Table of Contents

Introduction

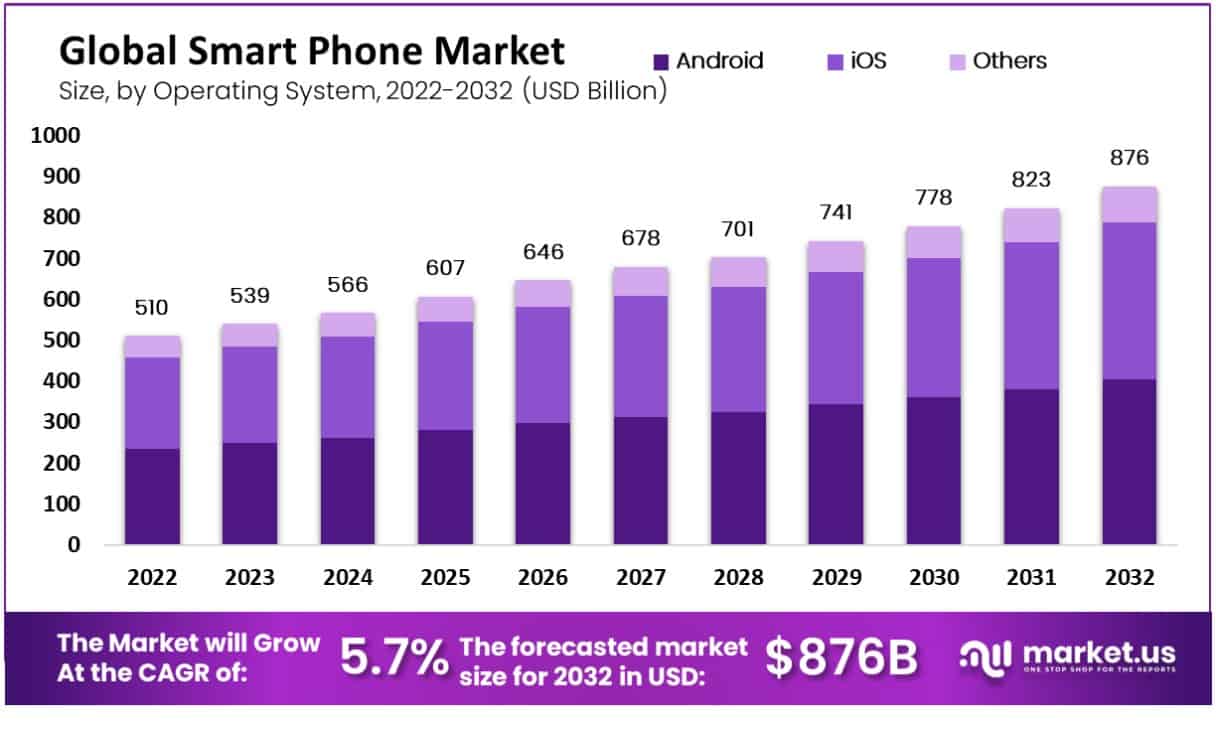

The Global Smartphone Market size is expected to be worth around USD 876.00 Billion by 2032 from USD 510.00 Billion in 2022, growing at a CAGR of 5.70% during the forecast period from 2023 to 2032.

The smartphone market encompasses the global industry dedicated to the production, distribution, and sale of smartphones portable devices that combine mobile telephony, computing capabilities, and internet access. This market includes a wide array of stakeholders such as smartphone manufacturers, software developers, network providers, and component suppliers. With the rapid evolution of technology, the smartphone market has expanded beyond basic communication functions, offering advanced features such as artificial intelligence (AI), augmented reality (AR), 5G connectivity, and sophisticated camera systems. It serves both consumer and enterprise segments, making it one of the most dynamic and innovative sectors within the broader technology and electronics industry.

The smartphone market is driven by several critical growth factors, including technological advancements, rising disposable income levels, and increasing internet penetration globally. The transition to 5G technology represents a significant catalyst, as it enables higher data speeds, improved network reliability, and new use cases such as enhanced mobile gaming, streaming, and the Internet of Things (IoT). Moreover, growing demand for multifunctional devices that combine computing, photography, and entertainment in a single product further fuels market growth. Another driver is the strong replacement cycle, where consumers frequently upgrade to newer models with enhanced features and better performance, stimulated by aggressive marketing and product launches by major manufacturers.

Moreover, growing demand for multifunctional devices that combine computing, photography, and entertainment in a single product further fuels market growth. Another driver is the strong replacement cycle, where consumers frequently upgrade to newer models with enhanced features and better performance, stimulated by aggressive marketing and product launches by major manufacturers.

The smartphone market is fueled by both emerging and developed markets. In developed regions, such as North America and Europe, the market sees a steady demand for premium and flagship models, with consumers seeking devices equipped with cutting-edge technology and superior user experiences.

In contrast, emerging markets like Asia-Pacific, Africa, and Latin America witness high demand for affordable, mid-range smartphones due to the expanding middle-class population and increasing digital connectivity initiatives. The demand is further supported by the growing reliance on smartphones for everyday activities such as online shopping, banking, remote work, and social interaction, making these devices indispensable.

The smartphone market presents numerous opportunities, particularly in the areas of innovation and expansion into untapped regions. The roll-out of 5G networks globally opens new avenues for manufacturers to develop devices that harness this technology’s potential, supporting applications like cloud gaming, immersive AR/VR experiences, and smart home integrations.

There is also a substantial opportunity for growth in emerging markets, where rising internet penetration and government initiatives promoting digital infrastructure create favorable conditions for smartphone adoption. Moreover, the integration of AI and machine learning (ML) features into smartphones offers companies the chance to enhance user personalization and differentiation, appealing to a tech-savvy consumer base eager for unique experiences.

Key Takeaways

- The global smartphone market is projected to reach USD 876.00 billion by 2032, growing at a CAGR of 5.70% from 2023 to 2032, driven by increasing technological advancements and consumer demand.

- Android dominates the market with a share of around 70%, supported by its open ecosystem and affordability. The iOS segment follows, gaining traction with high-end consumers and younger demographics.

- E-Commerce leads the distribution channels with a 38% market share, benefiting from the rise in online shopping and mobile-commerce (M-commerce) adoption.

- Asia Pacific is expected to maintain its leading position, reaching USD 199 billion by 2022, due to the region’s large consumer base and investments in 5G and IoT infrastructure.

- The 18-35 age group is the primary demographic driving growth, as they increasingly adopt smartphones equipped with advanced features like seamless voice control and flexible displays.

- 5G adoption is a significant driver, with the Asia-Pacific, Europe, and North America expected to have 25% of global 5G connections by 2032, indicating substantial growth in mobile technology infrastructure.

Smartphone Statistics

- Smartphone users worldwide are expected to reach 7.1 billion in 2024, representing approximately 90% of the global population.

- High Penetration in Developed Countries In the United States, 97% of adults own a cellphone, and 81.6% of the population actively uses smartphones.

- Millennial Ownership: 94.4% of millennials in the U.S. own smartphones, making them the most prominent user demographic.

- Youth Dependency: 96% of individuals aged 18-29 own smartphones, the highest percentage among all age groups.

- Rise in Digital Interaction: 33% of teens prefer socializing online rather than in-person, indicating a shift in social behavior.

- Phone Usage Habits: On average, American users reach for their devices 352 times per day.

- Sleep Disruption: 67% of teens report losing sleep due to late-night smartphone or internet usage.

- Checking Devices Frequently: 69% of smartphone users check their devices within the first five minutes of waking up.

- M-commerce Dominance: In 2023, mobile commerce (m-commerce) made up 73% of all e-commerce, highlighting the smartphone’s role in online shopping.

- Smartphone as a Primary Device: Approximately one in five American adults are “smartphone-only” internet users, relying solely on their mobile device for online access.

- Global Web Traffic: As of January 2024, mobile phones account for 56.1% of global web traffic.

- App Usage Increase: In the U.S., smartphone app usage time increased by 25% from 2019 to 2023.

- Frequent Notifications: 41% of teenagers feel overwhelmed by the number of alerts they receive daily.

- Daily Screen Time: Nearly half of Americans spend 5-6 hours daily on their smartphones as of 2024.

- Nomophobia Prevalence: 99.2% of smartphone users experience anxiety when disconnected from their phones.

- Video Consumption: 78% of U.S. millennials watch videos on their smartphones at least weekly as of 2023.

- M-Commerce Traffic: Mobile devices drive 65% of total e-commerce traffic.

- Urban vs. Rural Usage: Urban U.S. residents have higher smartphone ownership (83%) compared to suburban (78%) and rural (65%) populations.

- Phone Addiction: 47% of parents believe their children are addicted to smartphones.

- Smartphone Interactions: The average smartphone user taps, clicks, or swipes their phone 2,617 times daily.

- Generation Shift Post-Pandemic: Post-COVID-19, Gen Z saw an 82% rise in smartphone use, with Millennials following at 72%.

- E-commerce and Mobile Growth: Smartphone usage for online shopping continues to grow, with an expected 2-3% annual increase in cell phone use through 2025.

- Digital Media Dominance: Smartphones account for 70% of digital media consumption time in the U.S.

- Impact on Physical Health: 51% of Americans aged 18-40 express concerns about smartphone usage impacting their physical health.

- Increased Reliance: More people would rather go without essentials like shoes than be without their smartphones for a week.

- Work Distractions: 36% of millennials spend over two hours daily on non-work-related smartphone activities during work hours.

- High Smartphone Engagement: Smartphone penetration among college graduates is at 91%, the highest rate for any education level.

- Silent Use for Connectivity: 52% of teens report sitting silently on their phones while spending time with friends, indicating a preference for digital over physical presence.

Emerging Trends

- AI Integration: Smartphones are increasingly leveraging on-device AI to enhance user experience, from personalized recommendations to advanced photography capabilities

- Foldable and Flexible Displays: Foldable phones are gaining traction, with brands like Samsung and Oppo pushing boundaries in display technology, enhancing multitasking and portability

- Sustainability Focus: Brands are adopting eco-friendly practices such as recycled materials and extending software updates to promote device longevity

- 5G Expansion: The rollout of 5G technology is accelerating, with more affordable devices integrating 5G capabilities, particularly in emerging markets

- Emerging Market Growth: Strong growth is observed in markets like Africa and Southeast Asia, where lower-priced, feature-rich smartphones are driving sales

Top Use Cases

- Mobile Photography and Videography: Smartphones are central to capturing high-quality images and videos, often equipped with AI-enhanced camera features that rival professional equipment

- Gaming and Entertainment: Smartphones support advanced gaming experiences with powerful processors, high refresh rate screens, and integration with augmented reality (AR) technologies

- Health and Fitness Tracking: Many devices offer health apps and connectivity with wearables, allowing users to monitor vital signs, track fitness progress, and manage wellness routines directly from their phones

- Remote Work and Productivity: Smartphones enable remote work with productivity tools like document editors, cloud storage access, and video conferencing apps, making them essential for professional tasks on the go

- Digital Payments and E-commerce: Integrated mobile payment systems and e-commerce apps provide seamless and secure transaction capabilities, enhancing consumer convenience and driving digital commerce growth

Major Challenges

- Supply Chain Disruptions: Persistent semiconductor shortages and logistics issues are leading to production delays and increased costs, impacting the availability and pricing of smartphones

- Rising Component Costs: The growing price of essential materials like chips and display panels puts pressure on manufacturers, forcing either higher consumer prices or reduced profit margins

- Market Saturation in Developed Regions: In mature markets like North America and Europe, high smartphone penetration limits growth potential, prompting brands to focus on upgrades rather than new customer acquisition

- Sustainability and E-waste: Increasing regulatory and consumer demand for sustainable practices requires companies to invest in eco-friendly materials and recycling programs, adding operational complexity

- Intense Competition: Aggressive price wars and the rapid release of new models create a highly competitive landscape, making it difficult for brands to maintain differentiation and market share

Top Opportunities

- Expansion in Emerging Markets: With rising smartphone adoption in regions like Africa and Southeast Asia, brands can tap into large, underserved populations by offering affordable, feature-rich models

- AI-Driven Features: Integrating AI for personalization, enhanced photography, and security provides opportunities for differentiation and adds value to mid-range and premium models

- 5G Technology Proliferation: The continued rollout of 5G networks, especially in developing regions, creates demand for compatible devices, positioning brands to benefit from the upgrade cycle

- Foldable and Innovative Designs: The growth in foldable phones and other innovative form factors allows companies like Samsung and Oppo to capture premium segments by offering new user experiences

- Sustainability and Green Tech Initiatives: As environmental awareness increases, there’s an opportunity for brands to differentiate by focusing on sustainable manufacturing practices and longer-lasting devices

Key Player Analysis

- Samsung: Leading the market with a 19% share in Q2 2024, Samsung shipped approximately 54.9 million units, driven by its Galaxy S24 series and expanding 5G A-series. The company’s focus on AI and foldable models reinforces its dominant position, particularly in emerging markets.

- Apple: Apple holds the second spot with a 16% market share, shipping 45.6 million units. Despite modest growth of 1.5%, the brand saw significant traction in Europe and Latin America, aided by attractive discounts during promotional events like China’s 618 shopping festival.

- Xiaomi: With 15% of the global market, Xiaomi experienced a strong 27.4% year-on-year growth in Q2 2024, thanks to the popularity of its Redmi and Note series. The company’s aggressive pricing and feature-rich models make it highly competitive in emerging markets.

- vivo: Capturing 9% of the market, vivo shipped 25.9 million units in Q2 2024. The brand performed exceptionally well in China and India, leveraging its strong offline presence and local market strategies to gain share in these key regions.

- OPPO: OPPO rounds out the top five with a 9% market share, closely following vivo. The brand is expanding its mid-to-premium offerings and focusing on international growth beyond its home market of China to strengthen its global footprint.

Recent Developments

- In 2024, Apple overtook Samsung to become the top smartphone vendor for the first time since 2010, driven by record-high market share despite global challenges. According to IDC, global smartphone shipments in 2023 dropped 3.2% year-over-year to 1.17 billion units, the lowest in a decade due to economic and inventory issues. However, growth in the latter half, particularly in Q4 with an 8.5% increase and 326.1 million units shipped, signals a recovery trend for 2024

- In 2024, Samsung integrated AI into its products with the launch of the Galaxy S24 series, featuring “Galaxy AI,” which boosted sales in key regions like North America and Europe. Additionally, Samsung’s updated 5G models reinforced its mid-range market presence.

- In 2024, Xiaomi reported double-digit year-over-year revenue growth for two consecutive quarters, with Q1 2024 revenue reaching RMB75.5 billion a 27% increase. Adjusted net profit soared by 100.8% to RMB6.5 billion, even after allocating RMB2.3 billion for its smart EV business and other new ventures. The company’s strategy of balancing scale with profitability improved its gross profit margin to 22.3%, up 2.8 percentage points from the previous year.

- In October 8 ,2024 , Vodafone and Google announced an expanded ten-year partnership to develop new services, devices, and TV experiences for Vodafone’s customers across Europe and Africa, leveraging Google Cloud and Google’s AI models, including Gemini.

Conclusion

The global smartphone market is at a pivotal juncture, characterized by technological maturation, intensified competition, and shifting consumer preferences. While leading brands like Apple, Samsung, and emerging Chinese players such as Xiaomi and Oppo dominate market share, the emphasis is increasingly on innovation in AI integration, camera technology, and sustainability. The advent of 5G has spurred a cycle of device upgrades, but growth is gradually stabilizing as markets become saturated, especially in developed regions.

In contrast, opportunities abound in emerging markets where smartphone penetration is still rising, supported by affordability and accessibility strategies. To remain competitive, manufacturers must navigate evolving regulatory environments, focus on differentiation through ecosystem development, and capitalize on trends like foldable phones and subscription models. As a result, the smartphone market is evolving from a purely hardware-focused sector to one where services, software, and customer experience play pivotal roles in driving value and sustaining growth.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)