Table of Contents

Report Overview

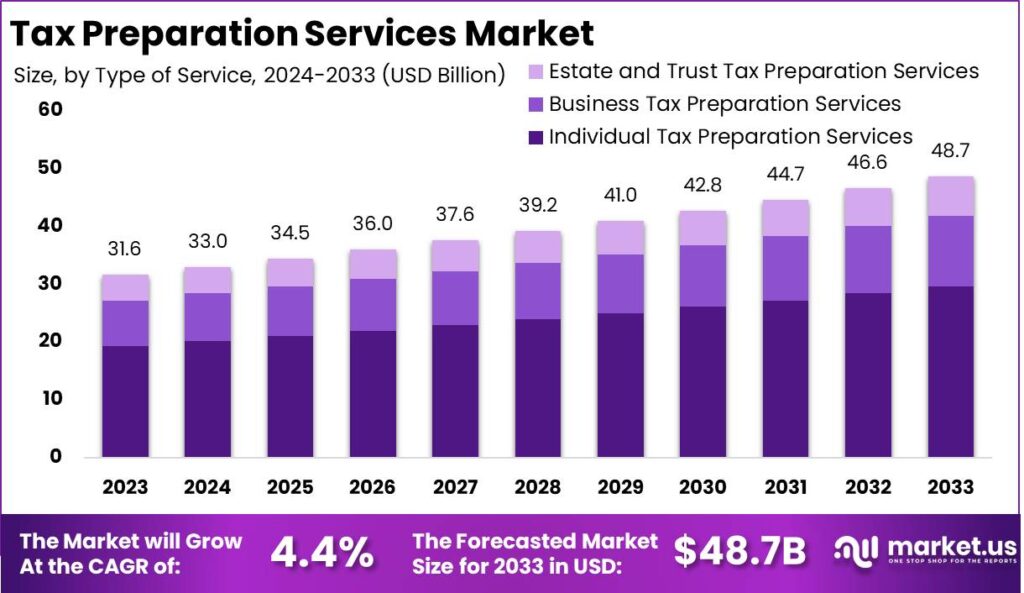

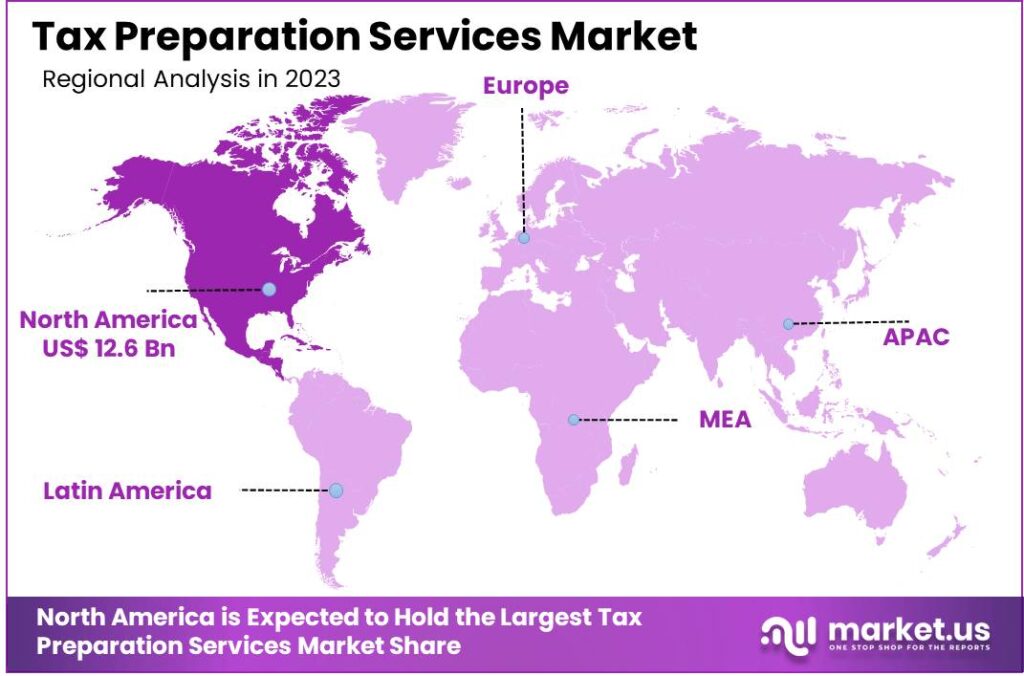

The Global Tax Preparation Services Market is poised for substantial growth, with its value projected to rise from USD 31.64 billion in 2023 to an impressive USD 48.7 billion by 2033, reflecting a steady compound annual growth rate (CAGR) of 4.40% during the forecast period from 2024 to 2033. North America led the industry in 2023, capturing over 40% of the market share and generating USD 12.6 billion in revenue. This dominance is fueled by the region’s strong adoption of both traditional and digital tax solutions. Additionally, the market is witnessing a shift towards automated and AI-driven tax preparation platforms, further boosting efficiency and accessibility for consumers worldwide.

Tax preparation services encompass the process of assisting individuals, businesses, and organizations in filing their tax returns in compliance with government regulations. These services are offered by professionals or specialized software, helping clients accurately report their income, deductions, and credits while ensuring they meet all legal requirements.

The growth of the tax preparation services market is driven by several key factors, including the increasing complexity of tax codes and regulations, which make compliance challenging for individuals and businesses. Rising financial literacy has led to greater demand for professional tax strategies to optimize tax positions and ensure long-term financial health. Additionally, the growing number of self-employed and gig workers, who face more intricate tax filings, has spurred the need for specialized tax services tailored to their unique financial situations.

The tax preparation services market is expanding beyond mature economies into emerging regions like Asia-Pacific, Latin America, and Africa, driven by economic growth and an expanding middle class. As workforces and businesses become more formalized, there is a growing need for tax compliance. Additionally, the rise of digital financial services in these regions has made tax preparation more accessible and efficient, enabling companies to quickly scale their services in new markets.

Analyst’s Viewpoint

The tax preparation services market is poised for growth through the expansion of digital platforms and automation technologies. As clients increasingly prefer online tax filing solutions, demand for tax software and cloud-based services has surged, providing greater efficiency and convenience. The adoption of artificial intelligence (AI) and machine learning (ML) is expected to further enhance accuracy, reduce errors, and deliver cost savings for both providers and clients.

Despite strong growth prospects, the tax preparation services sector faces key challenges, including rising competition from tax software companies offering low-cost or free filing options. These services attract individual filers with simple tax situations, creating price pressure on traditional providers. Additionally, the constantly evolving nature of tax regulations, with frequent updates and new policies at both state and federal levels, makes it increasingly difficult for tax preparers to stay ahead and ensure compliance.

Technological innovations are revolutionizing the tax preparation services industry, with automation tools, AI, and machine learning enhancing efficiency and accuracy. AI automates tasks like data entry, tax calculations, and deduction identification, reducing time and effort. Cloud-based solutions enable remote collaboration, improving flexibility and scalability. Additionally, blockchain technology is emerging as a secure, transparent way to streamline record-keeping and reduce fraud by offering an immutable system for storing tax-related documents.

Key Takeaways

- Individual Tax Preparation Services took the lead in 2023, commanding more than 61% of the market share.

- The Online Services segment also stood strong, securing over 57% of the market share in 2023.

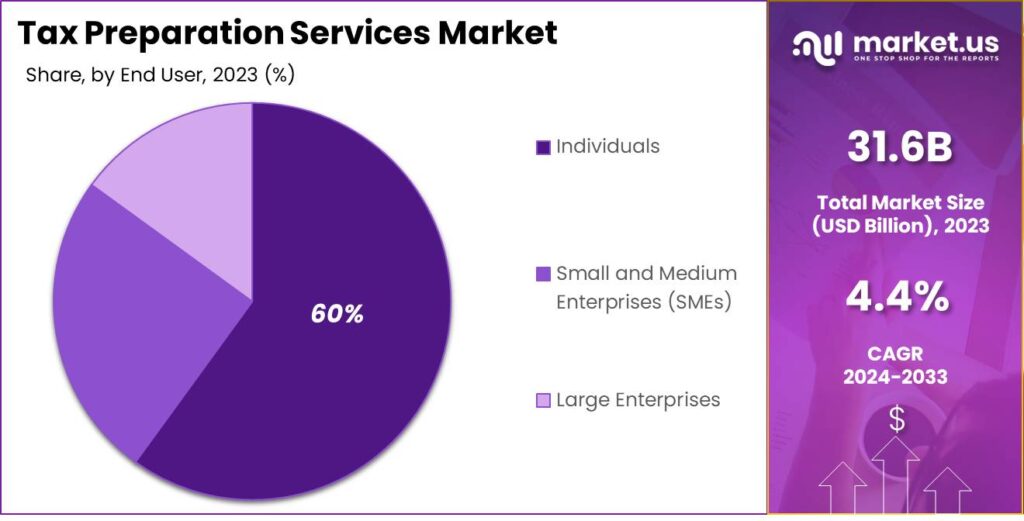

- In 2023, the Individuals segment was the frontrunner in the tax preparation services market, representing more than 60% of the total share.

- North America emerged as a dominant force in 2023, holding over 40% of the market share and generating an impressive USD 12.6 billion in revenue.

Regional Analysis

In 2023, North America led the global tax preparation services market, holding over 40% of the total market share and generating a revenue of USD 12.6 billion. This strong market position can be attributed to a combination of factors that give North America a unique advantage in the industry.

The region has a well-established and highly developed financial and regulatory environment, making tax preparation services essential for both individuals and businesses. With complex tax codes and numerous tax regulations in countries like the United States and Canada, many people and companies rely on expert services to ensure compliance and minimize liabilities.

Additionally, North America benefits from a large population of taxpayers, including a significant number of high-income earners and businesses, all of which require professional tax help. The high demand for tax-related services further supports the growth of the industry. The region also boasts a strong infrastructure, including advanced technology and software, which simplifies the tax preparation process, making it more efficient and accessible.

Market Segmentation

Type of Service Analysis

In 2023, the Individual Tax Preparation Services segment led the tax preparation market, capturing over 61% of the total market share. This dominance can be attributed to the large number of individual taxpayers who prefer professional assistance to ensure their taxes are filed accurately and in compliance with evolving tax laws. Many individuals, especially those with complex financial situations or those who may not have the time or expertise to prepare their own taxes, rely on tax preparation services to handle their filings. The growth of this segment is also fueled by a broader trend of people outsourcing tasks that require specialized knowledge, particularly in a complex regulatory environment.

Service Channel Analysis

The Online Services segment was also a major player in the tax preparation services market in 2023, accounting for more than 57% of the market share. The shift toward digitalization, accelerated by the COVID-19 pandemic, led more individuals and businesses to seek online platforms for their tax preparation needs. These online services offer convenience, affordability, and user-friendly interfaces that cater to a wide variety of customers. With a growing number of taxpayers opting for digital solutions, the online services market continues to expand as platforms provide tax filing tools, e-filing capabilities, and real-time support to streamline the tax preparation process.

End-User Analysis

The Individuals segment was the primary driver of the tax preparation services market in 2023, holding over 60% of the market share. This is reflective of the high volume of individual taxpayers who require assistance with filing their taxes. Factors such as tax complexity, income sources (e.g., investments, freelance work), and changes in tax laws have made it increasingly difficult for individuals to manage their own tax filings without expert help. Additionally, many individuals seek professional tax preparation services to maximize refunds, minimize tax liabilities, and avoid penalties.

Emerging Trends

- Increased IRS Audits and Enforcement: Due to enhanced funding by legislative acts such as the Inflation Reduction Act, the IRS is gearing up to intensify audits and enforcement in 2025, focusing on sectors with high risks of underreporting income. This mandates that tax professionals advise their clients to maintain meticulous records and adhere strictly to IRS guidelines to mitigate audit risks.

- Evolving Tax Credits for Green Energy: The tax landscape in 2025 will continue to be shaped by the push towards sustainable energy, with new and extended tax credits expected to support investments in renewable energy and energy-efficient projects. Tax professionals will need to stay informed on these credits to provide valuable advice to clients looking to leverage these incentives.

- Automation and AI Integration: The integration of Artificial Intelligence in tax preparation is transforming the industry by automating basic tasks and enhancing the efficiency of handling complex tax returns. Tax professionals are encouraged to adopt these AI tools to streamline their processes, reduce errors, and improve client satisfaction.

- Remote Workforce Expansion: With the rise of cloud-based software solutions, tax preparation services can now be managed remotely, broadening access to global talent pools and catering to a more extensive client base without geographical constraints.

- Increasing Complexity of International Tax Regulations: As global business operations continue to grow, tax regulations across borders are becoming more complex. This trend is crucial for tax professionals working with multinational clients, requiring a robust understanding of international tax laws to ensure compliance and avoid penalties.

Top Use Cases

- Handling Complex Deductions: With the phase-out of the 100% bonus depreciation provision by the end of 2025, tax professionals play a critical role in advising clients on timing asset purchases to maximize deductions before the provision is reduced.

- Cryptocurrency and Digital Asset Reporting: As regulations around cryptocurrency continue to develop, tax professionals must guide clients in maintaining detailed records of digital asset transactions to comply with evolving tax laws and avoid potential penalties.

- Strategic Retirement Planning: With potential changes to retirement plan contributions on the horizon, tax professionals are key in helping clients navigate these adjustments to maximize their tax-deferred savings opportunities.

- Navigating State and Local Tax (SALT) Variations: As SALT regulations continue to evolve, with potential changes to deduction caps and rate adjustments, tax professionals are essential in advising clients on optimal strategies to minimize their state and local tax liabilities.

- Advisory on Business Expansion and Mergers: The expanding role of tax professionals includes advising businesses on tax implications of mergers, acquisitions, and expansions, especially as companies seek to optimize their tax positions in light of new regulations and market dynamics.

Major Challenges

- Adapting to Regulatory Changes: Tax laws and regulations are continuously evolving, often at a rapid pace. Tax professionals must stay current with these changes to ensure compliance and accurate filing, a task that requires significant ongoing education and system updates.

- Data Security and Privacy Concerns: With the increase in digital tax preparation, ensuring the security and confidentiality of client data is paramount. Tax firms face the challenge of protecting sensitive information against cyber threats, which is critical to maintaining client trust and regulatory compliance.

- Integration of New Technologies: While AI and automation offer significant advantages in efficiency and accuracy, integrating these technologies into existing systems poses a challenge. Firms must invest in training and infrastructure, which can be costly and time-consuming.

- Handling International Tax Compliance: As businesses expand globally, navigating the complexities of international tax laws becomes more challenging. Tax professionals must understand diverse tax regimes and manage compliance across multiple jurisdictions, a daunting task for those without specialized knowledge.

- Recruitment and Retention of Skilled Staff: The tax preparation industry faces challenges in attracting and retaining qualified professionals, especially in a competitive job market. Firms need to offer competitive salaries, benefits, and career development opportunities to secure top talent.

Attractive Opportunities

- Expanding Advisory Services: There is a growing demand for comprehensive advisory services beyond traditional tax filing, including financial planning and business strategy consulting. This trend provides tax professionals with opportunities to diversify their offerings and increase client engagement.

- Leveraging Technology for Competitive Advantage: Adopting advanced technologies like AI and data analytics can significantly enhance service delivery, allowing firms to offer personalized advice and identify tax-saving opportunities for clients, thus differentiating themselves in the market.

- Market Expansion through Remote Services: The shift towards remote work and cloud-based platforms opens up new markets for tax preparation services, allowing firms to serve clients outside their immediate geographic area and tap into a broader client base.

- Green Energy Tax Incentives Consulting: With the increasing focus on sustainability, tax professionals can capitalize on advising clients about green energy tax credits and incentives, positioning themselves as leaders in this niche area.

- Specialization in Niche Markets: Specializing in particular sectors or client types, such as expatriates, digital nomads, or specific industries like cryptocurrency, can provide tax firms with unique market opportunities and the potential for premium pricing.

Market Opportunities for Key Players

- Expanding to Virtual and Online Platforms: As more consumers and businesses move online, there’s a growing demand for digital tax preparation services. Offering remote consultations, cloud-based tax filing, and easy-to-use software platforms can tap into the increasing number of tech-savvy clients. With the rise of remote work, this segment is expected to continue growing, providing firms with a broad market reach.

- Targeting Small and Medium-Sized Businesses (SMBs): Small and medium-sized businesses often struggle with tax preparation, especially when it comes to complex filings, deductions, and compliance issues. Offering tailored tax services for SMBs—such as bookkeeping, payroll management, and tax strategy—presents a huge opportunity. Many SMBs lack the internal resources for professional tax advice, making this a high-demand market.

- Advisory Services Beyond Filing: Today’s consumers and businesses are looking for more than just tax preparation. They want financial planning and advisory services that can help them minimize tax liabilities and grow wealth. Tax preparers who expand their offerings to include tax planning, retirement strategies, and investment advice can capture a larger share of the market, particularly among high-net-worth individuals and family-owned businesses.

- Focus on E-filing and Automation: E-filing has become the norm, and clients increasingly expect faster, more efficient processing. Investing in automated solutions to handle data entry, tax calculations, and document management can improve client satisfaction and reduce errors. Companies that embrace e-filing, machine learning, and artificial intelligence to streamline the tax filing process will likely see strong growth.

- Capitalizing on Seasonal Demand: Tax season remains a peak period for revenue, but there’s an opportunity to maintain client engagement year-round. Offering services like year-round tax advice, audit protection, and financial health checkups can help firms retain customers and smooth out seasonal fluctuations. Subscription-based or retainer models can also offer predictable cash flow and build long-term client relationships.

Recent Developments

- In September 2024, H&R Block launched AI Tax Assist, a generative AI-powered tax solution designed to enhance consumer experience in tax filing. This innovation represents a significant step in integrating advanced technology into tax preparation services, aiming to streamline the process for users.

- In January 2025, The United Way of Marquette County is excited to announce a major step forward in their mission to support the community. Thanks to a newly awarded grant, they will be expanding their free tax preparation services throughout 2025, offering greater assistance to individuals and families in need.

Conclusion

In summary, the tax preparation services market is experiencing steady growth, driven by increasing demand for professional assistance in navigating complex tax laws and optimizing financial outcomes. This growth is further fueled by advancements in technology, with software and AI tools enhancing service delivery and accuracy, making tax filing more accessible for individuals and businesses alike. As regulatory changes become more frequent and intricate, the need for expert tax preparers continues to rise, creating significant opportunities for firms offering specialized services.

Looking ahead, the market is expected to remain resilient, with emerging trends such as remote tax preparation and the integration of data analytics providing new avenues for service expansion. However, competition is intensifying as both traditional firms and new entrants innovate to meet evolving consumer needs. To stay competitive, tax preparation services will need to balance efficiency with personalized support, ensuring they deliver value and maintain trust in a fast-changing environment.

Discuss your needs with our analyst

Please share your requirements with more details so our analyst can check if they can solve your problem(s)