Table of Contents

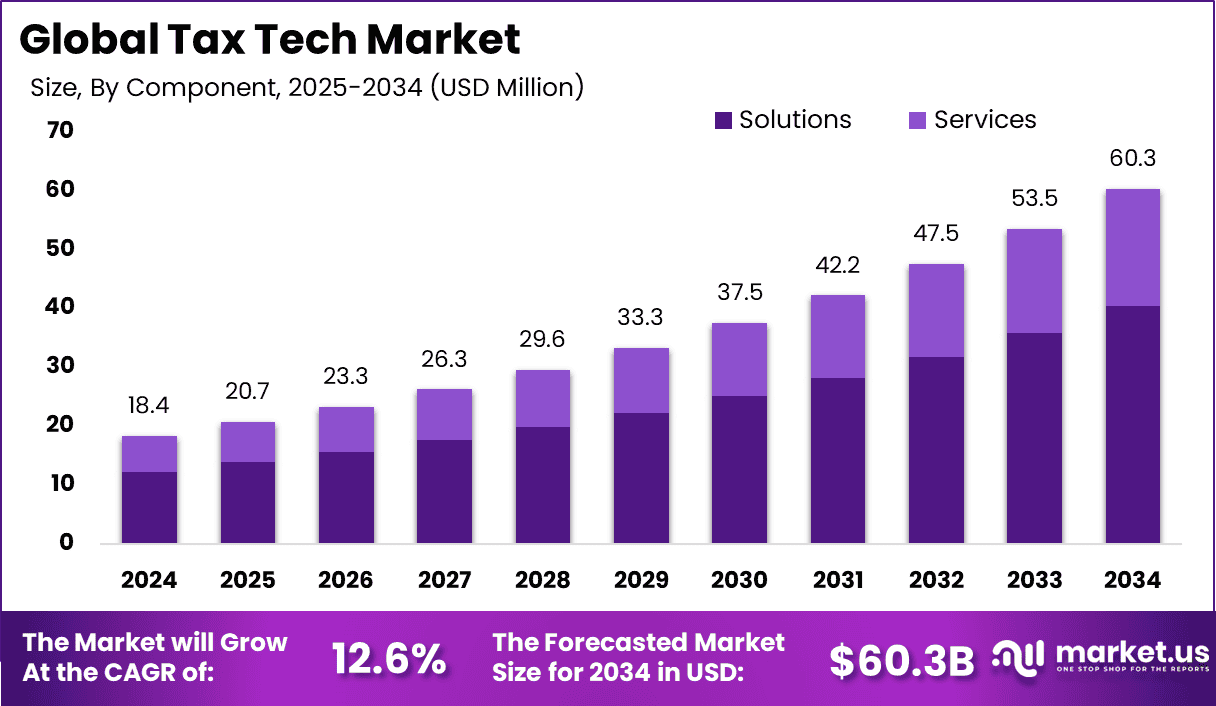

The Global Tax Tech Market is projected to grow from USD 18.4 billion in 2024 to approximately USD 60.3 billion by 2034, registering a steady CAGR of 12.6% during 2025-2034. The market expansion is driven by increasing demand for automation in tax compliance, regulatory changes, and growing complexity of global tax systems. North America dominated the market in 2024, accounting for over 38% market share with revenue of USD 6.98 billion, fueled by widespread adoption of advanced tax technology solutions by corporations and governments.

How Tariffs Are Impacting the Economy

Tariffs on imported software and hardware components essential for tax technology solutions have increased costs for providers and users. The U.S. tariffs on technology imports, particularly from China and other major suppliers, have led to higher prices for cloud infrastructure, data processing hardware, and security systems.

➤ Discover how our research uncovers business opportunities @ https://market.us/report/tax-tech-market/free-sample/

(Use corporate mail ID for quicker response)

This escalation results in increased operational costs for firms deploying tax tech platforms, potentially delaying implementation and scaling efforts. Supply chain disruptions due to tariffs affect availability of critical hardware, leading to project delays and higher prices passed to customers. These factors may slow digital transformation in tax administration and compliance. While tariffs aim to protect domestic industries, they introduce inflationary pressures and uncertainty in the tech ecosystem supporting tax solutions.

Impact on Global Businesses

Global tax tech providers and their clients face rising costs due to tariffs on IT equipment and software, affecting budgets for adoption and upgrades. Financial services, multinational corporations, and government agencies experience delays in deploying automated tax solutions, impacting compliance efficiency. Companies are shifting supply chains, increasing local sourcing, and exploring cloud-based alternatives to mitigate risks. Sector-specific challenges include increased regulatory demands and the need for secure, scalable solutions amid tariff-induced uncertainties.

Strategies for Businesses

Businesses are diversifying suppliers, investing in local production, adopting cloud-based tax tech solutions, lobbying for tariff relief, and optimizing procurement processes. These strategies help sustain growth and reduce exposure to tariff volatility.

Key Takeaways

- Market growth at 12.6% CAGR through 2034

- Tariffs increase costs of critical IT components

- Supply chain diversification and localization mitigate risks

- Cloud solutions reduce hardware dependency

- Policy engagement essential for trade barrier reduction

➤ Get full access now @ https://market.us/purchase-report/?report_id=148633

Analyst Viewpoint

Despite cost pressures from tariffs, the tax tech market remains strong due to rising regulatory complexity and digitalization needs. Companies embracing cloud solutions and agile supply chains will thrive. Advancements in AI and blockchain will further enhance compliance automation. Trade policy stabilization will support smoother market expansion. The outlook is positive as tax authorities and businesses increasingly rely on technology for efficient tax management.

Regional Analysis

North America leads with over 38% share, driven by advanced IT infrastructure and early tech adoption. Europe follows, propelled by strict tax regulations and digital initiatives. Asia-Pacific is the fastest-growing region, fueled by increasing cross-border trade and digital tax reforms in China, India, and Japan. Latin America and the Middle East are emerging markets investing in tax modernization and technology adoption.

➤ Discover More Trending Research

- AI-Powered Asset Tracking System Market

- Predictive Agents Market

- Smart Asset Management in Utility Market

- Task Management Agent Market

Business Opportunities

Rising demand for automated tax compliance, real-time reporting, and risk management creates ample opportunities. Cloud-based platforms, AI-driven analytics, and blockchain for secure tax data management offer growth potential. Expansion in emerging markets and growing SME adoption further fuel demand. Collaboration between tax authorities and technology providers fosters innovation in tax administration.

Key Segmentation

Segments include:

By Solution

- Tax Compliance Automation

- Tax Reporting and Analytics

- Risk and Audit Management

- Tax Data Management

By Deployment

- Cloud-Based

- On-Premise

By End-User

- Enterprises

- Government Agencies

- Accounting Firms

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa

Each segment exhibits distinct growth dynamics and technological adoption patterns.

Key Player Analysis

Market leaders invest heavily in AI, blockchain, and cloud platforms to deliver scalable, secure tax tech solutions. Strategic alliances with regulatory bodies and tech firms enhance capabilities. Emphasis is placed on compliance, data privacy, and user experience. Competitive differentiation stems from innovation, global reach, and customized services to meet diverse tax regimes.

Recent Developments

In 2024, key providers launched AI-enhanced tax compliance tools and expanded cloud integrations, improving automation and real-time reporting capabilities.

Conclusion

The Global Tax Tech Market is set for steady expansion driven by digital transformation and regulatory complexity. Companies focusing on supply chain resilience, cloud adoption, and innovation will capitalize on emerging growth opportunities despite tariff-related challenges.