Table of Contents

Introduction

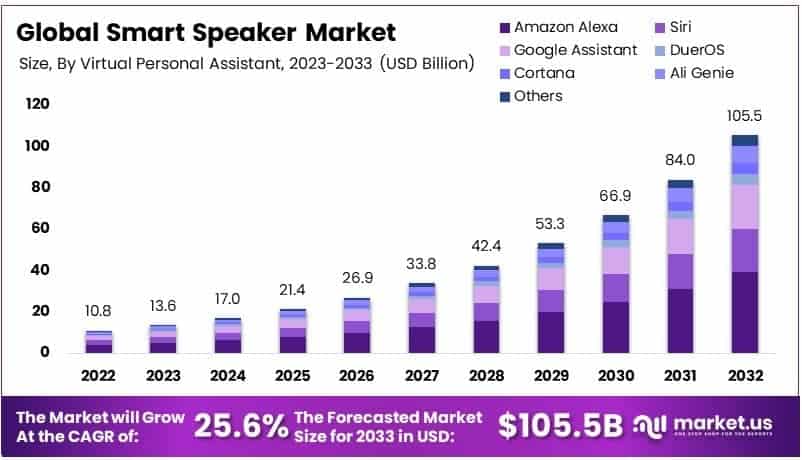

The Global Smart Speaker Market is projected to grow from USD 10.8 billion in 2023 to an estimated USD 105.5 billion by 2033, reflecting a robust compound annual growth rate (CAGR) of 25.6% during the forecast period from 2024 to 2033.

A smart speaker is a wireless audio device equipped with artificial intelligence (AI) and integrated virtual assistants such as Amazon Alexa, Google Assistant, or Apple Siri. These devices allow users to perform tasks through voice commands, including playing music, controlling smart home devices, answering queries, and managing schedules. Designed to enhance convenience, smart speakers leverage internet connectivity and advanced voice recognition technology, creating a seamless interface between users and their digital environment.

The smart speaker market refers to the global industry encompassing the development, manufacturing, and sales of smart speakers. This market includes various product categories based on features, price segments, and compatibility with smart home ecosystems. Key players in the market include Amazon, Google, Apple, and Samsung, alongside emerging competitors focusing on niche markets or unique functionalities. The market’s scope spans consumers, businesses, and industries leveraging these devices for personal use, customer interaction, or operational efficiencies.

Several factors are driving the growth of the smart speaker market. Rising adoption of IoT and smart home technology has significantly boosted demand, as smart speakers serve as a central hub for device connectivity. Increasing internet penetration and smartphone adoption have also enabled broader accessibility. Continuous advancements in AI and machine learning have enhanced voice recognition and personalization, making these devices more user-friendly. Additionally, declining device costs and aggressive marketing strategies by major players have expanded the market to new consumer segments.

The demand for smart speakers is fueled by their growing role in everyday life. Consumers increasingly value the convenience of hands-free control, whether for managing schedules, playing entertainment, or controlling smart home devices. Integration with streaming services and home automation systems further enhances their utility.

Business adoption is also on the rise, as companies use smart speakers to improve customer service and enhance workplace productivity. Demand is particularly strong in regions with high digital adoption rates, such as North America, Europe, and parts of Asia-Pacific.

The smart speaker market presents several lucrative opportunities. Expansion into untapped markets in emerging economies offers significant growth potential, as infrastructure and digital literacy improve. Innovations such as multi-lingual capabilities, enhanced privacy features, and specialized use cases (e.g., education, healthcare) can attract new users.

Partnerships with streaming services, IoT device manufacturers, and other technology providers could further strengthen market offerings. Moreover, the increasing integration of AI and natural language processing could pave the way for smarter, more adaptive devices, creating new revenue streams for industry players.

Key Takeaways

- The global smart speaker market was valued at USD 10.8 billion in 2023 and is projected to grow significantly, reaching USD 105.5 billion by 2033, driven by a robust compound annual growth rate (CAGR) of 25.6% over the forecast period.

- In 2023, Amazon Alexa led the virtual personal assistant segment with a 37.1% share, attributed to its high user engagement and widespread adoption.

- The software segment emerged as the dominant component in 2023, highlighting the increasing importance of digital solutions in powering smart home ecosystems.

- The smart home segment was the leading application in 2023, driven by the growing consumer demand for home automation and connected devices.

- North America led the global market with a 36.4% share in 2023, showcasing its technological advancements and high adoption rate of smart speaker technologies.

Smart Speaker Statistics

- Over 60 million people in the U.S. own 157 million smart speakers as of 2023.

- 53 million Americans own at least one voice-activated smart speaker.

- 72% of smart speaker owners integrate them into their daily routines.

- Globally, 27% of people use voice search regularly.

- In the U.S., 47.3 million adults actively use smart speakers.

- There were approximately 146 million voice assistant users in the U.S. in 2023.

- Amazon dominates the U.S. smart speaker market with a share of 60%-75%.

- The 35-54 age group represents 38% of smart speaker users.

- 17% of users are 55 and older, indicating a growing interest among older demographics.

- 51% of users are male, while 49% are female, showing a near-equal gender distribution.

- 33% of smart speaker owners use the device more than five times daily.

- 89% of owners interact with their smart speaker every day.

- 73% of smart speaker users have made purchases through their devices.

- 58% complete tasks with smart assistants that they previously performed manually.

- 18% of users search for brand or business information using voice commands.

- 35% of Americans use smart speakers for online shopping.

- 5.44 million adults in the U.S. purchase via voice search monthly, representing 11.5% of users.

- 65% of smart speaker owners feel comfortable using voice search for shopping.

Emerging Trends

- Integration of Advanced AI and Voice Assistants: Manufacturers are enhancing smart speakers with cutting-edge artificial intelligence, enabling more natural, context-aware interactions. These advancements allow devices to process complex commands and deliver a superior user experience. For instance, recent updates to Amazon Alexa focus on creating more conversational and intuitive interfaces.

- Expansion into Smart Home Ecosystems : Smart speakers are becoming central to smart home environments, enabling seamless control over devices like lights, thermostats, and security systems. This trend reflects the growing adoption of Internet of Things (IoT) technologies, positioning smart speakers as essential tools in home automation.

- Enhanced Audio Quality and Multi-Functionality: Consumers are prioritizing premium sound quality and versatile features in their smart speakers. In response, manufacturers are incorporating high-fidelity audio systems, touchscreens, and better integration with music and video streaming services to meet diverse needs.

- Privacy and Data Security Concerns: With the increasing adoption of smart speakers, privacy has become a key concern. Consumers are demanding better transparency and stricter data security measures from manufacturers. Addressing these concerns is critical for building trust and sustaining growth in this competitive market.

- Regional Market Diversification: While North America remains a dominant market for smart speakers, significant growth is projected in regions like Asia-Pacific. Factors such as rising disposable incomes, rapid urbanization, and increasing interest in smart home technology are fueling demand in emerging markets.

Top Use Cases

- Streaming Music and Audio Content: A significant majority of smart speaker owners utilize their devices to stream music. In the United States, 64% of users report using their smart speakers for this purpose, making it the most common application.

- Providing Weather Updates: Accessing weather information is a frequent use case, with 51% of U.S. smart speaker owners using their devices to check weather conditions.

- Setting Timers and Alarms: The convenience of voice-activated timers and alarms is appreciated by users, with 43% of U.S. smart speaker owners utilizing this feature.

- Controlling Smart Home Devices: Smart speakers serve as central hubs for managing smart home ecosystems. Approximately 30% of users employ their devices to control smart home features, such as lighting and thermostats.

- Answering General Questions: Leveraging built-in virtual assistants, users frequently ask general knowledge questions. In the U.S., 83% of smart speaker owners have used their devices to ask questions, highlighting this as a prevalent use case.

Major Challenges

- Privacy and Data Security Concerns: A substantial number of users are apprehensive about the data collected by smart speakers. Approximately 54% of smart speaker owners express concerns regarding the amount of personal data these devices gather. This apprehension can hinder broader adoption and trust in the technology.

- Market Saturation and Slowing Growth: After a period of rapid expansion, the smart speaker market is experiencing a deceleration. High double-digit growth rates have declined to low single digits in recent years, indicating a maturing market with fewer new adopters.

- Financial Viability and Profitability Issues: Leading companies like Amazon have encountered significant financial challenges with their smart speaker divisions. Between 2017 and 2021, Amazon’s devices unit, which includes Echo speakers, reported losses exceeding $25 billion, raising concerns about the long-term profitability of these products.

- Voice Recognition Accuracy and Bias: Studies have identified disparities in voice recognition accuracy across different demographics. For instance, speech recognition systems have been found to be 13% more accurate for men than women, and errors are more prevalent when interpreting speech from Black individuals compared to white individuals. These biases can lead to user frustration and limit the inclusivity of smart speaker technology.

- Integration and Compatibility Challenges: As the ecosystem of smart home devices expands, ensuring seamless integration and compatibility among various products remains a challenge. Users often encounter difficulties when attempting to connect smart speakers with devices from different manufacturers, leading to a fragmented user experience and potential reluctance to invest in additional smart home technologies.

Top Opportunities

- Integration with Smart Home Devices: As households increasingly adopt smart home technologies, there is a growing demand for smart speakers that seamlessly control various devices such as lighting, thermostats, and security systems. Developing speakers with enhanced compatibility and user-friendly interfaces can capitalize on this trend.

- Advancements in Voice Recognition and AI: Improving voice recognition accuracy and incorporating advanced artificial intelligence can enhance user experience, making interactions more natural and efficient. This progression can attract a broader user base, including non-native speakers and individuals with diverse accents.

- Expansion into Emerging Markets: Regions with increasing internet penetration and rising disposable incomes offer substantial growth potential. Tailoring smart speakers to meet the specific needs and languages of these markets can facilitate adoption and market expansion.

- Development of Specialized Applications: Creating smart speakers with specialized functionalities, such as educational tools for children or assistive devices for the elderly, can tap into niche markets. These targeted applications can address specific consumer needs, fostering greater adoption.

- Enhancement of Privacy and Security Features: Addressing consumer concerns about data privacy by implementing robust security measures and transparent data practices can build trust. Emphasizing privacy as a key feature can differentiate products in a competitive market.

Key Player Analysis

- Amazon Inc.: Amazon leads the global smart speaker market, primarily through its Echo line powered by Alexa. In the first quarter of 2022, Amazon held a 28% market share, maintaining its position as the top vendor.

- Alphabet Inc. (Google): Google’s Nest smart speakers, featuring Google Assistant, are Amazon’s closest competitors. In the same period, Google secured a 17.2% market share, reflecting its strong presence in the market.

- Apple Inc.: Apple’s HomePod series, integrated with Siri, has gained traction in the premium segment. As of the first quarter of 2022, Apple held a 10.2% market share, indicating steady growth in its user base.

- Alibaba Group (Tmall Genie): Alibaba’s Tmall Genie is a significant player in the Chinese market. In the first quarter of 2022, Alibaba achieved a 7.6% market share globally, underscoring its influence in the region.

- Xiaomi Inc.: Xiaomi’s smart speakers, known for affordability and integration with its ecosystem, captured a 6.5% market share in the first quarter of 2022, highlighting its competitive position.

Recent Developments

- In 2024, SoundHound AI, Inc. (Nasdaq: SOUN) announced its acquisition of Amelia, a top enterprise AI software company. This move strengthens SoundHound’s leadership in voice and conversational AI across sectors like retail, healthcare, automotive, and more.

- In 2024, Resideo Technologies, Inc. (NYSE: REZI) completed its acquisition of Snap One (Nasdaq: SNPO), enhancing its ADI Global Distribution segment. The combined platform now offers integrators a wider range of smart-living products and advanced digital solutions.

- In 2024, LG Electronics revealed its LG ThinQ ON AI home hub at IFA in Berlin. The hub integrates LG appliances with empathetic AI, creating a seamless smart home experience focused on personalized care and comfort.

- In 2023, Amazon introduced Echo Pop, priced at INR 4,999. With a unique semi-sphere design and vibrant color options, it features a directional speaker and the AZ2 Neural Edge processor for faster Alexa responses, making it ideal for any room.

Conclusion

The global smart speaker market is poised for substantial growth, driven by advancements in artificial intelligence and the expanding adoption of smart home technologies. As consumers increasingly seek seamless, voice-activated interactions within their living spaces, smart speakers are becoming integral to daily life. However, challenges such as privacy concerns and market saturation necessitate continuous innovation and strategic adaptation by industry players. By addressing these issues and capitalizing on emerging opportunities, the smart speaker market is expected to maintain its upward trajectory, offering enhanced user experiences and fostering deeper integration into the connected home ecosystem.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)