Table of Contents

Introduction

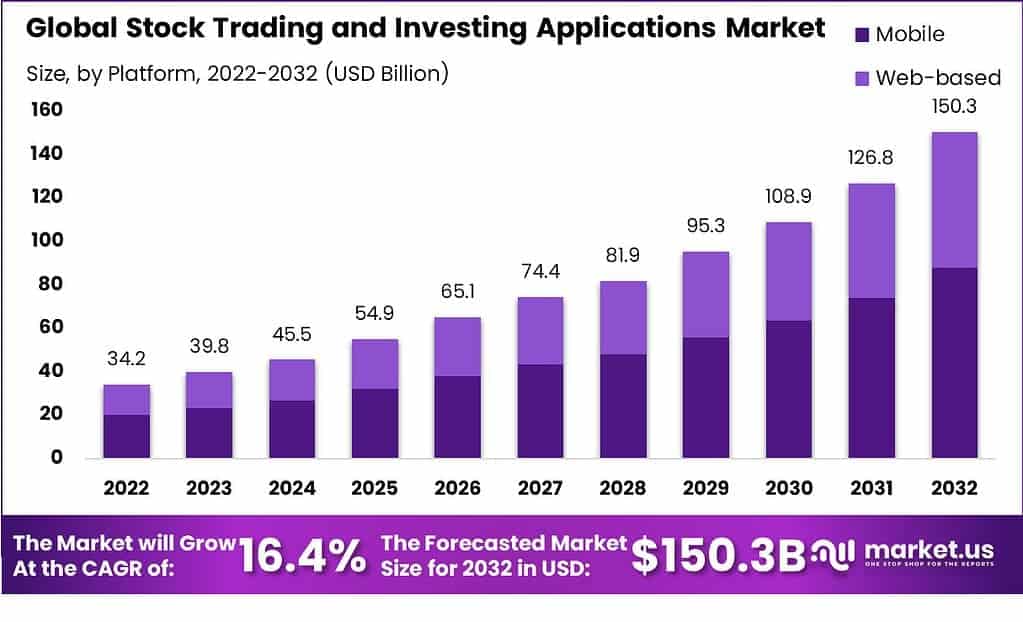

The Global Stock Trading and Investing Applications Market is experiencing significant growth, projected to reach USD 150 billion by 2032, up from USD 39.8 billion in 2023. This growth represents a strong CAGR of 16.4% from 2023 to 2032. The increasing popularity of self-directed investing, advancements in mobile trading technologies, and the rise of robo-advisors are key factors driving the market. As more investors adopt digital platforms for trading and investment, the market is witnessing a shift towards more accessible, efficient, and user-friendly solutions in stock trading, making investing easier for both retail and institutional investors.

How Growth is Impacting the Economy

The growth of the stock trading and investing applications market is having a significant positive impact on the global economy. As more retail investors engage in self-directed investing, financial literacy is improving, and wealth generation is becoming more accessible to a wider population. This democratization of finance is driving increased investment in markets, leading to greater liquidity and capital availability for businesses.

Additionally, the growth of investing apps is contributing to the rise of fintech, creating jobs in technology development, customer service, and cybersecurity. The market’s expansion is also encouraging innovation in financial services, leading to more diverse investment options and better customer experiences. As investment platforms become more mobile-friendly and accessible, the global stock trading market is poised to stimulate economic growth by expanding investor bases and increasing market participation. This, in turn, helps drive both corporate profitability and broader economic stability as more individuals participate in capital markets.

➤ Research uncovers business opportunities here @ https://market.us/report/stock-trading-and-investing-applications-market/free-sample/

Impact on Global Businesses

The stock trading and investing applications market’s rapid growth is creating both opportunities and challenges for global businesses. Rising demand for mobile trading platforms and easy-to-use investment solutions is prompting companies to invest heavily in technology development. However, this growth is accompanied by rising costs related to infrastructure, cybersecurity, and regulatory compliance. Supply chain shifts in terms of software development and data management are also impacting business operations, particularly as companies scale up to meet growing demand.

Sector-specific impacts are especially noticeable in the fintech, banking, and brokerage industries, where competition is increasing, and profit margins are under pressure due to the need for continuous innovation and low-cost solutions. Additionally, the increasing reliance on digital trading platforms is putting pressure on firms to improve their customer experience and adapt to the needs of tech-savvy retail investors. Businesses must innovate to stay ahead, balancing technological investment with operational efficiency.

Strategies for Businesses

To capitalize on the growth in the stock trading and investing applications market, businesses should prioritize technological innovation, ensuring their platforms are mobile-optimized, secure, and user-friendly. Investing in artificial intelligence and machine learning for better customer insights, robo-advisory services, and algorithmic trading can enhance the user experience and attract a broader customer base.

Furthermore, businesses should explore partnerships with financial institutions, data providers, and fintech companies to expand their service offerings and provide a comprehensive investment experience. Companies must also focus on strengthening their cybersecurity frameworks to protect users’ financial data, ensuring trust in their platforms. Offering educational tools, resources, and transparency in pricing can help build consumer confidence and loyalty. Additionally, businesses should continuously monitor regulatory changes and adapt their platforms to ensure compliance, particularly as global regulations surrounding fintech and trading evolve.

Key Takeaways

- The stock trading and investing applications market is projected to reach USD 150 billion by 2032, growing at a CAGR of 16.4%.

- Growth drivers include the democratization of finance, mobile trading, and robo-advisory services.

- Increasing demand for user-friendly, secure trading platforms is driving technological innovation.

- Rising costs and regulatory compliance challenges are major considerations for businesses.

- Companies should focus on innovation, cybersecurity, partnerships, and regulatory compliance to stay competitive.

➤ Quick Purchase Full Report Here @ https://market.us/purchase-report/?report_id=106116

Analyst Viewpoint

The stock trading and investing applications market is positioned for substantial growth, with a robust CAGR of 16.4% through 2032. The continued rise of retail investors and the shift toward mobile, low-cost trading platforms are reshaping the market landscape. Companies in this space will thrive by focusing on technological innovation, security, and customer education. As the market expands, the ongoing demand for efficient, accessible investing tools will fuel long-term growth. In the future, the rise of robo-advisors and algorithmic trading will offer even more opportunities for firms that are prepared to capitalize on these trends.

Regional Analysis

In 2023, North America holds a dominant share of the stock trading and investing applications market, driven by widespread adoption of mobile trading platforms and a strong base of retail investors. The region benefits from advanced technology infrastructure, regulatory clarity, and high financial literacy rates. Europe is also experiencing growth, as the increasing interest in self-directed investing is met with innovation in fintech and mobile applications. The Asia-Pacific region is projected to experience the fastest growth, as the expanding middle class, increasing smartphone penetration, and rising demand for mobile trading solutions are driving market adoption.

Business Opportunities

The global growth in stock trading and investing applications offers numerous business opportunities, particularly for fintech companies, brokers, and tech developers. Firms can capitalize on the growing demand for mobile-first trading platforms by offering intuitive, secure solutions that cater to both novice and experienced investors.

There is also significant potential in robo-advisory services, which provide automated investment management at a lower cost than traditional financial advisors. As emerging markets in Asia-Pacific and Africa experience increased smartphone penetration and financial inclusion, businesses can expand into these regions by offering localized, accessible investment tools. Additionally, firms focusing on data analytics and artificial intelligence can provide valuable insights to help investors make better-informed decisions.

Key Segmentation

The stock trading and investing applications market can be segmented by application type, user type, and region. Application types include mobile trading platforms, robo-advisory services, algorithmic trading tools, and investment management applications. User types include retail investors, institutional investors, and financial advisors.

The market is expected to be driven by retail investors, especially those using mobile applications to manage their investments. The regional segmentation highlights North America as the current market leader, followed by Europe and the Asia-Pacific region, which is expected to witness the highest growth due to increasing smartphone penetration and financial inclusion.

Key Player Analysis

Key players in the stock trading and investing applications market are focusing on technological innovations to provide advanced, secure, and user-friendly platforms. Many companies are investing heavily in mobile-first solutions and expanding their offerings to include robo-advisory services, algorithmic trading, and educational tools.

Partnerships between fintech companies and traditional financial institutions are also common, enabling firms to offer integrated solutions to investors. To remain competitive, these companies are prioritizing data security, transparency in pricing, and regulatory compliance. The ability to integrate artificial intelligence and machine learning to improve customer experience and provide personalized investment advice is becoming a key differentiator in the market.

- Morgan Stanley

- FMR LLC

- Charles Schwab & Co

- Robinhood

- Interactive Brokers LLC

- eToro

- Plus500

- Zerodha

- Angel One Limited

- Ameriprise Financial

- SoFi Invest

- E-Trade

Recent Developments

- Major fintech companies are launching mobile trading platforms that focus on ease of use and security.

- The adoption of robo-advisors is growing rapidly, offering automated, low-cost investment solutions.

- Increased collaboration between traditional financial institutions and fintech companies is expanding service offerings.

- Companies are incorporating artificial intelligence and machine learning to offer personalized investment strategies.

- Regulatory changes in key markets are driving the need for compliance and secure trading environments.

Conclusion

The stock trading and investing applications market is growing rapidly, driven by the demand for accessible, user-friendly, and cost-effective investment tools. Companies that innovate in mobile trading, security, and automation while maintaining regulatory compliance will be well-positioned for success in this expanding market.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)