Table of Contents

- Introduction

- Editor’s Choice

- History of Smart Wearables Technology Statistics

- Smart Wearables Devices Ownership and Usage Statistics

- Wearables Smart Devices Shipments Statistics

- Smart Wearables Market Statistics

- Worldwide Smart Wearables Device Shipments Statistics

- Smartwatch Statistics

- Fitness Tracker Statistics

- Smart Glass Statistics

- Smart Wearables Users Demographics and Statistics

- Spending on Smart Wearables Statistics

- Motivating Factors

- Regulations for Smart Wearables

- Recent Developments

- Conclusion

- FAQs

Introduction

Smart Wearables Statistics: Smart wearables are electronic devices worn on the body, designed to offer functionalities beyond traditional timekeeping.

These include smartwatches, fitness trackers, smart glasses, smart clothing, and smart rings, each equipped with sensors. Like accelerometers and heart rate monitors to track health metrics and physical activity.

Connectivity features, such as Bluetooth and Wi-Fi, enable data synchronization with other devices. Applications range from health monitoring and fitness tracking to communication and navigation. With the market expanding due to technological advancements and increasing health consciousness.

Integration with other smart devices and ecosystems is also a growing trend, enhancing the functionality and user experience of wearables.

Editor’s Choice

- As of March 2024, wearable device ownership varies significantly across different countries, according to survey respondents. In India, the highest percentage of ownership is observed. 57% of respondents own wearable devices, while 43% do not.

- By 2028, global wearable device shipments are expected to reach 645.7 million units.

- The global smart wearables market revenue reached USD 110.3 billion in 2023.

- By 2032, the market is forecasted to reach USD 383.5 billion. Wearable products contribute USD 217.06 billion, and wearable smart textiles USD 166.44 billion.

- The global smart wearables market is segmented by product type, with wristwear commanding the largest share at 35%.

- As of September 2022, various factors motivated consumers in India to purchase wearable devices. The primary reason, cited by 39.68% of respondents, was concern for their health. As they wanted to monitor and improve it.

- In the U.S., devices intended for medical purposes, such as heart rate monitors or pulse oximeters. They fall under the regulatory oversight of the FDA, governed by the Food, Drug, and Cosmetic Act.

History of Smart Wearables Technology Statistics

- The history of smart wearable technology traces its roots back to early inventions like eyeglasses in 1286 and progressed through innovations like the abacus ring in the 1600s.

- However, modern smart wearables began to take shape in the mid-20th century.

- However, In 1961, the first wearable computer was developed for cheating in roulette, and by the 1970s, devices like the Pulsar calculator watch emerged.

- The Sony Walkman in 1979 marked a major leap, introducing portability in entertainment.

- However, wearable tech gained momentum in the 2000s with the Nike+iPod in 2006 and the Fitbit in 2008, leading to today’s smartwatches, fitness trackers, and VR devices such as the Oculus Rift.

- Notably, the Apple Watch in 2015 further revolutionized the market, incorporating health and connectivity features.

- Further, the technology continues to evolve, integrating health monitoring, augmented reality, and sustainable designs in the 2020s, showing immense growth potential.

(Sources: Blumehive, Visual Capitalist, Splitfit)

Smart Wearables Devices Ownership and Usage Statistics

Country Statistics By Smart Wearables Device Ownership

- As of March 2024, wearable device ownership varies significantly across different countries, according to survey respondents.

- In India, the highest percentage of ownership is observed, with 57% of respondents owning wearable devices, while 43% do not.

- In Mainland China, 53% of the population owns wearables, and 47% do not use them.

- The United Kingdom follows closely, with 52% owning wearables and 48% not.

- Sweden has an equal split, with 50% of respondents owning wearables and the remaining 50% without.

- In the Netherlands, 44% of people own wearable devices, while 56% do not.

- Germany shows a similar trend, with 42% ownership and 58% non-ownership.

- In the United States and Canada, 41% of respondents own wearable devices, while 59% do not.

- South Korea sees a slightly lower percentage of ownership at 40%, with 60% of people not owning wearables.

- Brazil has the lowest ownership rate, with only 33% of respondents owning wearable devices, while 67% remain without.

- This data highlights varying levels of adoption of wearable technology across different regions.

(Source: Statista)

Smart Wearables Devices Usage – By Country Statistics

- As of March 2024, wearable device usage shows considerable variation across different countries.

- In India, half of the population uses wearable devices, with 50% of survey respondents reporting ownership.

- Mainland China follows, with 46% of respondents using wearables, while 54% do not.

- In the United Kingdom, 42% of individuals report using wearables, compared to 58% who do not.

- In Sweden, 37% of the population uses wearables, with 63% reporting non-usage.

- Germany has a wearable usage rate of 35%, with 65% of respondents not using wearables.

- Similarly, in South Korea and the Netherlands, 34% of respondents use wearables, while 66% do not.

- In the United States and Canada, 32% of respondents report wearable device usage, with 68% of the population not using them.

- Brazil shows the lowest rate of wearable usage, with only 28% of respondents using wearable devices and 72% not engaging with this technology.

- This data reflects varying levels of wearable technology adoption across different countries and regions.

(Source: Statista)

Wearables Smart Devices Shipments Statistics

Smart Wearables Device Shipments Worldwide

- The global shipment of wearable devices has seen a steady increase from 2014 to 2028.

- In 2014, only 28.8 million units were shipped, but this figure rose significantly to 81.9 million in 2015 and further increased to 102.4 million in 2016.

- By 2017, shipments reached 115.4 million units.

- A sharp rise was observed in 2018, with 172.2 million units shipped, which doubled to 346.4 million in 2019.

- The market continued to grow, with 444.7 million units shipped in 2020 and 533.6 million in 2021.

- However, a slight decrease was noted in 2022, with 492.1 million units.

- Further, the shipments rebounded in 2023, reaching 506.6 million units, and are projected to continue growing, with an estimated 559.7 million units in 2024, 590.7 million in 2025, and 614.1 million in 2026.

- By 2027, global shipments are expected to reach 632.3 million units, eventually rising to 645.7 million units by 2028.

- This data underscores the continuous demand and growing adoption of wearable devices worldwide.

(Source: Statista)

Wearables Smart Device Shipments Worldwide – By Product Category Statistics

2021-2024

- Global wearable device shipments from 2021 to 2024 are categorized by different product types, with earwear consistently leading in shipments.

- In 2021, earwear shipments totaled 339.62 million units, followed by 135.83 million smartwatches and 55.2 million wristbands. The “Others” category, which includes various less common wearables, accounted for 2.78 million units.

- By 2022, earwear shipments decreased slightly to 322.74 million units. While smartwatch shipments increased to 151.87 million, and wristband shipments fell to 39.02 million units.

- In 2023, earwear shipments rebounded to 341.55 million units, while smartwatches rose to 165.23 million units.

- A notable addition in 2023 was clothing wearables, with 438.05 million units. Along with 1.13 million smart glasses and 0.9 million units in the “Others” category.

- By 2024, earwear shipments are projected to grow to 347.28 million units. While smartwatch shipments are expected to reach 176.7 million units.

- Clothing wearables are forecasted to decline to 343.8 million units, with smart glasses reaching 1.65 million units and rings entering the market with 1.6 million units.

2025-2028

- From 2025 onwards, the upward trend continues. Earwear is projected to reach 367.85 million units, smartwatches 187.48 million units, and wristbands 30.67 million units.

- Clothing wearables will reach 350.97 million units, and shipments of rings and glasses will increase to 2.31 million and 1.75 million units, respectively.

- By 2028, earwear shipments are expected to reach 402.25 million units, smartwatches 208.63 million units, and wristbands 28.67 million units.

- Clothing wearables will stabilize at 374.28 million units. Rings and smart glasses are projected to rise to 3.23 million units and 2.17 million units, respectively.

- These figures demonstrate significant diversification and growth across multiple wearable product categories.

Wearables Smart Device Shipments Worldwide – By Vendor Statistics

2014-2018

- The global wearable device market has seen dynamic shifts in vendor unit shipments from the first quarter of 2014 through the third quarter of 2018.

- In Q1 2014, Fitbit led with 1.7 million units, followed by Samsung at 0.3 million units. By Q4 2014, Fitbit’s shipments grew to 5.3 million, while Apple entered the market later with significant growth.

- In Q1 2015, Xiaomi emerged as a notable player with 2.6 million units. While Apple shipped 4.1 million by Q4 2015.

- Moreover, Samsung and Fitbit maintained steady growth, with Samsung reaching 1.4 million units in Q4 2015 and Fitbit growing to 8.4 million units in the same period. By Q1 2016, Xiaomi shipped 3.8 million units, while Garmin and Samsung showed stable figures at 1.1 million and 0.7 million units, respectively.

- Apple’s dominance began to strengthen by Q4 2017, shipping 13.3 million units, while Fitbit declined slightly to 5.4 million units. Huawei entered the scene in Q4 2017 with 1.6 million units.

- By Q4 2018, Apple had surged to 19.7 million units, Samsung increased to 4.6 million units, and Fitbit shipped 5.5 million.

2019-2023

- In Q4 2019, Apple continued to lead with 43.7 million units, while Xiaomi shipped 12.8 million units. Samsung’s shipments reached 10.8 million, and Huawei’s reached 9.5 million.

- The market dynamics changed further in Q4 2020 when Apple reached 55.6 million units, and Samsung saw 13 million shipments.

- By Q1 2021, Apple shipped 30.1 million units, while Samsung followed with 11.8 million. Fitbit’s shipments had declined significantly, with the brand largely overshadowed by Apple and Xiaomi.

- By Q4 2022, Apple had reached 46.6 million units, followed by Xiaomi with 11.6 million and Samsung with 11 million units.

- In Q3 2023, Apple shipped 29.9 million units, Xiaomi reached 11.6 million, and Samsung maintained its position with 10.7 million units.

- New entrants like BoAt and Imagine Marketing began to gain traction, with BoAt shipping 8.5 million units and Imagine Marketing reaching 14.3 million.

- Other vendors continued to contribute a significant portion, with the “Other” category reaching 73.4 million units in Q3 2023. Reflecting the diversity and competition in the wearables market.

Smart Wearables Market Statistics

Global Smart Wearables Market Size Statistics

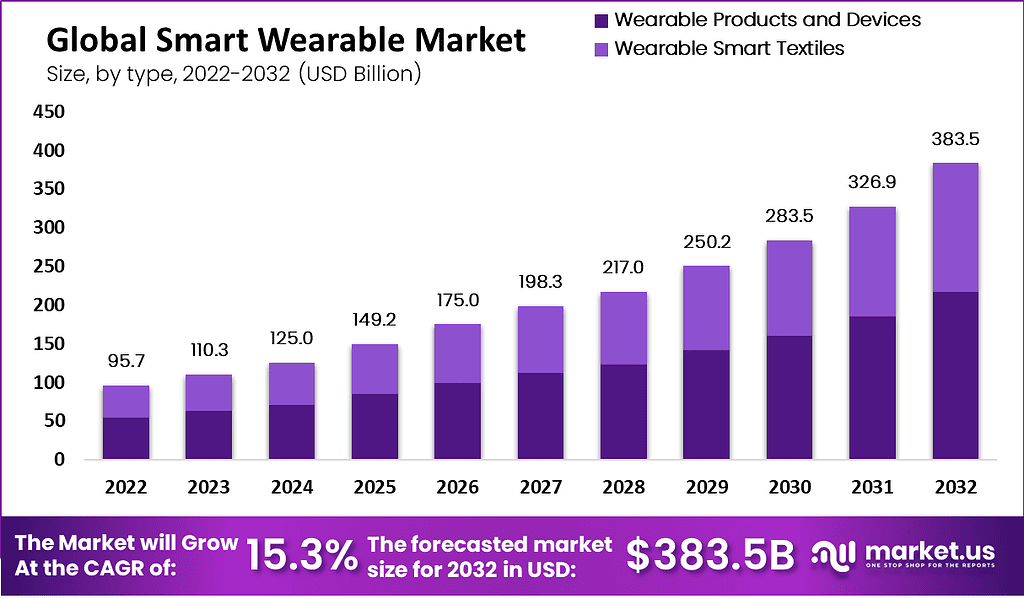

- The global smart wearables market has demonstrated significant growth in recent years and is projected to continue this trend over the next decade at a CAGR of 15.30%.

- In 2022, the market revenue was valued at USD 95.7 billion and increased to USD 110.3 billion in 2023.

- This upward trajectory is expected to continue, with market revenue reaching USD 125.0 billion in 2024 and USD 149.2 billion in 2025.

- By 2026, the market is projected to reach USD 175.0 billion, with further growth to USD 198.3 billion in 2027 and USD 217.0 billion in 2028.

- The market is forecasted to surpass USD 250.2 billion by 2029 and USD 283.5 billion by 2030.

- Looking further ahead, the global smart wearables market is expected to reach USD 326.9 billion in 2031 and USD 383.5 billion by 2032, highlighting the robust and sustained expansion of this sector.

(Source: market.us)

Global Smart Wearables Market Size – By Type Statistics

2022-2027

- The global smart wearables market is segmented by type. It has experienced steady growth from 2022 and is projected to expand further through 2027.

- In 2022, the market revenue was USD 95.7 billion, with wearable products and devices contributing USD 54.17 billion and wearable smart textiles accounting for USD 41.53 billion.

- By 2023, total market revenue rose to USD 110.3 billion, with USD 62.43 billion from wearable products and USD 47.87 billion from wearable smart textiles.

- The market is expected to continue its upward trajectory. Moreover, reaching USD 125.0 billion in 2024, with contributions of USD 70.75 billion from wearable products and USD 54.25 billion from wearable smart textiles.

- In 2025, the market is projected to hit USD 149.2 billion. With wearable products generating USD 84.45 billion and smart textiles contributing USD 64.75 billion.

- By 2026, the market size will likely increase to USD 175.0 billion, with wearable products at USD 99.05 billion and smart textiles at USD 75.95 billion.

- In 2027, the overall revenue is expected to reach USD 198.3 billion, with wearable products contributing USD 112.24 billion and smart textiles accounting for USD 86.06 billion.

2028-2032

- The trend continues in 2028, with the market anticipated to grow to USD 217.0 billion, USD 122.82 billion from wearable products, and USD 94.18 billion from smart textiles.

- By 2029, the global smart wearables market is projected to reach USD 250.2 billion, with wearable products contributing USD 141.61 billion and smart textiles USD 108.59 billion.

- The market is forecasted to grow further in 2030 to USD 283.5 billion, with wearable products at USD 160.46 billion and smart textiles at USD 123.04 billion.

- In 2031, the market is expected to generate USD 326.9 billion in total revenue, with wearable products contributing USD 185.03 billion and smart textiles USD 141.87 billion.

- Finally, by 2032, the market is forecasted to reach USD 383.5 billion, with wearable products contributing USD 217.06 billion and wearable smart textiles USD 166.44 billion.

- This data reflects the consistent growth and increasing adoption of smart wearables across various segments.

(Source: market.us)

Global Smart Wearables Market Share – By Product Type Statistics

- The global smart wearables market is segmented by product type, with wristwear commanding the largest share at 35%.

- Headwear follows, accounting for 23% of the market, while eyewear holds a 17% share.

- Neckwear products contribute 14% to the market, with footwear making up 8% and bodywear representing the smallest segment at 3%.

- Further, this distribution highlights the dominance of wristwear and headwear in the smart wearables sector, with other categories contributing to varying degrees based on consumer preferences and technological advancements.

(Source: market.us)

Worldwide Smart Wearables Device Shipments Statistics

- The global smart wearable device market experienced exponential growth in unit shipments from 2012 to 2019.

- In 2012, only 0.3 million units were shipped, which grew to 6 million units by 2013.

- This upward trend continued in 2014, with shipments reaching 36.8 million units.

- By 2015, the market saw a significant jump to 133 million units.

- In 2016, the number of units shipped more than doubled to 283.9 million.

- The rapid expansion persisted into 2017, with shipments increasing to 500.7 million units.

- By 2018, global shipments soared to 848.2 million units, and in 2019, the market saw a remarkable surge, with 1,399.5 million units shipped.

- This data underscores the strong and accelerating demand for smart wearable devices over this period.

(Source: Statista)

Smartwatch Statistics

Global Smartwatch Market Size

- The global smartwatch market is projected to experience significant revenue growth at a CAGR of 13.5% from 2023 to 2033.

- In 2023, the market is estimated to generate USD 39.1 billion, with a steady rise to USD 44.4 billion in 2024.

- This upward trajectory continues into 2025, with expected revenue of USD 50.4 billion, and by 2026, the market is anticipated to reach USD 57.2 billion.

- Further growth is projected through 2027, with the market reaching USD 64.9 billion, followed by USD 73.6 billion in 2028.

- By 2029, the global smartwatch market is expected to generate USD 83.6 billion, and this figure is forecasted to climb to USD 94.9 billion in 2030.

- The trend continues into 2031, with revenue projected at USD 107.7 billion, and by 2032, the market is anticipated to grow to USD 122.2 billion.

- Finally, in 2033, global smartwatch revenue is expected to reach USD 138.7 billion, demonstrating robust and sustained growth throughout the forecast period.

(Source: market.us)

Smartwatch Users Worldwide

- The number of smartwatch users worldwide has been experiencing substantial growth since 2020 and is projected to continue this trend through 2029.

- In 2020, there were approximately 97.63 million smartwatch users globally, which increased significantly to 140.92 million in 2021.

- By 2022, the user base expanded further to 212.84 million, and in 2023, it reached 323.99 million users.

- The global smartwatch user base is expected to continue its upward trajectory, with 454.69 million users projected for 2024.

- By 2025, the number of users is anticipated to grow to 562.86 million, followed by an estimated 640.15 million in 2026.

- The trend continues in 2027, with a forecast of 690.41 million smartwatch users, growing to 721.59 million in 2028.

- By 2029, the global number of smartwatch users is projected to reach 740.53 million, reflecting the increasing adoption of smartwatches worldwide.

(Source: Statista)

Penetration Rate of Smartwatches Worldwide

- The global penetration rate of smartwatches has been steadily increasing since 2020 and is expected to continue rising through 2029.

- In 2020, the penetration rate stood at 1.30%, growing to 1.86% in 2021.

- By 2022, the rate had reached 2.79%, with a significant jump to 4.22% in 2023.

- This upward trend is projected to continue, with the penetration rate expected to climb to 5.87% in 2024 and 7.20% in 2025.

- In the following years, smartwatch adoption is forecasted to grow further, with penetration rates reaching 8.13% in 2026, 8.70% in 2027, and 9.02% in 2028.

- By 2029, the global penetration rate of smartwatches is projected to hit 9.19%, reflecting the increasing popularity and integration of this technology into everyday life worldwide.

(Source: Statista)

Penetration Rate of Fitness/Activity Tracking Wristwear Worldwide

- The global penetration rate of fitness and activity-tracking wristwear has steadily increased since 2020 and is projected to continue growing through 2029.

- In 2020, the penetration rate was 2.29%, rising to 3.32% in 2021.

- By 2022, the rate had grown to 4.08%, with further growth expected in 2023, reaching 4.69%.

- Looking ahead, the penetration rate is forecasted to reach 5.14% in 2024 and 5.55% in 2025.

- The upward trend continues, with projections showing the rate at 5.87% in 2026, 6.14% in 2027, and 6.36% in 2028.

- By 2029, the global penetration rate for fitness and activity-tracking wristwear is expected to reach 6.51%, reflecting a consistent increase in the adoption of these devices.

(Source: Statista)

Smartwatch Shipments – By Region

- The share of global smartwatch shipments from 2020 to 2022 varied significantly across different regions.

- In 2020, North America led with 33% of the global smartwatch shipments, followed closely by China, which accounted for 27%.

- The rest of the world contributed 28% of the shipments, while India had a relatively small share of 3%.

- By 2021, the distribution of shipments began to shift, with both North America and China each accounting for 24% of the global shipments.

- Meanwhile, the rest of the world increased its share to 37%, and India’s share grew substantially to 10%.

- In 2022, the trend continued, with North America and China each further reducing their shares to 19%.

- In contrast, India’s share rose significantly to 21%, reflecting its growing market influence.

- The rest of the world, while still significant, saw a slight decrease to 31% of global smartwatch shipments.

- This data illustrates the dynamic changes in regional contributions to the global smartwatch market over the three years.

(Source: Statista)

Smartwatch Shipments – By Vendor

- The global smartwatch market share by vendor between 2018 and 2023 reveals fluctuations in dominance across several key players.

- Apple consistently maintained its leadership throughout the period, with its highest share of 40% in Q4 2020. In 2018, Apple’s market share ranged between 21% and 37%, with Samsung and Huawei trailing behind.

- Samsung held a steady position with a market share varying between 5% and 10%, while Huawei gradually increased its presence, reaching a peak of 15% in Q3 2020.

- Other notable players included Imoo, which maintained a steady share of 6% to 10% from 2018 to 2020, and Amazfit, which began to appear in 2020, with a maximum share of 5%. In the later years, new entrants like Noise and Fire Boltt emerged.

- Noise began to gain traction in Q1 2021 with a 1% market share and reached 10% by Q2 2023. Similarly, Fire Boltt appeared in 2023 with a share of 8% by Q4 2023.

- The market share of “Others,” representing smaller brands, showed consistent dominance in the early years, reaching 59% in Q2 2018. However, this category’s share decreased in later years, ranging between 32% and 59%.

- Despite some fluctuations, Apple’s dominance remained evident throughout the period, with competition growing from new brands such as Noise and Fire Boltt in recent years.

Fitness Tracker Statistics

Global Fitness Tracker Market Size

- The global fitness tracker market has experienced robust growth and is projected to continue expanding significantly over the next decade.

- In 2022, the market generated revenue of USD 39.5 billion, increasing to USD 46.3 billion in 2023.

- This upward trend is expected to persist, with market revenue forecasted to reach USD 53.3 billion in 2024 and USD 65.0 billion by 2025.

- By 2026, the market is anticipated to generate USD 77.7 billion, with further growth projected to USD 89.4 billion in 2027 and USD 98.9 billion in 2028.

- By 2029, the global fitness tracker market is expected to exceed USD 116.0 billion, rising to USD 133.5 billion in 2030.

- Looking ahead, the market is forecasted to reach USD 156.6 billion by 2031 and USD 187.2 billion by 2032, reflecting sustained and accelerating demand for fitness tracking devices globally.

(Source: market.us)

Fitness Tracker Device Shipments Worldwide

- The global shipments of fitness tracker devices have shown consistent growth from 2016 to 2022.

- In 2016, a total of 55.21 million units were shipped, increasing to 62.19 million in 2017.

- The upward trend continued in 2018, with 70.02 million units shipped, and by 2019, shipments reached 77.85 million units.

- In 2020, shipments rose further to 85.78 million units, reflecting the increasing adoption of fitness trackers worldwide.

- This growth persisted in 2021, with 94.33 million units shipped.

- By 2022, global shipments of fitness tracker devices surpassed 105 million units, underscoring the strong demand and expanding user base for these devices globally.

(Source: Statista)

Fitness Metrics Tracked by Wearables

- In 2022, consumers in the U.S. used wearable devices to track various fitness metrics in several ways.

- The most common use, reported by 64% of respondents, was counting steps per day.

- Additionally, 36% of users employed wearables for motivation to exercise receiving reminders or badges.

- Tracking speed and distance using GPS was used by 31%, while 28% stored workout data.

- Other common uses included tracking weight loss, reported by 27% of respondents, and measuring performance or exertion by 25%.

- A smaller portion of users, 17%, used wearables to plan workouts, while 16% followed workouts through an app.

- Lastly, 9% of respondents used their wearable devices to provide personalized coaching.

- This data highlights the diverse range of applications for fitness wearables among U.S. consumers.

(Source: Statista)

Smart Glass Statistics

Global Smart Glass Market Revenue

- The global smart glass market has demonstrated significant growth from 2018 and is projected to continue expanding through 2027.

- In 2018, the market generated USD 2,857.7 million in revenue, which increased to USD 3,289.8 million in 2019.

- By 2020, revenue reached USD 3,801.6 million, and this upward trend persisted into 2021, with the market growing to USD 4,410.3 million.

- In 2022, the global smart glass market revenue rose to USD 5,136.9 million and is estimated to reach USD 6,007.8 million in 2023.

- Future projections indicate continuous growth, with the market expected to generate USD 7,055.9 million in 2024 and USD 8,322.6 million in 2025.

- By 2026, the market is forecasted to reach USD 9,860.1 million, eventually expanding to USD 11,734.5 million by 2027, reflecting the increasing demand and adoption of smart glass technology worldwide.

(Source: Statista)

Smart Glasses Shipments Worldwide

- The global market for smart glasses has experienced tremendous growth in unit shipments between 2017 and 2022.

- In 2017, only 0.23 million smart glasses were shipped worldwide.

- However, by 2022, this figure had surged to 32.7 million units, reflecting the increasing adoption and demand for smart glasses technology over the five years.

- This sharp rise underscores the growing consumer and enterprise interest in wearable technology and its expanding use cases.

(Source: Statista)

Smart Wearables Users Demographics and Statistics

Frequency of Using Smart Wearables – By Age Statistics

- As of September 2022, the frequency of using smart wearables in India varies across different age groups.

- However, the highest daily usage was reported among individuals aged 35-44, with 71.27% of respondents in this group using their smart wearables every day.

- This was followed by the 25-34 age group at 68.97%, the over 55 age group at 68.87%, the 16-24 group at 61.64%, and the 45-54 group at 66.90%.

- Moreover, several times a week, usage was reported by 22.66% of individuals aged 45-54, followed by 20.34% of those over 55, 18.96% in the 35-44 group, 18.03% in the 25-34 group, and 18% in the 16-24 age group.

- Once-a-week usage was most common in the over 55 age group (5.39%), with lower percentages across other age groups, such as 6.90% among 16-24-year-olds and 3.51% in the 35-44 group.

- Less frequent usage, such as several times a month. It was reported by 5.13% of individuals aged 16-24, while once-a-month usage ranged from 3.09% among the youngest group to 1.05% among those aged 35-44.

- Rare usage was reported by a small percentage across all groups, with 3.04% in the 16-24 group and 0.74% in the over 55 group.

- Those who have stopped using their smartwatches or fitness trackers represent the smallest proportion. Ranging from 2.15% in the youngest group to 0.74% in the over-55 age group.

- This data reflects varying levels of engagement with smart wearables across different age demographics in India.

(Source: Statista)

Frequency of Using Smart Wearables – By Gender Statistics

- As of September 2022, the frequency of using smart wearables in India showed similar patterns across genders.

- Among males, 65.91% reported using their smart wearables every day, closely matched by 65.33% of females.

- Several times a week, usage was slightly higher among females (19.39%) compared to males (17.71%).

- Once-a-week usage was reported by 5.78% of males and 5.64% of females. While several times-a-month usage was slightly higher among females (4.43%) compared to males (4.09%).

- Once-a-month usage was reported by 2.44% of males and 2.12% of females.

- A small percentage of both genders reported rarely using their devices, with 2.26% of males and 2.02% of females falling into this category.

- The percentage of respondents who had stopped using their smartwatches or fitness trackers was slightly higher among males (1.72%) compared to females (1.05%).

- This data indicates that males and females in India use smart wearables with comparable habits.

(Source: Statista)

Smart Wearable Users – By Generation Statistics

- The number of smart wearable users in the United States has steadily increased across all generations from 2020 to 2024.

- In 2020, Generation Z accounted for 12.8 million users,

- Millennials led with 25.8 million, Generation X had 16.7 million users, and Baby Boomers had 8.9 million users.

- By 2021, these figures grew, with Generation Z reaching 14.6 million users, Millennials at 26.5 million, Generation X at 17.1 million, and Baby Boomers at 9.3 million.

- This trend continued into 2022, with Generation Z users increasing to 16.6 million, Millennials to 27.1 million, Generation X to 17.3 million, and Baby Boomers to 9.4 million.

- In 2023, the number of users further expanded, with Generation Z at 18.6 million, Millennials at 27.4 million, Generation X at 17.4 million, and Baby Boomers maintaining 9.4 million users.

- Further, projections for 2024 indicate continued growth, with Generation Z expected to reach 20.5 million users, Millennials 27.6 million, Generation X 17.5 million, and Baby Boomers remaining steady at 9.3 million users.

- This data highlights the increasing adoption of smart wearables across all age groups in the U.S. over time.

(Source: Statista)

Spending on Smart Wearables Statistics

- From 2019 to 2022, global end-user spending on wearable devices increased significantly across various categories.

- Smartwatch spending grew from USD 18.5 billion in 2019 to USD 31.34 billion in 2022.

- Spending on head-mounted displays also rose from USD 2.77 billion in 2019 to USD 4.57 billion in 2022.

- Ear-worn devices saw the most substantial growth, with spending rising from USD 14.58 billion in 2019 to USD 44.16 billion by 2022.

- However, wristbands experienced a slight decline in spending. Dropping from USD 5.1 billion in 2019 to USD 4.48 billion in 2022.

- Smart clothing showed a steady increase in spending. Rising from USD 1.33 billion in 2019 to USD 2.16 billion in 2022.

- Spending on smart patches also saw consistent growth. Increasing from USD 3.9 billion in 2019 to USD 7.15 billion by 2022.

- This data highlights the growing consumer interest and investment in various wearable technologies over the four years.

(Source: Statista)

Motivating Factors

- As of September 2022, various factors motivated consumers in India to purchase wearable devices.

- The primary reason, cited by 39.68% of respondents, was concern for their health, as they wanted to monitor and improve it.

- Another 36.69% of respondents were motivated by the desire for easier accessibility to smartphone functions without needing to handle their smartphones constantly.

- Fitness enthusiasts account for 33.05% of respondents. Wanted to track and optimize their training and performance.

- Keeping up with the latest tech trends and products was important for 31.77% of respondents. While 28.27% were motivated by the reasonable price relative to the device’s functionality.

- Additionally, 27.39% of respondents were already invested in the same brand’s ecosystem and wanted to stay connected with their other smart devices more easily.

- A small portion, 3.09%, cited other reasons for purchasing a wearable. This data highlights the diverse factors driving wearable purchases in India.

(Source: Statista)

Regulations for Smart Wearables

- The regulations for smart wearables differ significantly across regions. Primarily influenced by whether the device is categorized as a medical or non-medical product.

- In the U.S., devices intended for medical purposes, such as heart rate monitors or pulse oximeters, fall under the regulatory oversight of the FDA, governed by the Food, Drug, and Cosmetic Act.

- However, general wellness devices like fitness trackers may bypass stringent medical device regulations if they avoid claims related to disease diagnosis or treatment.

- Further, in Europe, the EU Medical Device Regulation (MDR) applies strict rules for wearables used in healthcare, requiring compliance with conformity assessments.

- Moreover, the GDPR governs how these devices handle sensitive user data, emphasizing privacy and data protection.

- Meanwhile, countries like China have introduced specific regulatory frameworks to ensure product safety and data security. Particularly focusing on wearable devices with health-related functions.

- Globally, there is increasing attention on the safety, efficacy, and data privacy associated with wearable technology. Which is expected to become more rigorous as technology evolves.

(Sources: Wareable, IAPP, RF Exposure Lab)

Recent Developments

Acquisitions and Mergers:

- Google completes acquisition of Fitbit: In early 2023, Google finalized its $2.1 billion acquisition of Fitbit, a leading smart wearable company. This acquisition is expected to bolster Google’s position in the smart health and fitness wearables market. Integrating Fitbit’s health-tracking technologies with Google’s AI and ecosystem.

- Facebook acquires CTRL-labs: Facebook (now Meta) acquired CTRL-labs in a deal worth $1 billion. CTRL-labs is known for its neural interface technology, which Meta plans to integrate into its smart wearables. Aiming to advance its vision for the metaverse and next-generation interactive wearables.

New Product Launches:

- Apple introduces Watch Series 9: In 2024, Apple launched its Apple Watch Series 9. Featuring enhanced health tracking capabilities, including more precise heart rate monitoring. Improved sleep analysis and a faster processor for more efficient fitness apps. Apple remains a dominant player in the wearables space, particularly with its health-focused innovations.

- Samsung Galaxy Watch 6: In late 2023, Samsung released the Galaxy Watch 6, boasting advanced bioactive sensors capable of tracking body composition, heart rate, and blood pressure. This new launch strengthens Samsung’s foothold in the premium smartwatch market, appealing to health-conscious consumers.

Funding:

- Whoop raises $200 million: In 2023, fitness wearable company Whoop raised $200 million in Series F funding to expand its health-focused wearables and further develop its platform for sleep, recovery, and fitness monitoring. The funding will also be used to enhance Whoop’s AI-driven analytics for athletes and health enthusiasts.

- Oura secures $100 million: Oura is known for its smart ring that tracks sleep and wellness metrics. Raised $100 million in early 2024 to scale its production and continue its global expansion. Oura’s wearable is gaining popularity due to its minimalist design and deep focus on health data analytics.

Technological Advancements:

- AI and Machine Learning in Wearables: AI integration in wearables is enhancing personalized health insights, offering real-time data on users’ vitals and activity. By 2025, over 50% of wearables are expected to leverage AI for more precise health tracking and predictive health insights, particularly in chronic disease management.

- Wearables for Mental Health Monitoring: The demand for smart wearables that track mental health metrics, such as stress and mood, is rising. Devices using biometric sensors to monitor emotional well-being are gaining popularity. In 2023, mental health wearables accounted for 15% of the overall wearables market, a figure expected to increase as mental health awareness grows.

Market Dynamics:

- Growth in the Smart Wearables Market: The market is driven by increasing consumer interest in health and fitness tracking. Advancements in wearable technology and the rising adoption of smartwatches and fitness bands.

- Rising Adoption of Smart Glasses and AR Wearables: Augmented reality (AR) wearables, such as smart glasses, are seeing increased adoption, especially in enterprise applications. By 2025, AR wearables are expected to make up 25% of the overall smart wearables market. Driven by uses in industries like healthcare, logistics, and retail.

Conclusion

Smart Wearables Statistics – The smart wearables market has seen significant growth in recent years. Which are driven by advancements in technology and increasing consumer interest.

However, categories like smartwatches, ear-worn devices, and smart clothing have experienced substantial revenue and shipment growth, with ear-worn devices leading the way.

Moreover, adoption rates have increased globally, particularly in North America, China, and India. Users are motivated by the desire to monitor health, track fitness, and access smartphone functions more easily.

As wearable technology continues to evolve and offer more advanced features, the market is expected to maintain its strong growth trajectory.

FAQs

Smart wearables are electronic devices that can be worn on the body, such as smartwatches, fitness trackers, smart glasses, and ear-worn devices. They typically monitor health metrics, provide notifications, and integrate with smartphones and other smart devices.

Popular smart wearables include smartwatches, fitness trackers, ear-worn devices like wireless earbuds, and smart clothing. Smart patches and head-mounted displays are also growing in popularity.

Smart wearables track metrics like steps, heart rate, sleep patterns, and calories burned. They help users monitor their fitness progress, optimize workouts, and, in some cases, even provide alerts about potential health issues.

People are often motivated by the ability to monitor their health, easily access smartphone functions, track fitness goals, and stay up to date with the latest tech trends. Affordability and integration with existing devices are also important factors.

The highest adoption rates are seen in regions like North America, China, and India. These markets are driving the growth of the smart wearables sector globally.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)