Table of Contents

Introduction

According to Smart Speaker Statistics, A smart speakers is a wireless and voice-controlled device that offers a range of functions beyond traditional audio playback. It integrates voice recognition technology and connectivity to the internet and often features a virtual assistant or voice assistant, which enables users to interact with the device through spoken commands.

Overall, the functionality of smart speakers is expanding as technology advances, enabling them to become versatile and central devices within homes for communication, information, entertainment, and home automation.

Editor’s Choice

- In 2022 the Smart Speaker Market generated around 11 billion USD in revenue.

- On a global scale, China presently stands as one of the largest markets for smart speakers, particularly in shipments.

- In the market’s competitive landscape, Amazon.com, Inc. holds a substantial share of 23%, making it a prominent player.

- Apple, Inc. follows with a 15% share, showcasing its notable presence.

- Approximately 100 million individuals, constituting 35% of the U.S. population aged 12 and above, possess a smart speaker.

- A recent survey found that the usage of Smart Speakers for voice commands had increased to 35%, a rise from 27% recorded two years ago in 2020.

- India’s smart speaker adoption rate is 20.9%, while the United Kingdom (UK) boasts a notable adoption rate of 18.3%, and the United States (U.S.) closely follows with 20.7%.

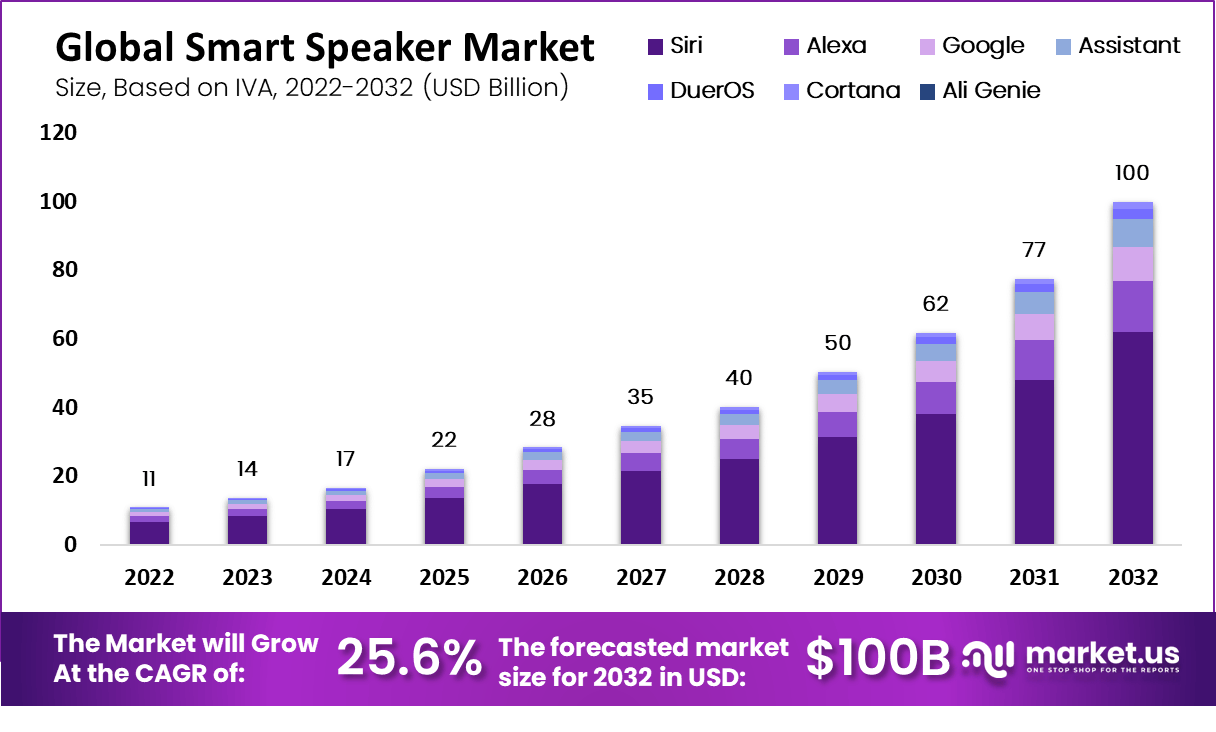

Global Smart Speaker Market Size

- The smart speaker market is demonstrating remarkable growth, with its revenue projected to follow an upward trajectory over the next decade. In 2022, the industry generated around 11 billion USD in revenue.

- The growth shows no signs of slowing down, with revenue forecasts of 35 billion USD in 2027 and 40 billion USD in 2028.

- The subsequent years, particularly 2029, are anticipated to mark a major milestone as the industry breaches the 50 billion USD revenue mark.

- The upward trajectory persists, with revenue projected to escalate to 62 billion USD by 2030, 77 billion USD by 2031, and a significant milestone of 100 billion USD by 2032. This remarkable growth trend underscores the increasing prominence of smart speakers in modern technology-driven lifestyles.

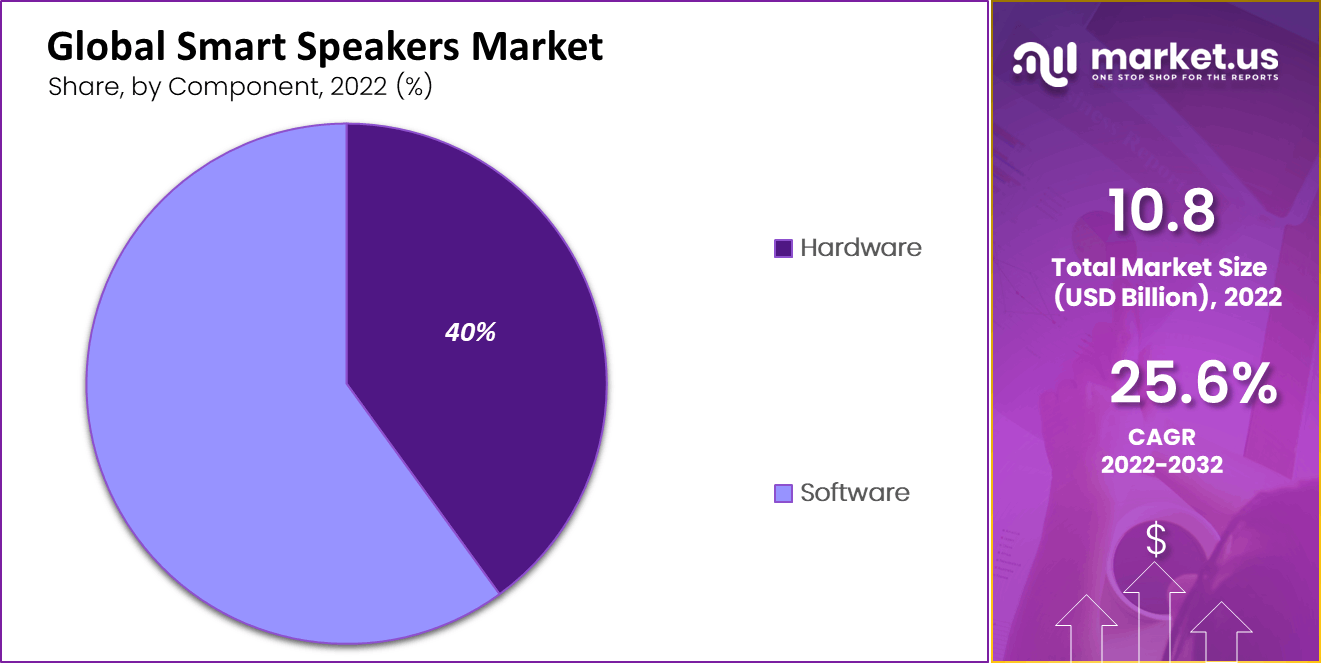

Global Smart Speaker Market Size by Segment

- The dominance in the market’s software segment, comprising 60% of the share, can be attributed to Amazon, Google, Apple, and other companies consistently providing updates to enhance customer experiences. This gives the software-oriented smart speaker segment a competitive advantage over its hardware counterpart.

- Conversely, the hardware sector holds 40% of the market share due to dwindling demand for hardware components like processors, memory, microphones, etc.

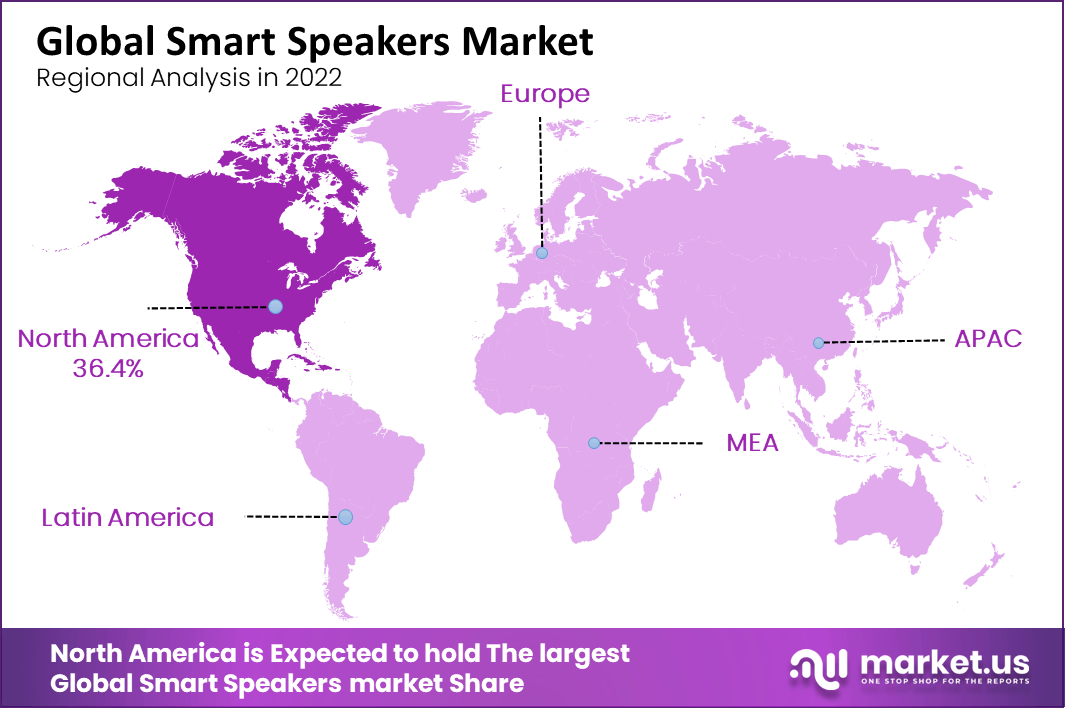

Regional Market Analysis

Overall

- North America leads with 36.4%, Europe at 18.0%, and the Asia-Pacific (APAC) region holds 25.4%.

- Latin America accounts for 10.4% of the market share, while the Middle East and Africa (MEA) region collectively contributes 9.8%.

China Smart Speaker Market

- On a global scale, China presently stands as one of the largest markets for smart speakers, particularly in shipments.

- Tech giants like Alibaba, Xiaomi, and Baidu exert significant dominance, accounting for over 80% of the market share—starkly contrasting their collective share of less than 30% on the global stage.

- During the initial half of 2022, the sales revenue of smart speakers in China surged to 4.2 billion yuan. This figure matched the total annual sales in 2018, even during the COVID-19 outbreak.

Key Players in the Smart Speaker Industry

- In the market’s competitive landscape, Amazon.com, Inc. holds a substantial share of 23%, making it a prominent player.

- Apple, Inc. follows with a 15% share, showcasing its notable presence.

- Alphabet Inc., the parent company of Google, secures 8% of the market, while Tmall Genie captures a significant share of 17%, reflecting its robust standing.

Household Penetration Rates

- In Australia, smart speaker adoption stands at 10.7%, reflecting a moderate level of engagement.

- Brazil showcases a lower adoption rate of 5.7%, while Canada exhibits a slightly higher penetration of 12.2%.

- Germany and India’s smart speaker adoption rates are 12.7% and 20.9%, respectively, with the latter indicating a stronger inclination.

The United Kingdom (U.K) boasts a notable adoption rate of 18.3%, and the United States (U.S) closely follows with 20.7%, underlining a relatively higher acceptance of this technology.

User Demographics

Age Distribution

- Smart speaker ownership varies across different age groups. Among individuals aged 18-24, 15% own a smart speaker, while ownership increases slightly to 18% within the 25-34 age bracket.

- In the 35-44 age range, ownership sees a further uptick, with 21% of people having a smart speaker.

- Approximately 100 million individuals, constituting 35% of the U.S. population aged 12 and above, possess a smart speaker.

- Within this landscape, Amazon continues to uphold its leading position.

- Specifically, 23% of Americans possess Amazon Alexa, 11% own a Google Nest, and 2% have an Apple HomePod. It’s worth noting that consumers might possess more than one smart speaker brand.

- For six years, the adoption of smart speakers among U.S. households has demonstrated a consistent upward trajectory.

- The subsequent years continued to ascend, with 23% in 2019 and a further increase to 27% in 2020. The momentum persisted, reaching 33% in 2021.

- This growth culminated in 2022, as smart speaker ownership achieved a notable 35% penetration rate.

Gender Distribution

- Around 59% of male participants in India did not possess a smart speaker.

- Meanwhile, among the surveyed Indians, most individuals owned a smart speaker primarily to manage their smart appliances remotely.

Most Common Use Cases

- A recent survey found that the usage of Smart Speakers for voice commands had increased to 35%, a rise from 27% recorded two years ago in 2020.

Popularity of Voice Assistants

- During the three months leading up to November 2018, about 89% of households with smart speakers reported actively using a digital assistant.

- In contrast, only 41% of the surveyed group engaged with a digital assistant.

- On average, 21% of households with Amazon Echo used two Echo speakers, and an additional 15% accessed three or more.

- In comparison, for Google Home users, only 15% had access to two devices, with another 15% having access to three or more devices.

Preferred Brands

- Amazon Echo is the dominant player, with a substantial 67% market share in smart speaker ownership. Its versatile features and integrated virtual assistant have garnered a significant user base.

- Following behind is Google Home, accounting for 27% of smart speaker owners.

- Apple HomePod maintains a respectable 21% presence, appealing to those entrenched in the Apple ecosystem.

User Satisfaction and Loyalty

- Among households owning smart speakers, 27% of participants indicated that the top priority was the “integration with services and devices” aspect.

- Following closely, 25% of respondents considered “questions and answers” highly significant. In the third position, 24% of participants emphasized “sound quality” as an essential feature.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)