Table of Contents

Introduction

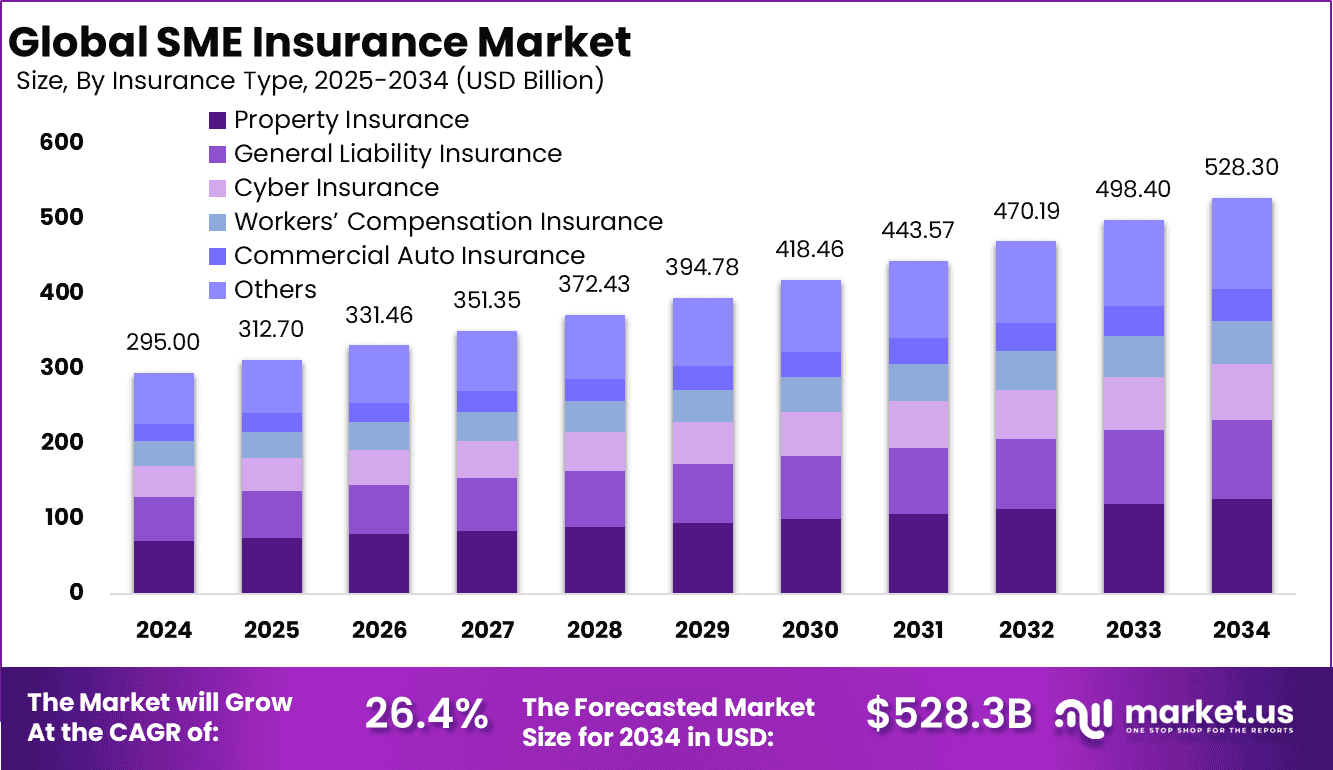

The global SME insurance market is projected to grow from USD 295 billion in 2024 to USD 528 billion by 2034, reflecting a compound annual growth rate (CAGR) of 6.0% during the forecast period from 2025 to 2034.

In 2024, North America held a dominant position, accounting for over 34% of the market share with USD 100.3 billion in revenue. This growth is driven by increasing demand for tailored insurance solutions for small and medium-sized enterprises (SMEs), as businesses seek to mitigate risks associated with technological disruptions, natural disasters, and financial uncertainties.

How Growth is Impacting the Economy

The expansion of the SME insurance market is positively influencing global economies by enhancing the financial stability of small and medium-sized businesses, which are crucial to economic growth and employment. As SMEs adopt more comprehensive insurance solutions, they are better equipped to handle unforeseen risks, allowing them to operate more effectively in an increasingly volatile market.

This increased resilience fosters greater consumer confidence, driving business innovation and expansion. Additionally, as the market grows, it stimulates job creation in insurance services, claims processing, and risk management.

The rise in SME insurance adoption also contributes to the global economy by increasing market liquidity, fostering entrepreneurial ventures, and supporting job creation in both developed and emerging markets. Furthermore, the financial security provided by insurance is attracting more investments into the SME sector, further driving economic development. In turn, this creates a robust ecosystem where SMEs can thrive, contributing to both local and global economies.

➤ Uncover best business opportunities here @ https://market.us/report/sme-insurance-market/free-sample/

Impact on Global Businesses

The growth of the SME insurance market is having a profound impact on global businesses, particularly small and medium-sized enterprises (SMEs). Rising insurance costs, driven by increased demand for coverage, are placing pressure on SMEs’ operating expenses. Supply chain disruptions are prompting businesses to seek better risk mitigation strategies, including insurance solutions tailored to their specific needs.

Sector-specific impacts include greater insurance penetration in industries such as technology, retail, and healthcare, where SMEs face heightened exposure to cybersecurity risks, regulatory compliance challenges, and operational disruptions.

As more SMEs recognize the value of risk management, the demand for flexible, scalable insurance solutions is increasing. However, the need for customized policies and higher premiums is presenting challenges, especially for SMEs with limited resources. Businesses are focusing on optimizing their insurance coverage while controlling costs through digital transformation and partnerships with insurers offering innovative, cost-effective products.

Strategies for Businesses

To capitalize on the growth of the SME insurance market, businesses must adopt strategic approaches to manage their risks effectively. First, they should prioritize digital insurance solutions to streamline the application process, claims management, and customer support. This can help reduce costs while improving customer experience.

Second, businesses should look for insurers offering customized policies that fit their specific industry needs, whether it’s cybersecurity coverage for tech startups or liability protection for manufacturers. Third, adopting a proactive risk management approach, including regular assessments and employee training, will help businesses minimize their exposure to insurance claims.

Additionally, companies should explore partnerships with insurance providers to create bundled packages that address multiple risks in a cost-effective manner. By leveraging technology, offering flexible coverage options, and fostering strong partnerships with insurers, SMEs can safeguard their assets while staying competitive in the growing insurance market.

Key Takeaways

- The global SME insurance market is expected to grow at a CAGR of 6.0% from 2025 to 2034.

- North America dominates the market, holding over 34% of the market share in 2024.

- Increasing demand for customized insurance solutions is driving market growth.

- Rising insurance costs are challenging SMEs, particularly those with limited resources.

- Digital insurance solutions are becoming crucial for SMEs to manage risk efficiently.

➤ Buy Report Here @ https://market.us/purchase-report/?report_id=152489

Analyst Viewpoint

The SME insurance market is currently experiencing steady growth, driven by rising awareness of the importance of risk management among small and medium-sized businesses. In the future, as SMEs increasingly adopt digital tools and solutions, insurers will likely offer more innovative and cost-effective coverage options.

The market’s expansion will continue to provide significant opportunities for businesses to improve their financial security and resilience. With the integration of advanced technologies like AI and data analytics, insurance providers will be able to offer more personalized, real-time solutions to SMEs, further accelerating market growth.

Regional Analysis

In 2024, North America held the largest share of the global SME insurance market, driven by a large number of small and medium-sized enterprises that are increasingly adopting insurance solutions. The region’s strong economic conditions and sophisticated insurance infrastructure contribute to its dominant market position. Europe follows closely behind, with a growing emphasis on comprehensive insurance solutions for SMEs across diverse sectors.

The Asia Pacific region is projected to experience the fastest growth due to rapid economic development, the rise of SMEs, and increasing awareness of risk management in countries like China and India. The Middle East and Latin America are also witnessing gradual growth in SME insurance, as local businesses face increasing risks from geopolitical instability and climate change.

➤ Discover More Trending Research

- Quantum Random Number Generator Market

- Points-Of-Interest (POI) Data Solutions Market

- Construction Insurance Market

- Software as a Service (SaaS) Market

Business Opportunities

The expansion of the SME insurance market presents numerous opportunities for businesses. Providers can capitalize on the growing demand for customized, industry-specific insurance products, particularly in sectors like technology, healthcare, and retail. There is also an increasing need for digital insurance platforms that simplify the insurance process and make it more accessible to SMEs.

Additionally, insurers can offer bundled packages, combining multiple coverage options to provide comprehensive protection for SMEs at a competitive price. With the rise of e-commerce and digital services, there are substantial opportunities to target online businesses, which require tailored coverage for risks like cyberattacks and data breaches. Moreover, as emerging markets grow, insurance providers can expand their offerings in these regions to meet the unique needs of local SMEs.

Key Segmentation

The global SME insurance market is segmented based on product type, application, and region. By product type, the market includes property insurance, liability insurance, workers’ compensation, health insurance, and others. By application, the market is divided into technology, retail, healthcare, manufacturing, and service sectors.

The market is analyzed across regions such as North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa. North America holds the largest market share, followed by Europe. However, the Asia Pacific region is expected to experience the fastest growth, driven by increasing SME adoption and market demand for insurance products.

Key Player Analysis

Key players in the SME insurance market are focusing on expanding their digital presence to offer more efficient, cost-effective insurance solutions. These players are increasingly leveraging artificial intelligence and data analytics to create customized policies that meet the specific needs of SMEs.

Additionally, they are investing in partnerships with other businesses, such as technology firms, to provide a broader range of services. To differentiate themselves in a competitive market, insurance providers are also emphasizing customer support, offering 24/7 assistance, and tailored advice. Overall, the market is becoming more dynamic as insurers innovate to meet the evolving demands of SMEs.

- AXA

- Allianz SE Company Profile

- Zurich Insurance Group

- Chubb Ltd.

- The Hartford

- Hiscox Ltd.

- Liberty Mutual

- Travelers Companies

- QBE Insurance Group

- MAPFRE S.A.

- Next Insurance

- Simply Business

- Others

Recent Developments

- The launch of digital platforms for simplified insurance application and claims processing.

- Increased focus on providing customized policies for high-risk sectors such as tech and healthcare.

- Partnerships with technology firms to provide integrated risk management solutions.

- Development of flexible insurance bundles tailored to the needs of SMEs.

- Expansion of SME insurance offerings in emerging markets, particularly in Asia Pacific.

Conclusion

The global SME insurance market is growing steadily, driven by increased demand for risk management solutions and digital transformation in small and medium-sized businesses. By focusing on innovation, customization, and digital platforms, businesses can position themselves to capitalize on this expanding market while addressing the evolving needs of SMEs.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)