Table of Contents

- Overview

- Editor’s Choice

- Major Streaming Services Platforms Statistics

- Streaming Services Diversity, Originality, and Global Reach Statistics

- Average Time Spent – Streaming Services Statistics

- Binge-Watching Trends – Streaming Services Statistics

- Devices Used for Streaming Services Statistics

- Subscription and Pricing Models

- Global Streaming Services Trends and Statistics

- Streaming Services Challenges and Opportunities Statistics

- Impact of Streaming Services on the Entertainment Industry Statistics

- Streaming Services Future Predictions and Projections Statistics

- Regulatory and Ethical Considerations

- Recent Developments

- Wrap Up

- FAQs

Overview

Streaming Services Statistics: Streaming services have transformed the entertainment landscape, revolutionizing how people consume content.

The advent of high-speed internet and the proliferation of smart devices have fueled the growth of these platforms, offering a wide array of movies, TV shows, music, and more, at the viewers’ convenience.

This introduction provides an overview of key statistics that shed light on the impact, trends, and challenges within the streaming industry.

Editor’s Choice

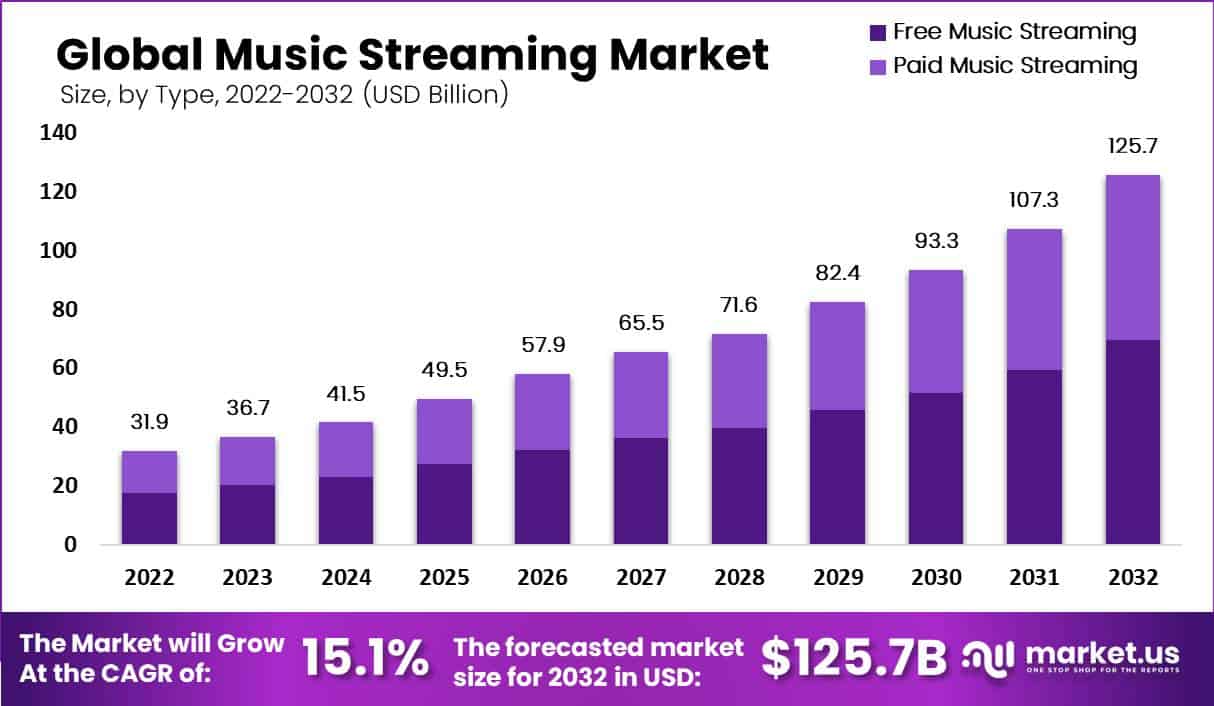

- The Global Music Streaming Market size is expected to be worth around USD 125.70 Billion by 2032 from USD 36.7 Billion in 2023, growing at a CAGR of 15.10% during the forecast period from 2023 to 2032.

- Global Streaming Revenue: In 2020, the global streaming industry generated over $100 billion in revenue.

- Number of Streaming Subscribers: As of 2021, streaming platforms collectively had over 1.1 billion subscribers globally.

- Netflix Dominance: Netflix remains a major player with 208 million subscribers worldwide in early 2021.

- Rise of Mobile Streaming: Mobile devices account for about 25% of all streaming video plays globally.

- Original Content Investment: Streaming giants like Netflix and Disney+ have spent billions on original content production in recent years.

- Binge-Watching Behavior: Around 73% of subscribers admit to binge-watching, consuming multiple episodes or movies in a single session.

- Cord-Cutting Trend: Cord-cutting in the US increased by 27.1% in 2020, with millions canceling traditional cable subscriptions.

(Source: Motion Picture Association, Digital TV Research, Netflix, Conviva, Variety, Deloitte Digital Media Trends Survey)

Major Streaming Services Platforms Statistics

Netflix:

- Netflix had over 200 million paid subscribers worldwide as of 2021.

- The platform released over 500 original TV shows and movies in 2020.

- In 2020, the average Netflix subscriber streamed around 3 hours per day.

- “Bridgerton” became one of Netflix’s most-watched original series, reaching over 82 million households within its first 28 days.

- Netflix’s total revenue for 2020 was around $25 billion.

(Source: Netflix Q4 2020 Earnings Report, Variety, Conviva State of Streaming, Statista, Netflix)

Amazon Prime Video:

- Amazon Prime Video had over 175 million Prime members worldwide as of 2021.

- “The Boys” and “The Marvelous Mrs. Maisel” were among the top-watched Amazon Original series.

- Amazon Prime Video’s share of the U.S. subscription video market was around 20% in 2020.

- The platform’s global digital video advertising revenue was projected to surpass $17 billion in 2021.

- Amazon’s content budget for Prime Video was expected to reach $9 billion in 2020.

(Source: Jeff Bezos Letter to Shareholders, Variety, Wall Street Journal)

Disney+:

- Disney+ gained over 100 million subscribers within its first 16 months of launch.

- “The Mandalorian” was a flagship show for Disney+, driving its popularity and attracting a significant audience.

- Disney+ accounted for around 14% of all over-the-top (OTT) subscriptions in the U.S. in 2020.

- The service’s global revenue was projected to reach $6.9 billion in 2021.

- Disney+ expanded its presence to numerous international markets within its first year, contributing to its rapid growth.

(Source: The Walt Disney Company, Business Insider, Statista, Disney)

Hulu:

- Hulu had over 39 million paid subscribers and over 75 million total subscribers in the U.S. as of 2021.

- The platform’s ad-supported plan was a significant contributor to its growth, attracting viewers seeking a lower-cost option.

- Hulu’s total revenue in 2020 was approximately $2.8 billion.

- “The Handmaid’s Tale” was a critically acclaimed original series on Hulu that gained a substantial following.

- Hulu invested in expanding its original content offerings to compete with other major streaming platforms.

(Source: Hulu, Variety, Statista, The New York Times, The Wall Street Journal)

Apple TV+:

- Apple TV+ launched in over 100 countries and regions simultaneously in November 2019.

- Apple TV+ offered a free year of service to customers who purchased eligible Apple devices.

- While exact subscriber numbers were not disclosed, analysts estimated that Apple TV+ had 34 million subscribers within its first year.

- Apple allocated around $6 billion for original content production for Apple TV+ in 2021.

- The service aimed to differentiate itself by focusing on high-quality original content, including shows like “Ted Lasso” and “The Morning Show.”

(Source: Apple, CNBC, Variety, The Wall Street Journal, Apple)

HBO Max:

- HBO Max has garnered over 67 million subscribers since its launch in May 2020.

- HBO Max offered a vast library with over 10,000 hours of content, including HBO originals, Warner Bros. films, and more.

- HBO Max was the exclusive streaming home for all Warner Bros. movie releases in 2021, offering same-day streaming with theatrical releases.

- HBO Max had plans to expand its international presence, with a focus on Latin America and Europe in 2021.

- HBO Max aimed to retain subscribers by offering a mix of original programming and a diverse range of content across genres.

(Source: WarnerMedia Investor Relations, WarnerMedia Press Release, Variety, The Hollywood Reporter)

Spotify (Music Streaming)

- As of July 2021, Spotify had over 365 million monthly active users, including both free and premium subscribers.

- The platform had over 165 million premium subscribers globally in 2021.

- Spotify offers a vast music library with more than 70 million tracks and over 4 billion playlists.

- The platform’s algorithm-driven personalized playlists, like “Discover Weekly,” were a key feature.

- Spotify expanded its offerings beyond music, including podcasts and exclusive podcast deals.

(Source: Spotify)

Streaming Services Diversity, Originality, and Global Reach Statistics

- Number of Titles: Streaming services offer a vast array of content. As of 2021, Netflix had around 3,781 titles available in the United States alone.

- Original vs. Licensed Content: Original content production is a major focus. In 2020, Netflix had 371 original titles, while Amazon Prime Video had 124 original titles released globally.

- Content Diversity: Streaming platforms prioritize diverse content. Netflix had content from over 190 countries in 2020, showcasing a global range of entertainment.

- Movies vs. TV Shows: The balance between movies and TV shows varies. As of 2021, Amazon Prime Video had a higher percentage of movie titles (69.5%) compared to TV shows.

- Genres and Categories: Streaming libraries cover a wide range of genres. Netflix, for instance, offers over 1,000 TV shows across genres like drama, comedy, and reality TV.

- Exclusivity and Availability: Exclusive content defines platform identity. Disney+ secured exclusive rights to a substantial portion of Disney’s content, bolstering its library.

- Content Refresh Rate: Libraries frequently change due to licensing agreements. In 2020, around 40% of Netflix’s library content changed over 12 months.

- Content Localization: Services localize content for global audiences. Netflix, in 2021, had dubbed and subtitled versions available for 26 languages on average.

- Vintage and Classic Content: Old content finds a place. In 2020, HBO Max offered a collection of over 2,000 vintage films and classic TV series.

- Documentaries and Original Films: Streaming platforms emphasize documentaries. Netflix released 160 original documentaries in 2020, targeting various topics.

(Source: Reelgood, JustWatch, Statista, Streaming Observer, Finder, Disney, Exstreamist, Netflix, WarnerMedia, Variety)

Average Time Spent – Streaming Services Statistics

- On average, global consumers spent over 4.2 hours per day watching streaming content in 2020.

- The pandemic led to a 16% increase in streaming time during 2020.

- In the U.S., adults spent an average of 3 hours and 46 minutes per day on digital media consumption, including streaming, in 2020.

- Streaming accounted for 27% of total TV time among U.S. adults in 2020.

- In 2021, streaming services saw a 30% increase in global streaming hours compared to the previous year.

- The average time spent watching streaming video on mobile devices increased by 20% in 2020.

- Streaming contributed to 82% of total music industry revenues in the U.S. in 2020.

- Among younger audiences (ages 18-34), 60% regularly binge-watch streaming content.

- The global streaming audience is projected to grow to over 1.2 billion viewers by 2024.

- In 2020, Netflix users spent an average of 3 hours and 18 minutes per day on the platform.

(Source: Conv iva’s “State of Streaming” report, Nielsen Total Audience Report, App Annie, Recording Industry Association of America, Deloitte’s Digital Media Trends survey, Statista)

Binge-Watching Trends – Streaming Services Statistics

- Binge-Watching Behavior: The binge-watching trend continues, with an estimated 73% of global viewers binge-watching TV shows regularly.

- Hours Spent Binge-Watching: On average, subscribers of streaming services spend around 3 to 4 hours per day binge-watching content.

- Popular Binge-Watched Genres: Drama series are the most commonly binge-watched genre, followed by comedy and thriller shows.

- Binge-Watching Speed: The concept of “binge-racing,” where viewers strive to finish an entire series on its release day, has gained traction.

- Binge-Watching Habits by Age: Younger viewers aged 18-34 are more likely to binge-watch, with 86% of them admitting to this behavior.

- Weekend Binge-Watching: Binge-watching is most common during weekends and holidays, with viewers using this time to catch up on shows.

- Multiple Episodes in One Sitting: About 35% of viewers watch three or more episodes of a TV show in one sitting during a binge-watching session.

- Impact of COVID-19 on Binge-Watching: The global pandemic further boosted binge-watching, with a 50% increase in streaming viewership during lockdowns.

- Top Binge-Watched Shows: Shows like “Stranger Things,” “Game of Thrones,” and “Breaking Bad” are often cited as popular choices for binge-watching.

- Psychology of Binge-Watching: Binge-watching is linked to a mix of enjoyment, escape, and even feelings of guilt or addiction among viewers.

(Source: Deloitte Digital Democracy Survey, Conviva Streaming TV Census, Reelgood Streaming Stats, Netflix, Nielsen Total Audience Report, Conviva State of Streaming, Various streaming platforms’ viewership reports, Journal of Behavioral Addictions)

Devices Used for Streaming Services Statistics

- Smartphones: Mobile devices remain a dominant choice for streaming, with over 60% of users accessing streaming services via smartphones.

- Smart TVs: Smart TVs have gained popularity, accounting for around 45% of streaming device usage globally.

- Laptops/Computers: About 30% of users still prefer streaming content on laptops or desktop computers.

- Tablets: Tablet usage for streaming stands at around 20% of total streaming device usage.

- Streaming Devices: Dedicated streaming devices like Roku, Amazon Fire TV, and Google Chromecast are used by approximately 15% of streamers.

- Gaming Consoles: Gaming consoles like PlayStation and Xbox contribute to about 10% of streaming device usage.

- Connected Devices: Other connected devices, such as media players and set-top boxes, make up the remaining 5% of streaming device usage.

- Shift to Mobile: The mobile share of streaming is steadily growing due to the convenience of on-the-go viewing.

- Smart TV Market Growth: The smart TV market is projected to grow at a CAGR of over 20% during the forecast period.

- Laptop Decline: Laptops and desktops are seeing a decline in streaming usage as users opt for larger screens.

(Source: Statista, Nielsen, Pew Research Center, Conviva, Streaming Observer, Parks Associates, Digital TV Research)

Subscription and Pricing Models

- Average Monthly Subscription Cost: The average monthly cost of streaming services is around $10 to $12.

- Freemium vs. Premium: Freemium (free with ads) models are popular, with around 55% of users opting for free streaming services.

- Premium Subscription Revenue: Premium subscription services generate over $37 billion in revenue annually.

- Family and Multi-User Plans: Approximately 38% of households subscribe to family or multi-user plans, sharing accounts across family members.

- Bundling Services: About 30% of streaming subscribers choose bundles that combine multiple streaming services for a discounted price.

- Price Sensitivity: Price remains a significant factor for consumers, with 41% indicating that they cancel subscriptions due to cost concerns.

- Special Pricing Tiers: Streaming services offer special pricing tiers, like lower-cost mobile-only plans, to attract more users in emerging markets.

- Free Trials Impact: Around 60% of users who sign up for free trials end up converting to paid subscriptions.

- Price Increases: Streaming platforms periodically increase subscription prices, with an average annual increase of around 9%.

(Source: Parks Associates, Deloitte’s Digital Media Trends Survey, Motion Picture Association, TechCrunch, J.D. Power)

Global Streaming Services Trends and Statistics

- Shift to Digital Entertainment: The global streaming market is projected to reach $223.98 billion by 2028, driven by the increasing preference for digital content consumption.

- Rise of Mobile Streaming: Mobile devices account for approximately 35% of global streaming, with mobile video streaming traffic growing by around 27% annually.

- Content Consumption: Streaming now accounts for over 80% of total music industry revenue, marking a significant shift from physical sales and downloads.

- Cord-Cutting Acceleration: The number of cord-cutting households is expected to reach 55.1 million in the US by 2022, reflecting a 27% increase over five years.

- Global Subscribers Growth: Netflix reached 208 million subscribers worldwide in Q2 2021, showcasing the continued global expansion of streaming services.

- Original Content Investments: Netflix and Amazon Prime Video have collectively invested over $38 billion in original content, highlighting the industry’s emphasis on unique offerings.

- Streaming on Smart TVs: Smart TVs are the most popular device for streaming video content, accounting for about 33% of streaming hours.

- Competitive Landscape: The number of streaming services has nearly doubled in the past five years, with over 400 services available globally.

- Global Streaming Habits: The average global viewer subscribes to four streaming services and spends around 3.7 hours per day watching streamed content.

- Localization Efforts: Streaming services are increasingly investing in local and regional content to cater to diverse audiences and gain a competitive edge.

(Source: Statista, Recording Industry Association of America,

Netflix Investor Relations, Variety, Conviva, Reelgood, Digital TV Europe, Deloitte)

Streaming Services Challenges and Opportunities Statistics

Challenges:

- High Content Production Costs: Streaming platforms spend an average of $15 billion per year on content production.

- Content Discovery Challenge: 75% of viewers struggle to find something to watch due to content oversaturation.

- Competition and Fragmentation: The average viewer subscribes to 4 streaming services, leading to increased competition.

(Source: Motion Picture Association, Deloitte’s Digital Media Trends)

Opportunities:

- Global Market Potential: The global streaming market was projected to reach $184.27 billion by 2027, with a CAGR of 20.4%.

- Original Content Investment: Streaming platforms were expected to spend over $40 billion on original content by 2022.

- Personalized Advertising: Streaming services can leverage user data for targeted ads, with digital ad spending projected to exceed $455 billion globally by 2023.

Impact of Streaming Services on the Entertainment Industry Statistics

- The global streaming market was valued at over $42.6 billion in 2020, with a projected CAGR of 21.0% from 2021 to 2028.

- By the end of 2020, Netflix had approximately 203.67 million paid streaming subscribers worldwide.

- In the first quarter of 2021, Disney+ reported 103.6 million paid subscribers, just over a year after its launch.

- Traditional box office revenues declined by nearly 72% in 2020 due to the COVID-19 pandemic, leading studios to explore hybrid release models.

- Music streaming subscriptions accounted for over 80% of global music industry revenues in 2020, reaching a total of $13.4 billion.

- Amazon Prime Video’s user base grew by 41% in 2020, reaching 175 million viewers globally.

- In 2020, more than 60% of U.S. consumers subscribed to at least one streaming service, up from 48% in 2019.

- The number of households without traditional cable TV is expected to reach 40 million in the U.S. by the end of 2021.

- Streaming platforms released over 160,000 original TV series and movies worldwide in 2020, a significant increase from previous years.

- The global digital music revenue surpassed $11 billion in 2020, with streaming revenues accounting for the majority.

(Source: Statista, The Walt Disney Company, Motion Picture Association, IFPI Global Music Report, Deloitte, Ampere Analysis, Recording Industry Association of America)

Streaming Services Future Predictions and Projections Statistics

- By 2025, global streaming subscribers are projected to surpass 1.1 billion, indicating continued rapid growth in the industry.

- The global streaming market is estimated to reach a value of over $184 billion by 2027, driven by increasing demand for on-demand content.

- Live streaming is predicted to gain significant momentum, with the live video streaming market expected to grow at a CAGR of around 21.3% from 2021 to 2028.

- Personalized content recommendations and AI-driven curation will become even more crucial in retaining and engaging subscribers, as the number of available titles continues to increase.

- Mobile streaming is anticipated to continue its rise, with mobile devices accounting for over 60% of global streaming consumption by 2025.

- Hybrid monetization models, combining subscription and advertising, will likely become more common as streaming services aim to diversify revenue streams.

- Virtual reality (VR) and augmented reality (AR) integration into streaming platforms are projected to offer immersive content experiences, potentially gaining significant traction by 2025.

(Source: Digital TV Research, Deloitte, Conviva, PwC, Statista)

Regulatory and Ethical Considerations

- Data Privacy Concerns: Over 50% of streaming service users express concerns about their data privacy and how their personal information is used.

- Content Moderation Challenges: Streaming platforms struggle to moderate content; YouTube removed over 11 million videos and TikTok removed over 89 million videos for policy violations in a short period.

- Child Protection Measures: A study found that a significant portion of children’s content on YouTube contained potentially harmful comments, prompting discussions about child safety online.

- User Tracking and Targeted Ads: Streaming services often track user behavior for targeted advertising; research shows that around 70% of free streaming apps share data with third parties.

(Source: Statista, The Verge, Journal of Pediatrics, Digital Content Next)

Recent Developments

Acquisitions:

- Amazon’s Acquisition of MGM: In 2022, Amazon completed the acquisition of MGM (Metro-Goldwyn-Mayer) for $8.45 billion. This acquisition adds a vast library of films and TV shows, including the James Bond franchise, to Amazon Prime Video, enhancing its content offerings and competitive position in the streaming market.

New Product Launches:

- Netflix’s “Basic with Ads” Plan: Netflix launched a new ad-supported subscription tier, “Basic with Ads,” which aims to attract cost-sensitive subscribers. J.P. Morgan analysts predict this plan will attract 7.5 million domestic subscribers in its first year. The introduction of this tier reflects a growing trend among streaming services to diversify revenue streams through advertising.

- Amazon’s New Features and Partnerships: At CES 2023, Amazon announced several new features for its streaming services, including support for Matter Casting on Fire TV and Echo Show 15 devices, and a partnership with Panasonic to integrate Fire TV into Panasonic TVs. Additionally, Amazon is expanding its content portfolio with exclusive sports broadcasts like the NFL Black Friday game and original series such as “Blade Runner 2099” and “God of War”.

Funding:

- Apple’s Investment in Live Sports: Apple TV+ entered the live sports arena by securing broadcasting rights for Major League Baseball’s “Friday Night Baseball” and launching the “MLS Season Pass” for Major League Soccer fans. This strategic investment aims to boost subscriber engagement and attract sports enthusiasts to the platform.

Market Growth:

- Increasing Subscriber Base: Paramount+ reported significant growth, ending 2022 with 46 million global subscribers, driven by partnerships with Walmart+ and The Roku Channel. Paramount+ aims to reach 100 million subscribers by 2024 and plans to increase its content spending to $6 billion, up from $2 billion in 2022.

- Streaming Market Expansion: The global streaming market is projected to grow substantially, driven by increasing demand for diverse content and the adoption of ad-supported tiers. Netflix alone is expected to generate $600 million in advertising revenue in 2023.

Innovation in Streaming Technologies:

- AI and Interactivity: Streaming services are integrating AI and interactive features to enhance user engagement.

- For example, Amazon is testing virtual product placement in Prime Video and expanding the capabilities of Alexa within its streaming ecosystem, offering personalized and interactive viewing experiences.

Wrap Up

Streaming Services Statistics – The landscape of streaming services has experienced remarkable growth and transformation in recent years.

With a steady increase in subscriber numbers, these platforms have become integral to modern entertainment consumption.

The fierce competition among major players, combined with the emergence of niche services catering to specific interests, has diversified the streaming market.

Original content production has played a pivotal role in attracting and retaining subscribers, driving the need for innovative and captivating programming.

As the industry continues to evolve, adaptability and unique content will likely remain key factors for success in this dynamic and ever-changing arena.

FAQs

As of 2021, Netflix remained the dominant player globally in terms of subscriber count, but other platforms such as Amazon Prime Video, Disney+, and HBO Max were catching up quickly.

The COVID-19 pandemic led to an increase in streaming service subscriptions and usage due to lockdowns and the closure of cinemas. Many people turned to digital platforms for entertainment.

– An increase in original content offerings.

– Global expansion and localization of content.

– The shift away from traditional cable TV.

– The rise in mobile viewing and better internet accessibility.

– The high cost of producing or acquiring content.

– Maintaining subscriber growth and avoiding churn.

– Adapting to regional preferences and regulations when expanding globally.

– Competition not just from other streaming platforms, but also from traditional TV, cinemas, and other forms of entertainment.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)