Table of Contents

The global smart mobility apps market is experiencing remarkable growth, projected to expand from USD 48.1 billion in 2024 to approximately USD 340.0 billion by 2034, reflecting a robust CAGR of 21.60%. In 2024, the Asia-Pacific region led the market with over 38.4% share, generating USD 18.4 billion in revenue, with China contributing USD 6.46 billion and growing at a rapid CAGR of 23.7%.

Ride-sharing and carpooling services dominated the market, capturing more than 61.4% of the share, while cloud-based platforms held over 72.3% of the market, underscoring the industry’s shift towards scalable, on-demand solutions.

Transport and logistics providers led the market in 2024, holding over 62.8% of the market share, highlighting the critical role of smart mobility apps in optimizing urban transportation systems.

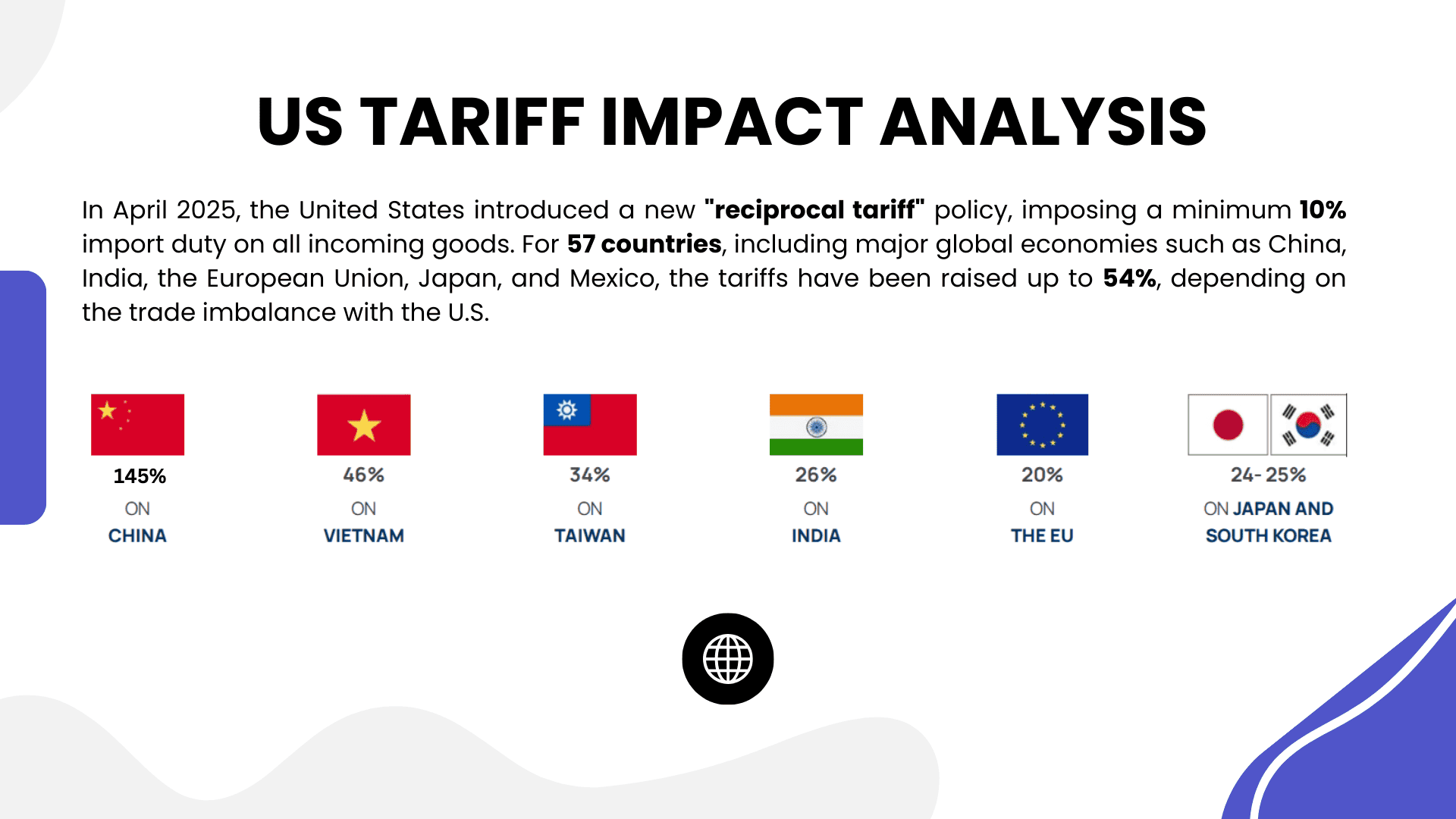

U.S. Tariff Impact on Smart Mobility Apps Market

The U.S. administration’s recent tariff policies have introduced significant challenges for the smart mobility apps market. While electronics like smartphones and laptops were initially exempted from tariffs, the broader implications of these trade policies are being felt across the industry.

For instance, Apple reported that impending tariffs could cost the company $900 million in the June quarter, primarily due to increased production costs and supply chain disruptions. Similarly, Amazon sellers are facing increased costs due to the elimination of the de minimis trade exemption, leading to potential price hikes and reduced profit margins.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/smart-mobility-apps-market/free-sample/

These developments highlight the interconnectedness of hardware and software in the smart mobility ecosystem, where tariffs on physical components can indirectly affect app developers and service providers. The increased operational costs may lead to reduced marketing budgets and potential price hikes for consumers, impacting user acquisition and retention.

Economic Impact

- Increased Operational Costs: Tariffs on imported components have led to higher production expenses for smart mobility app providers.

- Reduced Profit Margins: Higher costs may result in squeezed margins, affecting overall profitability.

- Investment Delays: Uncertainty in trade policies may lead to postponed investments in infrastructure and technology.

Geographical Impact

- North America: Faces significant cost increases due to tariffs on imported components.

- Asia-Pacific: May experience less impact due to local production, but global supply chain disruptions can still affect the region.

- Europe: Potential for increased costs and delays in service expansion due to reliance on imported technologies.

Business Impact

- Operational Adjustments: Companies may need to reassess their supply chains and production strategies.

- Pricing Strategies: Increased costs may lead to higher service prices, affecting competitiveness.

- Market Expansion: Tariffs may hinder expansion efforts into new markets due to increased operational costs.

Key Takeaways

- U.S. tariffs have increased operational costs for smart mobility app providers.

- The interconnectedness of hardware and software in the industry amplifies the impact of these tariffs.

- Companies may need to adjust pricing strategies and supply chains to mitigate the effects.

➤ Get Full Access Purchase Now @ https://market.us/purchase-report/?report_id=147385

Analyst Viewpoint

Currently, the smart mobility apps market is thriving, driven by urbanization and technological advancements. The future outlook remains positive, with continued growth anticipated as cities invest in smart infrastructure and consumers embrace digital transportation solutions.

However, the ongoing trade tensions and tariff policies introduce uncertainties that may affect short-term profitability and operational strategies. Companies that can adapt to these challenges by diversifying supply chains and exploring alternative markets are likely to maintain a competitive edge in the evolving landscape.

Regional Analysis

North America continues to lead the smart mobility apps market, driven by strong demand for ride-sharing and carpooling services. The U.S. market, in particular, benefits from a large urban population and high smartphone penetration. Asia-Pacific is experiencing rapid growth, with China emerging as a key player due to its expanding middle class and government support for smart city initiatives.

Europe is also witnessing steady growth, supported by environmental policies and investments in sustainable transportation solutions. Latin America and the Middle East & Africa regions show potential, with increasing urbanization and mobile internet access driving demand for smart mobility services.

Business Opportunities

The evolving smart mobility apps market presents several opportunities for stakeholders. Companies can explore partnerships with local governments to develop integrated transportation solutions. Investing in electric and autonomous vehicle technologies aligns with sustainability trends and regulatory incentives. Expanding into emerging markets with growing urban populations offers avenues for growth.

Additionally, leveraging data analytics to optimize routes and improve user experiences can enhance service offerings and customer satisfaction. Adapting to changing trade policies by diversifying supply chains and sourcing components from tariff-exempt regions can mitigate cost increases and ensure business continuity.

➤ Discover More Latest Research

- Asia Pacific AI in Industrial Design Market

- Personal AI Assistant Market

- Predictive AI Animation Market

- Metaverse Commerce Market

Key Segmentation

- By Service Type: Ride-Sharing, Carpooling, Bike-Sharing, E-Scooter Sharing.

- By Platform: Cloud-Based, On-Premises.

- By End-User: Transport and Logistics Providers, Individual Consumers, Corporate Fleets.

- By Region: North America, Europe, Asia-Pacific, Latin America, Middle East & Africa.

The ride-sharing and carpooling segments dominate the market, driven by consumer preference for cost-effective and convenient transportation options. Cloud-based platforms offer scalability and flexibility, supporting the growing demand for on-demand services. Transport and logistics providers are increasingly adopting smart mobility solutions to enhance operational efficiency and reduce costs. Regional dynamics influence service adoption, with North America leading in market share, followed by rapid growth in Asia-Pacific and steady expansion in Europe.

Key Player Analysis

Leading players in the smart mobility apps market are focusing on innovation and strategic partnerships to enhance their market position. Companies are investing in research and development to develop advanced algorithms for route optimization and to integrate electric vehicles into their fleets. Collaborations with local governments and urban planners are facilitating the development of integrated transportation solutions.

The competitive landscape is characterized by a mix of established ride-sharing giants and emerging players offering niche services such as bike-sharing and e-scooter rentals. Market leaders are also expanding their service offerings to include food delivery and logistics solutions, diversifying revenue streams, and increasing customer engagement.

Top Key Players in the Market

- Uber Technologies Inc.

- Lyft, Inc.

- Bolt Technology

- Ola Cabs (ANI Technologies Pvt. Ltd.)

- Grab Holdings Inc.

- Didi Chuxing Technology Co.

- Wingz, Inc.

- Curb Mobility

- Gett, Inc.

- Via Transportation, Inc.

- BlaBlaCar

- Ziro

- MaaS Global Ltd. (Whim)

- Other Major Players

Recent Developments

In 2025, several smart mobility app providers announced advancements in electric vehicle integration and AI-driven route optimization. Collaborations with municipal governments are facilitating the development of smart transportation hubs and integrated ticketing systems. Additionally, partnerships with automotive manufacturers are enabling the deployment of autonomous vehicles in select urban areas, paving the way for future mobility solutions.

Conclusion

The smart mobility apps market is poised for significant growth, driven by technological advancements and increasing demand for sustainable transportation solutions. While U.S. tariff policies present challenges, companies that can adapt to the evolving trade landscape by diversifying supply chains and exploring alternative markets are well-positioned for long-term success. Continued investment in innovation and strategic partnerships will be key to maintaining a competitive edge in this dynamic industry.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)