Table of Contents

Introduction

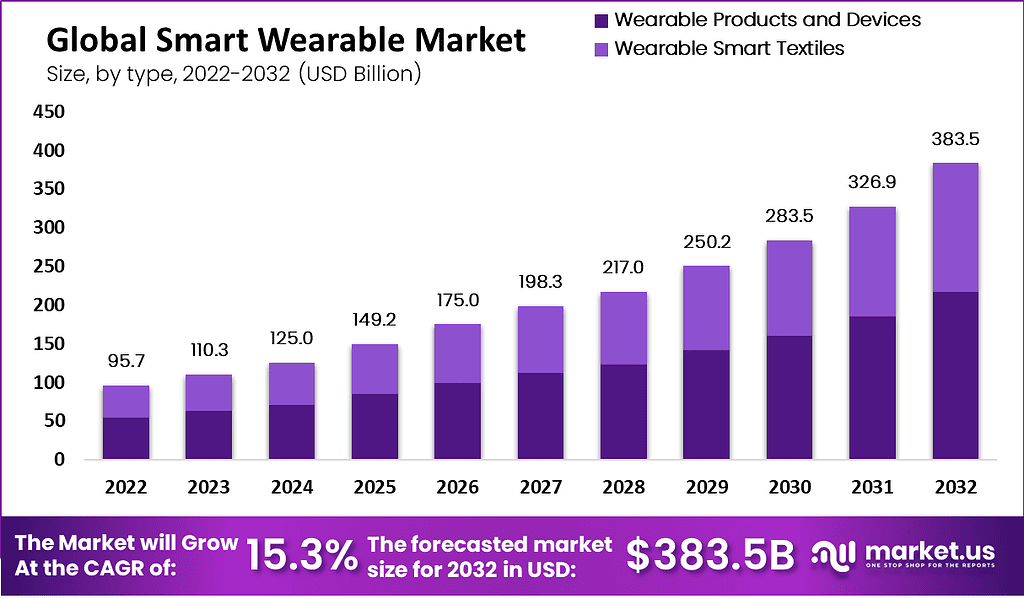

The global market for smart wearables is predicted to grow significantly, from USD 110.3 billion in 2023 to an estimated USD 383.5 billion by 2032, at a CAGR of 15.3%. This growth is driven by technological advancements and the increasing trend of health and fitness monitoring, which are spurring consumer demand for smart wearable devices. These devices are now being integrated into daily life and offer various functionalities, ranging from fitness tracking to integration with smart home systems.

The smart wearables industry is experiencing rapid growth and change, with many notable mergers, acquisitions, and investments taking place. Medtronic has recently acquired EOFlow Co. Ltd., which manufactures the EOPatch®, a wearable insulin delivery device, to expand its diabetes management portfolio. Honeywell International Inc. has acquired Global Access Solutions from Carrier for USD 4.95 billion, as part of its strategy to align its portfolio with emerging megatrends such as automation, digitalization, and energy transition. Finally, Bose has invested in Gurugram-based smart wearables brand Noise, to help fund its growth and product innovation in the Indian market.

However, the market faces multiple challenges. The high costs, limited battery life, and functionality constraints compared to dedicated devices are prominent barriers. Additionally, security concerns related to the handling and transmission of personal data also pose significant challenges. Despite these challenges, the market provides several opportunities, particularly in health and fitness tracking and workplace applications, where there is a growing demand for devices that can enhance productivity and safety.

Key Takeaways

- The Smart Wearables Market is expected to grow at a rate of 15.3% annually from 2023 to 2032, reaching a total value of USD 383.50 Billion by 2032, a significant increase from USD 110.3 Billion in 2023.

- Wearable Smart Textiles and Wearable Products and Devices are the main segments driving market growth.

- Wristwear is the most popular product segment, making up 53.4% of the market in 2022, generating USD 82.6 Billion in revenue.

- Headwear and Eyewear are expected to grow the fastest, especially due to the rising use of virtual reality (VR) and augmented reality (AR) headsets.

- Consumer Electronics is the leading application segment, holding 45.8% of the market share in 2022.

- North America has the largest revenue share (35.3% in 2022), while the Asia Pacific region shows promising growth potential, with a projected Compound Annual Growth Rate (CAGR) of 7.24%.

- Major companies driving innovation and competition in the market include Xiaomi Global Community, Huawei Technologies Co., Ltd., Apple Inc., Samsung, Sony Corporation, among others.

Smart Wearables Statistics

- In 2020, 30% of middle-income families in the US used fitness trackers.

- In 2020, 22% of people worldwide had a wearable device, and 60% used theirs every day.

- In 2019, 21% of Americans used fitness trackers or smartwatches.

- Companies sold 223 million health wearables globally in 2019.

- In 2017, 18.6 million sports wearables were shipped worldwide, and their sales are increasing quickly.

- Smartwatch sales in the US increased from 9 million units in 2016 to 22 million in 2020.

- Analysts predict a 2% decrease in revenue and a reduction in penetration to 4.8% starting in 2024

- People with different income levels use wearable technology in different ways.

- Apple sells the most wearable technology.

- Over 1 billion people use wearable devices.

Recent Developments

Product Developments and Launches:

- Apple Watch Series 9 is expected to emphasize health tracking, potentially introducing non-invasive glucose monitoring and blood pressure features.

- Fitbit Charge 6 is rumored to launch with enhanced fitness tracking capabilities.

- Huawei Watch Buds, combining earbuds with a smartwatch, have recently been introduced in China, with plans for wider distribution.

- WHOOP is focusing on improving the software experience, enhancing how data translates to actionable health insights.

Innovations in Form Factors:

- New form factors like smart rings are being explored by major companies such as Samsung, Apple, Google, and Fitbit, which could change the landscape of wearable devices.

Integration and Partnerships:

- Google’s Wear OS 4 is expected to feature full Fitbit integration, enhancing functionality across Google and Fitbit devices.

Focus on Specific Demographics:

Companies are starting to target children with wearable devices, with Fitbit and Google reportedly developing a dedicated smartwatch for kids.

Use Cases

Healthcare Monitoring

Wearable devices in healthcare allow continuous monitoring of patients’ vital signs, improving timely medical interventions and overall patient care. This integration supports telehealth applications by providing real-time data remotely to healthcare professionals, enhancing the ability to manage chronic conditions and reduce hospital visits.

Sports Performance:

In sports, smart wearables like clothing and accessories equipped with sensors track performance metrics such as heart rate, physical activity levels, and overall athlete conditioning. This data helps coaches tailor training programs and enhance athletes’ performance and safety.

Industrial Safety

In manufacturing and industrial settings, wearables monitor worker safety by tracking health parameters and environmental conditions. Devices such as smartwatches enhance operational efficiency and ensure safety by alerting workers to potential hazards.

Fashion and Personalization

Smart wearables integrate technology with fashion, offering features that adapt to the wearer’s preferences, such as changing colors or patterns based on mood or environment. This blend of style and functionality caters to consumer desires for personalized and interactive apparel.

Financial Transactions

In the financial sector, wearables facilitate secure and convenient contactless payments, enhancing transaction security and user convenience. Smart rings and watches allow users to carry out financial transactions seamlessly, blending security with ease of use.

Security Enhancements

With a growing focus on security, wearables are incorporating advanced features such as voice commands and acoustic event detection, ensuring data privacy and enhancing user safety against potential cybersecurity risks.

Key Players Analysis

Apple Inc.

Apple Inc. remains a dominant force in the smart wearables sector, consistently pushing the boundaries of technology and design. In 2023, Apple expanded its wearable technology portfolio by introducing two new models of the Apple Watch Series 9 and a second-generation Apple Watch Ultra, alongside the iPhone 15 lineup. These devices are designed to enhance user experience with cutting-edge features and improved integration within Apple’s ecosystem.

Looking ahead, 2024 marks the 10th anniversary of the Apple Watch, and Apple is poised to celebrate this milestone with the launch of the Apple Watch X. This new model is rumored to feature significant design changes and new health sensors for monitoring sleep apnea and blood pressure, setting new standards in health monitoring technology.

Furthermore, Apple’s continuous innovation is evident in its strategic product roadmap, which includes the development of advanced wearable devices integrated with AR and VR technologies, highlighting the company’s commitment to leading the tech industry’s future.

Xiaomi

Xiaomi, a major player in the global smart wearables market, has been actively expanding its product offerings and technological capabilities. Recently, Xiaomi launched several new devices, including the Xiaomi Smart Band 8 Pro, Xiaomi Watch S3, and Xiaomi Watch 2, showcasing their commitment to innovation in the wearable tech space. These launches not only enhance Xiaomi’s product lineup but also strengthen its position in the competitive wearables market. The company has also been investing in its smart ecosystem, integrating various smart devices to create a more connected and efficient user experience. Xiaomi’s strategic focus on R&D and marketing, coupled with its robust portfolio expansion, are key factors driving its growth and presence in the global smart wearables sector.

Huawei Technologies Co., Ltd.

Huawei Technologies Co., Ltd. has made significant strides in the smart wearables sector, particularly noted for its integration of health-focused technologies and fashion-forward design. Celebrating a decade in the wearables industry, Huawei continues to innovate, notably with its recent launch of the Huawei Watch 3 Series and the Huawei MatePad Pro under its HarmonyOS 2. This operating system is designed to enhance interconnectivity across Huawei devices, offering a seamless user experience. Additionally, the Huawei Watch 3 Series features advanced health monitoring capabilities, including high-precision temperature sensors and professional fitness tracking across more than 100 workout modes. These developments underscore Huawei’s commitment to integrating sophisticated health monitoring and smart capabilities in their wearable devices, aiming to provide users with both style and enhanced functionality.

Nike, Inc.

Nike, Inc. has been actively engaging in the smart wearables sector, leveraging its expertise in sports and innovation to develop fitness-focused technology. The company has focused on integrating advanced tracking capabilities into its wearable devices, which not only monitor physical activities but also enhance the overall user experience through innovative features. A significant recent development includes Nike’s expansion into digital platforms, particularly with the launch of the .SWOOSH platform, which aims to merge digital experiences with physical athletic engagement. Nike continues to innovate in smart wearables, maintaining a strong emphasis on combining fashion with functional technology to cater to a broad audience of fitness enthusiasts and professional athletes.

Fitbit Inc.

Fitbit Inc., now a part of Google, continues to be a significant player in the smart wearables sector, known for its innovative fitness trackers and smartwatches. The acquisition by Google, completed in January 2021, has further expanded Fitbit’s capabilities, particularly in integrating Google’s AI and software expertise into Fitbit devices. This merger is seen as a strategic move to enhance Google’s position in the wearable market and does not involve using Fitbit users’ health data for Google ads, ensuring privacy concerns are addressed.

Recent product launches include the Fitbit Charge 6, which integrates Google’s services like Maps and Wallet, and offers advanced health tracking features like a precise heart rate monitor and sleep tracking. Additionally, Fitbit has upgraded its app, improving user interface and personal health insights, which shows their commitment to enhancing user engagement and wellness tracking.

LG Electronics

LG Electronics has been actively expanding its portfolio in the smart wearables sector. They launched their foray into wearable technology with products like the LG Lifeband Touch and Heart Rate Earphones, which mark their initial steps into fitness and health tracking. These developments are part of LG’s broader innovation strategy, which includes the establishment of LG NOVA, an innovation center based in Silicon Valley. This center is designed to accelerate the growth of new ideas by collaborating with startups and entrepreneurs, fostering innovations that enhance life quality through technology.

Moreover, LG’s commitment to the wearable sector is evident not just in product launches but also in their efforts to integrate these technologies into a broader ecosystem that enhances connectivity and usability in everyday life. This strategy aligns with their long-term vision to innovate for a better life, leveraging advanced technologies to create more personalized and accessible user experiences.

Samsung Electronics Co., Ltd.

Samsung Electronics Co., Ltd. continues to make significant strides in the smart wearables sector, focusing on innovation and user-centric designs. They have recently introduced new products such as the Galaxy Watch6, which emphasizes fitness tracking and a customized user experience with an advanced sleep coaching system. Additionally, Samsung has launched the Galaxy Fit and Galaxy Fit e, which are designed for a wide range of fitness activities and support lifestyles from casual to intensive athletes. These devices offer intuitive tracking, enhanced sleep analysis, and smart stress management capabilities.

Samsung’s commitment to health and wellness extends through their wearables’ seamless integration with the Galaxy ecosystem, enabling comprehensive health management and real-time coaching. This integration enhances the user experience by allowing for efficient interaction and connectivity across Samsung’s device range.

Moreover, Samsung has been proactive in rolling out technological innovations, such as their partnership with Google to unify their smartwatch platforms. This collaboration aims to create a more cohesive and enhanced user experience across Samsung and Google devices, promoting an open ecosystem for developers and providing long-term software support for existing devices

Conclusion

In conclusion, while the smart wearables market is poised for significant growth, driven by technological innovations and a growing focus on health and fitness, it must navigate challenges related to cost, battery life, and data security. The continuous introduction of advanced features and products suggests a dynamic and evolving market landscape that could overcome these hurdles to meet the diverse needs of consumers globally.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)