.9%, with revenues reaching $254.7 billion in 2022.

- This upward trajectory is expected to continue in the coming years, with projected revenues of $292.7 billion in 2023 and a further increase to $336.3 billion in 2024.

- The market is set to expand even more in the following years, reaching $386.4 billion in 2025 and $443.9 billion in 2026.

- As we look further ahead, the growth continues, with revenues expected to surpass the $500 billion mark in 2027 at $510.1 billion.

- The market’s expansion remains robust, with revenues projected to reach $673.4 billion in 2029 and a significant milestone of $1,021.5 billion by 2032.

- This remarkable growth underscores smart manufacturing solutions’ increasing importance and adoption across various industries, driving substantial market revenue.

(Source: Market.us)

Key Technologies Driving Smart Manufacturing Statistics

Internet of Things (IoT) and Sensors

- Companies engaged in the IoT sector are foreseen to achieve annual revenues exceeding $450 billion.

- The comprehensive IoT market, covering hardware, software, systems integration, and data services, is expected to attain a scale of approximately $520 billion.

- On a global scale, investments in IoT technology are projected to reach a substantial figure of $1 trillion.

- Regarding regional breakdown, the Asia Pacific region is poised to take the lead in IoT expenditure market share, accounting for a notable 35%.

- In close pursuit, North America is projected to contribute 27%. At the same time, the Europe, Middle East, and Africa (EMA) region is expected to account for 25% of the overall expenditure market share, following the Asia Pacific region.

- The IoT market’s size is expected to grow significantly, potentially exceeding the $2 trillion milestone by 2027.

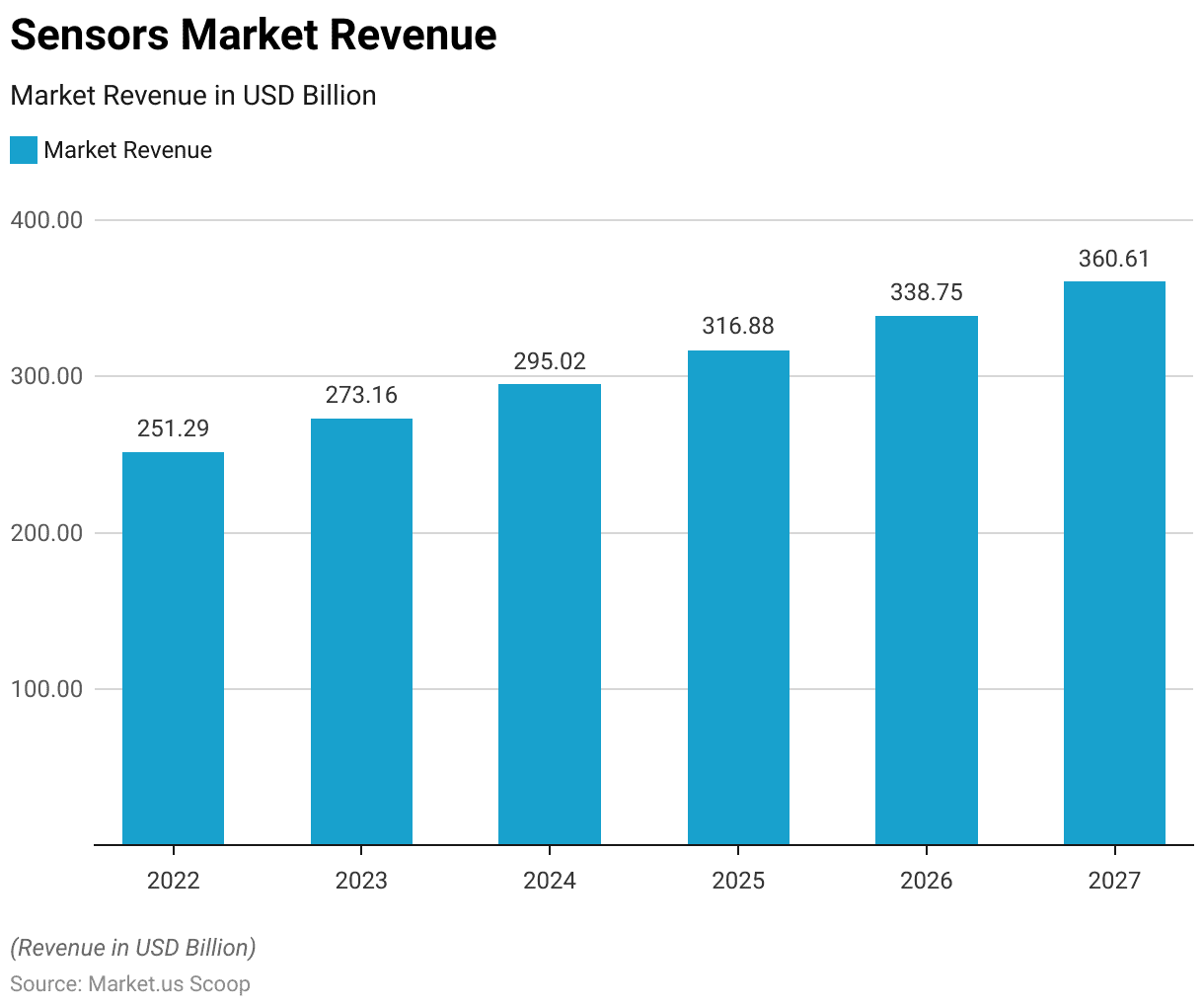

- The revenue generated by the sensors market is on a steady upward trajectory.

- In 2022, it stood at $251.29 billion, projected to grow consistently in the coming years.

- By 2023, the market is expected to reach $273.16 billion. With further increases forecasted for 2024 at $295.02 billion and 2025 at $316.88 billion.

- The trend continues with revenues of $338.75 billion in 2026 and $360.61 billion in 2027.

- This growth reflects the increasing demand for sensors across various industries, including automotive, healthcare, and consumer electronics. As they play a pivotal role in enabling data collection and automation in our increasingly connected world.

(Source: Bain & Company, Statista, Business Insider)

Artificial Intelligence (AI) and Machine Learning

- The global artificial intelligence (AI) market is currently valued at more than $136 billion, and it is expected to experience extraordinary growth. Expanding by over 13 times its current value in the next seven years.

- Specifically, the AI industry in the United States is projected to reach $299.64 billion by the year 2026. This expansion of the AI market is characterized by a remarkable compound annual growth rate (CAGR) of 38.1% from 2022 to 2030.

- Furthermore, it’s anticipated that by 2025, the AI sector will employ approximately 97 million individuals worldwide, indicating its substantial workforce involvement.

- The AI market’s size is poised to exhibit significant year-over-year growth of at least 120%, underscoring its rapid development.

- An overwhelming 83% of companies consider AI a paramount aspect of their business strategies.

- As an example of AI’s impact, Netflix generates $1 billion annually through automated personalized recommendations.

- Additionally, nearly half of businesses, at 48%, are integrating some form of AI to harness big data effectively.

- The projected global market size for machine learning platforms will be $31.36 billion by 2028.

- The natural language processing market is also expected to experience significant growth. Increasing from $26.42 billion in 2022 to $161.81 billion by 2029.

- 49% of respondents identified AI and ML projects as high-priority initiatives. With 28% considering their top priorities among their company’s IT projects in 2021.

- A substantial 35% of companies reported using AI in their operations. While 42% stated they are in the exploration phase of adopting AI solutions.

(Source: Garter, Statista, IBM)

Big Data Analytics By Smart Manufacturing Statistics

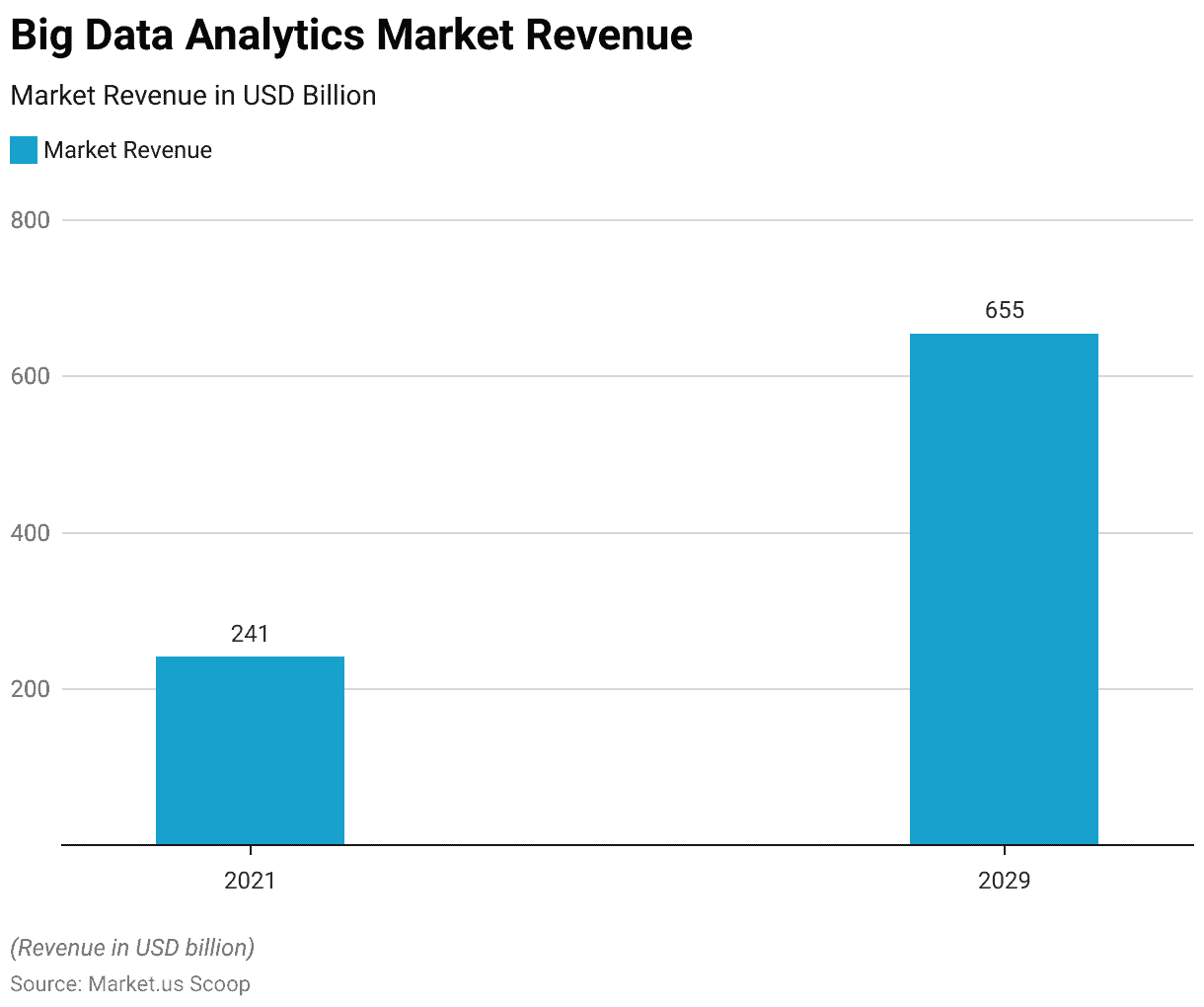

- The big data analytics market is projected to surpass $655 billion by 2029. Showing significant growth from approximately $241 billion in 2021.

- Adopting big data analytics is often seen as a crucial part of broader digital transformation efforts across industries.

- Within this landscape, various segments offer diverse capabilities.

- The predictive analytics market, considered at the forefront of this market, empowers analysts to foresee business outcomes using statistical models.

- In 2020, the predictive analytics market was valued at $5.29 billion, and it is expected to grow substantially, reaching $41.52 billion by 2028.

- Concurrently, the social media analytics market is growing, increasing from $7.01 billion in 2021 to $26.3 billion in 2028.

- Despite this robust market expansion, it’s important to highlight that the transformation process is still ongoing.

- While 57% of leading organizations claim to use data for innovation. Only 27% believe they have fully established a “data-driven” organizational culture.

- According to a report from Dresner Advisory Services, 36% of companies view big data as a critical factor within their organizations.

- Approximately 29% consider it highly significant, 20% find it important, and 12% rate it as moderately important.

- This represents a notable surge in the level of interest in data compared to 2018 when Dresner’s insights indicated that only 60% of companies were actively utilizing data.

(Source: Dresner Advisory Services, Statista)

Augmented Reality (AR) and Virtual Reality (VR)

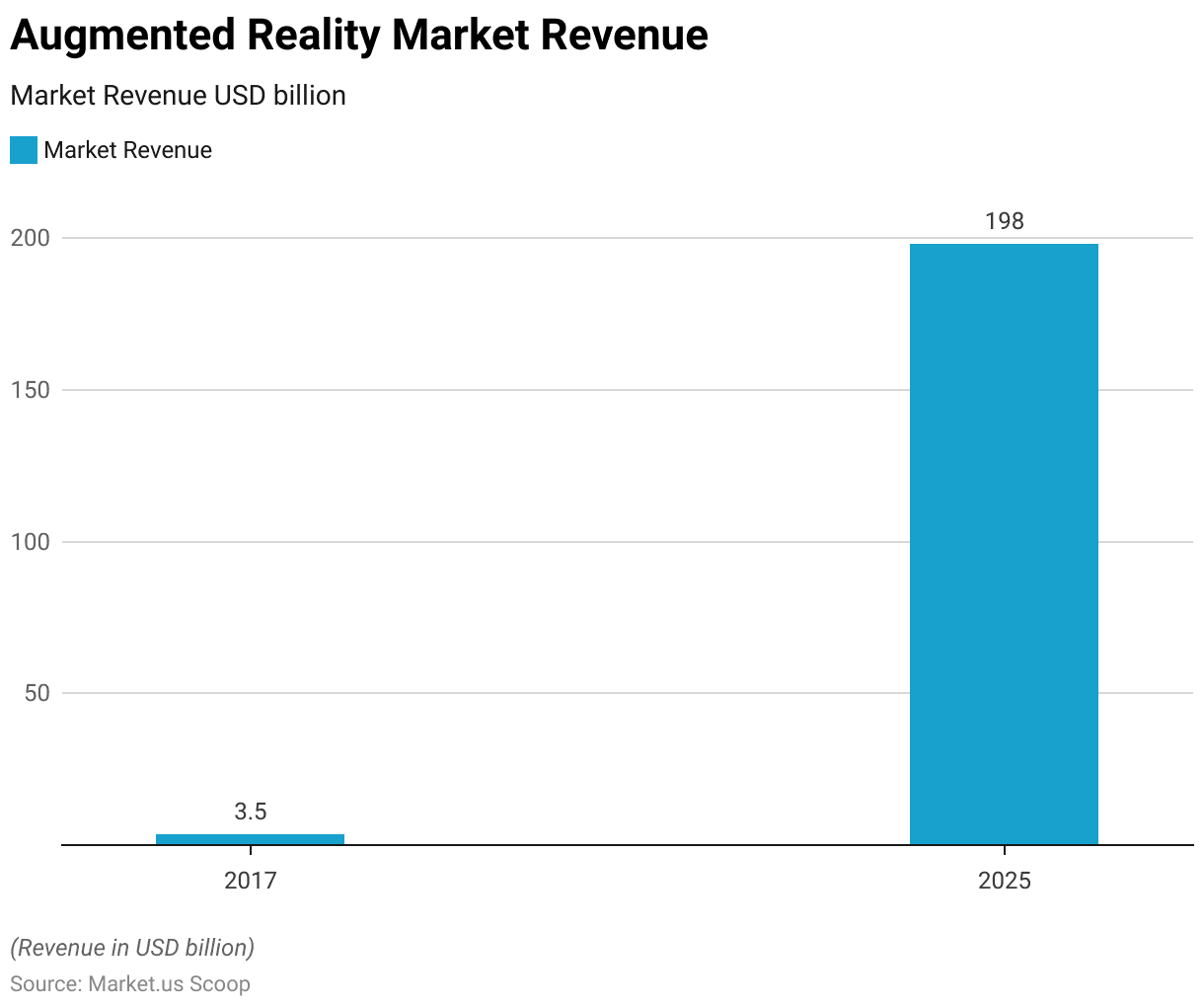

- In 2017, the Augmented Reality (AR) market was estimated to be worth around $3.5 billion, and it is on track for substantial expansion. With a projected value of an astounding $198 billion by 2025.

- However, an alternate source offers a slightly different forecast, suggesting that the AR market could reach $120 billion by 2020. Nevertheless, there is a consensus across various predictions that AR revenues will surpass those of Virtual Reality (VR).

- Specifically, 70% of technology leaders anticipate that the AR market will exceed the VR market in revenue, with 49% believing this transition will happen within the next 3 to 5 years.

- According to the 2019 Augmented Reality Report by Greenlight Insights. The AR market is expected to grow at a somewhat lower but impressive rate, reaching $31 billion by 2023.

- In 2020, the worldwide shipments of virtual and augmented reality headsets reached 5.5 million units, and this figure is expected to rise to 11 million units in 2021 and a substantial 43.5 million units by 2025.

- The market size for virtual reality head-mounted displays (HMDs) was valued at $5.5 billion in 2019, with a strong compound annual growth rate (CAGR) of 22.3%, projected to reach $18.6 billion by 2026.

- As of the second quarter of 2020, the dominant market leaders in virtual reality headsets include Facebook, with a share of 38.7%, followed by Sony at 21.9%, Pico at 9.2%, DPVR at 8.9%, and HTC at 4.9%.

(Source: BIS Research, Digi-Capital, Perkins Coie-2019, Greenlight Insights-2019, Statista, Valuates, IDC)

Additive Manufacturing (3D Printing)

- The global additive manufacturing market is anticipated to witness substantial growth. With a projected increase of nearly 24% between 2023 and 2025.

- Additionally, the 3D printing market is set to expand significantly, almost tripling in size from 2020 to 2026.

- In 2019, the automotive and manufacturing sectors emerged as the most profitable global additive manufacturing segments.

- During the same year, South Korea led the list of countries with the highest expertise in additive manufacturing, followed by China and Canada.

- Nevertheless, it’s noteworthy that in 2019, more than half of all additive manufacturing companies were in Europe. While around 32% were based in the Americas, with only 13% in Asia.

- In 2019, 3D printing market revenues within the footwear industry represented roughly 0.3% of the total global footwear market revenues, as disclosed by SmarTech Analysis.

- The market for medical 3D Printing, covering materials, services, software, and hardware, is currently assessed at approximately $1.25 billion, according to SmarTech Analysis.

- Insights from a SmarTech Analysis report suggest that revenues from 3D-printed dentistry are expected to achieve $3.7 billion by 2021. Positioning the technology as the primary method for manufacturing dental restorations and devices globally by 2027.

(Source: SmarTech Analysis, Statista)

Smart Manufacturing Investment Statistics

Technological Investments

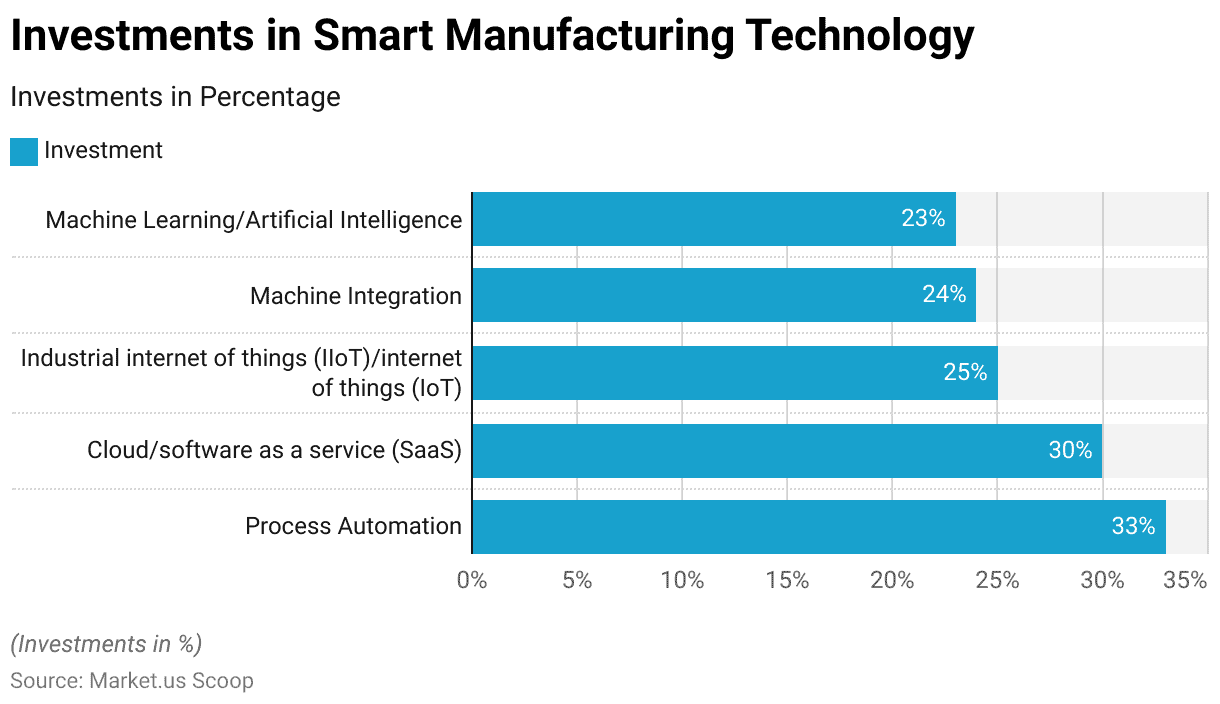

- When it comes to investing in smart manufacturing technology, companies are allocating their resources strategically.

- The majority of investments, approximately 33%, are directed toward Process Automation, streamlining, and optimizing production processes.

- Cloud-based solutions, including software as a service (SaaS), account for a significant portion, standing at 30%, offering flexibility and accessibility.

- Another essential area of focus is the Industrial Internet of Things (IIoT) and the Internet of Things (IoT). Collectively representing 25% of investments, enabling connectivity and data-driven decision-making.

- Machine Integration is also a priority, with 24% of investments dedicated to seamless machinery coordination.

- Lastly, Machine Learning and Artificial Intelligence (AI) technologies garner 23% of the investment Emphasizing the importance of data analysis and intelligent systems in the smart manufacturing landscape.

(Source: State of Smart Manufacturing Report” by Rockwell Automation)

Impact of Technological Needs in Terms of Costs

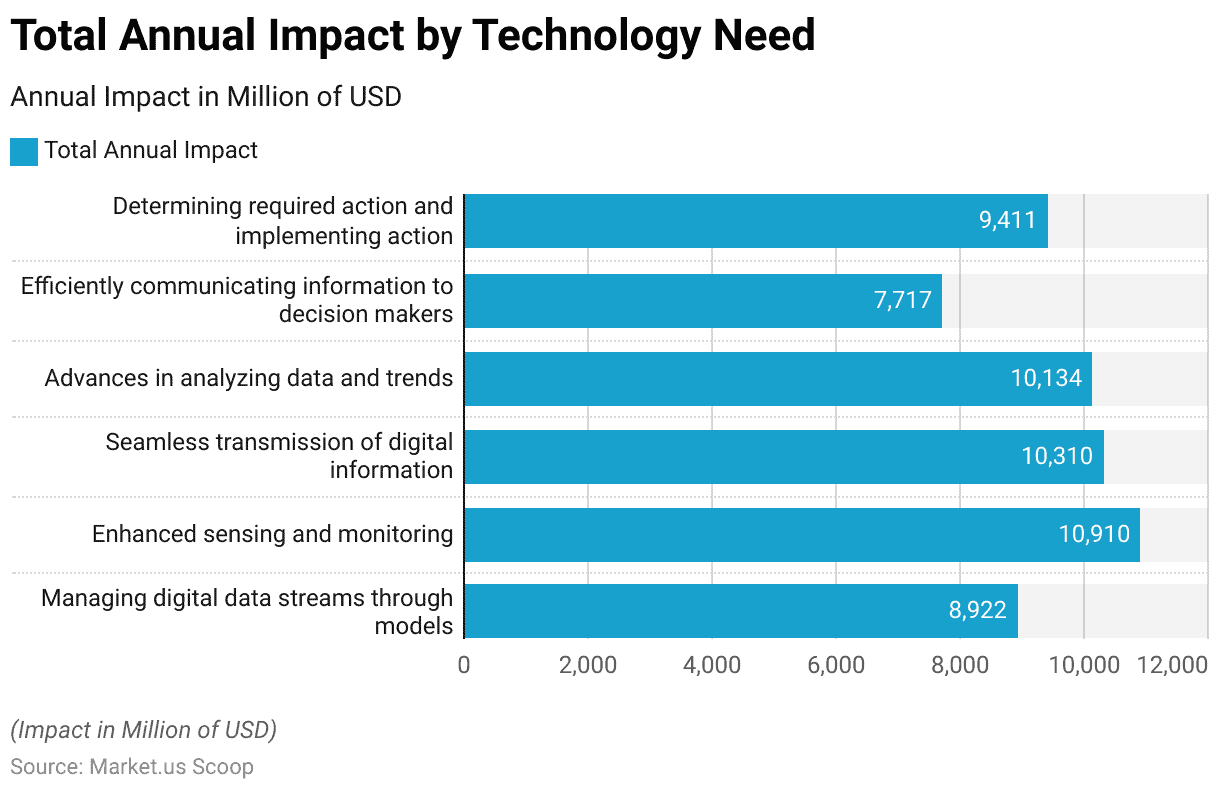

- The annual impact of various technology needs, measured in millions of US dollars, reflects significant contributions to operations.

- Enhanced sensing and monitoring top the list with an annual impact of 10,910 million US dollars, closely followed by advances in analyzing data and trends at 10,134 million US dollars.

- The seamless transmission of digital information is another crucial factor, accounting for an annual impact of 10,310 million US dollars.

- Determining and implementing required action effectively contributes 9,411 million US dollars, showcasing the importance of swift decision-making and execution.

- Managing digital data streams through models plays a significant role with an annual impact of 8,922 million US dollars, while efficiently communicating information to decision-makers is valued at 7,717 million US dollars.

- These figures illustrate the diverse technology needs and their respective impacts on operations in millions of US dollars.

(Source: NIST Economic Analysis)

Challenges in Smart Manufacturing Statistics

Skills Shortage

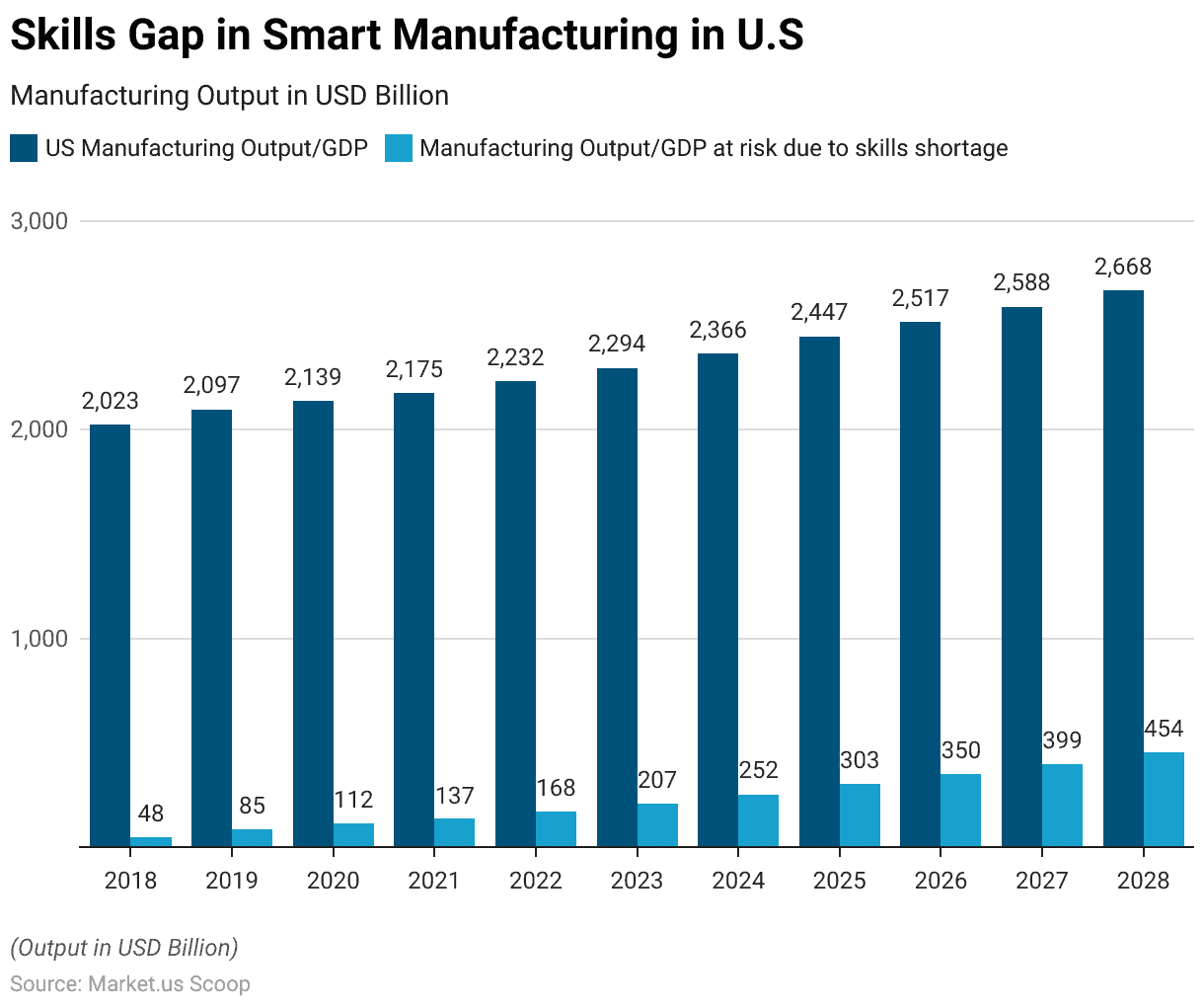

- In recent years, the manufacturing sector in the United States has been experiencing a growing skills gap that has raised concerns about its impact on the industry’s productivity.

- Between 2018 and 2028, the manufacturing output as a percentage of the country’s GDP has steadily increased.

- In 2018, it stood at 48 billion USD; by 2028, it is projected to reach 454 billion USD. However, this growth is not without its challenges.

- The manufacturing output at risk due to a skills shortage has also increased during this period.

- In 2018, it was estimated at 48 billion USD. Still, by 2023, it is projected to reach a significant 207 billion USD. Indicating a substantial gap between the industry’s output potential and actual performance.

- This gap is expected to widen further in the coming years if steps are not taken to address the skills shortage issue. Potentially affecting the overall health and competitiveness of the manufacturing sector in the United States.

(Source: Tulip)

New Trends in Smart Manufacturing Statistics

- In July 2023, annual construction spending in manufacturing reached US$201 billion. Marking a substantial 70% year-over-year growth and signaling positive prospects for the industry in 2024.

- Despite this expansion, Deloitte’s analysis of the Purchasing Managers’ Index (PMI) data reveals that the manufacturing sector experienced periods of contraction throughout 2023.

- Manufacturing executives are notably confident in the potential of smart factory solutions as primary drivers of competitiveness over the next five years, with 86% expressing this belief.

- Additionally, manufacturers anticipate a potential 12% boost in labor productivity from the industrial metaverse, which could help address ongoing labor shortages.

- Deloitte’s analysis also indicates a 4% increase in average hourly earnings for employees between Q1 FY2022 and Q1 FY2023. Along with a substantial 19% reduction in the average number of voluntary separations during the same period.

- Furthermore, over 70% of surveyed manufacturers have integrated technologies like data analytics and cloud computing into their processes through smart factory initiatives, and nearly half have already adopted IoT sensors, devices, and systems.

- Moreover, 92% of manufacturers are exploring or implementing various metaverse-related use cases, averaging more than six use cases per manufacturer.

(Source: Deloitte)

Strategies and Responses From Manufacturers

- The number of respondents indicating that they lack the necessary technology to outperform competitors has nearly doubled compared to the previous year’s survey.

- A significant 97% of participants have either adopted or intend to adopt smart manufacturing technology within the next 1-2 years.

- Additionally, over two-thirds of manufacturers believe technology can be highly beneficial or exceptionally beneficial in tackling workforce-related challenges.

- Furthermore, there has been a more than 50% increase in the adoption of Machine Learning and Artificial Intelligence among manufacturers compared to the previous year.

(Source: Rockwell Automation’s 8th Annual State of Smart Manufacturing Report)

Conclusion

Smart Manufacturing Statistics – In conclusion, smart manufacturing represents a transformative approach in the industrial landscape.

Harnessing advanced technologies to optimize production processes, enhance efficiency, and improve product quality.

While challenges such as initial investment costs and data security concerns exist, the future outlook for smart manufacturing remains optimistic.

Technological advancements are expected to make it more accessible and pivotal in the ongoing Industry 4.0 transformation of manufacturing.

The substantial growth in the smart manufacturing market and the increasing adoption of technologies like IoT, AI, and data analytics underlines its significance in shaping the future of manufacturing industries worldwide.

FAQs

Smart manufacturing is an advanced industrial approach incorporating technologies like the Internet of Things (IoT), Artificial Intelligence (AI), data analytics, automation, and more to optimize production processes, improve efficiency, and enhance manufacturing operations.

Key technologies in smart manufacturing include IoT for connectivity and data collection, AI and machine learning for data analysis and decision-making, automation for process optimization, and cloud computing for data storage and accessibility.

Smart manufacturing offers improved production efficiency, reduced downtime, enhanced product quality, customization capabilities, and the ability to make data-driven decisions for better outcomes.

Challenges include initial investment costs, data security concerns, workforce training needs, integration with legacy systems, and compliance with regulatory requirements.

Smart manufacturing transforms industries by streamlining operations, reducing waste, increasing productivity, and enabling more agile and responsive manufacturing processes.