Table of Contents

- Introduction

- Editor’s Choice

- Smart Speaker Statistics – Market Size

- Smart Speaker Statistics – Market Size by Segment

- Smart Speaker Statistics by Region

- Top Key Players in the Industry Statistics

- Household Adoption Rate – Smart Speaker Statistics

- Smart Speaker Statistics by User Demographics

- User Engagement and Trends

- Most Preferred Smart Speakers Statistics

- Smart Speakers Statistics by User Satisfaction

- Recent Developments

- Conclusion

- FAQs

Introduction

Smart Speaker Statistics: A smart speaker is a wireless and voice-controlled device that offers a range of functions beyond traditional audio playback.

It integrates voice recognition technology and connectivity to the internet and often features a virtual assistant or voice assistant, which enables users to interact with the device through spoken commands.

Overall, the functionality of smart speakers is expanding as technology advances, enabling them to become versatile and central devices within homes for communication, information, entertainment, and home automation.

Editor’s Choice

- In 2022the smart speaker market generated around 11 billion USD in revenue.

- On a global scale, China presently stands as one of the largest markets for smart speakers, particularly in shipments.

- In the market’s competitive landscape, Amazon.com, Inc. holds a substantial share of 23%, making it a prominent player.

- Apple, Inc. follows with a 15% share, showcasing its notable presence.

- Approximately 100 million individuals, constituting 35% of the U.S. population aged 12 and above, possess a smart speaker.

- A recent survey found that the usage of Smart Speakers for voice commands had increased to 35%, a rise from 27% recorded two years ago in 2020.

- India‘s smart speaker adoption rate is 20.9%, while the United Kingdom (UK) boasts a notable adoption rate of 18.3%, and the United States (U.S.) closely follows with 20.7%.

Smart Speaker Statistics – Market Size

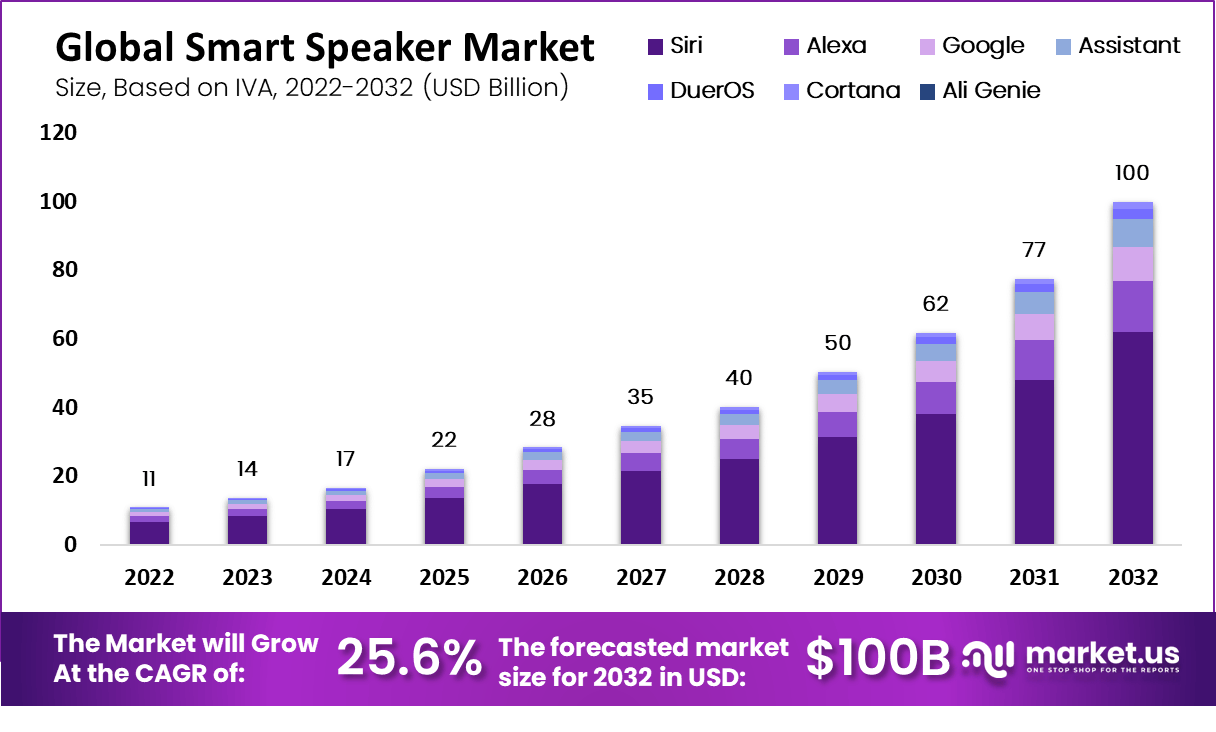

- The smart speaker market is demonstrating remarkable growth, with its revenue projected to follow an upward trajectory over the next decade. In 2022, the industry generated around 11 billion USD in revenue.

- Building on this momentum, the sector is anticipated to witness significant expansion, with revenue expected to reach 14 billion USD in 2023 and increase to 17 billion USD in 2024.

- As smart speakers continue to capture consumer interest and integrate into various aspects of daily life, their revenue is projected to surge to 22 billion USD by 2025 and 28 billion USD by 2026.

- The growth shows no signs of slowing down, with revenue forecasts of 35 billion USD in 2027 and 40 billion USD in 2028.

- The subsequent years, particularly 2029, are anticipated to mark a major milestone as the industry breaches the 50 billion USD revenue mark.

- The upward trajectory persists, with revenue projected to escalate to 62 billion USD by 2030, 77 billion USD by 2031, and a significant milestone of 100 billion USD by 2032. This remarkable growth trend underscores the increasing prominence of smart speakers in modern technology-driven lifestyles.

(Source: Market.us)

Smart Speaker Statistics – Market Size by Segment

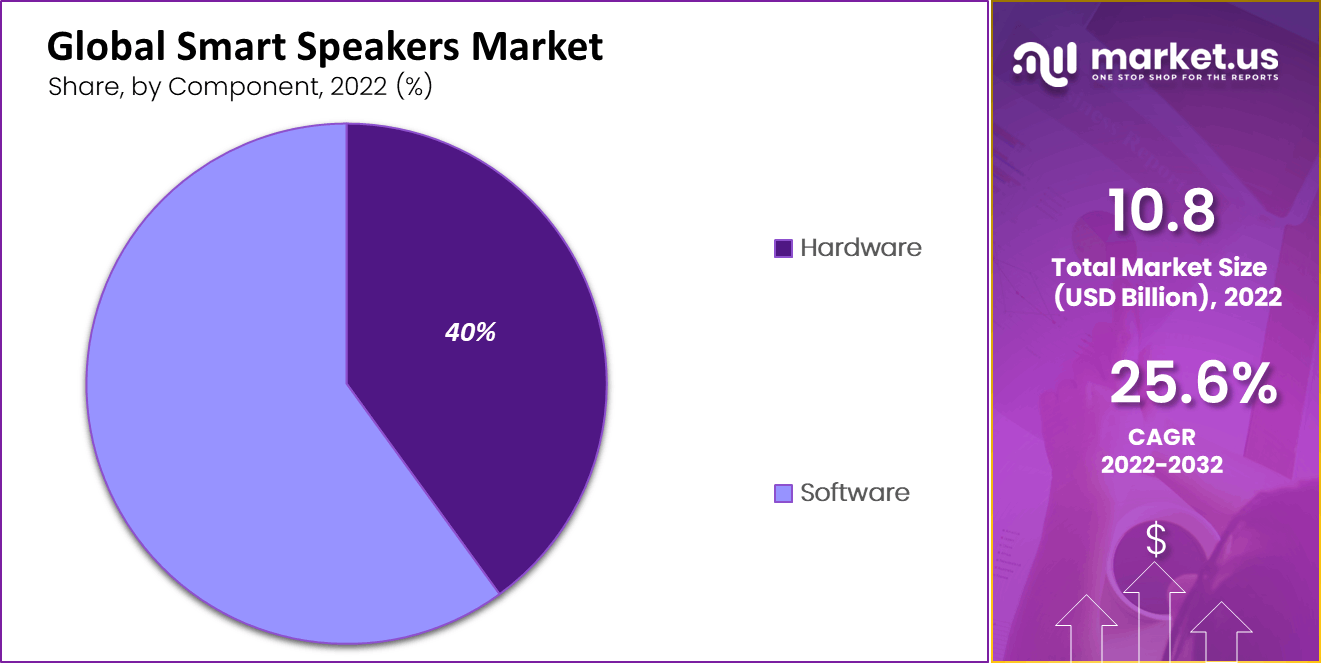

- The dominance in the market’s software segment, comprising 60% of the share, can be attributed to Amazon, Google, Apple, and other companies consistently providing updates to enhance customer experiences. This gives the software-oriented smart speaker segment a competitive advantage over its hardware counterpart.

- Among the software offerings are various versions of Alexa devices, such as Echo, Dot, Amazon Smart Plug, and Echo Auto. The most cost-effective iteration of the Amazon Echo speaker, recognized as the most advanced in 2022, is also referred to as the superior choice.

- Conversely, the hardware sector holds 40% of the market share due to dwindling demand for hardware components like processors, memory, microphones, etc.

(Source: Market.us)

Smart Speaker Statistics by Region

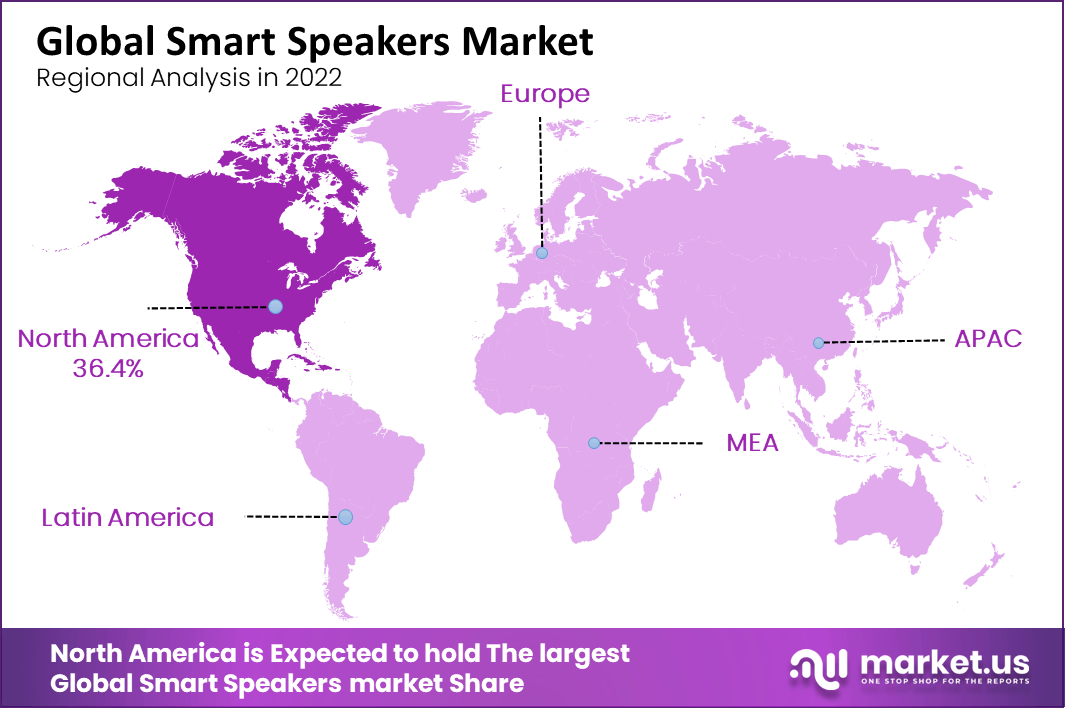

- North America leads with 36.4%, Europe at 18.0%, and the Asia-Pacific (APAC) region holds 25.4%.

- Latin America accounts for 10.4% of the market share, while the Middle East and Africa (MEA) region collectively contributes 9.8%. These figures highlight the varying levels of market presence across these regions, with North America and APAC standing out as the leading contributors to this particular sector’s market landscape.

- On a global scale, China presently stands as one of the largest markets for smart speakers, particularly in shipments.

- Following closely is the United States, a hub for some of the world’s most renowned smart speaker brands. Notably, domestic brands take center stage in China’s smart speaker market.

- Tech giants like Alibaba, Xiaomi, and Baidu exert significant dominance, accounting for over 80% of the market share—starkly contrasting their collective share of less than 30% on the global stage.

- During the initial half of 2022, the sales revenue of smart speakers in China surged to 4.2 billion yuan. This figure matched the total annual sales in 2018, even during the COVID-19 outbreak.

- In 2020, approximately 36% of the market share was attributed to smart speakers featuring built-in screens.

- The internet firm Baidu led this sector, which provides screen-equipped and screenless smart speaker options.

- In contrast, Apple, Amazon, and Google focus on smart speaker models lacking screens, while notable Chinese brands exclusively present a variant with an integrated display.

(Source: Market.us, Statista)

Top Key Players in the Industry Statistics

- In the market’s competitive landscape, Amazon.com, Inc. holds a substantial share of 23%, making it a prominent player.

- Apple, Inc. follows with a 15% share, showcasing its notable presence.

- Alphabet Inc., the parent company of Google, secures 8% of the market, while Tmall Genie captures a significant share of 17%, reflecting its robust standing.

- AliGenie contributes 12% to the market, adding to the diversity. Bose Corporation and Xiaomi hold 9% and 6%, respectively, underscoring their involvement.

- Panasonic Corporation and other key players command a 6% share, signifying their participation.

- The remaining 4% is attributed to various other significant contributors in the market.

(Source: Market.us)

Household Adoption Rate – Smart Speaker Statistics

- Across different countries, the penetration of smart speakers varies distinctly. In Australia, smart speaker adoption stands at 10.7%, reflecting a moderate level of engagement.

- Brazil showcases a lower adoption rate of 5.7%, while Canada exhibits a slightly higher penetration of 12.2%.

- Germany and India’s smart speaker adoption rates are 12.7% and 20.9%, respectively, with the latter indicating a stronger inclination.

- In Japan, the utilization of smart speakers lags with a modest 5.6% penetration.

- The United Kingdom (UK) boasts a notable adoption rate of 18.3%, and the United States (U.S) closely follows with 20.7%, underlining a relatively higher acceptance of this technology.

(Source: November 2018 IHS Markit Survey)

Smart Speaker Statistics by User Demographics

Age Distribution

- Smart speaker ownership varies across different age groups. Among individuals aged 18-24, 15% own a smart speaker, while ownership increases slightly to 18% within the 25-34 age bracket.

- In the 35-44 age range, ownership sees a further uptick, with 21% of people having a smart speaker.

- Those between 45 and 54 years old exhibit the highest ownership at 24%, demonstrating a greater adoption of this technology.

- Among those above 55, 22% possess a smart speaker, indicating that this trend is not limited to younger generations and has garnered popularity among diverse age groups.

- Approximately 100 million individuals, constituting 35% of the U.S. population aged 12 and above, possess a smart speaker.

- Within this landscape, Amazon continues to uphold its leading position.

- Specifically, 23% of Americans possess an Amazon Alexa, 11% own a Google Nest, and 2% have an Apple HomePod. It’s worth noting that consumers might possess more than one smart speaker brand.

- For six years, the adoption of smart speakers among U.S. households has demonstrated a consistent upward trajectory.

- Starting at a modest 7% in 2017, the ownership penetration has progressively expanded. In 2018, it jumped to 18%, signaling a noteworthy surge.

- The subsequent years continued to ascend, with 23% in 2019 and a further increase to 27% in 2020. The momentum persisted, reaching 33% in 2021.

- This growth culminated in 2022, as smart speaker ownership achieved a notable 35% penetration rate, underlining this technology’s steady and substantial integration into U.S. households.

(Source: Edison Research and NPR)

Gender Distribution

- Around 59% of male participants in India did not possess a smart speaker.

- Meanwhile, among the surveyed Indians, most individuals owned a smart speaker primarily to manage their smart appliances remotely.

(Source: Rakuten Insight survey)

User Engagement and Trends

- During the three months leading up to November 2018, about 89% of households with smart speakers reported actively using a digital assistant.

- In contrast, only 41% of the surveyed group engaged with a digital assistant.

- When considering all markets, the availability of multiple Amazon Echo devices outweighed that of multiple Google Home devices.

- On average, 21% of households with an Amazon Echo used two Echo speakers, and an additional 15% accessed three or more.

- In comparison, for Google Home users, only 15% had access to two devices, with another 15% having access to three or more devices.

- A recent survey found that the usage of Smart Speakers for voice commands had increased to 35%, a rise from 27% recorded two years ago in 2020.

- Although smartphones remain the lead as the most commonly used devices for voice commands and interacting with personal assistants, the survey highlights that Smart Speakers have now secured the second position for this type of usage.

(Source: 2023 National Public Media Survey, November 2018 IHS Markit Survey)

Most Preferred Smart Speakers Statistics

- Amazon Echo is the dominant player, with a substantial 67% market share in smart speaker ownership. Its versatile features and integrated virtual assistant have garnered a significant user base.

- Following behind is Google Home, accounting for 27% of smart speaker owners.

- Apple HomePod maintains a respectable 21% presence, appealing to those entrenched in the Apple ecosystem.

- Google Nest follows with 16%, offering a choice within the Google ecosystem.

- Sony also holds a notable share, capturing the attention of 10% of smart speaker users. These statistics reflect the dynamic landscape of smart speakers and the diverse preferences of consumers across these leading brands.

(Source: Statista)

Smart Speakers Statistics by User Satisfaction

- Among households owning smart speakers, 27% of participants indicated that the top priority was the “integration with services and devices” aspect.

- Following closely, 25% of respondents considered “questions and answers” highly significant. In the third position, 24% of participants emphasized “sound quality” as an essential feature.

- Those with smart speakers powered by Google Assistant or Amazon Alexa were more inclined to view integration as the most crucial element.

- This highlights the strategic advantage of positioning their digital assistants as central to smart home control. Both Amazon and Google capitalized on their entertainment services, offering features like access to music streaming and audiobooks as part of their propositions.

(Source: November 2018 IHS Markit Survey)

Recent Developments

Acquisitions:

- Amazon’s Acquisition of Eero: Amazon acquired Eero, a mesh Wi-Fi router company, to enhance the integration of smart home devices with its Echo smart speakers. This acquisition aims to improve connectivity and network performance for users of Amazon’s smart home ecosystem.

New Product Launches:

- Apple HomePod Mini (Second Generation): In January 2023, Apple introduced the second-generation HomePod Mini, featuring enhanced sound quality and new functionalities like immersive spatial audio and support for smart home automation via Siri.

- Amazon Echo Pop: In June 2023, Amazon launched the Echo Pop smart speaker. Priced at USD 60, it features a hemispherical design, supports multiple languages, and integrates the AZ2 Neural Edge processor for improved performance and responsiveness.

- Google Nest Audio Updates: Google announced updates for its Nest Audio smart speakers in 2023, enhancing sound quality and integrating advanced AI features to adjust sound based on the environment and content.

Funding:

- Investment in AI and Machine Learning: Companies like Amazon, Google, and Apple continue to invest heavily in AI and machine learning to enhance the capabilities of their smart speakers. These investments are focused on improving voice recognition and sound quality, and integrating new features to stay competitive.

Market Growth:

- Global Market Expansion: The growth is driven by increasing consumer demand for smart home devices and advancements in voice assistant technologies.

- Regional Insights: North America dominates the smart speaker market, accounting for 41.0% of the market share in 2022. The Asia-Pacific region is expected to grow at the fastest CAGR of 26.1% from 2024 to 2032, driven by the rising adoption of smart home technologies and increasing disposable incomes.

Innovation and Trends:

- Integration with Smart Home Devices: Smart speakers are increasingly being integrated with various smart home devices such as lights, thermostats, and security systems, providing users with centralized voice control.

- Enhanced Privacy Features: Companies are focusing on improving the privacy and security features of their smart speakers. This includes implementing physical controls for microphones and developing software to better manage user data and prevent unauthorized access.

- Voice Commerce: The use of smart speakers for voice commerce is growing, allowing users to make purchases, place orders, and conduct transactions using voice commands. This trend is expanding the functionality of smart speakers beyond entertainment and home automation.

Conclusion

Smart Speaker Statistics: Smart speakers powered by virtual assistants like Amazon Alexa, Google Assistant, and Apple Siri have seen significant adoption globally since their introduction. They have become one of the fastest-growing consumer technology segments.

Amazon’s Echo and Google’s Home/Nest devices have dominated the global smart speaker market. Amazon holds a larger market share due to its early entry and strong product line-up.

However, competition from companies like Apple, Samsung, and others has also grown. The primary use case for smart speakers has been voice search and voice-controlled tasks, such as setting alarms, playing music, providing weather forecasts, and controlling smart home devices.

Smart speakers have played a central role in the growth of the smart home ecosystem. They act as central hubs for controlling various smart devices, including lights, thermostats, security cameras, etc.

FAQs

Amazon’s Echo devices and Google’s Home/Nest devices were the market leaders, with Amazon having a larger market share due to its early entry and extensive product range.

Amazon’s Alexa and Google Assistant are the two most popular virtual assistants used in smart speakers.

The main uses include voice search, playing music, providing weather updates, setting alarms, and controlling smart home devices.

Privacy concerns exist due to the potential for accidental recordings and uncertainty about how voice data is stored and used.

Smart speakers often act as central hubs for controlling smart home devices such as lights, thermostats, and security cameras.