Table of Contents

Introduction

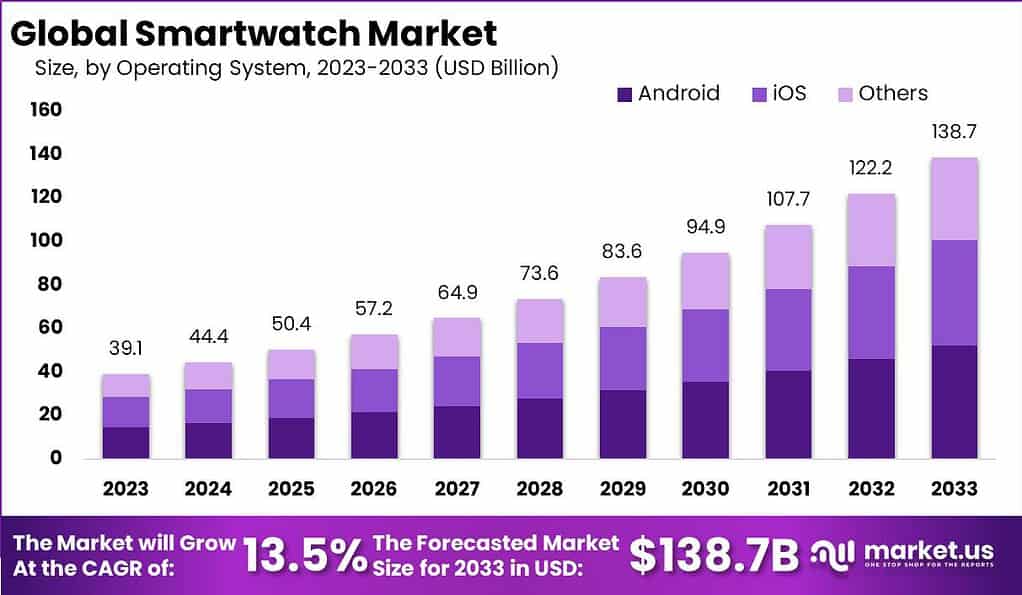

The Smartwatch Market is poised for significant growth, with a projected value of USD 138.7 billion by 2033, indicating a robust Compound Annual Growth Rate (CAGR) of 13.5% from 2024 to 2033. Smartwatches, wearable devices that combine traditional wristwatch functionality with smartphone capabilities, have witnessed remarkable advancements, fueled by technological progress and shifting consumer preferences. These devices offer a plethora of features, including timekeeping, fitness tracking, message notifications, and app integration, catering to diverse user needs and preferences.

Advancements in technology, particularly in processors, battery life, and sensors, have enabled the development of smartwatches with enhanced capabilities. These include heart rate monitoring, GPS tracking, and advanced health monitoring, expanding the potential use cases and attracting consumers from various demographics. However, one of the primary challenges facing the smartwatch market is its reliance on smartphone connectivity, limiting independence and usability. Efforts to develop standalone smartwatches with built-in cellular connectivity aim to mitigate this challenge.

As of 2024, approximately 24.31 million users worldwide utilize smartwatches, with significant interest observed among individuals aged 35-54. Moreover, China dominates the global smartwatch market, accounting for a substantial 60% share, while the United States has experienced a doubling in smartwatch purchases since 2016, with around 26% of American households owning a smartwatch.

To learn more about this report – request a sample report PDF

Key Takeaways

- The Smartwatch Market is projected to reach a significant value of USD 138.7 billion by 2033, showcasing a robust Compound Annual Growth Rate (CAGR) of 13.5% from 2024 to 2033.

- Android-based smartwatches held a dominant market position in 2023, capturing over 37.7% of the market share. This preference is attributed to the widespread adoption of Android smartphones globally.

- OLED displays dominated the smartwatch market in 2023, capturing over 88.5% of the market share. The advanced features offered by OLED technology have significantly contributed to its popularity among consumers.

- The Communication segment led the smartwatch market in 2023, accounting for over 35.0% of the market share. Smartwatches equipped with communication features such as calls, messages, and social media notifications have become indispensable tools for real-time communication.

- North America dominated the smartwatch market in 2023, capturing over 39.4% of the market share. Factors such as high smartphone penetration, advanced technological infrastructure, and increasing consumer awareness regarding health and fitness contributed to this dominance.

Top Smartwatch Statistics

- As of 2024, there are approximately 24.31 million smartwatch users worldwide.

- China dominates the global smartwatch market, accounting for 60% of all cellular smartwatches.

- Nearly 180 million smartwatches are predicted to be shipped in 2024.

- Apple owns 30% of the smartwatch market share worldwide.

- 23% of men and 21.8% of women worldwide own a smartwatch.

- 92% of people use smartwatches to maintain their health and fitness.

- In 2023, there was a remarkable 30% increase in average battery life compared to the previous year, attributed to advancements in battery technology.

- In 2023, 65% of smartwatch owners used their devices for health and fitness tracking, up from 55% in 2022.

- The enterprise sector experienced a 25% growth in smartwatch sales during 2023, driven by the adoption of wearable technology in workplaces.

- Apple captured over 43% of the smartwatch market share in 2023, followed by Samsung with 8%, Huawei with 7%, Noise with 5%, and imoo with 3%.

- In 2023, 78% of smartwatch users utilized their devices for receiving and responding to notifications, a 10% increase from the previous year.

- In 2023, 72% of smartwatch owners used their devices for mobile payments, marking a 7% increase from 2022.

- In 2023, 60% of smartwatch owners used voice commands and seamless digital assistant integration, experiencing a 15% surge compared to the previous year.

Emerging Trends

- Health and Wellness Focus: A major trend is the heightened focus on health-related features in smartwatches. Manufacturers are increasingly emphasizing devices capable of sophisticated health monitoring, such as cardiac tracking, responding to a surge in consumer health consciousness.

- Advanced Display Technologies: OLED and AMOLED displays are becoming standard in smartwatches due to their superior clarity, dynamic range, and efficiency. These technologies enable flexible, innovative designs without compromising on screen quality.

- E-commerce Growth Impact: The rise in e-commerce across various regions, notably South America and the Middle East, is propelling smartwatch sales. The ease of online shopping is making advanced electronics, including smartwatches, more accessible to consumers.

- Data Privacy and Security: The industry faces challenges around data privacy and security, with incidents of data breaches underscoring the need for robust data management and protection measures.

- Affordability and Market Expansion: The market is seeing a trend towards more affordable smartwatch options, driven by economic considerations and the entry of new products from Chinese and Indian brands, making smartwatches accessible to a broader audience.

Top Use Cases

- Fitness and Activity Tracking: Fitness tracking remains a core function of smartwatches, with features designed to monitor activities like running, swimming, and cycling. These devices provide valuable insights into users’ physical performance and health stats.

- Health Monitoring: Beyond fitness, modern smartwatches offer a range of health monitoring capabilities, from heart rate tracking to stress levels and ECG functionality, becoming essential tools for personal health management.

- Notification and Communication: Smartwatches enable users to manage notifications, calls, and messages without needing to access their smartphones, offering convenience and enhanced connectivity.

- Navigation and Safety: With GPS and location-based services, smartwatches assist with navigation and tracking, useful for outdoor exploration and personal safety.

- Smart Home Integration: Integration with IoT and smart home devices allows users to control various aspects of their home environment directly from their wrist, adding a level of convenience and control over home automation systems.

Major Challenges

- Technological Complexity and Security Risks: The advanced features of smartwatches bring about complexity and potential security concerns related to the privacy of personal data.

- Limited Battery Life: The need for frequent charging due to battery drainage by sophisticated functionalities is a significant inconvenience.

- High Cost: The premium pricing of advanced smartwatches makes them inaccessible to a wider audience.

- Dependence on Smartphones: The functionality of many smartwatches is heavily tied to being connected to a smartphone, limiting their independence and full utility.

- Market Fragmentation: A diverse range of players and operating systems fragments the market, creating challenges for both app developers and consumers.

Market Opportunities

- Personalized Healthcare and Fitness: There’s a growing market for smartwatches that offer personalized health monitoring and fitness tracking, driven by consumer demand for better health management tools.

- Expansion in Emerging Markets: The Asia-Pacific region shows high growth potential due to its expanding consumer electronics industry and an increasing focus on health and fitness.

- Integration with the IoT Ecosystem: The expanding IoT ecosystem presents opportunities for smartwatches to integrate more deeply with other smart devices, enhancing user experiences.

- Technological Innovations: Innovations such as improved battery technology, better displays, and user-friendly interfaces offer opportunities to address current limitations and attract more users.

- Expansion into New Applications: Beyond health and fitness, there are opportunities for smartwatches to explore new functionalities such as mobile payments, smart home control, and remote healthcare monitoring.

Recent Developments

- Samsung’s Latest Galaxy Watch6 Series: In July 2023, Samsung Electronics Co., Ltd. introduced the latest Galaxy Watch6 and Galaxy Watch6 Classic. These watches showcased advancements in health monitoring, design modifications, and an improved mobile experience. The launch attracted attention from tech enthusiasts and consumers alike, signaling Samsung’s continued innovation in the smartwatch sector.

- Apple’s watchOS 10 Update: In June 2023, Apple made significant waves in the smartwatch industry with the launch of watchOS 10. This updated smartwatch operating system brought forth several noteworthy features, including the Smart Stack, additional watch faces, and specialized functions for cycling and hiking. The inclusion of mental health tools further enhanced the user experience, solidifying Apple’s position in the market.

- Garmin’s Epix Pro Series: In May 2023, Garmin introduced the Epix Pro Series smartwatches. These watches stood out with features such as AMOLED crystal-clear displays, remarkable battery life of up to 31 days, and comprehensive health and fitness monitoring features. Additionally, the built-in illumination LED incorporated in three distinct watch designs added to their appeal and functionality, demonstrating Garmin’s commitment to innovation in the smartwatch sector.

Conclusion

One key conclusion is that the smartwatch market is highly competitive, with several major players vying for market share. Companies such as Apple, Samsung, Garmin, Fitbit, and Huawei have dominated the market, offering a diverse range of smartwatches with different features, styles, and price points.

Another conclusion is that the smartwatch market has expanded beyond fitness and health tracking. While fitness features like activity monitoring, heart rate tracking, and sleep analysis remain essential, smartwatches now offer a broader set of functionalities. These include smartphone notifications, music playback, GPS navigation, contactless payments, voice assistants, and even standalone communication capabilities in some models.

Additionally, the smartwatch market has witnessed increased adoption across various demographics. Initially popular among tech enthusiasts and early adopters, smartwatches have gained traction among health-conscious individuals, fitness enthusiasts, professionals, and even fashion-conscious consumers. The ability to personalize watch faces, bands, and overall aesthetics has contributed to their broader appeal.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)