Table of Contents

Introduction

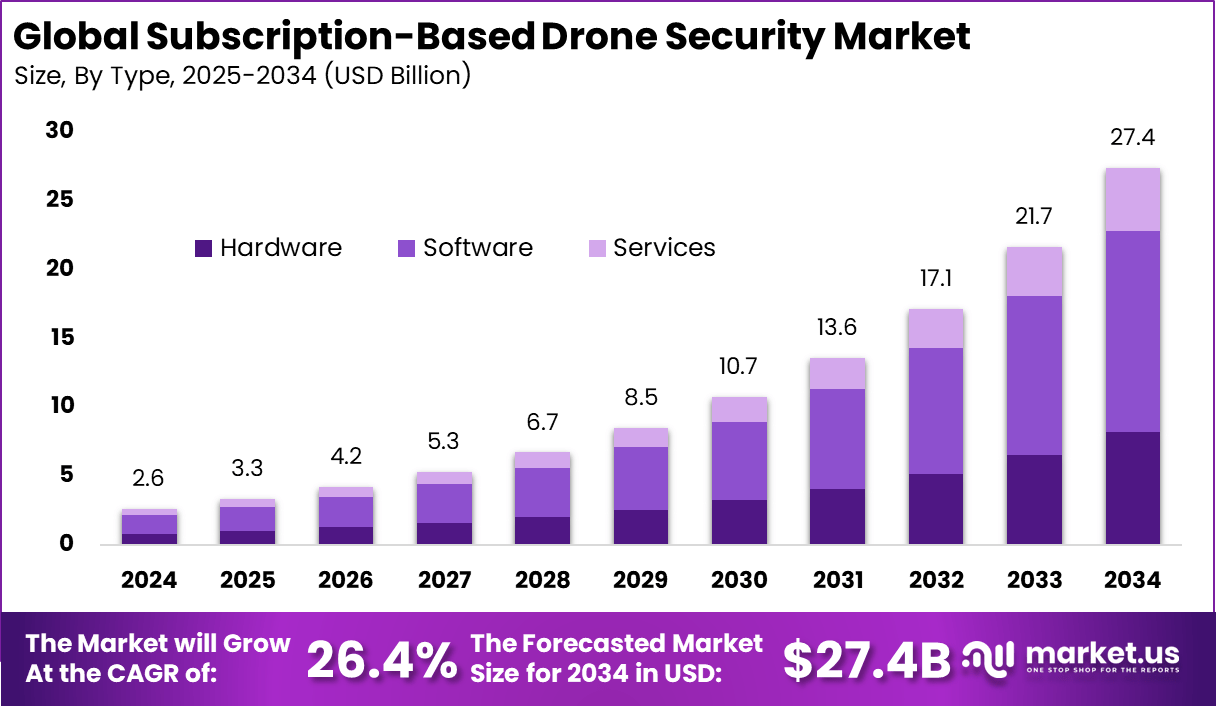

The global subscription-based drone security market generated USD 2.6 billion in 2024 and is projected to grow from USD 3.3 billion in 2025 to about USD 27.4 billion by 2034, reflecting a CAGR of 26.4 %. In 2024, North America held a dominant position, capturing more than 38.5 % of the market share, equating to approximately USD 1.0 billion in revenue. This growth is driven by increasing threats to critical infrastructure, rising demand for continuous aerial surveillance and remote monitoring, and the shift towards subscription-as-a-service models that reduce upfront investment and enable scalable deployments.

How Growth is Impacting the Economy

As the market expands, its economic impact is manifesting across sectors. The uptake of subscription-based drone security solutions is anticipated to stimulate investment in drone manufacturing, sensor development, AI analytics, and connectivity infrastructure. This wave of investment is projected to support job creation in high-tech manufacturing, software engineering, and services around drone operations and maintenance.

Increased adoption across critical infrastructure, logistics, and urban environments is estimated to raise productivity by enabling proactive monitoring, reduced downtime, and improved asset utilisation. Export opportunities for drone security systems are expected to enhance trade balances for leading producing nations. Governments investing in drone-enabled surveillance are likely to reduce incident-response costs and enhance resilience against security threats. As a result, the drone security subscription model is projected to contribute meaningfully to economic growth by fostering innovation, supply-chain advancement, and cross-sector efficiencies.

➤ Smarter strategy starts here! Get the sample – https://market.us/report/subscription-based-drone-security-market/free-sample/

Impact on Global Businesses

Rising Costs & Supply Chain Shifts

As businesses migrate to subscription-based drone security services, they encounter elevated costs associated with recurring subscriptions, sensor and drone hardware upgrades, connectivity (e.g., 5G, satellite) and service support. Supply chains are shifting to support modular drone fleets, advanced sensors, edge computing, cloud analytics and maintenance services rather than one-time equipment purchases.

Sector-Specific Impacts

In the energy and utilities sector operators deploy drone subscriptions to monitor pipelines, transmission lines and remote facilities to reduce downtime and safety risk. Logistics and warehousing businesses are leveraging aerial security to monitor perimeters, yard operations and asset movement. In defence and border surveillance, governments integrate subscription drones for real-time monitoring of restricted zones, requiring continuous service models.

Agriculture and infrastructure monitoring sectors are also using drone subscriptions for asset protection and operational visibility. Across these sectors companies must adapt procurement, operations and vendor relationships to subscription-centric models rather than traditional CapEx purchases.

Strategies for Businesses

Businesses aiming to capitalise on this market should embrace a phased deployment strategy: begin with pilot programmes in high-risk zones or assets, evaluate vendor subscription offers and monitor ROI before full rollout. Firms should prioritise vendors offering flexible subscription tiers, hardware upgrades, cloud analytics and support services. They must establish service-level agreements (SLAs) addressing maintenance, uptime, data latency and analytics accuracy.

Enterprise procurement should shift from capital purchase mindset to operational expenditure (OpEx) models, optimising budgeting and cash flow. Integration of drone security services with existing enterprise security, IoT and analytics platforms will enhance value. Continuous monitoring of regulatory compliance (airspace, privacy, data protection) and interoperability across geographies is essential. Finally, businesses should monitor the subscription vendor ecosystem, partner with specialists and build internal capabilities to manage drone-based security services.

Key Takeaways

- Rapid compound annual growth of ~26.4 % indicates strong demand for subscription-based drone security across sectors.

- North America currently dominates the market with over 38.5 % share in 2024.

- Subscription model shifts procurement from one-time hardware purchase to recurring service-based models, driving business model changes.

- Businesses will face increased operational cost pressures and supply-chain shifts, but gain enhanced asset visibility, monitoring and risk mitigation.

- Strategic vendors offering flexible subscription tiers, hardware upgrades, cloud analytics and global service support are positioned to lead.

➤ Unlock growth secrets! Buy the full report – https://market.us/purchase-report/?report_id=163628

Analyst Viewpoint

In the present landscape the subscription-based drone security market is emerging as a critical tool for organisations seeking continuous, scalable surveillance and asset protection. The model aligns with the broader trend towards “as-a-service” solutions and supports operational agility. Looking forward the positive outlook remains strong: the projected USD 27.4 billion market by 2034 signals mainstream adoption across industries.

Vendors that build integrated ecosystems—combining drones, sensors, analytics, connectivity and service tiers—are expected to capture significant market share. Overall, the market trajectory is favourable as businesses and governments prioritise resilient, scalable aerial security solutions rather than one-off systems.

Use Case and Growth Factors

| Use Case | Growth Factor |

|---|---|

| Continuous aerial monitoring of critical infrastructure (utilities, pipelines, telecom towers) | Rising threats to infrastructure, regulatory mandates for surveillance and cost pressures on manual inspection. |

| Perimeter and yard security in logistics/warehousing facilities | Shift towards automated surveillance, need for real-time asset visibility and reduction of theft/operational loss. |

| Government and defence border surveillance and public-safety monitoring | Increased demand for rapid deployment, scalable security services and subscription models to reduce capital burden. |

Regional Analysis

North America leads the subscription-based drone security market, holding over 38.5 % share in 2024 with approximate revenue of USD 1.0 billion. This leadership is supported by mature defence spending, strong infrastructure investment and advanced connectivity ecosystems. Europe and Asia-Pacific are expected to follow with robust growth driven by urbanisation, smart-city initiatives, infrastructure security and increasing commercial drone adoption. Emerging markets in Latin America and Middle East & Africa start from a smaller base but present growth potential as subscription models reduce entry cost. Regional variance in regulation, airspace control, data privacy and service models will influence uptake pace and vendor strategy.

➤ More data, more decisions! see what’s next –

- Neocloud Market

- Multi-sensory AI Market

- Virtual Reality Wedding Planners Market

- Quantum-Safe Messaging Apps Market

Business Opportunities

Significant business opportunities exist for service providers offering subscription-based drone security platforms, including hardware-software-service bundles, analytics-driven threat detection and managed drone fleets. Vendors can target SMEs and mid-market enterprises that may lack in-house capabilities for aerial surveillance by offering tiered subscription plans.

There are opportunities for partnerships between drone manufacturers, sensor/analytics firms and telecom/5G providers to deliver seamless end-to-end solutions. Consultancy firms can support migration from legacy security to drone-centric models. Regional adaptation—tailoring service models to local regulation, infrastructure and security needs—also presents growth potential. Overall, the market offers new value streams in operations, risk mitigation and asset monitoring beyond traditional security frameworks.

Key Segmentation

The market segments can be structured by type (hardware, software, services), by deployment model (on-premises, cloud-based subscription), by application (critical infrastructure monitoring, logistics/warehousing security, government/defence surveillance, agriculture, emergency services) and by end-user (SMEs, large enterprises, public sector).

Hardware includes drones, sensors and communication modules; software covers analytics, AI threat detection and fleet management; services embrace subscription maintenance, upgrades and cloud analytics. Cloud-based deployment is expected to gain traction due to scalability and lower upfront cost. Application-wise, critical infrastructure and government/defence sectors are projected to establish the largest demand base given high risk and regulatory emphasis.

Key Player Analysis

Key firms in the market are investing heavily in service-based delivery models, forming strategic alliances and developing drone fleets equipped with advanced sensors, AI analytics and connectivity modules. They are shifting toward integrated subscription platforms rather than simply selling hardware. Vendor differentiation is increasingly based on global service reach, modular subscription tiers, upgrade flexibility and analytics capability.

Competitive activity includes acquisitions of niche drone security firms, partnerships with telecoms or defence agencies and expansion into emerging markets. As the market matures, consolidation is expected, and only vendors with scalable service models and robust support ecosystems will maintain leadership.

- PatrolDrones Inc.

- DroneSec Solutions

- TerraDrones

- AirWatch

- CyberHawk

- SkyPatrol

- Sentinel Drones

- DroneSecurix

- GlobalSecurity Drones

- AerialShield

- AeroDefense

- DroneShield

- FlySafe Security

- NightVision Drones

- SkyGuard Technologies

- SecureAir

- Others

Recent Developments

- A technology provider launched a new subscription-based drone security service offering AI-powered threat detection and real-time analytics for infrastructure monitoring.

- A drone security vendor partnered with a major telecom operator to integrate 5G-enabled connectivity into its fleet for rapid data transmission and low-latency monitoring.

- A public-sector agency in North America adopted subscription-based drone surveillance for border and critical infrastructure protection under a multi-year service contract.

- A logistics company commenced pilot deployment of drone-based subscription monitoring for yard asset security, reducing loss and improving operational visibility.

- A sensor manufacturer introduced advanced thermal-imaging drone modules packaged within a subscription service bundle, enabling night-time and low-visibility surveillance.

Conclusion

The subscription-based drone security market is positioned for rapid expansion and transformational impact across industries. Organisations that transition to service-based aerial security models stand to gain in resilience, visibility and cost efficiency. As adoption broadens, service providers and enterprises alike must align strategy to leverage this evolving market opportunity.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)